What is the compliant cryptocurrency exchange HashKey doing as it approaches its 1st anniversary? 👀

HashKey Exchange is about to celebrate its 1st anniversary. This licensed compliant cryptocurrency exchange in Hong Kong was once highly anticipated by industry practitioners in the first half of 2023, with many naively believing it would be the hero to rescue the industry from its troubles. However, it turned out that the real saviors of the industry and everyone’s balance sheets were the approval of Bitcoin spot ETFs, the peak of U.S. Treasury yields, and Trump’s trading.

But this is actually understandable. As a pilot project in the regulatory sandbox initiated by the University of Tokyo in Hong Kong, a self-rescue Plan B for the financial center's intangible cultural heritage, and a channel for Chinese institutions to hedge systemic risks, HashKey's business freedom is far less than that of its counterpart Coinbase. What does it mean to "dance with shackles"? Just take a look at the HashKey Exchange's Hong Kong site.

Moreover, the U.S. dominance in the global financial market is real and tangible. In this cycle, BTC and ETH spot ETFs, stablecoins like USDT and USDC, and projects like MakerDAO and OndoFinance that tokenize U.S. Treasury assets have fundamentally and permanently changed the basic rules of the game in the cryptocurrency industry. Silicon Valley and Wall Street have almost completely mastered the pricing power of the primary and secondary markets in the crypto industry. Our optimistic expectations for HashKey Exchange last year now seem like a typical case of market expectation overload.

So, after experiencing the process of carrying expectations, falling short, and making gradual progress, what has HashKey Exchange accomplished this year?

1️⃣ "Dual-Drive" Strategy Achieves Exchange Business Growth

Broadly speaking, centralized exchanges are the earliest abstract products of blockchain, but unlike current blockchain abstraction solutions, they are built on traditional Web2 technology architecture. Structure determines characteristics. For centralized exchanges, whether compliant or non-compliant, the primary task is to achieve user growth and increase assets under management (AUM).

Faced with real constraints, HashKey Exchange chose a "dual-drive" strategy. On one hand, it continues to explore potential within the compliance framework, establishing partnerships with several local brokers in Hong Kong and vigorously promoting Omnibus broker comprehensive accounts, allowing local users to trade cryptocurrencies without changing their trading habits. On the other hand, HashKey Exchange launched its global site in April 2024, actively listing new assets, debuting $EIGEN and $ALEO, and conducting IEOs for $MAK, $BOX, and $SHIFT. At the same time, seizing market opportunities, it launched the Tap-to-Earn mini-game "Big Golden Dog" to drive traffic from Telegram, which has reached 7.5 million users since its launch.

The market feedback for HashKey Exchange's strategy has been quite positive. According to publicly available data from September, the Omnibus trading volume exceeded HKD 2 billion, a 74% increase month-on-month; the exchange added 150,000 new registered users, with trading users increasing by 150% month-on-month.

Currently, HashKey Exchange (Hong Kong site + global site) has 350,000 registered users, with thousands having verified their funds through HashKey's professional investor (PI) service (with funds exceeding HKD 8 million). HashKey Exchange's AUM has grown from 0 to HKD 5 billion.

Although this data growth is impressive, compared to the daily trading volume of offshore exchanges totaling hundreds of billions of dollars, HashKey Exchange, as a compliant exchange, is still in the budding stage of growing from 0 to 1.

However, overall, compliance is the trend in the cryptocurrency industry. Although the release of Binance founder CZ from prison has sparked some speculation among industry insiders, it will not change the overarching trend of shrinking market size for offshore exchanges; the curtain on the era of regulatory arbitrage is slowly falling.

HashKey CEO Livio Weng predicted in an interview: "2024 will be a big year for compliance in the cryptocurrency industry, and it is expected that within the next 2-3 years, the market share of licensed exchanges may exceed 50%." As the barriers to regulatory compliance increase marginally, latecomers can only consume the "hot pot base" of the pioneers.

The compliance barriers currently constructed by HashKey include:

- Multi-layered License Moat

-- Comprehensive regional license advantages:

Hong Kong: Obtained all necessary virtual asset licenses from the SFC

Singapore: Obtained the MAS OTC major payment institution license

Japan and Bermuda: Also obtained corresponding licenses

Forming the most complete compliance license system in the Asia-Pacific region

-- Enhanced by Hong Kong's special status:

As one of only two licensed compliant exchanges in Hong Kong

First to pilot in Hong Kong's regulatory sandbox

Becoming an important participant in the transformation of Hong Kong's financial center

- Institutional-Level Service System

-- Professional Investor (PI) Services:

Verification threshold of HKD 8 million

Building a high-net-worth client service ecosystem

-- Omnibus Broker Innovation:

Deep cooperation with Hong Kong brokers

Seamlessly connecting traditional financial users to the crypto market

- Strategic Cooperation Network

-- Cooperation with Regulatory Authorities:

Close collaboration with the Hong Kong Monetary Authority

Participating in discussions on regulatory policy formulation

Becoming a practitioner of compliance standards

-- Cooperation with Financial Institutions:

Establishing partnerships with traditional financial institutions like ZA Bank

Co-developing industry standards with HKDAS (Hong Kong Digital Asset Association)

Establishing Omnibus service cooperation with leading brokers

The compliance barrier is HashKey's core competitive advantage and a key feature that distinguishes it from other exchanges. Through multi-dimensional layout, HashKey is transforming regulatory compliance into a sustainable business advantage, which will be a key factor for its success in the next industry development cycle.

