Master Talks Hot Topics:

The stock price of Trump Technology Group (DJT) has plummeted, causing a brake on both the US stock market and Bitcoin. One reason for this is that the market had previously fantasized too optimistically about a bull market following Trump's election.

Yesterday, Trump "boastfully congratulated" Bitcoin on its 16th anniversary on Twitter, claiming he would end Harris's "war" on cryptocurrencies and even declared he would "make Bitcoin in America." He ended with a reminder: "Vote for me!" His intention to become the "big brother" of the Bitcoin community is quite evident.

Even more jaw-dropping is that overnight, Fox News surprisingly "turned against" Trump, with public polls showing Harris actually surpassing Trump in several key states. The sudden reversal from the Republican mouthpiece raises questions about whether the wind has genuinely changed or if Fox is playing some new tricks.

In Arizona, Georgia, and Nevada, Harris has a slight lead, while Trump has a narrow victory in North Carolina. The two are neck and neck, with the gap resembling a seesaw that could flip at any moment. Watching their battle feels like a contest to see who falters first.

In recent days, fans reaching out to Master have been asking a few key questions over the phone: one is about how long the Bitcoin bull market will last, another is when the buying opportunity for altcoins will arise, and lastly, whether Ethereum's recent sluggishness will lead to a significant correction.

Due to time constraints, Master didn't elaborate much over the phone, so today I will provide a bit more detail in this article.

Today marks the beginning of November, so let’s discuss the market outlook from November to December. Regardless of whether Bitcoin can reach new highs or just slightly surpass previous highs, it will face a "high and cold" situation— a weekly divergence is about to form, indicating a long and significant correction is on the horizon.

November can be seen as a turning point for Bitcoin from bull to bear! Following the US elections and the potential for a second rate cut, the historical performance of the US stock market around the second and third rate cuts has often shown significant pullbacks.

The economic "faucet" in the US has tightened, and the Bitcoin bubble can no longer be inflated. This can be referenced in Master’s previous analysis, which largely explained the market dynamics following the US elections and rate cuts.

Thus, it can be said that the Bitcoin bull market has already reversed; any further price increase is no longer significant. The trend of a major correction will not change, and you need to understand the trend before discussing trading.

Secondly, although Ethereum has seen a rebound in the past two months, it still struggles to break free from the bearish trend on the daily chart, repeatedly hitting resistance at the 2820 level. Historical data shows that during non-bull markets, Ethereum tends to decline in November and December.

Therefore, this time, Ethereum is likely to continue its bearish trend, possibly falling below the 2000 mark. Meanwhile, altcoins will likely plunge to historical lows, creating a desolate scene.

As the saying goes, "A thousand years of waiting for a moment," Bitcoin and Ethereum will eventually reach their bottoms. The opportunity for altcoins will await discovery during this relentless winter, and we will see if spring truly arrives after this cold season.

Finally, regarding tonight's non-farm payroll data, there is no surprise at all about the US economic data exceeding expectations, as since the Federal Reserve cut interest rates, US economic data has hardly been disappointing.

If all goes as expected, tonight's US non-farm payroll data will also exceed expectations, making it possible for the Federal Reserve to slow down or even halt rate cuts. What is the purpose of this?

The main goal is to maintain a strong US dollar index and a robust stock market, as long as the dollar index remains strong, the US can continue to harvest global market capital. It will then be a matter of who can outlast whom.

Initially, the Federal Reserve claimed it would never cut rates, but on September 18, it finally gave in. Now, the Federal Reserve could choose not to cut rates or even continue raising them, and the market may have the patience to endure.

Master Looks at Trends:

Bitcoin has dropped over 5% from its peak due to the declining probability of Trump winning and the poor performance of the New York stock market. This trend feels like it’s on the verge of collapse.

That said, as Trump's election probability rises, Bitcoin's market seems to have already digested 50-60% of the market's expectations. However, if Trump is indeed elected on November 5, a significant market shift could occur, and a rollercoaster ride is not out of the question.

Currently, the selling pressure support line remains relatively stable. This might be a short-term entry opportunity; everyone should keep an eye on it, as there could be a chance to make a trend-following trade during a rebound from the lows.

