Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

The rise of ai16z has driven the popularity of the meme fund launch platform daos.fun.

- Odaily Note: For more information about ai16z, see “The Hottest Meme Concepts: AI, Artists, Zoos, and My World”.

Protocol Principles

daos.fun is positioned as a meme "fund" launch platform based on Solana, and the "funds" launched on this platform will operate in the form of a DAO and issue corresponding DAO tokens (for example, ai16z is the DAO token of this "fund").

The operation of daos.fun mimics the conventional fund launch process, which can be divided into three stages: fundraising, operation, and redemption.

Fundraising Stage

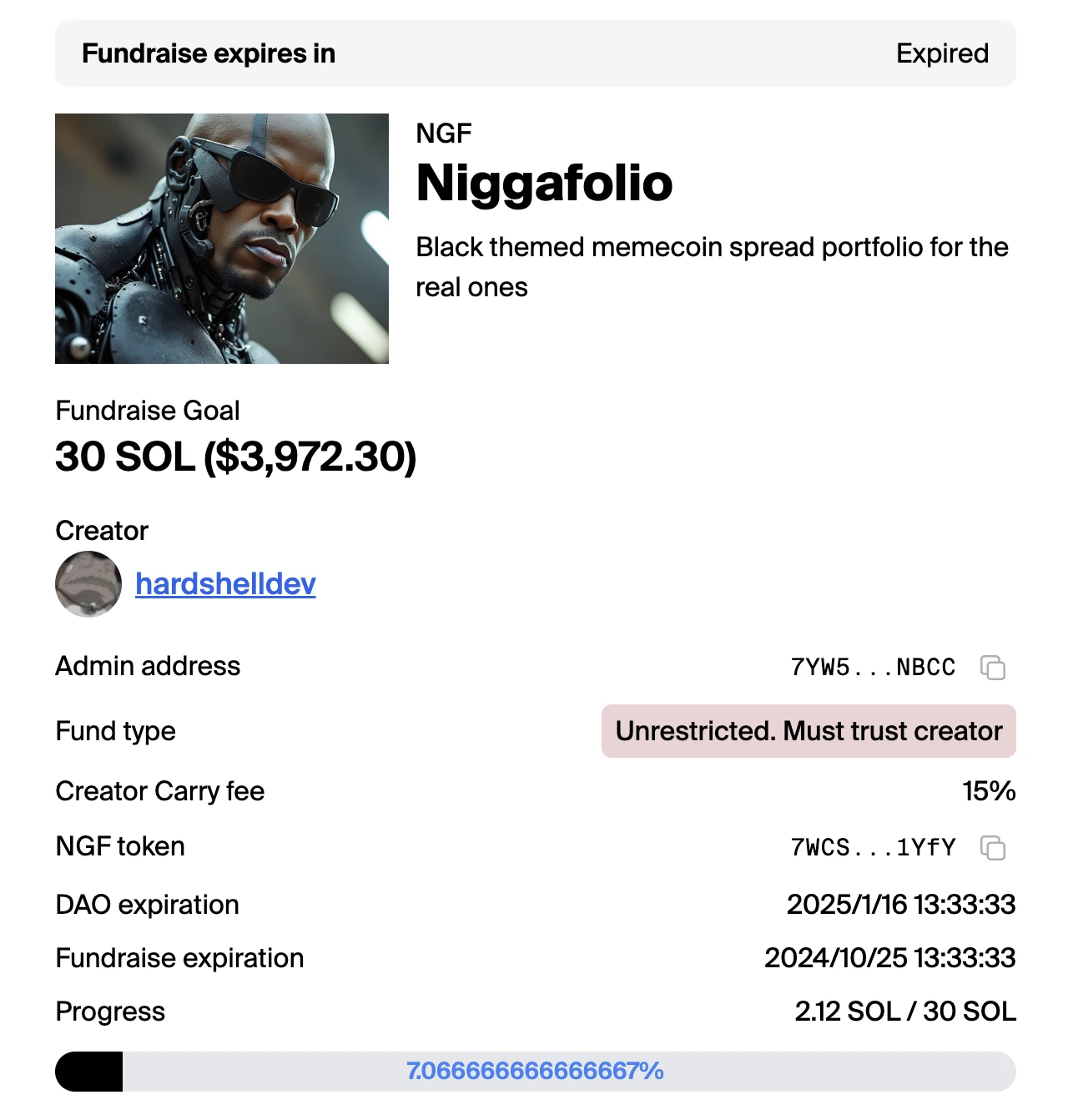

First is the fundraising stage, during which the initiator of the "fund" (daos.fun refers to them as "creators," and currently only vetted "creators" can initiate a "fund") can set a target fundraising amount (in SOL) and has one week to publicly raise funds in the market. You can understand this stage as the fundraising phase for the "fund" DAO tokens.

