Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

The largest decentralized exchange on Solana, Jupiter, is advancing its second major vote on the disposal of its token JUP (J4J #2), the voting result will directly determine the disposal of approximately 215 million JUP (about $1.9 billion).

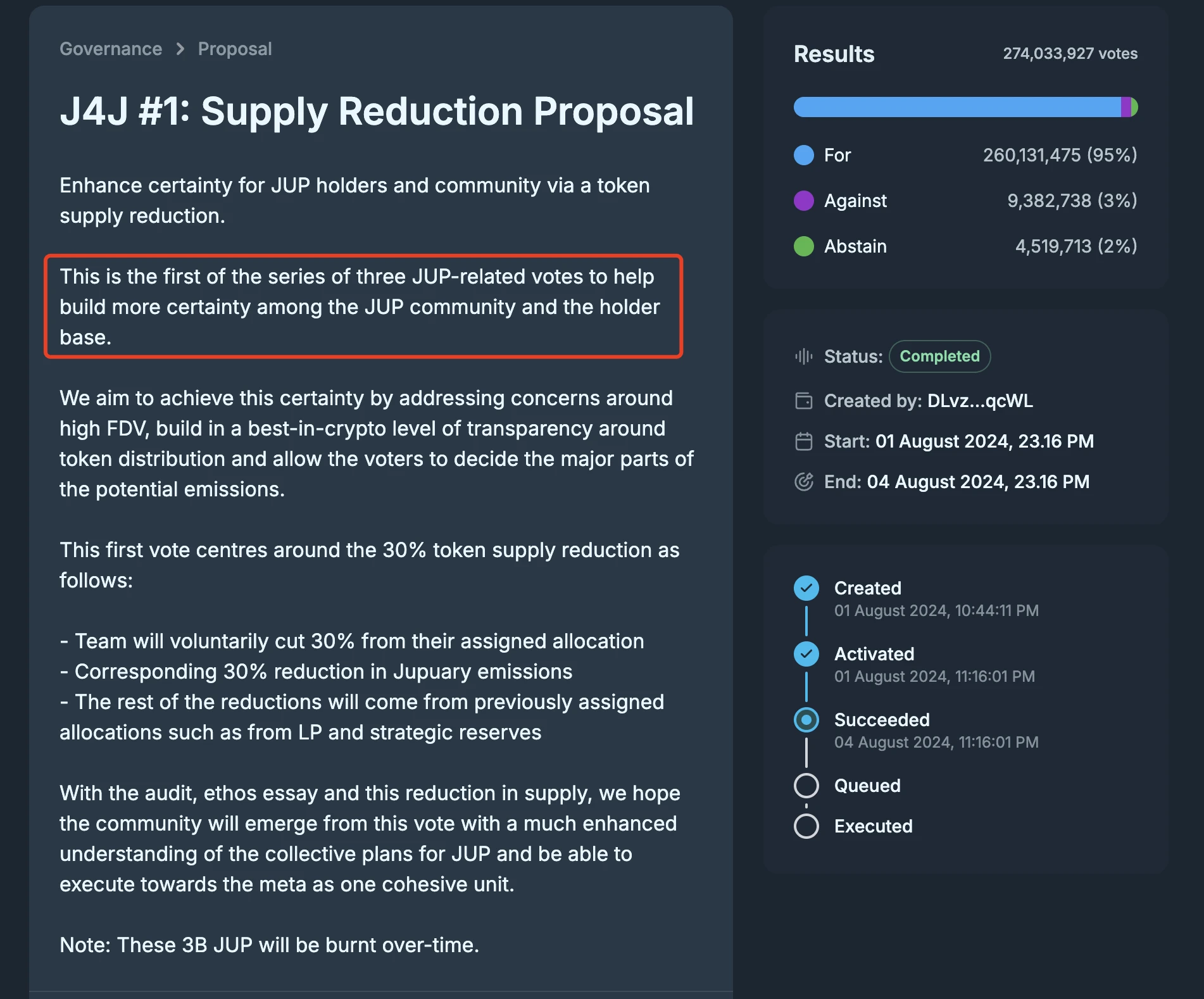

In early August of this year, the Jupiter community passed the first major vote (J4J #1) on the disposal of JUP with a 95% approval rate, which decided to burn 3 billion JUP (30% of the total supply) to reduce Jupiter's maximum supply.

