Original source: @thedefiedge

Translation: Odaily Planet Daily Wenser (@wenser2010)

Editor’s note: Bitcoin has risen to its highest point since the end of July, and top venture capital firms are once again seeing paper profits. Crypto KOL DeFi Edgy recently conducted a tracking survey of the on-chain assets of 8 major crypto venture capital firms, allowing us to glimpse the current asset allocation and investment preferences of these industry players "at the top of the food chain." The following is the full content for readers' reference. Odaily Planet Daily reminds: The following is only a perspective share and does not constitute investment advice.

The Truth Behind the 8 Top Venture Capital Wallets: Just "Broadly Casting Nets and Early Profits"?

This is the strangest cycle so far—no one knows what will happen next.

In times like this, it can be helpful to understand what others are doing. So, I spent the entire weekend delving into what the venture capital bigwigs have been up to lately. Now, I know some of you might think, "They are just making broad investments and profiting from early involvement."

Listen, I don’t think they are the smartest people in the cryptocurrency industry, especially after experiencing the last cycle (Odaily Planet Daily note: referring to a series of institutional collapses and related events). But we should still pay attention to them: they do have an information advantage, ample funds, and are closer to the projects than we are.

I’ve been thinking:

• Are they engaging in any interesting operations?

• Are they playing altcoins like we are?

• Or do they still hold some of the old value coins from the past?

So, let’s see what these "speculators" in suits are up to.

Note:

Do not blindly copy the trading operations of venture capitalists. They have access to better trading opportunities than we do, and they are playing a different game; this is just to help us better understand other participants in this field.

We do not have all their wallet information. We did our best to use crowdsourced tags and our own on-chain analysis, but you can’t capture all addresses for analysis.

We selected several top funds and ranked them by size. We will introduce the total assets of each fund, major assets, minor assets, and any interesting recent operations.

8 Top Crypto Venture Capital Firms and Their Major Asset Holdings

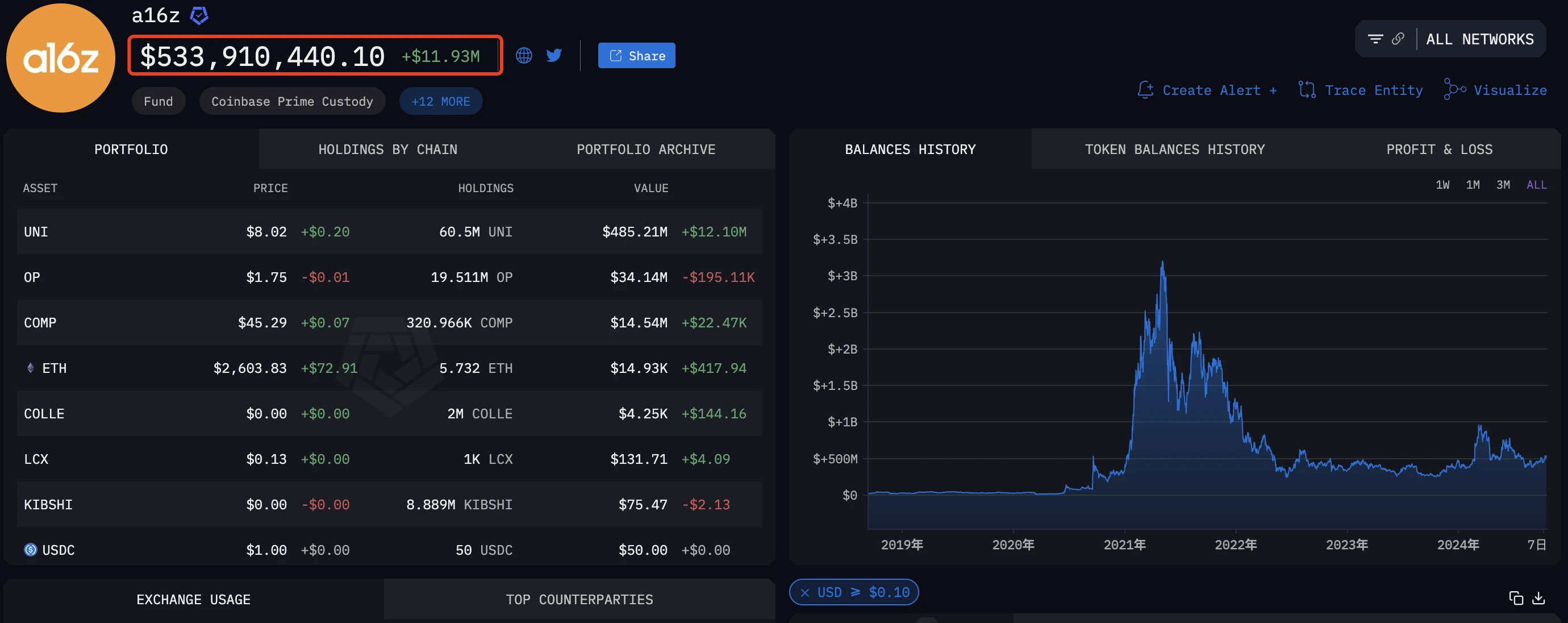

1. a16z ($482.3 million)