2️⃣ Building Next-Generation Financial Technology Infrastructure

At the recently concluded Hong Kong FinTech Week, Dr. Xiao Feng, Chairman and CEO of HashKey Group, made a new statement following his assertion that "2024 will mark the '1995 moment' for Web3 in the internet": In the financial sector, over the next decade, Web3 will build a new financial market system different from the current one. He believes that in the future, there will be two financial market systems coexisting in the world: one is the traditional financial market system based on bank accounts; the other is the crypto financial market system based on crypto accounts and tokens.

This is both a high-level strategic vision of HashKey Group and a plan that the HashKey team is currently striving to implement. HashKey is currently building the next-generation financial technology infrastructure from the following three aspects:

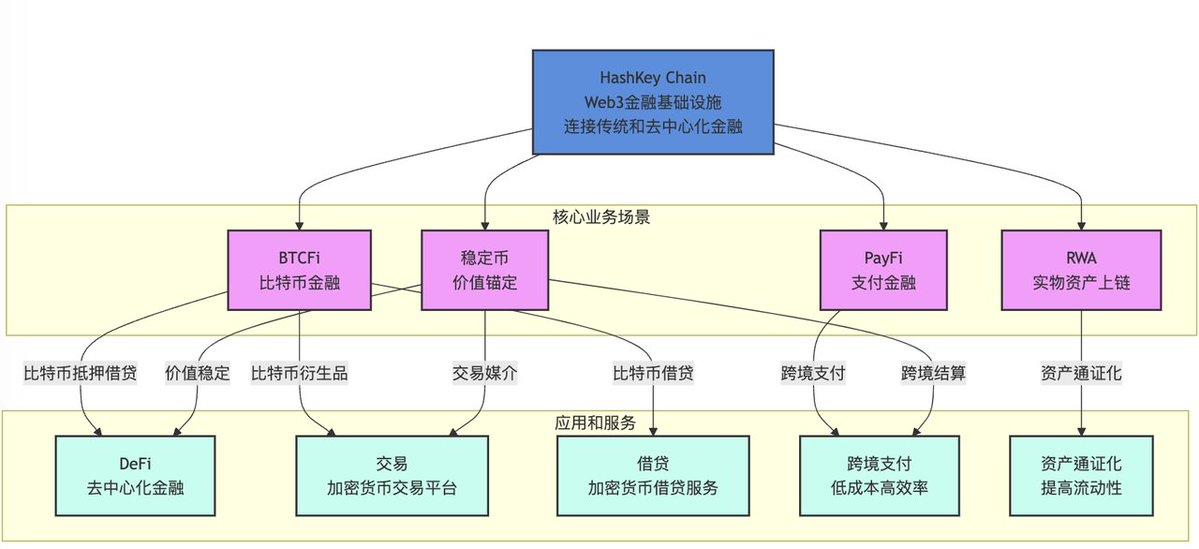

-- HashKey Chain Ecosystem:

Positioning: Not just a simple exchange L2, but a compliance-oriented financial infrastructure

Key Tracks: BTCFi, PayFi, Stablecoin, RWA, DePIN

Goal: To create a full-stack solution connecting Web2 and Web3

Timeline: Public testing expected to start in Q4, with mainnet launch within the year

-- Tokenization Service Infrastructure:

HashKey Tokenization services collaborating with HashKey Cloud

Participating in the Hong Kong Monetary Authority's Ensemble project

Creating liquidity for traditional and Web3 projects

Establishing a bridge connecting the real economy and digital assets

-- Technical Support:

HashKey Cloud providing node verification services across 80+ public chains

Asset management scale reaching 1.2 million (calculated in ETH)

New product lines including Restaking and Bitcoin node verification

Among these, HashKey Chain is the cornerstone of HashKey's strategy to build next-generation financial technology infrastructure.