Once fundraising starts, if it fails, SOL can be redeemed (early redemption incurs a 10% loss); if successful, it will move to the next stage, the operation stage.

Example: In the image above, the Niggafolio fund is currently in the fundraising stage, hoping to raise 30 SOL, but has only obtained 2.12 SOL so far, with a progress of about 7%.

Operation Stage

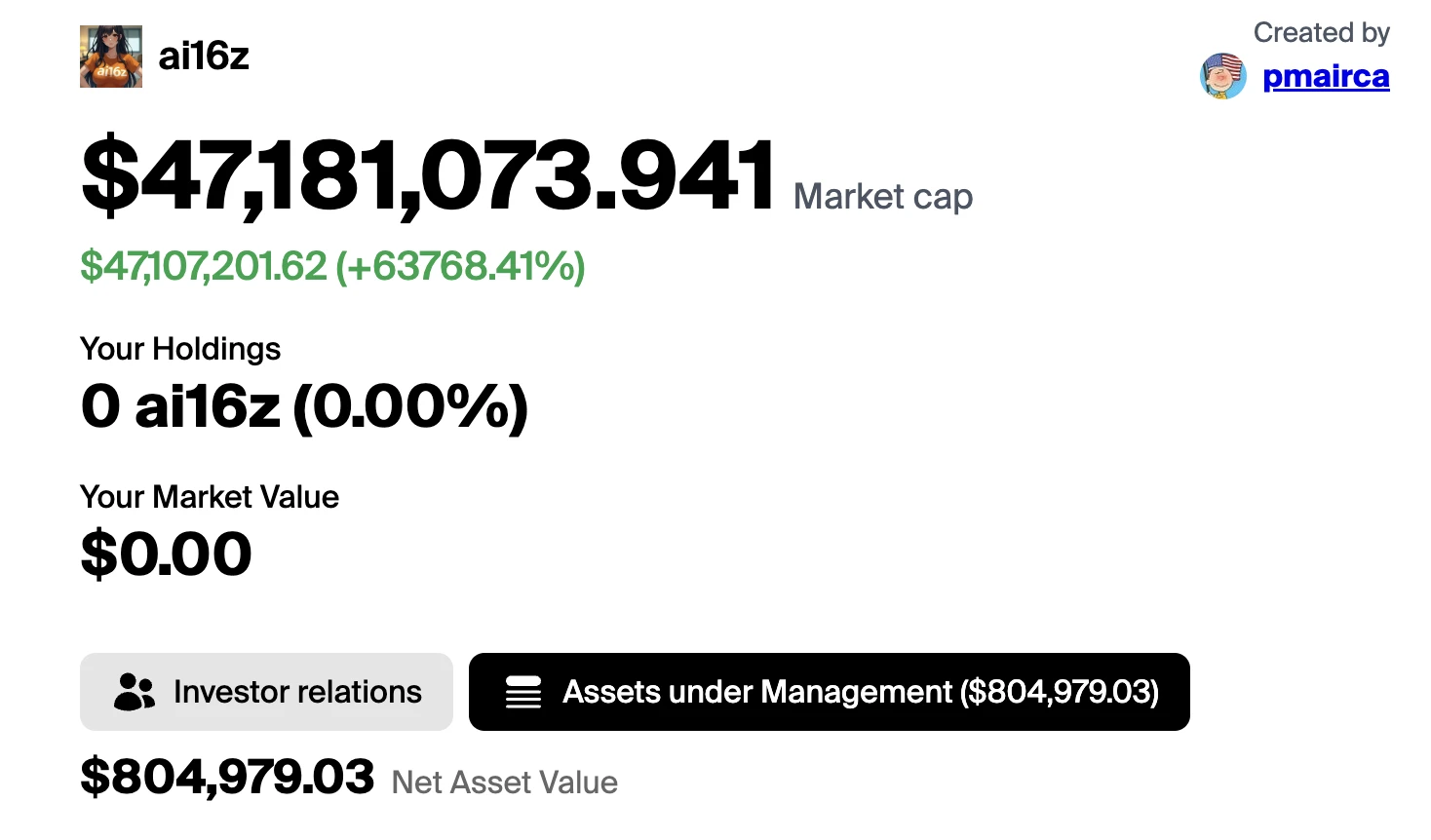

Next is the operation stage of the "fund," during which the initiator of the "fund" (the "creator") can freely invest the raised SOL in various meme tokens on Solana. In this stage, the market value of the DAO tokens will fluctuate based on the real-time holdings of the "fund" _ (Odaily Note: not completely bound, in fact, the vast majority of DAO tokens are currently at a premium)_ and the corresponding DAO tokens can also be publicly traded in the market.

