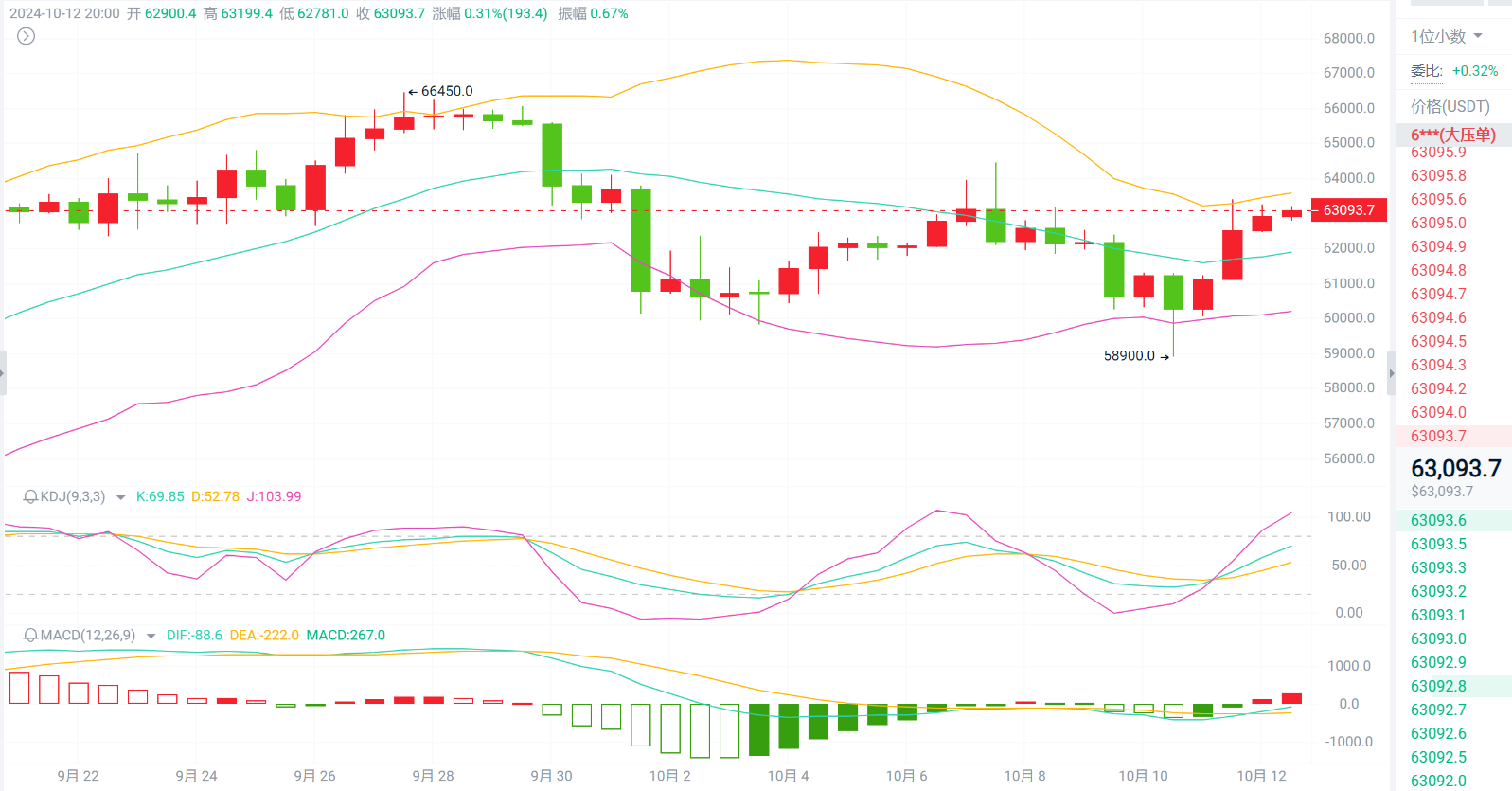

On the daily chart, the current MACD indicator is still hovering near the 0 axis, undergoing a consolidation adjustment, while the trading volume is also relatively weak. The volume released today is less than that of yesterday, and the overall intraday fluctuations are not very strong. The BOLL indicator is currently still tilted downwards, with the price showing a slight rebound within the BOLL bands. However, considering the overall downward pressure, the middle band serves as a strong resistance line in the short term.

Looking at the 12-hour level, the MACD has shown a golden cross and a rebound sentiment. The current price has broken through the middle band of the BOLL, but the overall trend of the BOLL is still tilted downwards (indicating that there is still strong pressure in the current trend). Therefore, in the short term, we expect a consolidation and decline. For specific trading points, you can refer to:

BTC: Short at 63300-63800, target 62000

ETH: Short in batches at 2470-2500, target 2410

The above is my personal evening market analysis, first published on "Public Account: Mu Feng Looks at Trends." Feel free to exchange and learn together!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。