Master Discusses Hot Topics:

First, let's talk about the Federal Reserve's interest rate decision in the early morning. Personally, I found the outcome rather bland and the biggest feeling was that it was quite boring.

Firstly, this time the voting committee unanimously decided to cut interest rates by 25 basis points, and the wording of the statement has become more moderate: no longer emphasizing greater confidence in inflation, but rather stating progress has been made; the slowdown in job growth has been replaced with a general easing in the market.

It is clear that the Federal Reserve is also contemplating: the non-farm payrolls in September were impressive, but the unemployment rate did not continue to rise, and the CPI in October slightly exceeded expectations, so they dared not be too aggressive in their tone.

Powell's press conference was basically unremarkable, sticking to the same old approach of taking it step by step based on data. In essence, if the economy is good, they will slow down the rate cuts; if the economy is poor, they will cut rates faster. Ah, the classic "flexibility"!

The most eye-catching moment was when someone asked Powell, "What would you do if Trump asked you to resign?" Old Powell decisively stated, "I won't, and the law doesn't allow the president to fire me!" This response was quite on point; the Federal Reserve Chair must have an independent stance, which also serves to defend the credibility of the Federal Reserve.

That said, if Trump were to come back into power, a game of chess between the two is inevitable, as Trump is known for being a proponent of rate cuts.

As for the most concerning question of whether there will be another rate cut in December, Powell's forward guidance has become more cautious this time. It is estimated that unless there is a significant rebound in inflation, there should still be a slight cut in December. Although if Trump comes back and implements stimulus policies, it might bring some inflation expectations, but the short-term impact is likely to be minimal, and the path of rate cuts is expected to continue.

Returning to the market, Bitcoin has been hitting new highs while simultaneously experiencing a short-seller massacre over the past few days. After all this turmoil, Bitcoin needs a breather, which gives Ethereum a chance to shine.

On the other hand, ETH/BTC has started to take a strong route, with funds flowing from Bitcoin to Ethereum for two consecutive days, indicating a potential trend. Additionally, Ethereum's ETF has seen a net inflow of over $50 million for two consecutive days, reaching a recent high, indicating a strong market.

In the early morning, Bitcoin surged due to the Federal Reserve's rate cut, reaching a high of 76,850 before a slight pullback; the Nasdaq, S&P 500, and Dow Jones also hit new highs, but the Dow formed a "dark cloud cover," indicating some divergence.

The dollar index has declined, allowing gold to rebound. Although this rate cut is favorable, the expectation for future rate cuts has weakened, so this short-term gain may turn into a gradual flattening or even a reversal in the medium term.

Master Looks at Trends:

In the past three days, Bitcoin has risen about 8.5%, currently consolidating in the upper region, showing an alternating trend of adjustment and upward movement.

I believe the probability of a significant drop in the short term is low. If there is a pullback due to some profit-taking, it could actually present an entry opportunity to find a suitable average holding point.

Resistance Levels Reference:

First Resistance Level: 76,600

Second Resistance Level: 77,300

Support Levels Reference:

First Support Level: 75,800

Second Support Level: 75,400

Today's Trading Suggestions:

If the current upward trend continues, although it may not be in the short term, the possibility of testing 80,000 will increase. Therefore, it is essential to pay attention to whether there will be a situation where the low points rise and new highs are set. If the high points temporarily decline, the closing of the K-line can be seen as a short-term adjustment entry opportunity.

In today's trading, since we are currently in an upward trend, it is recommended to maintain a rebound perspective for trading. The current upward momentum is strong, so holding short positions carries higher risks. It is advisable to focus only on short-term downward opportunities, with psychological resistance levels at 78,000 and 78,500.

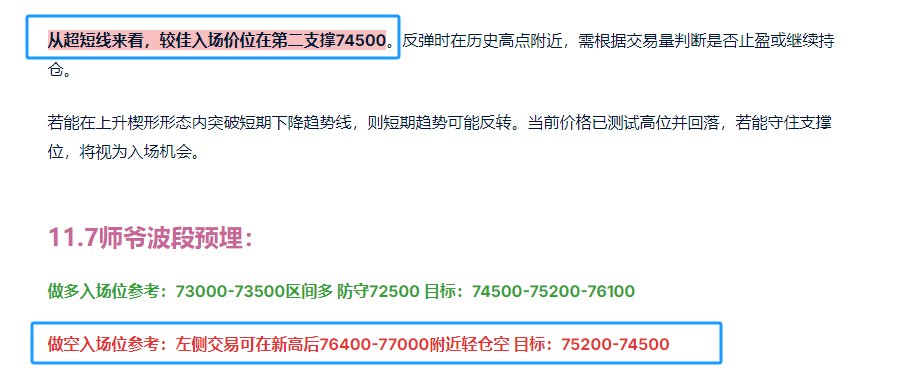

In yesterday's article, I suggested a short-term long position near 74,500, and at 10:45 PM, the price dropped to a low of 74,508. After the Federal Reserve's decision was announced, Bitcoin surged to a high of 76,900. I believe those who followed my suggestions were pleasantly surprised.

Meanwhile, the light short position set around 76,400-77,000 was successfully activated in the early morning, with the price dropping to around 75,500, yielding a gain of 1,400 points.

11.8 Master’s Swing Positioning:

Long Entry Reference: Buy in the range of 74,600-75,000, Target: 75,800-76,600

Short Entry Reference: Light short in the range of 76,850-77,300, Target: 75,800-75,400

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about K-lines, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above). Any other advertisements at the end of the article and in the comments section are unrelated to the author! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。