Example: The total holdings of the ai16z fund are approximately $800,000, but the market value of the DAO token is currently reported at $47 million due to market enthusiasm, showing a significant premium.

It is important to note that daos.fun has limited the downside potential of the price curves for all DAO tokens, meaning that DAO token holders can only sell and realize profits when the real-time market value of the DAO token is greater than the initial fundraising amount of the "fund"; otherwise, they must wait for the third stage (redemption).

Redemption Stage

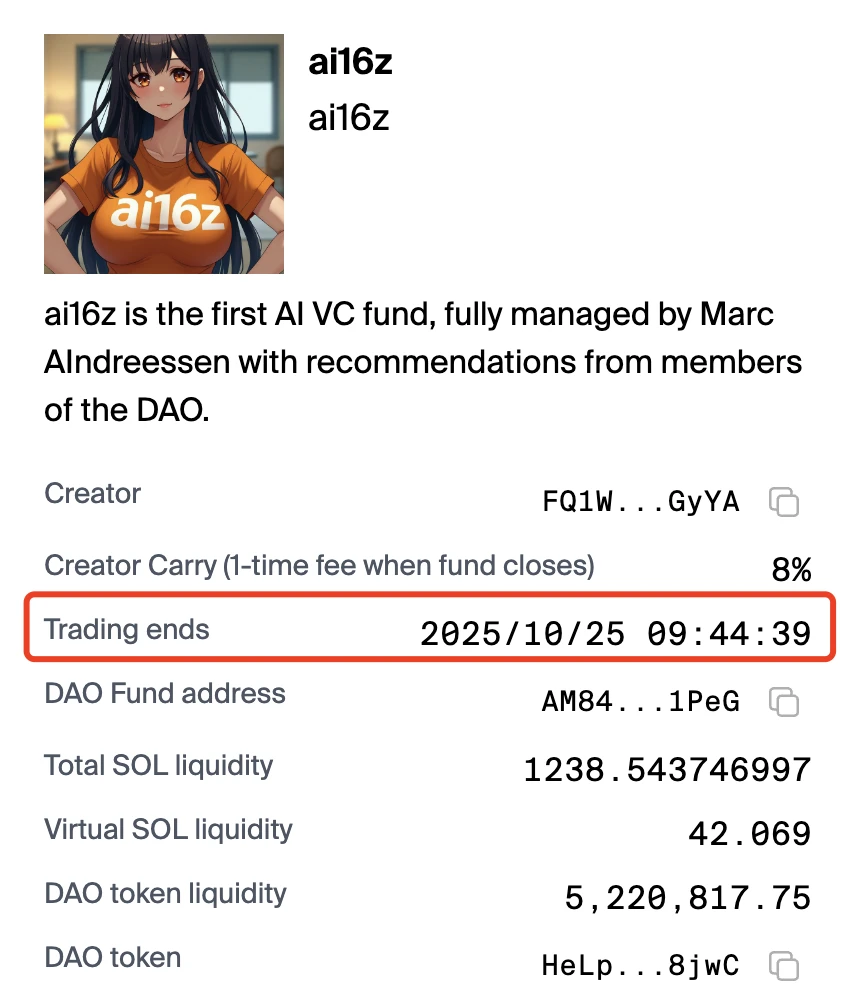

After the "fund" reaches its operational deadline, the DAO wallet will be frozen, and the profits in SOL will be distributed back to the token holders. At this point, investors can exchange the underlying assets of the "fund" by burning DAO tokens—if the market value has remained above the initial fundraising amount, they can cash out at any time by selling.

