Master Discusses Hot Topics:

Let's first talk about the recent market. The emotional fluctuations are quite significant, especially with the upcoming U.S. elections, where retail investors' expectations are constantly reversing like a drama.

With the emergence of expectations for Trump's victory, the market has gone through a transmission process from first-order to second-order, where the apparent benefits are gradually being replaced by potential risks. Master still believes that the market hasn't changed; only the expectations have.

First-order expectation: Trump is about to take office, and everyone is thinking positively—tax cuts, falling oil prices, cryptocurrencies soaring, and the stock market skyrocketing alongside Bitcoin. This rhythm is simply like "money falling from the sky."

Second-order expectation: Wait a minute, the money might be toxic! Increased tariffs, tough immigration policies, resulting in Americans paying the price, rising prices, and inflation might come back again.

The Federal Reserve, watching the excitement, might have to call a halt to interest rate cuts, or even reverse and raise rates, which could lead to rising interest rates, and the dollar and U.S. Treasury yields could soar. Thus, the market is retreating while shouting, "Wasn't it supposed to be a party together?"

Why is the market always so bizarre? First looking at the benefits and then thinking of the bad things is like when everyone drinks and says, "It's fine, we'll talk about it after drinking." As for gold, it was first "Ah, interest rate cuts are coming!" Only to turn around and find inflation returning, causing gold to rise accordingly.

The market's reaction is like that line from a Stephen Chow movie: "Actually, I just wanted to choose a president properly, but accidentally caused inflation." Looking back, the dollar index and U.S. Treasury yields have both hit the ceiling.

Trump seems to be in a great position recently, but don't forget that Harris's fundraising in September far exceeded Trump's, and this year's voter participation rate has set a record—history shows that the higher the voter turnout, the happier the Democrats are. The election is like Bitcoin's performance in a bull market; the climax often happens when you least expect it.

In summary, the expectation of Trump's victory has temporarily excited the cryptocurrency market, like picking up money falling from the sky. However, with the arrival of second-order expectations, inflation rebounding and the risk of interest rate hikes, in short, there is potential in the short term, but greater volatility in the long term. As small retail investors in the market, we still need to stay steady; we can win!

Master Looks at Trends:

Bitcoin is currently fluctuating within a range, and the best strategy now is to closely monitor the upper and lower bounds, deciding on action once it breaks through, as it currently lacks momentum.

After previously entering a sideways phase following a decline, if the high point does not appear for a long time, the possibility of a drop will increase. Therefore, the 66.8K support line has become particularly important, like the last line of defense for a goalkeeper, and everyone needs to keep an eye on it.

Resistance Levels Reference:

First Resistance Level: 67800

Second Resistance Level: 67300

As long as the first resistance is broken, there is a possibility to continue looking bullish and retest the high point of the range.

If the support level can hold, we can expect further resistance testing. However, if it fails several times, disappointed selling in the market will follow. At that time, remember not to hold on stubbornly; taking profits early is the best strategy.

Support Levels Reference:

First Support Level: 66800

Second Support Level: 66400

If the first support level cannot hold, the risk of a short-term decline will arise. If it breaks down, it could directly open up to 66K below, so the 66800 point needs special attention.

Currently, Bitcoin is still swaying within the range, and 66.8K remains an important threshold for profit and loss. If you plan to trade, it would be safer to operate around this point.

Today's Trading Suggestions:

In today's trading, try to observe the movements within the range as much as possible and remain flexible. The market is currently filled with greed, and retail investors are looking forward to a rise. Therefore, you can look for opportunities to enter during the adjustment period while paying attention to support and resistance breakouts.

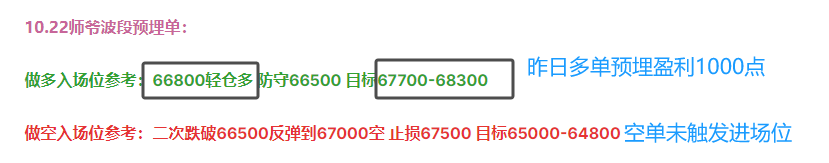

10.23 Master’s Swing Trading Orders:

Long Entry Reference: 66000-66400 Long, Stop Loss 65600, Target 67300-67800

Short Entry Reference: 67800-68200 Short, Stop Loss 68600, Target 67300-66400

This article is exclusively planned and published by Master Chen (WeChat Official Account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article or in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。