Central Northern and Western Europe has the second largest commercial services market in the world, primarily driven by the UK, with a year-on-year growth of 58.4%.

Source: Chainalysis

Translation: Bai Shui, Golden Finance

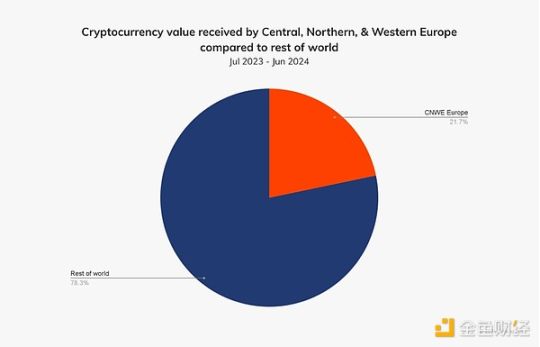

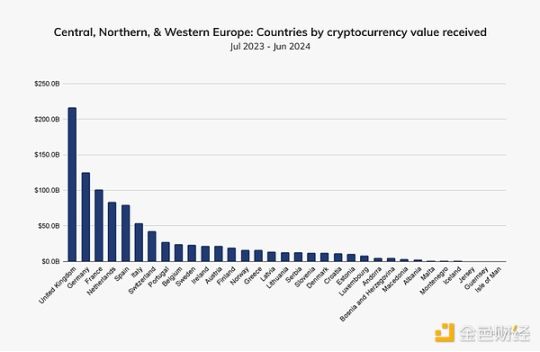

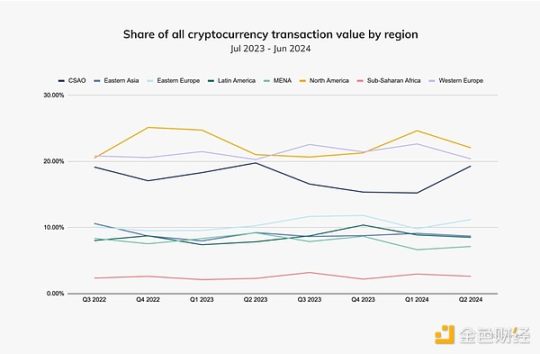

Central Northern and Western Europe (CNWE) is the second largest cryptocurrency economy in the world, following North America, with an on-chain value of $98.725 billion from July 2023 to June 2024, accounting for 21.7% of global transaction volume. Most countries/regions in CNWE are experiencing growth in cryptocurrency activity, with an average year-on-year growth rate of 44%. The UK remains the largest cryptocurrency economy in CNWE, receiving $217 billion in cryptocurrency and ranking 12th in our global cryptocurrency adoption index.

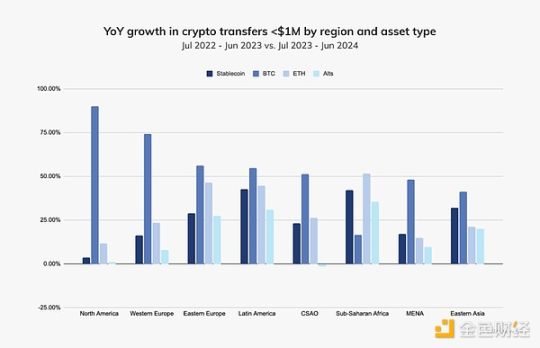

For transactions below $1 million, specifically professional ($10,000 to $1 million) and retail ($10,000) transfers, Bitcoin (BTC) has grown by nearly 75%, the highest among all asset types in CNWE. Across all transaction sizes, BTC accounts for $21.23 billion of the total value received on-chain in CNWE (about one-fifth). Although the growth rate of BTC activity for transactions under $1 million in CNWE is lower than that in North America (as shown in the chart below), the former outperforms the latter in growth across all other asset types, particularly stablecoins.

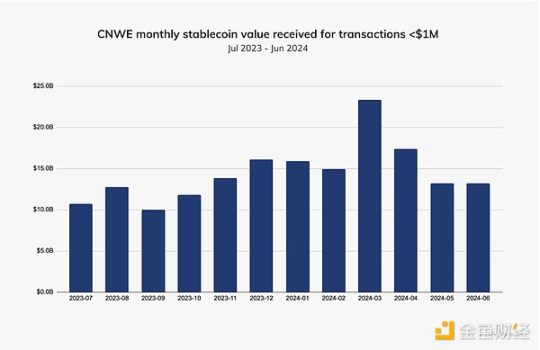

For transfers below $1 million, CNWE has seen stablecoin transaction volume grow 2.5 times that of North America. The value of stablecoins across all transaction sizes in CNWE accounts for nearly half of its total cryptocurrency inflow ($42.23 billion). The chart below shows the performance of stablecoin transfers under $1 million over the past year, averaging between $1 billion and $15 billion per month.

