Analysis of MicroStrategy/MSTR

I looked at MSTR's financial report, and this company's cash flow is very limited, with negative profits, so it shouldn't be considered for the valuation of a normally operating company. Of course, there will be some valuation, but it should be negligible.

Let's treat MSTR as a fund that borrows money/issues stock to raise funds to purchase BTC.

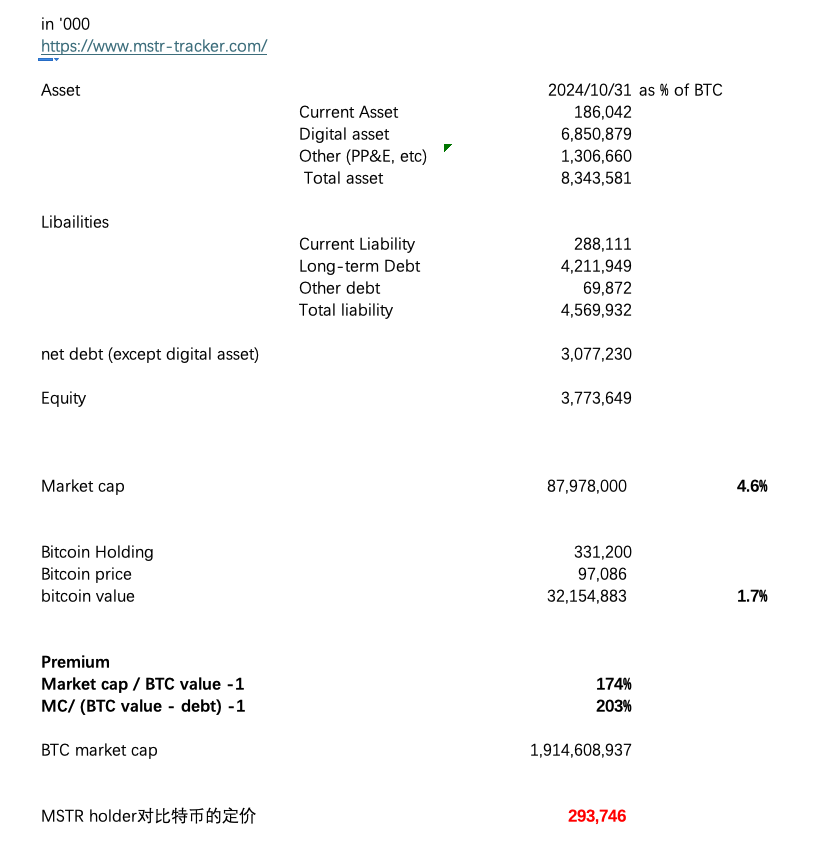

Using MSTR's market value / (BTC value - net debt), the premium is 203%, which means its market value is about twice its actual net asset value - first, let's marvel at the madness of the market; it truly is a case of only higher, never highest.

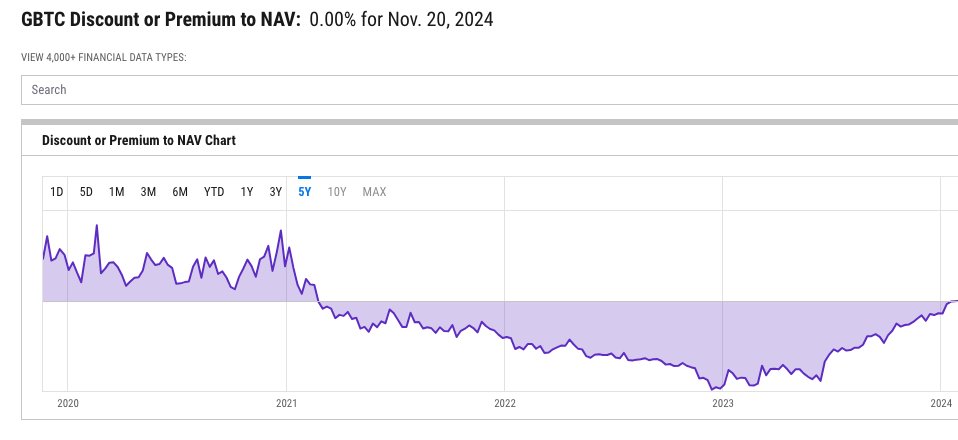

In fact, a similar scenario played out in the last cycle, where GBTC's premium consistently remained positive in 2020-2021, reaching over 30% at its peak. Those who were around during the last cycle may remember that Three Arrows, Voyager, and others were engaging in this arbitrage, and the outcome was, of course, disastrous.