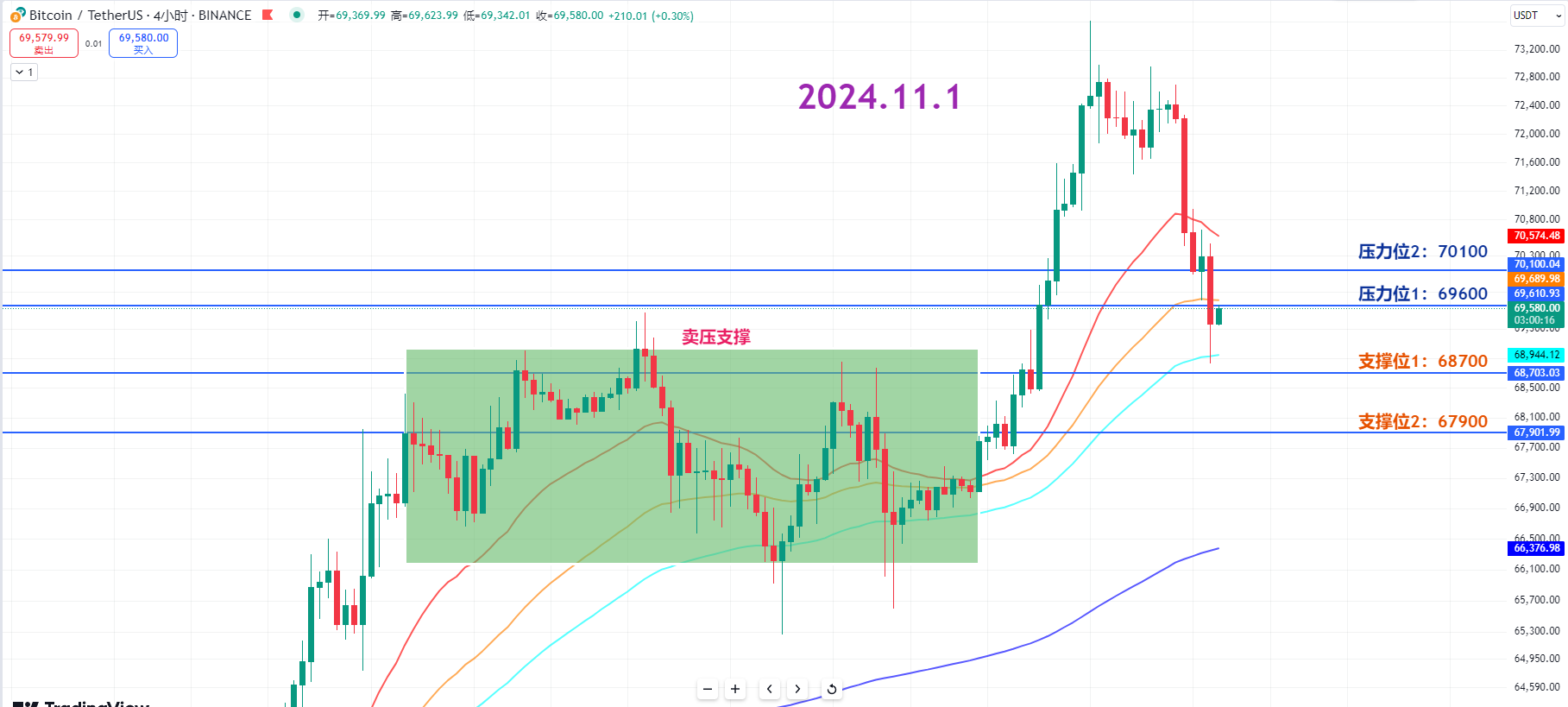

Resistance Levels:

First Resistance Level: 69600

Second Resistance Level: 70100

Support Levels:

First Support Level: 68700

Second Support Level: 67900

Today's Trading Suggestions:

You can look for entry opportunities in the lower selling pressure zone, waiting for a rebound before taking action. Additionally, with the election approaching, the market's "Trump sentiment" is still present. If a correction does occur, keep an eye on the selling pressure zone and find a suitable average price to re-enter, as the entry point is crucial.

11.1 Master’s Segment Pre-Orders:

Long Entry Reference: Buy near 68800, exit if it breaks below, don’t hesitate; this is a speculative trade. Target: 69600-70100

Short Entry Reference: Sell at 71500-71800, stop loss: 72300, target: 70100-69600

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, and knowledge about K-lines, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official public account (as shown above). Any other advertisements at the end of the article and in the comments section are unrelated to the author! Please be cautious in discerning authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。