HashKey Chain will deeply layout five core tracks:

BTCFi (Bitcoin Finance):

Potential focus on compliant Bitcoin collateralized lending

Developing institutional-level Bitcoin derivatives

Innovating links with traditional financial products

PayFi (Payment Finance):

Building a compliant cross-border payment network

Providing efficient clearing systems for institutions

Integrating with traditional payment systems

Stablecoin:

Expected to launch HKD stablecoin infrastructure

Creating a stablecoin settlement center in the Asia-Pacific region

Linking traditional foreign exchange markets with crypto markets

RWA (Real-World Assets on Chain):

Promoting security token offerings (STO)

Tokenization of real assets like real estate

Building a compliant secondary trading market

DePIN (Decentralized Physical Infrastructure):

Linking physical economic infrastructure

Promoting the assetization of data and devices

Exploring new business models

Frankly speaking, the shift from platformization to "infra-ization" has become an industry consensus. The integration of on-chain and off-chain, extending upstream along the industrial chain, is a major trend in this cycle. For example, Coinbase is fully incubating Rollup L2 Base and has achieved impressive growth data.

However, HashKey Chain differs from other L2s that blindly pursue trading volume and TVL; it is taking a differentiated path that serves institutions and emphasizes compliance. This may make its development appear slower, but in the long run, this "slow is fast" strategy may align better with the laws of industry development. Especially against the backdrop of Hong Kong accelerating the development of crypto assets, HashKey Chain is expected to become an important infrastructure connecting traditional finance and Web3, contributing to the institutionalization and compliance of the entire industry.

3️⃣ Empowering the Platform Token HSK to Build the Golden Shovel of the Crypto Industry for the Next Decade

In the cryptocurrency industry, the fate of platform tokens is often closely tied to that of exchanges. BNB witnessed Binance's rise from zero to the world's number one, while HT experienced the ups and downs of Huobi's decline. Now, the HSK launched by HashKey will also become an important milestone for this low-profile and pragmatic compliant exchange in Hong Kong.

Unlike the "speculative hype" path of other exchanges' platform tokens, HSK's design reflects HashKey's consistent philosophy of "slow is fast." Its core highlight is the "20% platform profit permanent buyback" mechanism - this is not a short-term speculative gimmick, but a long-term mechanism design that binds platform value. By linking platform profits with token value, HSK aims to create a sustainable value capture model.

The ecological layout of HSK also reflects its strategic thinking:

Value Support:

20% of platform profits are used for buybacks and permanent destruction

Linked to actual business revenue, not an airy castle in the sky

Providing additional rights for token holders through mechanisms like LaunchPad and LaunchPool

Application Scenarios:

As a payment tool for platform service fees

Used for user growth and community incentives

A pass to access various value-added services

Ecological Synergy:

Creating a synergistic effect with HashKey Chain

Connecting the flow of value inside and outside the exchange

Incentivizing the development of the entire ecosystem

In a sense, HSK's design reflects HashKey's thoughts on the future of the industry - how to build a sustainable crypto ecosystem within the framework of regulatory compliance. This is not a tool for "harvesting leeks," but an infrastructure that links value and serves users.

In this era full of uncertainty, the development trajectory of HSK may provide some insights for the industry: compliance is not a shackle, but a new starting point for innovation; stability is not conservatism, but the cornerstone of long-term development. In the next decade, as the cryptocurrency industry gradually matures, this platform token that emphasizes long-term value and ecological construction may demonstrate stronger vitality.

Conclusion

Recently, HashKey held 17 events during FinTech Week, showing us that this low-profile exchange is playing a bigger game. HashKey is not only solidifying its existing business foundation but also preparing for the upcoming transformation:

On the token side, HSK will become the link connecting the ecosystem.

On the technical side, HashKey Chain will become a testing ground for compliance innovation.

On the business side, the full licensing advantage will transform into market barriers.

On the strategic side, Hong Kong's hub status will become increasingly prominent.

From an exchange to financial technology infrastructure, from a single business to a full industry chain layout, HashKey aims not only to be Hong Kong's Coinbase but also to become a bridge connecting the Eastern and Western crypto worlds. In this era full of uncertainty, HashKey's advancement may represent the future of the Asian crypto market.

The U.S. election on November 5 will be a crucial turning point in the timeline of the crypto industry. The election of Trump, as the first "crypto government" in U.S. history, will greatly promote the large-scale adoption of cryptocurrencies and Web3.

The traditional financial world will accelerate its embrace of crypto and its underlying technology, blockchain. Currently, the EU has legislated and passed the EU MICA framework for crypto compliance, and Hong Kong's VASP regulatory system has also been recently released, while the highly anticipated U.S. FIT21 bill is likely to pass after the election.

With a comprehensive crypto compliance legal framework established in the center of the world empire (the U.S.), the peripheries of this world empire (Japan, South Korea, Southeast Asia, and the Middle East) will likely replicate this model. So the question arises: how should the other world empire, the University of Tokyo, respond to this wave of financial paradigm innovation and the new digital currency system?

Looking eastward, we see Hong Kong, and we see HashKey in Base Hong Kong.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。