Question 1: What kind of people can only buy MSTR and not BTC or ETFs? ChatGPT provided several answers, which I will include at the end of this article for reference. In short, some institutions may have no choice but to buy the overvalued MSTR stock. There is undoubtedly speculation involved here.

Question 2: What does this mean?

When the prices of two channels differ, there are two explanations: first, the lower price is too low, and second, the higher price is too high. I suspect both are true. One is that MSTR should be in a state of overvaluation, and I do not recommend investing in it, nor do I suggest shorting it. I remember an institution shorting it in March, and I suspect they have lost their pants by now.

From another perspective, if MSTR's pricing is correct, it means Bitcoin needs to reach $290,000… which is, of course, too good to be true. So ultimately, Bitcoin still has upward potential.

Specifically, MSTR can continuously issue new shares to buy BTC. In practice, MSTR has gone through multiple rounds of share issuance (see Figure 3), and it also uses convertible bonds, which is quite similar to issuing stock. For example, on November 18, MicroStrategy announced a $1.75 billion convertible senior note.

MSTR's market value is 4.6% of BTC's market value, while its BTC holding is only 1.7%. The difference of 2.9% indicates it has a potential buying power of 2.9%, and if we apply at least a 1% discount, this suggests a bullish outlook for BTC prices during a bull market.

Question 3: Will MSTR bring risks to the crypto space?

There is no free lunch; MSTR can be understood as a leveraged BTC fund, increasing BTC buying pressure, which will inevitably have a negative impact on coin prices during a bear market.

Specifically, during a bear market, if MSTR's stock price falls, it may drop below its BTC holdings. However, this doesn't seem to pose a risk to the market, as it merely means it cannot buy coins through the previously issued new shares.

Another risk is that when the coin price drops to a certain level, MSTR may be unable to repay its debts, forcing it to sell BTC. This depends on its specific debt structure; for example, the aforementioned convertible bonds do not require selling coins to repay debts. From a total perspective, its net debt is $3 billion, while it holds 330,000 coins worth $32 billion, giving it a leverage ratio of about 10%, which seems far from liquidation.

Question 4: What are the similarities and differences with Luna?

As mentioned earlier, MSTR is like Luna. We can make the following analogy:

MSTR stock = Luna

MSTR debt = UST

So the overall structure is quite similar. However, its risk is an order of magnitude smaller than Luna's. One reason is that UST is a high-interest debt (20% APY), while MSTR's debt interest rate does not exceed 2%. The second reason is that UST must maintain its peg, which adds an extra risk. Finally, Luna had a very high leverage ratio at its peak, while MSTR's leverage ratio is very low.

So what?

The conclusion is: MSTR stock is currently at a high point; it is more suitable for bottom-fishing during a bear market when the premium drops. Additionally, this premium represents the upward potential of BTC prices.

- Regulatory Restrictions

Pension Funds and Insurance Companies

These institutions are usually subject to strict regulations that require investments in products that meet certain risk levels and asset classes. Directly holding Bitcoin or Bitcoin ETFs may be considered too high risk or non-compliant with regulations, but holding publicly traded stocks (like MSTR) typically meets investment standards.

Public Fund Restrictions

Some public funds (especially traditional equity funds) may be prohibited from holding cryptocurrencies or cryptocurrency derivatives (like Bitcoin ETFs). Investing in MSTR stock can circumvent this restriction, as it falls under the category of regular tech company stocks.

- Internal Policies or Compliance Issues

Investment Strategy Restrictions

Certain institutions have internal investment policies that restrict them from investing in "non-traditional assets" (like cryptocurrencies), but MSTR, as a publicly listed company, qualifies as a traditional stock asset.

Risk Management Considerations

Some institutions may perceive the liquidity and volatility risks of Bitcoin ETFs as too high, preferring to choose indirect exposure, such as through MSTR stock.

- Regional or Industry Restrictions

Regional Policies

In some regions (such as certain Asian countries), governments may impose strict restrictions on cryptocurrency investments, prohibiting institutional investors from directly holding Bitcoin or related derivatives. However, investing in U.S. stocks is usually not subject to these restrictions.

Banks and Non-Profit Organizations

Banks or non-profit organizations may sometimes face additional constraints that prevent them from directly investing in cryptocurrency-related assets.

- Preference for Indirect Exposure

Balance Sheet Transparency

Investing in MSTR stock not only provides Bitcoin exposure but also allows institutional investors to analyze its other business's balance sheet, whereas Bitcoin ETFs only provide pure cryptocurrency risk.

Tax and Compliance Convenience

Holding MSTR stock may be simpler in terms of tax reporting and compliance management compared to holding Bitcoin ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。