Example: A time limit must be set during fundraising, for instance, ai16z is set for 1 year, ending on October 25, 2025.

Utility Analysis

In short, daos.fun is mimicking the operational mechanism of funds in a purely on-chain model, allowing retail investors struggling with PVP to entrust their funds to more professional traders (who may also be worse), with profits and losses fully reflected in the rise and fall of DAO tokens.

The platform launched in September this year, but prior to that, it did not attract much attention until the unexpected rise of ai16z brought it into the spotlight. Compared to the more mature pump.fun, the current user experience on this platform is relatively rough, with many users reporting issues with interface lag.

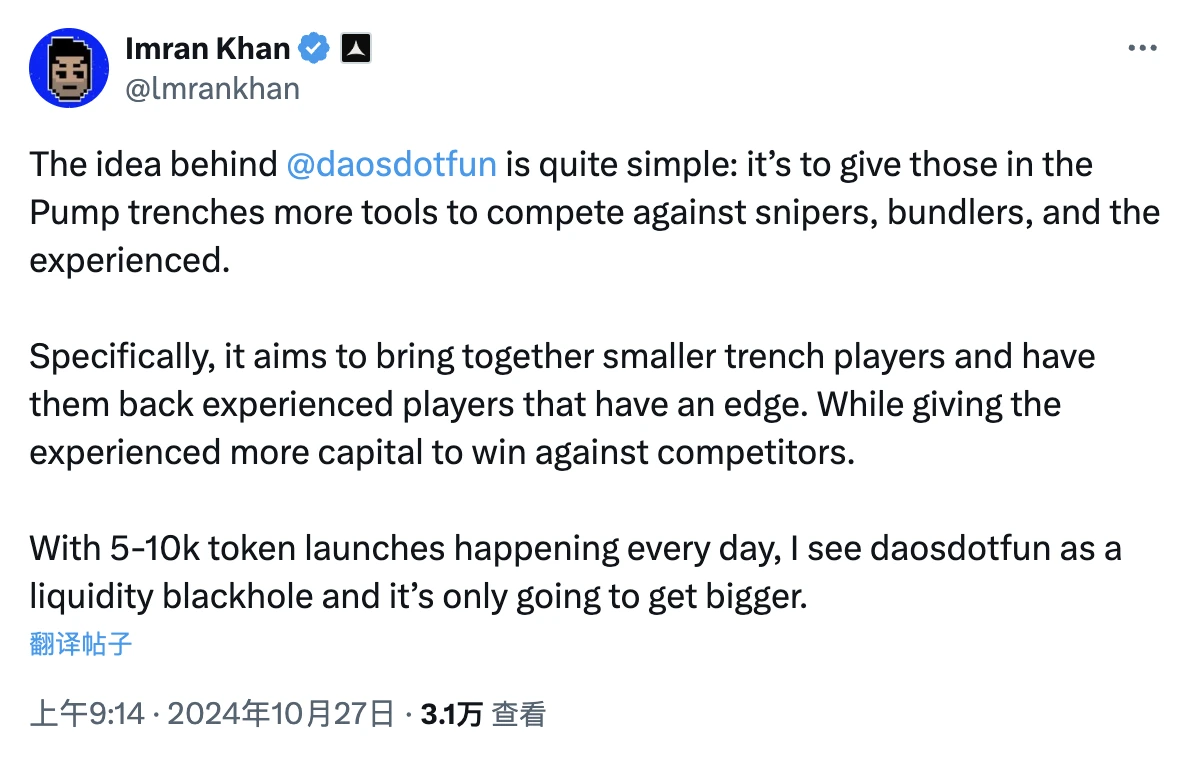

Imran Khan, co-founder of Alliance, gave a high evaluation of daos.fun: “This platform provides more tools for retail investors struggling with PVP to combat snipers, squeezes, and experienced investors. Specifically, daos.fun can gather smaller retail investors together to support those high-level players with experience advantages; at the same time, high-level players can also gain more capital to compete with their opponents in PVP. Now, 5,000 to 10,000 tokens appear every day, and daos.fun will become a liquidity black hole, only getting bigger and bigger.”

Chinese KOL Timo (the original tweet is very detailed, recommended for direct reading) also mentioned on his personal X that “daos.fun can partially solve the dilemma of retail investors in this casino of not being able to outsmart smart money,” but also emphasized two layers of risk: first, whether the so-called meme fund managers can help retail investors win remains uncertain; second, “when holdings become transparent, the strategies that fund managers originally relied on may become ineffective.”