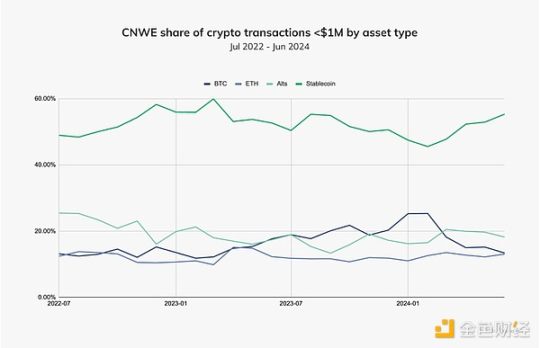

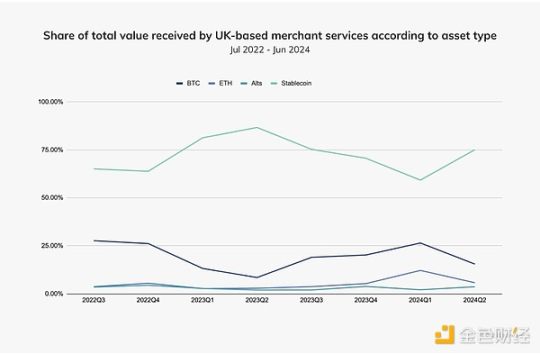

Despite a decrease in inflows in May and June 2024, the share of stablecoin transactions has increased, indicating that despite a market downturn post-bull run, the usage of stablecoins remains strong. A further review of the past two years shows that stablecoins have dominated among other asset types. The chart below examines purchases under $1 million by asset type. As we can see, from July 2022 to June 2024, stablecoins averaged a 52.36% share in transactions across various asset types.

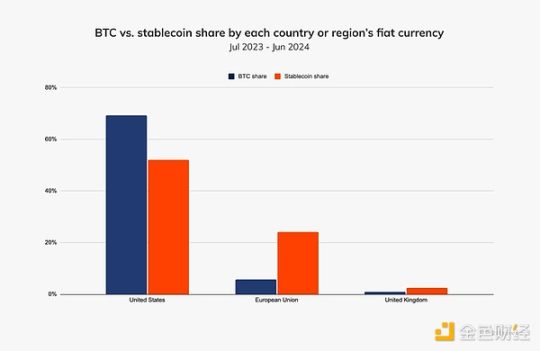

Last year, the share of stablecoins purchased with fiat currency in CNWE far exceeded that of BTC. The chart below uses order book data (a list of buy and sell orders for assets or securities) to supplement on-chain activity and shows that the euro (EUR) accounted for 24% of stablecoin purchases in fiat currency transactions, but only 6% of BTC purchases. In contrast, the US dollar (USD) accounted for a larger share in BTC purchases than in stablecoin purchases.

Data indicates that when it comes to cryptocurrency transactions with fiat currency, CNWE is more optimized for cryptocurrency users purchasing stablecoins than for those purchasing BTC.

To gain more insights into stablecoin activity in the region, we interviewed BVNK, a global company providing multi-asset stablecoin payment platforms. Chris Harmse, co-founder and Chief Business Officer of BVNK, stated, "Our fiat business serves our stablecoin platform. We see them as coexisting, and we need to bridge the gap with the fiat world."

Harmse confirmed that Chainalysis's findings on stablecoin usage in the region align with the company's observations. BVNK's business clients purchase stablecoins to meet various payment use cases. For consumers of these businesses, 90% of their payments are made using stablecoins. We will share more information about BVNK in the next section.

Commercial services thrive in the UK

CNWE has the second largest commercial services market in the world, following CSAO, primarily driven by the UK, with a year-on-year growth of 58.4%.

Stablecoins are the most commonly used asset type in these services, consistently accounting for 60-80% of market share each quarter, as shown in the chart below.

As one of the commercial service providers offering stablecoin transactions for businesses in the UK and Europe, BVNK covers B2B and B2B to consumer (B2B2C) use cases, such as the following examples:

- Settlement: Fintech or payment service providers help merchants settle invoices, offering faster and cheaper payment channels than traditional finance (TradFi).

- Payment: When consumers want to use stablecoins to pay businesses (e.g., depositing on trading platforms, funding gaming or sports betting accounts, or making online purchases), BVNK's business clients utilize APIs to provide cryptocurrency payment gateways.

