Polymarket Hedging Tips: How to Earn High Certain Returns as Much as Possible

The biggest winner of the U.S. election is neither Trump nor Musk, but Polymarket, which has made many friends aware of a place to "bet." But to be honest, this is no different from gambling; you either win 100% or lose everything. But is it really like that? Is there no way to guarantee a win?

Indeed, there is no guaranteed win, but there are strategies with a win rate of over 80% that can still yield profits. Of course, these opportunities do not arise every day and require personal effort to find. Now, I will use a case study to demonstrate how I did it.

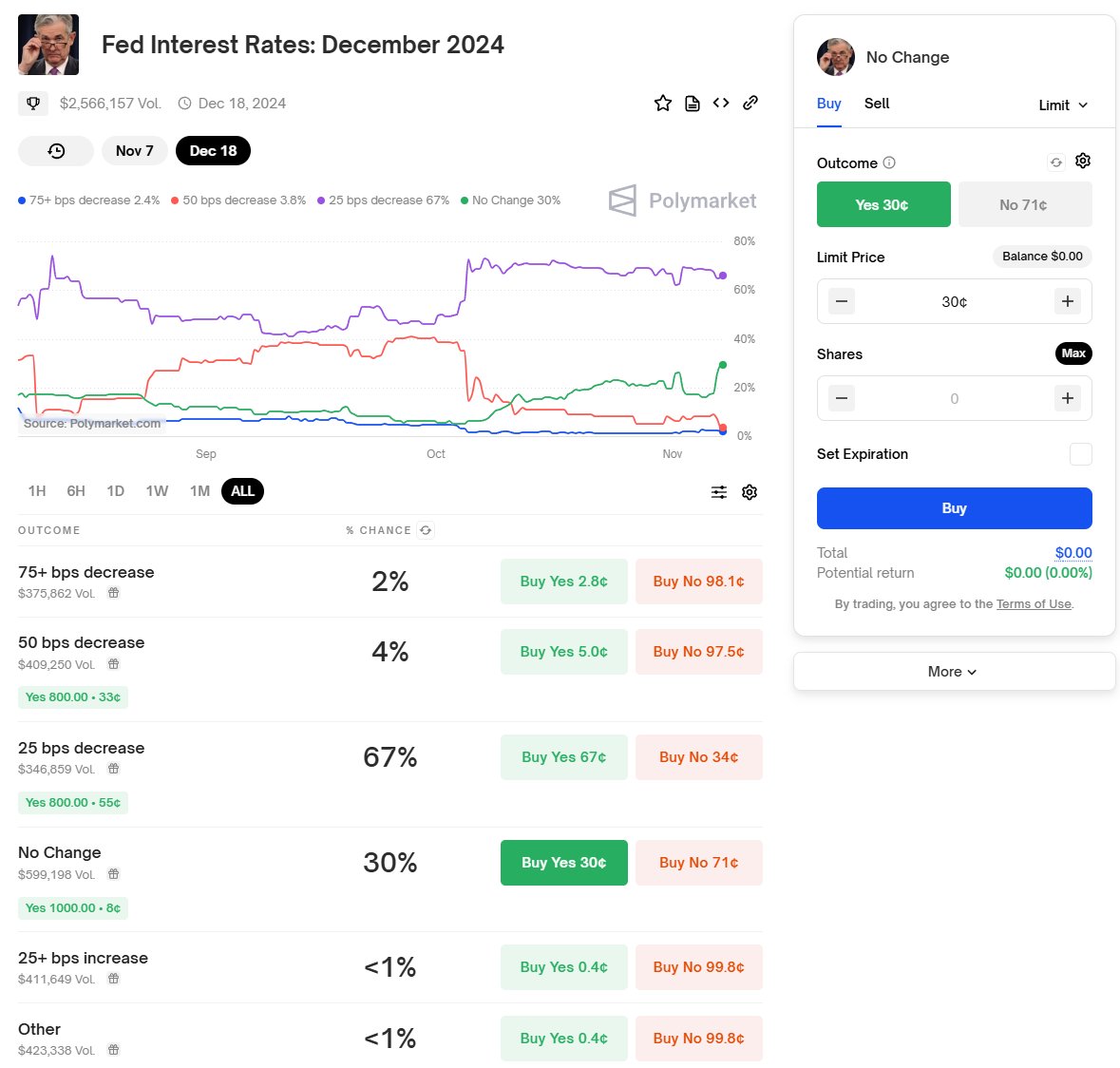

First, the idea is definitely about hedging, especially since Polymarket is a very good hedging platform. I placed a bet on Fed Interest Rates: December 2024.

First, look at Figure 1, where you can clearly see that I placed a total bet of $784 on the December interest rates. First, I believe there is a high probability of a 25 basis point rate cut, so I bet $440 on a 25 basis point cut. At that time, the predicted probability of a 25 basis point cut was 55%. If I win, I can take home $800. This is the first step, meaning if I win, I can gain a profit of $360.

But what if there is no 25 basis point cut? Will there be a 50 basis point cut? It's hard to say for December because there are still two non-farm payroll data releases. If the unemployment rate rises significantly or if there is an economic recession, a 50 basis point cut cannot be ruled out, but this is still a low probability event. At that time, there was a 33% probability of a 50 basis point cut. Since the probability is relatively low, my hedge is still based on the premise of obtaining $800, and this time the cost is $264.

After this bet, whether there is a 25 basis point cut or a 50 basis point cut, I can earn $800, and the cost incurred is:

440 + 264 = 704 dollars

800 - 704 = 96 dollars

This means that as long as there is a 25 or 50 basis point cut, I can end up with a profit of $96.

But is it stable now? Not really. What if the Fed chooses not to cut rates? There is also a probability of not cutting rates, which at that time was 8%. If Trump or Harris comes to power after the election, it could increase the probability of not cutting rates. Buying a $1,000 win would only require $80, which is key.

