Strength does not need to be overly displayed; the key is to gain recognition from more people. On the investment journey, doing well for oneself is more important than proving one's strength to others. Whether it’s a mule or a horse, you’ll know once you take it out for a walk.

As a veteran in the cryptocurrency space, I have always been committed to providing beneficial advice to everyone, hoping to help you avoid detours and mistakes in this market. Although I speak earnestly, the path of investment must still be explored by yourself; learning is endless, and the experiences gained are the true wealth!

On a side note, the big bull market is here, but the National Day holiday has begun. Many people are eager to enter the stock market, and during this holiday, the 24-hour market without breaks presents good opportunities. The cryptocurrency market is no exception; funds have been continuously flowing in, and the turnover rate has been increasing. Now that the world is releasing positive news, the cryptocurrency market will certainly not miss this opportunity. Coupled with the holiday coinciding with the major non-farm payroll report, there will definitely be significant market movements this week. To avoid being washed out, one must be well-prepared; remember that the essence of trading is survival.

Here, I wish my followers financial freedom in 2024. Let’s work hard together!

Cryptocurrency Scholar: Bitcoin (BTC) Latest Market Analysis on 2024.10.1

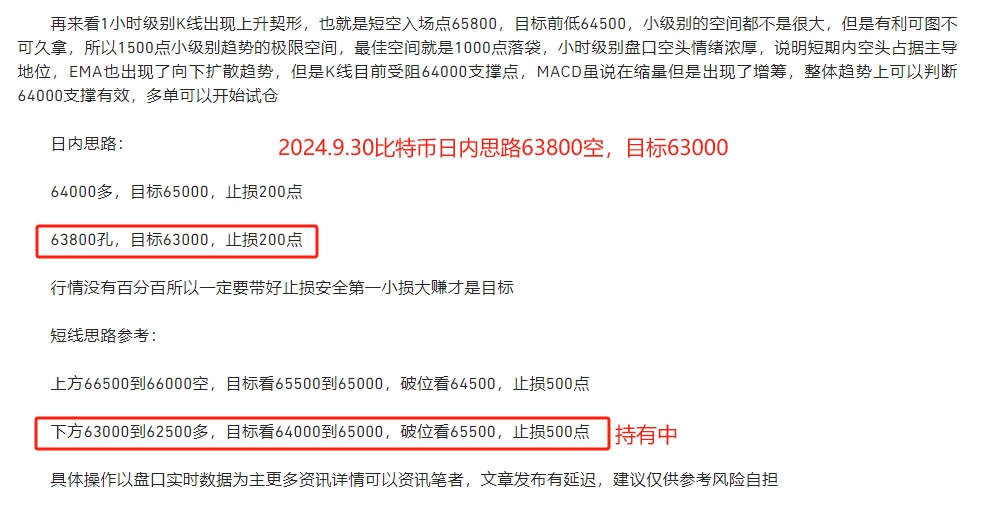

First, I wish everyone a happy holiday. It is now noon Beijing time, and the current price of Bitcoin is 63,650. This morning around 7 AM, a buy signal appeared as Bitcoin retraced to 63,000, which is the first trade of the month. Everyone can pay attention to this; looking at the market, the daily K-line has completed its range, and after a week of market movement, it returned to the starting point in one day. Entering long positions below 63,000, it finally took profit at 66,400. This week, the layout remains at 63,000, and how many points can be gained will depend on the subsequent market.

The trend indicator's fast line support EMA15 has met with the daily K-line, and the support point has broken 63,000. The EMA30 trend line has also broken the major trend level of 62,000. A large-scale alternating bullish trend has emerged, indicating that the bulls are still present, and the trend remains unchanged. I previously mentioned that we do not trade when the trend is not adjusted; now that the trend has adjusted, it is time to trade. The MACD volume has decreased, and the DIF and DEA are contracting at high levels, showing a top divergence. The death cross has not formed, and the Bollinger Bands are contracting. The upper pressure level is at 67,300, with the standard support at 62,600. The KDJ is approaching the oversold area downwards, indicating that the support at 63,000 is effective for long positions.

The four-hour K-line has continuously retraced to the EMA90 trend support point at 63,250. It is now starting to pull back and test the EMA60 pressure level at 64,000. The MACD shows a decrease in volume, and the DIF and DEA have dropped below the zero axis. Additionally, the K-line has been accumulating at the lower Bollinger Band at 63,000 for some time, increasing the probability of a breakout. Pay attention to the pressure level at 65,000. The KDJ golden cross has formed, and the short-term bullish trend remains unchanged. Long positions can continue to be held. If you missed the opportunity to enter at 63,000, do not rush to enter; wait for the best entry point or look for short opportunities.

Short-term strategy reference: The market is never 100% certain, so always set stop-losses. Safety first; small losses and big gains are the goal.

Sell at 65,000 to 65,300, targeting 64,000 to 63,500. If it breaks, look at 63,000, with a stop-loss of 300 points.

Buy at 63,000 to 62,500, targeting 64,000 to 65,000. If it breaks, look at 65,500, with a stop-loss of 500 points.

Specific operations should be based on real-time market data. For more information, you can consult the author. The publication of this article may be delayed; the suggestions are for reference only, and risks are borne by the reader.

This article is exclusively contributed by the Cryptocurrency Scholar and represents the scholar's unique views. In-depth research has been conducted on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of the article's release, the above views and suggestions may not be real-time and are for reference only. Risks are borne by the reader. Please indicate the source when reprinting. Manage your positions reasonably and avoid heavy or full positions. The scholar also hopes that all investors understand that the market is always right. If you are wrong, you should reflect on where the problem lies. Do not let the profits that should be yours slip away. There is no need to be smarter than the market; when the trend comes, respond and follow it; when there is no trend, observe and remain calm. It is not too late to act once the trend becomes clear. Tomorrow's success stems from today's choices. Heaven rewards diligence, the earth rewards kindness, humanity rewards sincerity, business rewards trust, industry rewards excellence, and art rewards passion. Gains and losses often occur unexpectedly. Develop the habit of strictly setting stop-losses and take-profits for each trade. The Cryptocurrency Scholar wishes you happy investing!

Warm reminder: The above content is solely created by the author of the public account. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。