- Payments: Money service businesses (MSBs) use stablecoins to pay contractors or employees, many of whom live in South America, experiencing currency devaluation and/or lack of access to USD.

In this context, citizens in countries like Argentina (with an inflation rate reaching 143% in the second half of 2024) are turning to stablecoins to mitigate the effects of currency devaluation.

Harmse stated, "In an emerging market, businesses are starting to see stablecoins as an alternative. Just as consumers in Argentina cannot access USD in the market, businesses are hindered by traditional payment channels. They cannot pay invoices on time, and they are making these payments using stablecoins, leveraging global trade flows."

BVNK sees an average transaction size on its platform ranging from $100,000 to $250,000, typically for large commercial transactions aimed at settling invoices, as mentioned. Most B2B transactions handled by the company are cross-border payments, with a significant portion of stablecoin payments flowing to Latin America. Consumer payment amounts processed through the BVNK platform range from $100 to $1,000.

When asked about new or surprising stablecoin use cases, Harmse mentioned small payments to freelancers in the gig economy—these are often cross-border payments where traditional payment methods are too costly. He also noted that the region is beginning to see more non-profit organizations and NGOs using cryptocurrency payments (especially stablecoins) during crises to provide aid more quickly to conflict areas.

Payhound is another company providing commercial services in CNWE. It is a cryptocurrency payment processor based in Malta, serving the online gaming industry in the country and offering settlement and large transaction services. While the latter constitutes the majority of Payhound's revenue, the company also recognizes the value and potential of its payment processing products.

Elton Dimech, Managing Director of Payhound, stated, "We believe that online businesses will have significant interest and enthusiasm in providing as many options as possible, especially more innovative payment methods."

Tokenization of real-world assets gains attention

This year, regional experts indicated that the tokenization of real-world assets (RWA), while still in its infancy, is gaining attention in CNWE. Philipp Bohrn, Vice President of Public and Regulatory Affairs at the Austrian cryptocurrency exchange Bitpanda, stated, "Across Europe, we are seeing an increasing popularity of RWA tokenization projects, particularly in areas such as real estate, intellectual property, and collectibles like art, cars, or wine."

We also interviewed Sylvain Prigent, Chief Product Officer at Societe Generale-FORGE (SG-FORGE), a fully integrated and regulated subsidiary of Societe Generale Group. SG-FORGE is paving the way for the adoption of security tokens, particularly with the first digital green bond issuance registered directly on the Ethereum public blockchain last year, enhancing the transparency and traceability of ESG data. Prigent believes that security tokens and RWAs will create accessible investment opportunities for the traditional competitive securities market. He stated that significant development work has been done to ensure this new infrastructure can be smoothly utilized by TradFi.

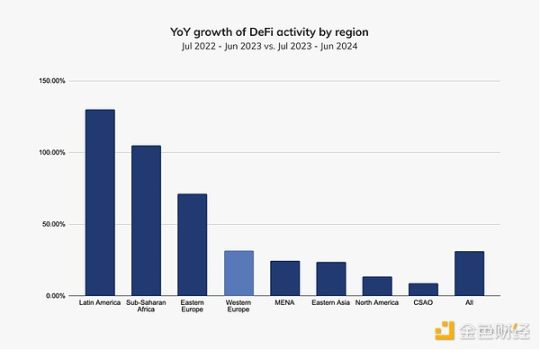

CNWE DeFi growth ranks fourth globally

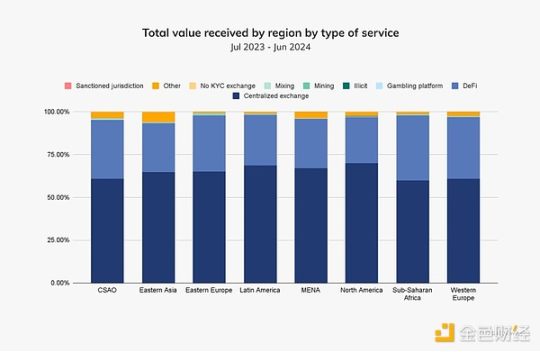

DeFi activity in CNWE over the past year has been on par with the global average. The region's year-on-year growth performance has outpaced North America, East Asia, and the Middle East and North Africa, accounting for $270.5 billion of all cryptocurrency received in the region.