Major assets:

- UNI: $436 million

- OP: $31 million

- COMP: $14 million

Minor assets: ETH ($14,000), COLLE ($6,000)

A16z is one of the largest holders of UNI tokens in the market, which means they have enough power to influence proposals in that community, as 4% of the UNI supply can reach the quorum for voting, and they have held UNI tokens for many years. The recent changes in a16z's wallet are related to the initial unlock portion of the OP tokens they still hold.

Query link: https://platform.arkhamintelligence.com/explorer/entity/a16z

Odaily Planet Daily note: With the recent continuous rise of BTC, a16z's total assets have increased to around $534 million.

a16z Asset Balance Panel

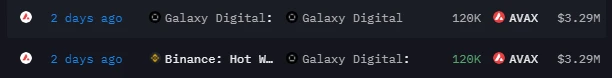

2. Galaxy Digital ($364.5 million)

Major assets:

- BTC: $194 million

- ETH: $115 million

- USDC: $40 million

- USDT: $5 million

- AVAX: $4 million

- USDC: $1.3 million

- AAVE: $1.14 million

Notable minor assets ($100,000 - $500,000): MKR, OXT, UNI, TOKE;

The tokens they hold have undergone significant trading volume, mainly stablecoins and BTC, suggesting they may be distributing tokens and engaging in some arbitrage strategies.

Recently, they withdrew $3.3 million worth of AVAX from Binance.

Query link: https://platform.arkhamintelligence.com/explorer/entity/galaxy-digital

Recently, possibly due to the market recovery, Galaxy Digital has repeatedly transferred out various tokens such as BTC, ETH, USDT, and USDC, reducing their balance to $354 million.

Galaxy Digital AVAX Withdrawal Record

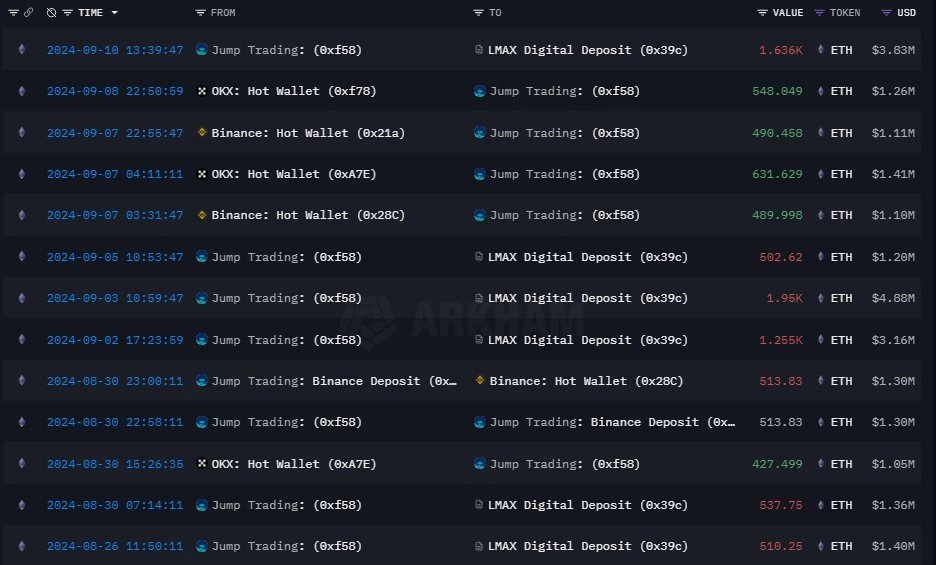

3. Jump Trading ($286.4 million)

Major assets:

- USDC: $78 million

- USDT: $70.38 million

- stETH: $70.38 million

- ETH: $54.9 million

- T: $2.15 million

- WETH: $1.24 million

- SHIB: $1.2 million

- SNX: $1.16 million

Minor holdings include ($200,000 - $700,000): MKR, LDO, GRT, DAI, UNI, KNC, HMT, BNB, CVX, COMP, INJ, MNT.