According to the plan mentioned by Jupiter's founder, meow, Jupiter plans to initiate three JUP disposal votes named J4J to address the issue of JUP's high FDV, establish the best transparency in token allocation, and allow the community to vote on the potential issuance of JUP.

The proposal currently being advanced is the second of these three important votes, namely J4J #2.

The background of this proposal is that earlier this year, Jupiter executed an airdrop activity called Jupuary, due to the fact that not all of the airdrop was claimed, there are still approximately 215 million (215,461,850.21) JUP remaining. Based on the current market price of about $0.88, the total value of this portion of JUP is as high as $1.9 billion, which is an asset that cannot be ignored by any protocol.

Yesterday evening, Jupiter founder meow initiated a governance proposal on how to dispose of these 215 million JUP on the governance forum. The proposal includes three disposal options:

Use the tokens for the Active Staking Rewards (ASR) plan for the next year;

Burn the tokens;

Return the tokens to the community's multi-signature wallet.

meow mentioned that the Jupiter team currently leans more towards the first option because ASR has successfully proven over the past few months that it can drive community participation in every proposal, discussion, and vote, so investing funds in ASR can help the Jupiter community continue to grow.

In the following text, we will briefly summarize the specific scale of ASR and calculate the effect of the above options on the reward increase of the existing ASR plan.

The so-called ASR, directly translated, is "Active Staking Rewards." ASR is a staking and governance reward method designed by Jupiter, aimed at rewarding community members who stake JUP and actively participate in governance, voting, and discussions, encouraging them to more deeply integrate into the Jupiter ecosystem.

The rewards of ASR mainly come from two parts, one is the 0.75% LFG Launchpad fee (which comes from specific LFG issuance projects, so it will consist of multiple tokens), and the other part comes from the initial allocation of 100 million JUP provided by the treasury.

In early July, Jupiter distributed the first round of ASR rewards, totaling 50 million JUP, to all community users who voted on proposals from March to June this year. Now, there are still 50 million JUP remaining in the ASR plan, and it is planned to be distributed to community users who voted on all proposals between July 1 and September 30 starting in October.

Looking at the results of the past two quarters, ASR has had a significant effect in incentivizing community activity.

As of meow's post, a total of 585,000 addresses have staked 361 million JUP; after 12 votes since the launch of the plan, an average of 280 million JUP has been involved in each vote; a large amount of discussion and suggestions can be seen on the governance page of each vote.

Therefore, with the idea of maintaining ASR incentives, meow and the Jupiter team propose to continue using the 215 million JUP mentioned above for ASR incentives for the next year, releasing an average of 50 million JUP per quarter, with the remaining 15 million JUP surplus temporarily returned to the treasury for specific future needs.

Based on the current scale of ASR staking, injecting 200 million JUP into the ASR incentive pool means that stakers of 361 million JUP can enjoy a guaranteed return of 55% over the next year — not counting other earnings from the 0.75% LFG Launchpad fee.

Clearly, this proposal is sufficient to continue to ensure the attractiveness of the ASR plan, thereby maintaining the community's willingness to participate in the development of the Jupiter protocol.

It is for this reason that meow and other members of the Jupiter team openly support this proposal and call on the community to vote in favor.

However, this does not mean that this proposal will definitely pass. Among the other potential options listed by meow, the "direct burn" option is also seen by some community members as more in line with the interests of all JUP holders, not just stakers, but considering that the users participating in the vote are stakers directly linked to ASR incentives, the probability of the first option being approved is still greater.

According to the current schedule, the proposal will be voted on starting at 15:30 UTC on September 27 (23:30 Beijing time), and Odaily Planet Daily will continue to keep an eye on it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。