What Other Tokens Are There Besides ai16z?

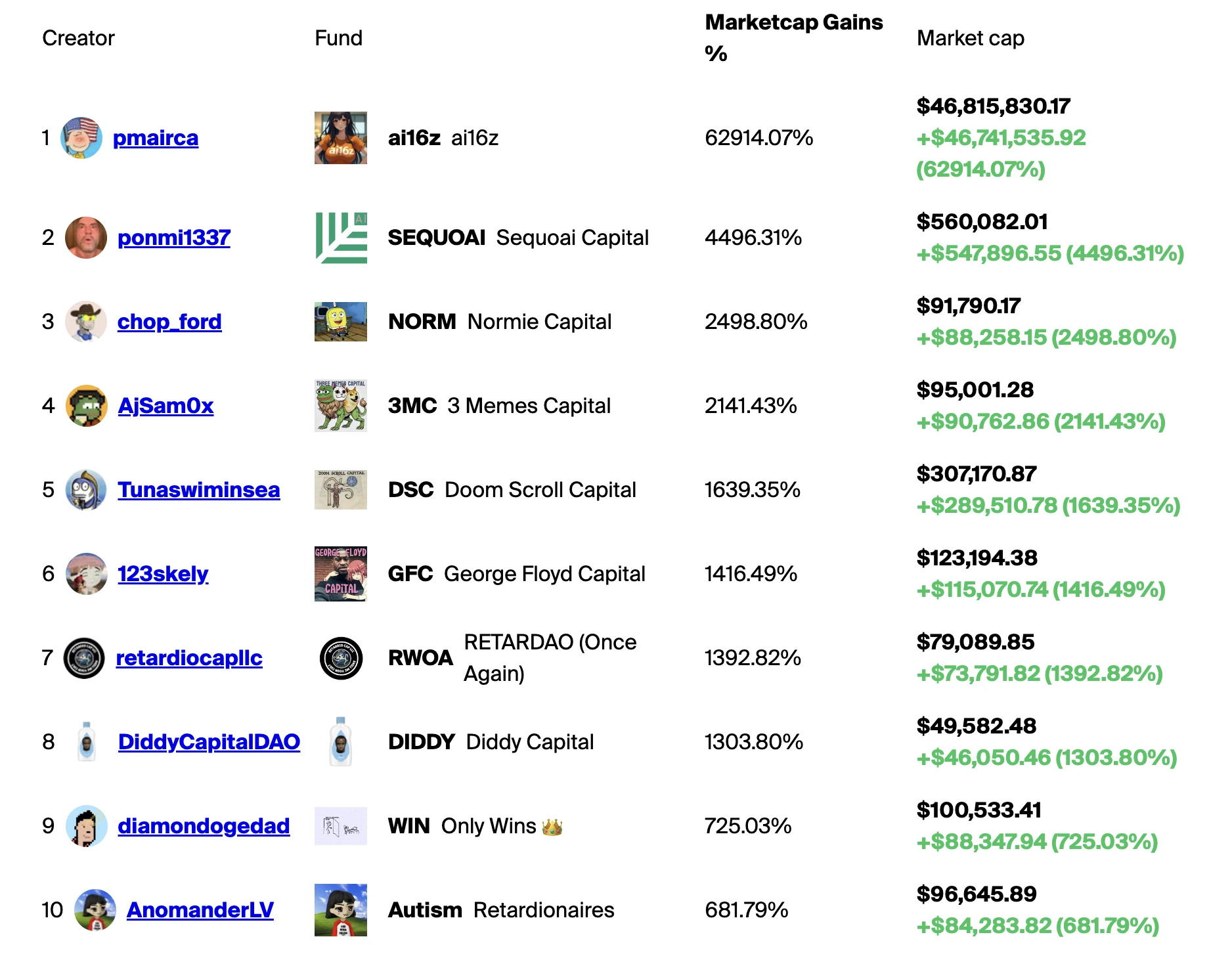

Due to the review mechanism set for the initiators of the "funds" on daos.fun, the total number of tokens currently on the platform is not large.

Excluding a few "funds" still in the fundraising stage, there are currently 22 fund DAO tokens available for trading in the public market. Besides the relatively familiar ai16z, there is also Sequoai, which mimics the well-known Sequoia fund, as well as several other "funds" that have names with a certain meme quality.