This means my cost becomes:

440 + 264 + 80 = 784 dollars

800 - 784 = 16 dollars

Now, regardless of whether there is a 25 basis point cut, a 50 basis point cut, or no cut, the minimum profit I can earn is $16.

The other three options are a 25 basis point hike, a 75 basis point hike, and others. The probabilities of these three are even lower. In fact, I can still hedge, but according to my understanding, these three probabilities are too low to be relevant. Moreover, the most important thing is that my goal is not to wait until the end but to take profits early.

From Figure 2, we can see that so far, the probability of a 25 basis point cut has risen to 66%, allowing for a profit of $88. The probability of a 50 basis point cut has dropped to 4%, resulting in a loss of $234, but the probability of no cut has risen to 30%, allowing for a profit of $215. So if I choose to exit completely now, my actual profit is:

88 - 234 + 215 = 69 dollars

This means my final profit has directly doubled. However, in reality, there is an even better plan in this situation: since the possibility of a 50 basis point cut is too low, I keep my positions for both 25 and 50 basis point cuts unchanged and only reduce my position for no cut, earning $215, minus the $80 cost, resulting in a net profit of $135.

Then I wait for the December rate cut. If there is a 25 basis point cut, the profit is $800, minus $704 in costs, resulting in a net profit of $96.

The total profit is $231. The total investment is $784, with a return rate of 30%.

This is 6.8 times the expected return. Of course, as mentioned at the beginning, this is also a form of gambling; there is no 100% win rate. What can be done is to take advantage of the win rate difference. If suitable targets can be selected, there can be a win rate of over 80%, although the returns may not be high.

It is also important to note that if you do not wait for the final profit but engage in secondary market trading, you need to consider depth issues. The larger the capital, the worse the depth, and the more you need to play until the end.

Finally, Polymarket is also a form of gambling. Small bets can be enjoyable, but if you place heavy bets or rely on it for a living, you may very well lose everything.

This post is sponsored by @ApeXProtocolCN | Dex With Ap

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。