Original Author: James Smith

Translation by|Odaily Planet Daily (@OdailyChina)

Translator|CryptoLeo (@LeoAndCrypto)

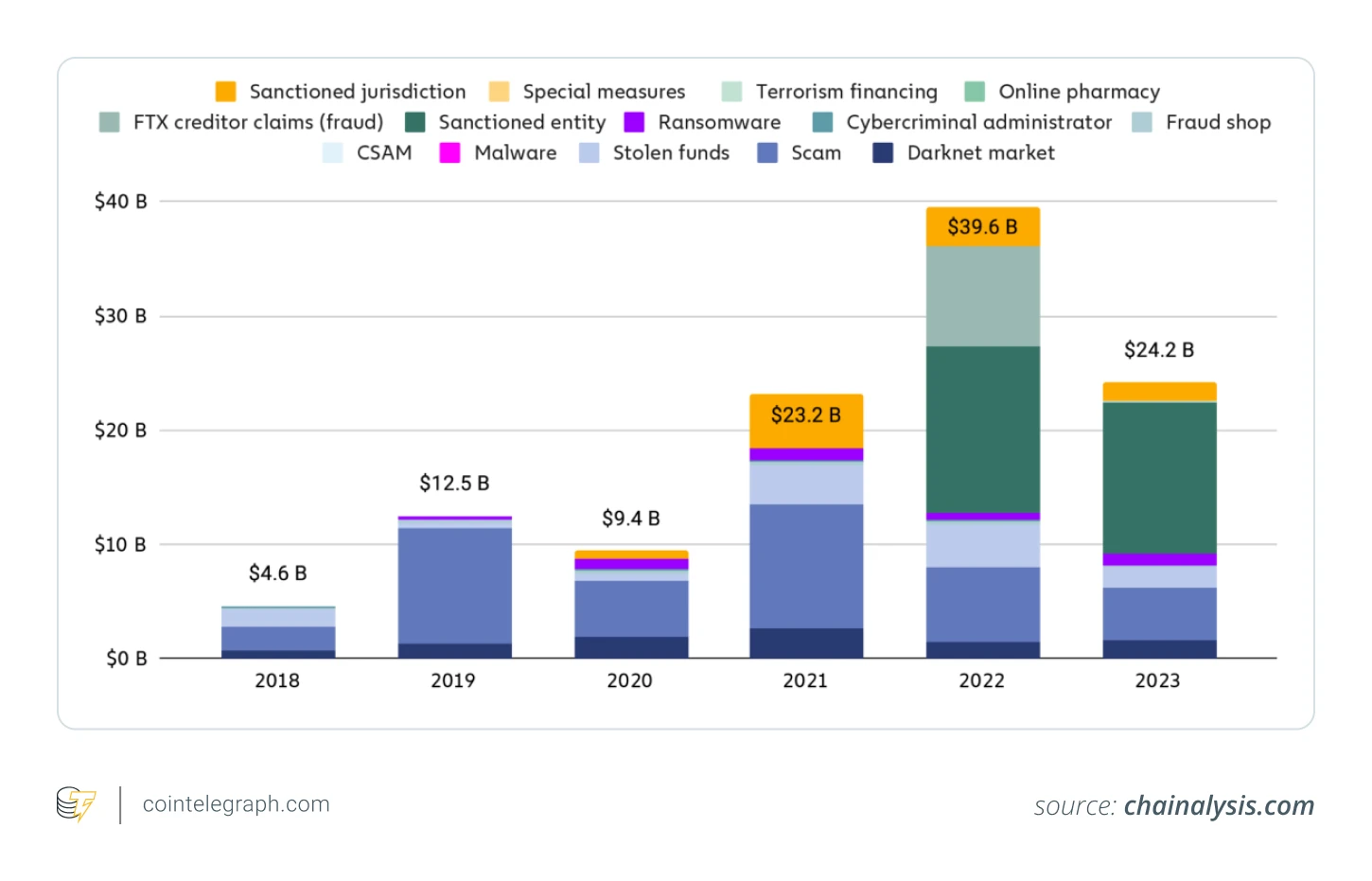

In 2024, after the United States approved Bitcoin ETFs and Ethereum ETFs, cryptocurrency took a step closer to mass adoption. However, the inflow data of cryptocurrencies related to specific cybercrime entities remains concerning. Chainalysis previously released a security report on the crypto industry, indicating that while overall illegal transactions have decreased compared to the same period last year, two notable illegal activities—stolen funds and ransomware—have been on the rise. The amount of stolen funds in cryptocurrency theft cases has doubled year-on-year, reaching $1.58 billion by the end of July, up from $857 million. Additionally, there has been a surge in cryptocurrency entities sanctioned by governments or international organizations in 2022 and 2023.

