MicroStrategy, as a company actively investing in Bitcoin, has a vision of becoming a Bitcoin bank, and the consistently performing MSTR has become one of the important ways for investors to participate in the Bitcoin market.

MicroStrategy's Vision of a Bitcoin Bank

Board Executive Chairman Michael Saylor stated in an interview with Bernstein analysts, "Bitcoin is the most valuable asset in the world," adding, "Our ultimate goal is to become a leading Bitcoin bank or commercial bank, or you can call it a Bitcoin financial company."

"If we ultimately secure $20 billion in convertible bonds, $20 billion in preferred stock, $10 billion in debt, and $50 billion in some form of debt instruments and structured tools, then we will have $100 billion to $150 billion in Bitcoin."

Saylor firmly believes in the unlimited growth potential of Bitcoin.

"I believe its scalability is infinite," Saylor responded. "I have no doubt about how we can raise $100 billion and then raise $200 billion. This is a trillion-dollar asset class that will reach $10 trillion and then $100 trillion. The risk is simple—this is Bitcoin. You either believe Bitcoin is something or you believe it is nothing."

MicroStrategy's Bold Bitcoin Strategy

MicroStrategy firmly views Bitcoin as the core of its enterprise value creation, with a strategy that is relatively straightforward. Unlike other companies (such as Tesla or BlackRock), MicroStrategy's strategy is to continuously purchase more Bitcoin using convertible bonds, preferred stock, and other structured debt instruments. Saylor predicts that the price of Bitcoin will reach $13 million per coin by 2045.

MicroStrategy has adopted a leveraged Bitcoin hybrid strategy aimed at growing its enterprise analytics business while holding Bitcoin as a long-term reserve. This strategy includes positioning through low entry points and repeatedly purchasing Bitcoin, thereby continuously increasing its total holdings.

At the same time, MicroStrategy treats Bitcoin as its primary asset reserve, continuously accumulating Bitcoin through cash flow and the proceeds from equity or debt financing. Additionally, the company has adopted a balance sheet strategy, purchasing Bitcoin only in the U.S. market and storing it in custody secured by U.S. regulatory agencies and cold storage.

Bitcoin Plans Bring Opportunities, MSTR May Become a Better Way to Participate in the Bitcoin Market

As of September 2024, MicroStrategy holds 252,220 Bitcoins, with a total value of approximately $15 billion, making it one of the largest corporate Bitcoin holders in the world.

As of the latest trading day data (October 11), MSTR performed outstandingly, breaking through $210 per share.

Image Source: Internet

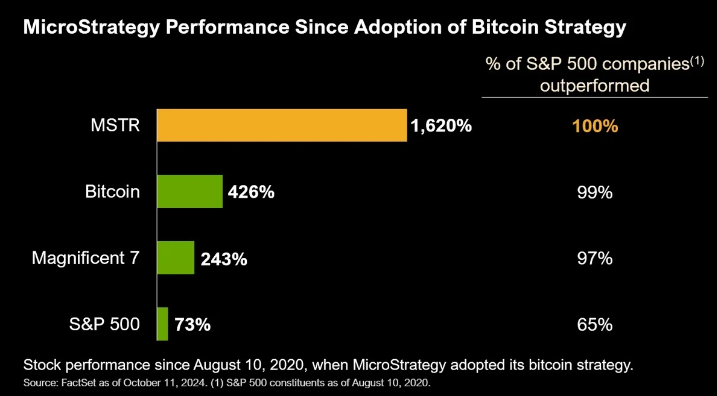

Moreover, since MicroStrategy implemented its Bitcoin plan in 2020, MicroStrategy's stock has consistently outperformed other companies. According to data, from August 2020 to now, MSTR has risen by 1,620%, while Bitcoin has risen by 426%, the Magnificent 7 has risen by 243%, and the S&P 500 index has risen by 73%.

Image Source: Internet

These data seem to indicate that holding MSTR to indirectly participate in the Bitcoin market is a better investment route than directly holding Bitcoin to participate in the cryptocurrency market.

For investors looking to indirectly participate in the Bitcoin market, MicroStrategy offers an attractive avenue. By holding MicroStrategy stock, investors can benefit from the company's performance growth while indirectly gaining from the rise in Bitcoin prices. Additionally, MicroStrategy's core business remains its steadily growing business intelligence services, providing a certain degree of risk buffer for investors.

Bitcoin prices are volatile, but MicroStrategy's Bitcoin holding premium remains healthy. Michael Saylor explained this, stating, "Long-term Bitcoin holders view Bitcoin as a top asset that should not be sold." He emphasized that MicroStrategy can achieve positive BTC returns, unlike the negative returns of closed-end funds, which contributes to the equity premium. Investors value the company's strategy of acquiring Bitcoin and its differentiated investment approach.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。