Jump's portfolio is very typical, mainly consisting of ETH and stablecoins. Interestingly, they also hold non-mainstream tokens like Threshold Network, SHIB, and SNX. Despite previous claims that Jump had exited the crypto space, they are still engaging in significant operations.

Additionally, Jump has recently started depositing ETH into LMAX (an institutional crypto exchange).

Query link: https://platform.arkhamintelligence.com/explorer/entity/jump-trading

Recently, possibly due to the market recovery, Jump Trading's total assets have increased to $350 million.

Jump Transfer Operation Record

4. Wintermute ($159.8 million)

Major assets:

- USDC: $16.6 million

- WBTC: $11.15 million

- PEPECOIN: $10.52 million

- ETH: $10.39 million

- USDT: $9.11 million

- TKO: $4.67 million

- CBBTC: $4.63 million

- MATIC: $4.41 million

- BMC: $4.36 million

- NEIRO: $3.48 million

Minor assets ($200,000 - $3 million) include BASEDAI, TON, ZK, MOG, stETH, ARB, ENA, ARKM, APE, LDO, ONDO, etc.

Wintermute is heavily invested in meme tokens. Besides their largest holding (PEPECOIN - which is not PEPE, but another meme coin), they also have significant holdings in MOG, NEIRO, COQ, APU, SHIB, BENJI, etc.

They are known for being market makers for meme coin projects.

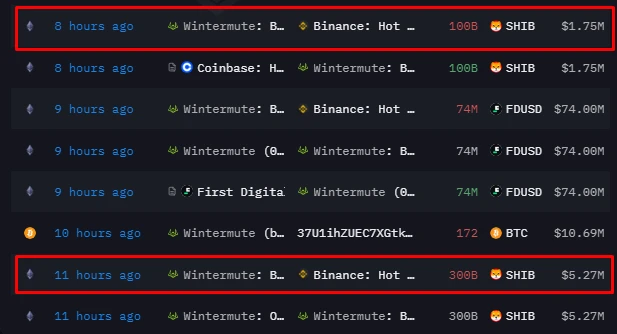

Recently, Wintermute has accumulated a certain amount of cbBTC (Coinbase BTC) and BTC in their wallet; additionally, they sent over $6 million worth of SHIB to Binance.

Query link: https://platform.arkhamintelligence.com/explorer/entity/wintermute

Recently, possibly due to the market recovery, Wintermute's total assets have increased to $229 million.

Wintermute Operation Record

5. Pantera Capital ($161.15 million)

Major assets:

- ONDO: $152 million

- ETHX: $4.4 million

- SD: $1.11 million

- ECOX: $9.416 million

- LDO: $388,000

- PERC: $375,000

- NOTE: $274,000

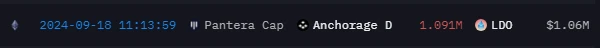

Recently, Pantera transferred nearly $3 million worth of MATIC to Coinbase; they also transferred $1 million worth of LDO to Anchorage (an institutional crypto staking platform). Interestingly, most of their ETH has been moved to centralized exchanges.

In addition, we can see that their investment in ONDO has decreased in value by 56%. Notably, Pantera is one of the early private investors in ONDO.

Query link: https://platform.arkhamintelligence.com/explorer/entity/pantera-capital

Recently, possibly due to the market recovery, Pantera's total assets have increased to $178.9 million.

Pantera LDO Sale Operation Record

6. Blockchain Capital ($67.1 million)

Major assets:

- AAVE: $32.8 million

- UNI: $18.35 million

- ETH: $4.16 million

- UMA: $2.12 million

- SAFE: $1.89 million

- 1INCH: $1.88 million

- COW: $1.62 million

- FORT: $1.31 million

- USDC: $1 million

Minor assets ($100,000 - $600,000): SUSHI, BAL, PSP, USDC, PERP

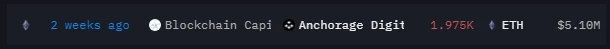

The largest holding, AAVE tokens, is interesting; Blockchain has held AAVE for many years, and due to its recent price increase, it may be worth paying close attention to. Additionally, like Pantera, Blockchain previously transferred over $5 million worth of ETH to Anchorage exchange.

Query link: https://platform.arkhamintelligence.com/explorer/entity/blockchain-capital

Recently, possibly due to the market recovery, Blockchain's total assets have increased to $75.73 million.