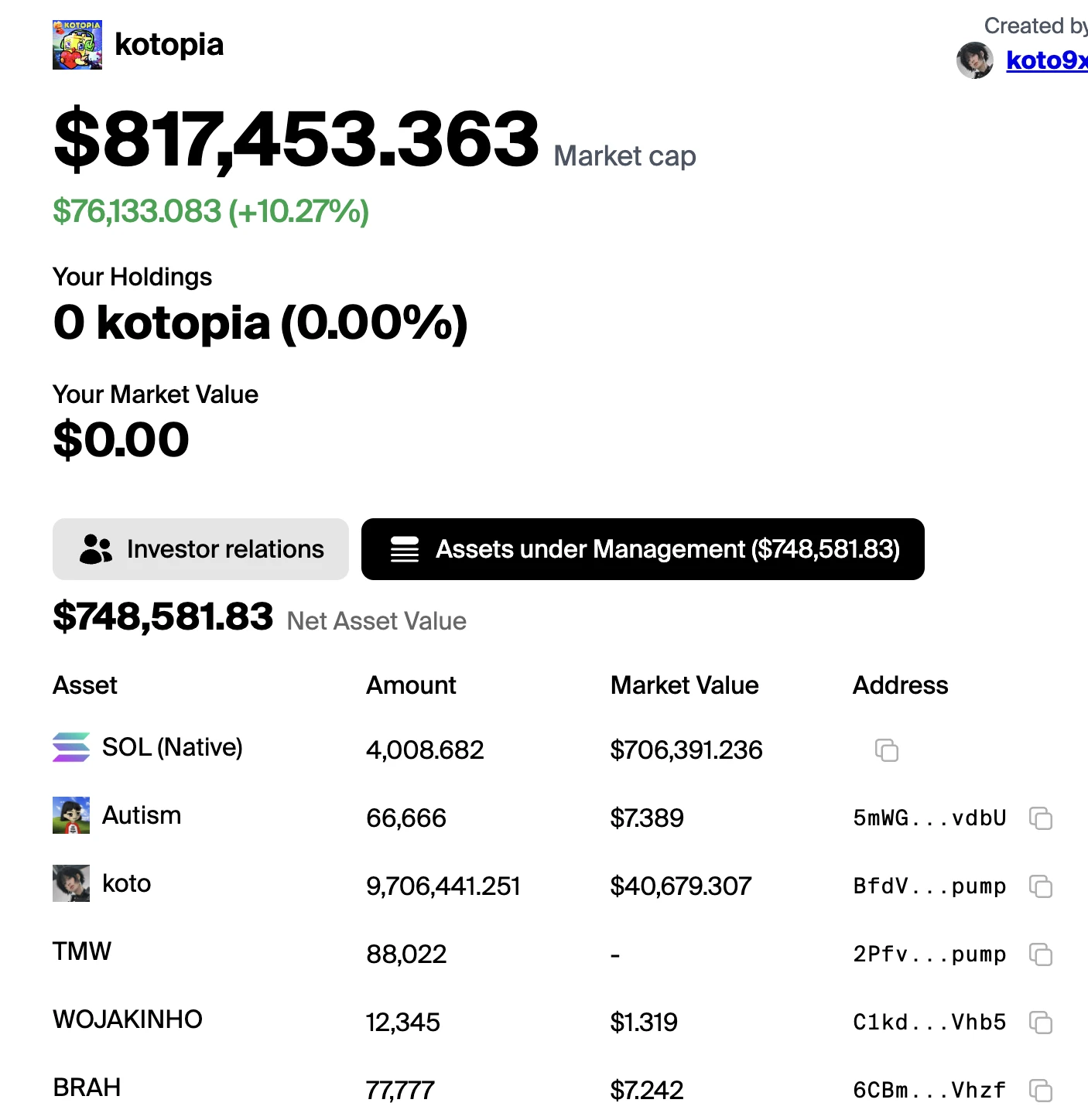

However, apart from the already successful ai16z, the current market value of other "fund" DAO tokens on daos.fun is generally low, with the second-ranked kotopia having just over $800,000, which is still because this "fund" raised 4,206 SOL (the highest amount on the platform) and most of the SOL has not been distributed (still holding 4,008 SOL).