The data also indicates that cryptocurrency-related crime cases are increasingly attracting the attention of law enforcement agencies. Periodically, the industry sees a "big news" in the security field, such as the theft of funds from a major exchange or involvement in illegal activities. Some of these high-profile cases involve law enforcement agencies needing to freeze or seize the funds in question. Recently, crypto author James Smith wrote a popular science article on how law enforcement agencies handle cryptocurrency-related crime cases. The article covers a series of processes from the legal investigation of the involved cryptocurrency to its eventual seizure and handling by law enforcement agencies. Below is the full content, translated by Odaily Planet Daily:

1. What Does Seizing Cryptocurrency Mean?

Seizing cryptocurrency refers to law enforcement agencies confiscating crypto assets, usually as part of a legal investigation. This can occur in cases of fraud, money laundering, or other illegal activities.

If law enforcement suspects that a user or organization is involved in illegal activities, they can confiscate the crypto assets in their wallet. These funds are typically transferred to a government-controlled wallet until the judicial process is concluded. If the defendant is convicted in court, the seized assets will be sold or auctioned. However, if they are acquitted, the cryptocurrency will be returned to their wallet.

Seizures are executed in the context of arrest warrants, search warrants, or seizure orders, which specify the property to be confiscated. Cryptocurrency seizure orders are usually issued to exchanges or other custodians rather than individuals.

The arrest warrant will list the wallet address of the exchange and the reason for the seizure. The exchange will be required to provide the private key for that wallet to the prosecuting agency. To avoid liability and more severe consequences, exchanges typically comply with this requirement and hand over the private key.

However, under the pressure of legal orders, requiring exchanges to hand over private keys poses a fundamental challenge to the decentralized spirit that cryptocurrencies rely on. Moreover, search warrants are not the only way for law enforcement to seize cryptocurrencies held by other individuals or entities; the government can also confiscate cryptocurrencies through a "forfeiture process," which refers to a court order or judgment that mandates the permanent loss of assets. Cryptocurrency seizures usually occur before forfeiture, but not all seized assets will be forfeited.

2. What is the Process of Seizing Cryptocurrency?

The process of confiscating cryptocurrency differs from the procedures for seizing physical assets like real estate, vehicles, or jewelry, which can be physically taken away. In contrast, a crypto wallet requires the corresponding private key to unlock and transfer funds.

Law enforcement agencies often collaborate with exchanges that hold custodial wallets to obtain and recover funds. This method is applicable to hot wallets, as exchanges typically have a copy of the private key. For offline and personally owned hardware wallets or cold wallets, law enforcement may need to hack into the relevant devices to recover the funds.

After seizing crypto assets, law enforcement will hold the cryptocurrency and liquidate it, which usually requires waiting for a court order. This process can take years. The funds from the liquidation are either given to the victims of the crime or allocated to government agencies.

In 2022, the U.S. Department of Justice (DOJ) established the Virtual Asset Utilization Division (VAXU) within the FBI, focusing on blockchain analysis and virtual asset seizures. VAXU works closely with the DOJ's National Cryptocurrency Enforcement Team (NCET) on seizure matters.

In some cases, government agencies may use a procedure called administrative forfeiture, in which the government seizes assets without charging the wallet holder with a crime. This means that without a court hearing, users may ultimately lose the cryptocurrency in their wallets.

In this context, the FBI launched a token called NexFundAI in May 2024, as part of the "Token Mirror Operation," aimed at targeting individuals and organizations involved in fraudulent cryptocurrency activities, particularly pump-and-dump schemes. NexFundAI is designed to mimic legitimate cryptocurrencies, serving as bait to attract market manipulators, allowing the FBI to collect evidence against them.

3. When is Cryptocurrency Seized?

Cryptocurrency is seized when it is used for illegal activities such as tax evasion, money laundering, fraud, or drug trafficking.

If someone uses cryptocurrency for illegal activities, such as drug trafficking or hacking, it may lead to the cryptocurrency being considered "proceeds of crime" and confiscated by government agencies. The purpose of the seizure is to prevent illegal activities or recover stolen funds.

Criminals use cryptocurrency for "anonymous" transactions on the blockchain to conceal the flow of funds. Nevertheless, law enforcement can still identify criminal proceeds and seize funds through on-chain data traces, and they can request cryptocurrency exchanges to freeze the involved wallets.

When deciding whether to proceed with a seizure, prosecutors consider the organizational work involved in seizing crypto assets, potential challenges in forfeiture and management, and the value of the assets.

(As shown in the image above, there has been a surge in cryptocurrency entities sanctioned by governments or international organizations since 2022)

4. What Happens After Cryptocurrency is Confiscated?

In the United States, under civil law, when funds that belong to you are confiscated under civil law, you need to hire an asset forfeiture attorney to submit a verified claim to the forfeiting agency to take legal action. The agency has a 90-day deadline to file a complaint seeking the forfeiture of funds or the return of cryptocurrency.