Blockchain ETH Transfer Operation Record

7. Spartan Group ($35.38 million)

Major assets:

- PENDLE: $16.93 million

- GAL: $2.65 million

- MNT: $2.49 million

- OP: $1.4 million

- IMX: $1.18 million

- WILD: $1.09 million

- GRT: $1.04 million

- AEVO: $982,000

- USDC: $841,000

- PTU: $800,000

- RBN: $778,000

- 1INCH: $700,000

Minor assets ($100,000 - $500,000) include: MAV, CHESS, MPL, G, DYDX, ALI, BETA, PSTAKE, ETH.

It can be seen that Spartan Group has heavily invested in Pendle. Besides that, we haven't seen many significant trades. They are mainly engaging in arbitrage trading strategies with USDC.

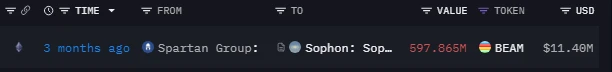

Interestingly, they have transferred all BEAM assets to Sophon, an upcoming chain where you can start depositing assets now to participate in airdrop interactions.

Query link: https://platform.arkhamintelligence.com/explorer/entity/spartan-group

Recently, possibly due to the market recovery, Spartan Group's total assets have increased to $38.03 million.

Is Spartan also "farming airdrops"?

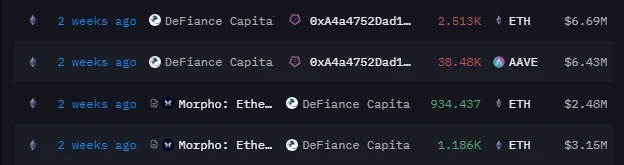

8. DeFiance Capital ($33.6 million)

Major assets:

- PYUSD: $20 million

- LDO: $6.08 million

- BEAM: $3.94 million

- USDC: $1.1 million

- TBILL: $1.04 million

Minor assets ($50,000 - $300,000) include VIRTUAL, AVAX, BAL, MCB, USDT, INSUR.

DeFiance has made significant bets on gaming tokens, with their recent trades involving several transfers from Shrapnel (a Web3 shooting game).

Additionally, they have recently received a large amount of ETH from Morpho.

Query link: https://platform.arkhamintelligence.com/explorer/entity/defiance-capital

Recently, possibly due to the market recovery, DeFiance's total assets have increased to $34.8 million.

Is there "insider trading" between Morpho and DeFiance?

Overall Trend of VC Holdings:

Based on the above information, we can see—

Common Holdings: a16z, Jump, Wintermute, and Blockchain Capital prefer top DeFi tokens (UNI, AAVE), ETH, and stablecoins. This may be due to these institutions focusing more on liquidity and DeFi protocols during the bear market.

Long-term Holdings: a16z and Blockchain Capital are "diamond hands" in the industry—they have held assets like UNI and AAVE for many years.

Stablecoin Arbitrage: Many institutions are engaging in this operation, as evidenced by their high trading volume in stablecoins.

Bitcoin Layer 2 Networks: This sector continues to receive significant investment. BTC L2 companies and projects previously raised $94.6 million, a 174% increase quarter-over-quarter.

Early Investments Still Dominate: Nearly 80% of investment capital and seed pre-round transactions account for 13% of all investment operations.

Shift in Popular Investment Areas: Although NFT and GameFi sectors were hot in 2021, these two areas have rapidly cooled in 2024; now VCs are more inclined towards hot trend sectors like AI, infrastructure, and even meme coins.