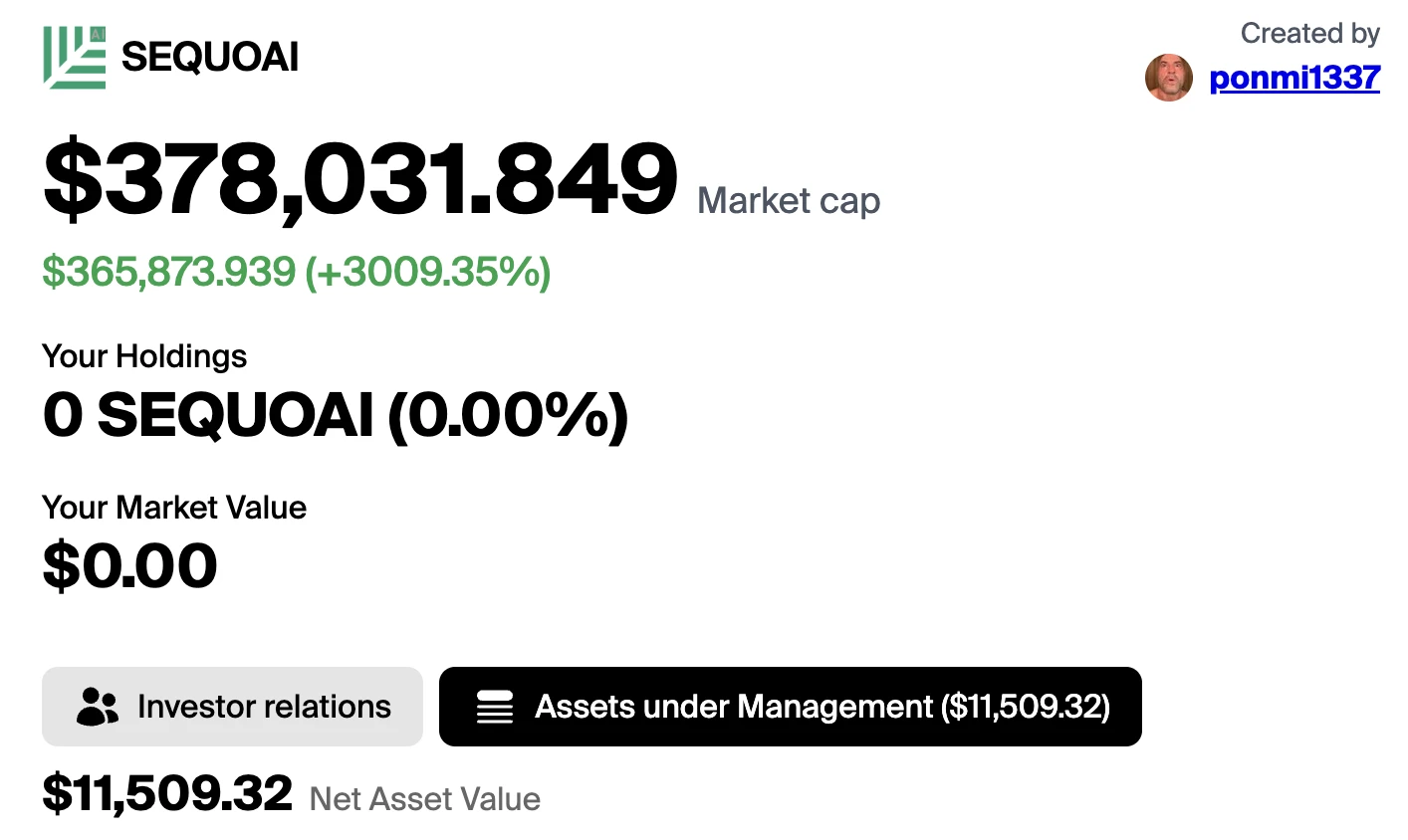

Additionally, it is important to note that despite the already low market value, the vast majority of "fund" DAO tokens still exhibit significant premiums. The previous section mentioned the holdings of ai16z, and the following image shows that the current DAO token with a market value of $378,000, Sequoai, has a total holding value of nearly $11,509.

Last night, I also tentatively bought a small position in some DAO tokens to observe, and this morning I found that they had generally halved… For users intending to participate in daos.fun, in addition to paying attention to the quality of the initiators of the corresponding "funds," please be sure to be aware of the premium risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。