When the agency files a forfeiture complaint, the court will notify all relevant parties to present their case. Your attorney can submit defenses, counterclaims, and motions to dismiss the agency's lawsuit. If the case is valid, the court may dismiss the agency's lawsuit against you and order it to pay your attorney's fees and return the seized crypto assets.

If the agency brings criminal charges against you, the process may be more complicated, and you will also need to defend against other charges. In such cases, defendants often accept plea agreements, eliminating the need for a seizure order. In this scenario, defendants may voluntarily hand over their private keys as part of the plea agreement.

In the UK, the Proceeds of Crime Act 2002 outlines how seized cryptocurrencies should be handled. Similar to other confiscated assets, 50% goes to the Home Office, while the remaining 50% is distributed among the police, the Crown Prosecution Service, and the courts. There is also a possibility that some of the confiscated assets may be returned to the victims of crypto cases.

In Europe, when illegal cryptocurrency transactions are discovered, authorities seek court orders to freeze or seize assets. To enforce the orders, they collaborate with crypto platforms, and in cross-border cases, regulatory agencies like Europol may provide assistance. The confiscated cryptocurrencies are stored in government-controlled wallets and may be auctioned or liquidated after a conviction, depending on the laws of the country.

In contrast, Indian law enforcement agencies (ED) work jointly or independently with local cybercrime units to confiscate cryptocurrencies. When illegal activities are detected, authorities may seek court orders directing exchanges to freeze or seize assets. Until a final court ruling, the confiscated cryptocurrencies will be held in wallets under government supervision. However, as India is developing a clear legal framework for handling crypto-related crimes, this process may involve long investigations.

5. Examples of Cryptocurrency Forfeiture

There are many well-known examples of government seizures of crypto assets, such as those from Bitfinex, Silk Road, and Mt. Gox.

Bitfinex Hack Incident

In 2022, U.S. federal authorities recovered approximately $3.6 billion worth of Bitcoin related to the 2016 Bitfinex exchange hack, where about 120,000 BTC were stolen by hackers. Years later, this money was ultimately linked to two individuals (Morgan and Lichtenstein).

As part of the investigation, authorities seized these assets. Although Bitcoin transactions are anonymous, this case highlights the development of on-chain analysis investigations, demonstrating that even illegal funds from years ago can be found and confiscated.

Silk Road Dark Web Incident

In 2013, the U.S. government seized approximately 144,000 Bitcoins from the dark web market Silk Road, whose founder, Ross Ulbricht, was arrested for facilitating illegal drug transactions. This widely publicized cryptocurrency seizure was part of a broader campaign against illegal cryptocurrency activities.

The U.S. Marshals Service subsequently auctioned the seized Bitcoins (now worth billions of dollars). The Silk Road case remains a landmark moment in regulating and prosecuting crimes involving cryptocurrencies.

Mt. Gox Hack Incident

Mt. Gox was once the largest Bitcoin exchange but went bankrupt in 2014 after losing 850,000 Bitcoins (worth about $450 million at the time). After filing for bankruptcy, the remaining assets of the exchange (including over 200,000 Bitcoins) were seized by Japanese authorities. During the legal process to pay creditors, these seized funds were held in a custodial account.

In March 2014, Mt. Gox CEO Mark Karpelès announced the discovery of 200,000 Bitcoins in an old digital wallet, reducing the total loss to 650,000 Bitcoins, which gave creditors hope. The Tokyo District Court subsequently appointed a temporary administrator to manage this complex legal case, with the biggest challenge being to revalue the lost Bitcoins, as their price had skyrocketed since the hack. Karpelès faced charges of embezzlement but was only convicted of falsifying records. In 2024, repayments to creditors continued, with the repayment deadline extended to October 31, 2025.

6. How Do Law Enforcement Agencies Handle Seized Funds?

In the United States, federal agencies must submit a plan for the use of seized funds to the Department of Justice, outlining how the funds will be utilized. Civil forfeiture became common during the drug war of the 1980s and has faced criticism ever since.

Sometimes, as part of a plea agreement, seized assets are partially returned to the owners, but only 1% of seized assets are returned to their owners. The seized funds are typically used to support law enforcement actions, such as equipment, training, and investigations. For example, in 2011, the St. Louis County Police Department spent $400,000 on helicopter equipment.

While some U.S. states, like Missouri, require that seized funds be allocated to schools, law enforcement agencies often retain most of the funds through the federal equitable sharing program. However, the long-standing practice of forcibly seizing assets from individuals or companies has faced criticism from various quarters.

Many believe that reform in this area is necessary to ensure that asset forfeiture is conducted fairly and transparently, providing adequate protection for those at risk of having their assets seized.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。