Crypto News

September 25th Hot Topics:

1. US Congressman Tom Emmer said to SEC Chairman Gary Gensler: "We cannot have a more historically destructive or unlawful SEC chairman."

2. Gary Gensler reiterated that the SEC maintains a "neutral" attitude towards blockchain technology, emphasizing that the technology itself does not change the economic attributes of investments.

3. After discussions with BitGo's Belshe, Sky has temporarily suspended the plan to delist Wrapped Bitcoin.

4. The US SEC reached a settlement with TrustToken and TrueCoin regarding allegations against stablecoins.

5. Caroline Ellison sentenced to 24 months in prison for FTX fraud case.

Trading Insights

The characteristics of frequent losses in the crypto circle, see how many apply to you? 1. Frequent trading not only increases trading costs but also easily affects mindset by market fluctuations. 2. Chasing after price increases: lacking a clear investment strategy can lead to buying high and selling low. 3. Failing to set stop-loss orders when trapped: not setting stop-loss orders in time may result in greater losses. 4. Blindly adding positions in the early stages of a downtrend: adding positions in uncertain trends carries higher risks. 5. Holding coins for a short time: short-term price fluctuations may lead to missing long-term growth opportunities. 6. Chasing after rises and cutting losses on declines: trend-following operations without a clear plan can be easily influenced by market sentiment. 7. Frequently changing coins: frequent coin changes increase trading costs and make it difficult to accumulate in-depth research experience. 8. Holding a large number of different coins: although diversifying investments can reduce risks, managing too many coins increases difficulty and makes it hard to focus on in-depth research. 9. Listening to news from all sources: blindly trusting news can lead to being misled and lacking independent judgment. 10. Stubbornly sticking to one's own opinions and being resistant to new knowledge: unwillingness to learn and accept new knowledge can lead to falling into one's own thinking traps. 11. Lack of courage: lacking decisiveness at critical moments makes it difficult to seize opportunities. 12. Not daring to buy at the bottom and not willing to sell at the top: lacking judgment and execution in the market. 13. Not persisting with the original strategy after multiple failures: frequent changes in strategy lead to a lack of systematic approach. Being content with small gains: being satisfied with short-term gains and neglecting long-term potential.

LIFE IS LIKE A JOURNEY ▲

Below are the real trading signals from the DaBai community this week. Congratulations to those who followed. If your operations are not going well, you can come and give it a try.

Real data, each signal has a screenshot taken at the time.