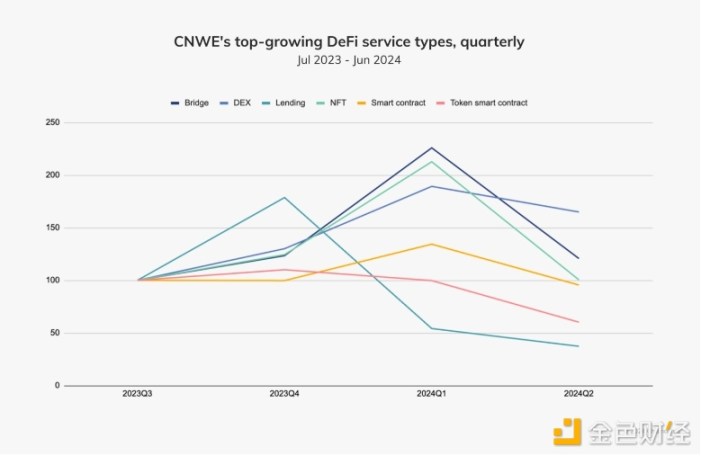

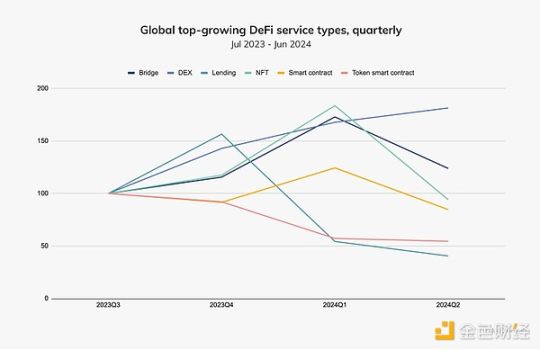

Decentralized exchanges (DEX) have driven DeFi growth in CNWE, while inflows in most other DeFi service categories have declined in recent quarters. In the first quarter of this year, there was a brief surge in NFTs and bridges, which then gradually faded back to previous levels. Lending saw an increase in the fourth quarter of 2023, but has steadily declined entering 2024 and has yet to rebound.

While similar growth trends are reflected globally, the growth rate of DeFi in CNWE is faster than the global average. In CNWE, the growth rates for bridges and NFTs are 2 times, while in other parts of the world, it is only 1.5 times.

The Future of Cryptocurrency in Central, Northern, and Western Europe

This summer, the EU's Markets in Crypto-Assets (MiCA) regulation came into effect for stablecoins, which have been steadily gaining market share in CNWE over the past year. However, the region has yet to feel the regulatory impact of MiCA on cryptocurrency asset service providers (CASPs), which will take effect in December. We interviewed several experts about the potential regulatory impact of MiCA across the EU.

Philipp Bohrn from Bitpanda stated, "A major challenge that still exists is regulatory uncertainty and the complexity of cross-border compliance." "There also seems to be an education gap, with many participants unaware of how tokenization projects work and what benefits and risks they may bring. However, we see a tremendous opportunity here—by bridging this knowledge gap and creating a clear regulatory framework, we can unlock the true potential of asset tokenization, driving innovation and robust growth in global financial markets."

Elton Dimech from Payhound discussed how MiCA will affect payment processors, particularly those serving the online gaming industry in CNWE. "In Malta, we have a strong framework that must compete with other businesses that are almost unregulated. Therefore, if merchants want a simpler route, we will not be their right choice. This will change dramatically when MiCA comes into effect, and I hope that regulators within the EU will enforce this new regulation to provide a fair competitive environment for all cryptocurrency service providers."

As the CASP rules of MiCA will take effect in December, compliance teams will be at the forefront of implementation and related control enhancements. Zodia Custody, a UK-based company bridging the gap between TradFi and cryptocurrency, also expressed its views through its Group Chief Compliance Officer, Sophie Bowler.

"We believe that regulation is key to the mainstream adoption of digital assets and further success and innovation," Bowler said. "Regulatory clarity not only enables digital asset companies to confidently develop new products but will also encourage more traditional financial institutions to engage in digital asset business within a clear regulatory framework."

As MiCA develops in the EU, the UK is also continuously evolving its regulatory framework.

Bowler stated, "Companies that cannot or do not wish to meet MiCA requirements may temporarily turn to the UK market. However, we believe this will be short-lived, as UK crypto legislation is expected to closely align with MiCA, and the FCA's roadmap for crypto legislation and related consultation documents are expected to be released in early 2025, providing us with greater clarity on the timeline for these legislative changes."

At Chainalysis, we will monitor the final stages of MiCA's rollout and regulatory developments in the UK, and we look forward to understanding how these measures will impact cryptocurrency adoption in the coming year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。