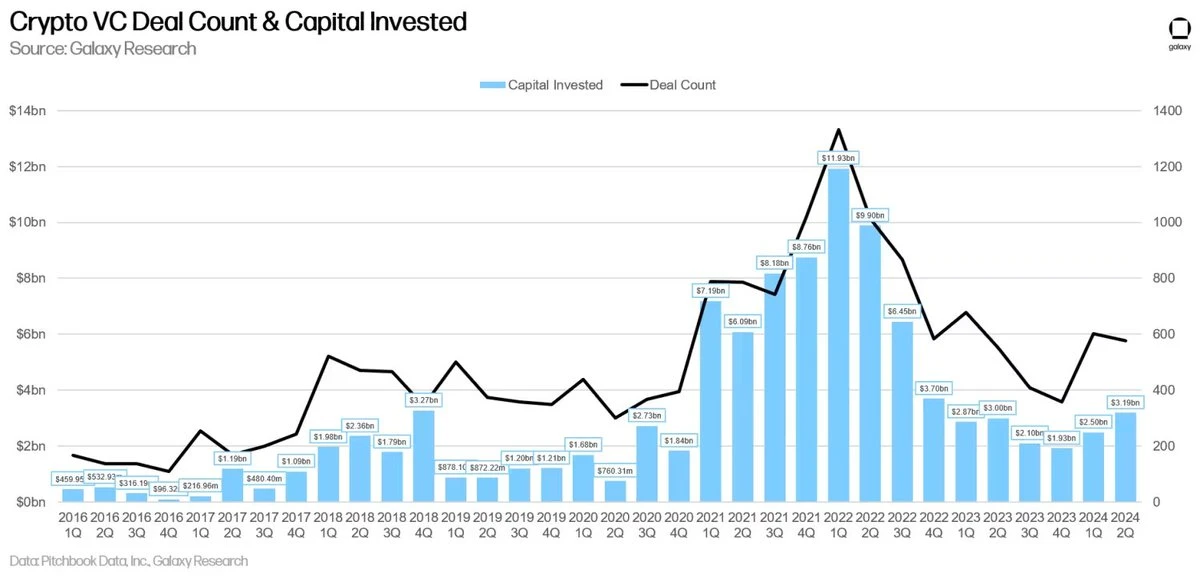

We recently studied a report from Galaxy on "VC Trends in 2024," and here are some highlights worth sharing:

Compared to the same period in 2021-2022, venture capital investment amounts have significantly decreased. Nevertheless, VCs still invested $3.19 billion in the second quarter of 2024 (an increase of 28% quarter-over-quarter).

**Statistics on VC Investment Amounts and Number of Investment Cases

**

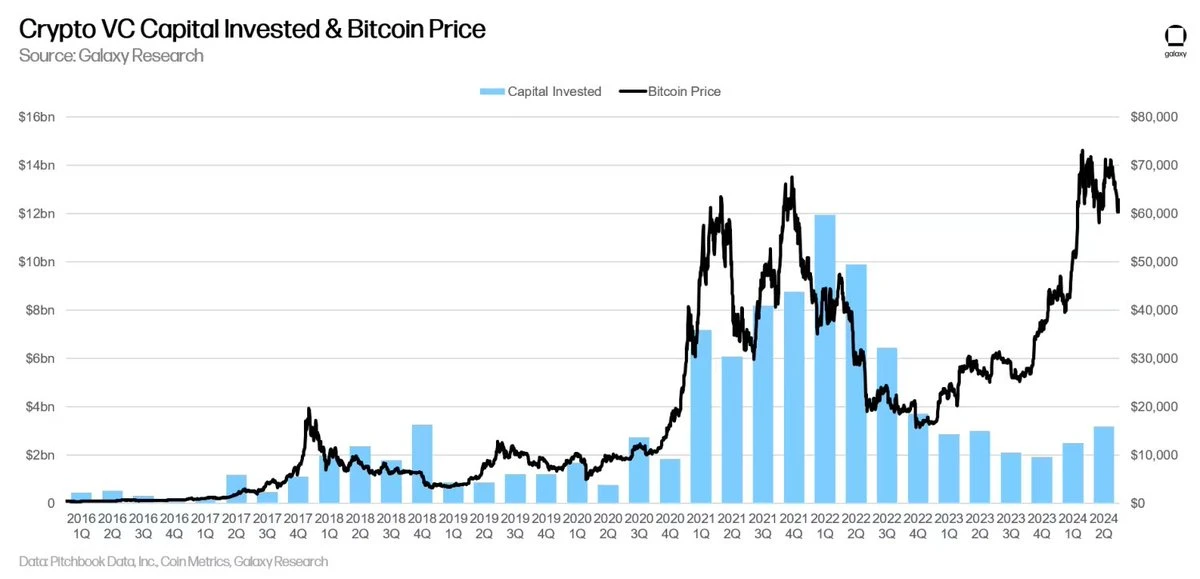

Interestingly, the scale of investment does not completely follow the rise and fall of BTC prices. In the past, this correlation was more accurate, but now it seems that venture capital funds are tighter, with liquidity being relatively scarce.

Correlation Chart of VC Investment Scale and BTC Price

Most investments are still concentrated in sectors like NFT/gaming/DAO, followed by infrastructure. According to the report data, "In the second quarter of 2024, companies and projects in the 'Web3/NFT/DAO/Metaverse/Gaming' category raised the largest share of crypto venture capital (24%), totaling $758 million. The two largest transactions in this category were Farcaster and Zentry, raising $150 million and $140 million, respectively."

Pie Chart of Investment Shares by Different Sectors

I hope this in-depth analysis report provides you with effective information on how VCs are operating in the crypto space. The key to this analysis is to help you predict potential trends and understand how venture capital firms operate through their investment behaviors and trading operations.

Always remember: Do not blindly follow VC trades, but use them as a resource to enhance the depth and effectiveness of your research.

Related tools reference:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。