Search for the public account: DaBaiLunBi

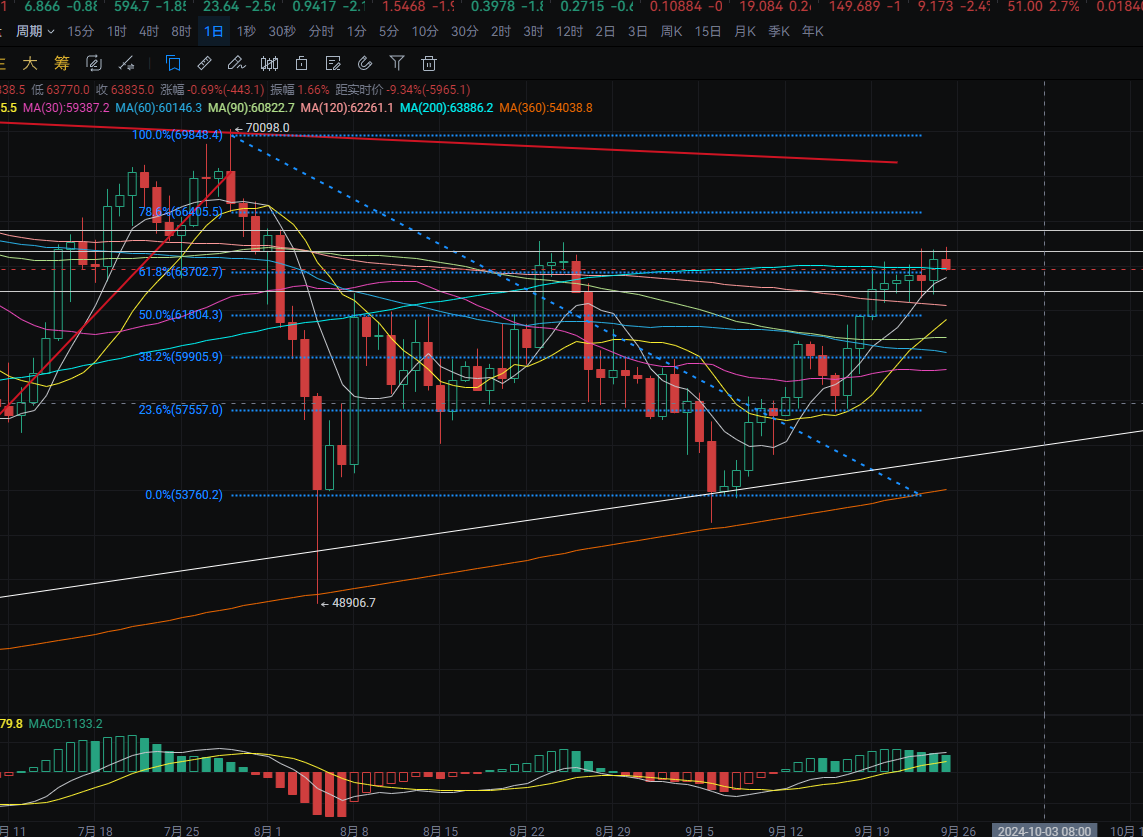

BTC

Analysis

Bitcoin yesterday gave a long entry near 63235 and has now reached the second profit target near 64400, with a maximum price difference of about $1200. The daily chart showed a rebound from around 62700 to near 64700, closing near 64300. The resistance is near 65000, and the support is near the MA7 moving average. If it falls below, it may test near the MA120. Long positions can be taken near the retracement of the MA7. The MACD is showing a decreasing bullish trend. The four-hour support is near the MA30, and the MACD is showing an increasing bearish trend, forming a death cross. Short positions can be taken near 65500, with the target near 64600-62880.

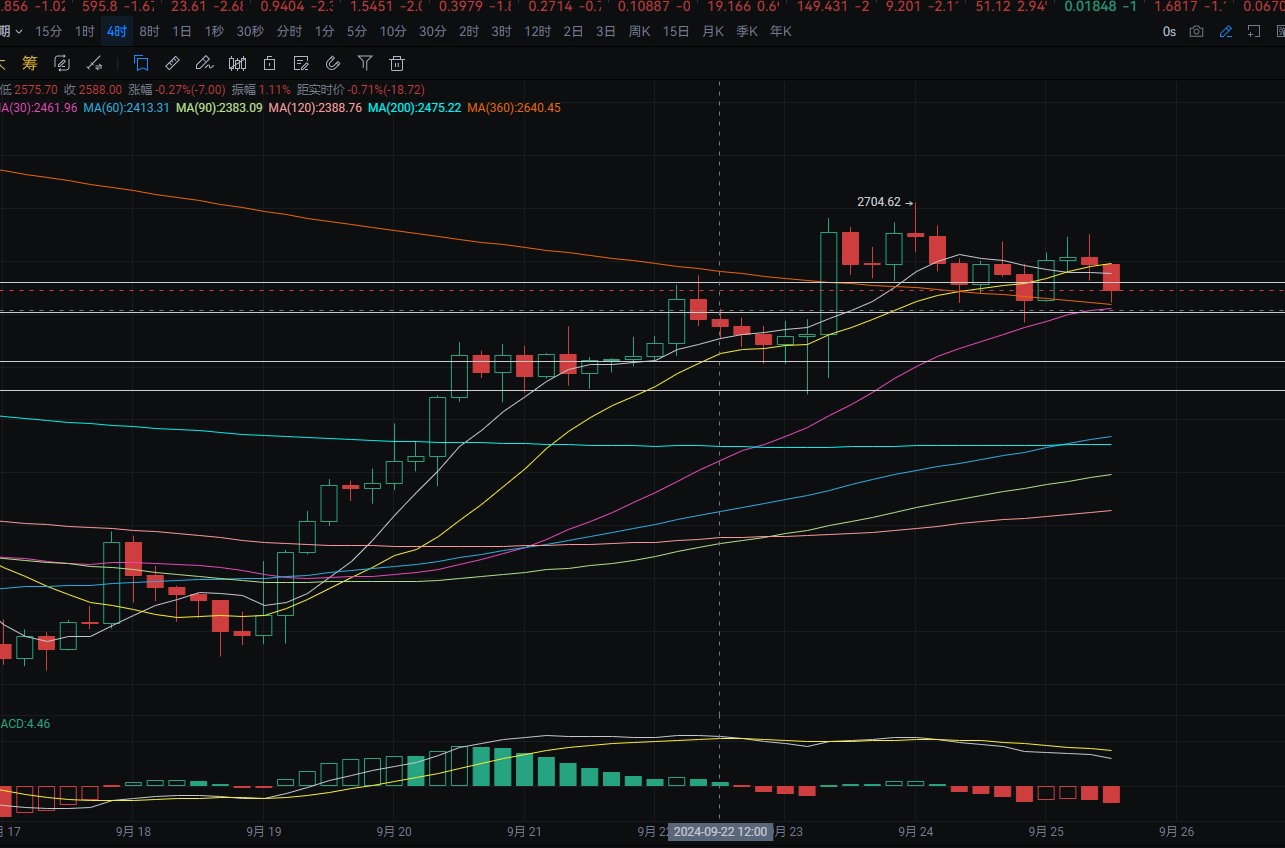

ETH

Analysis

Ethereum's daily chart yesterday reached a low near 2590 and a high near 2670, closing near 2655. The support is near the MA60, with multiple tests near 2555 forming support. Long positions can be taken near the retracement of the MA30. The MACD is showing an increasing bullish trend. The four-hour resistance is near the MA14, and the support is near the MA30. If it falls below, it may test near the MA60. Long positions can be taken near 2555-2528. The rebound target can be seen near 2600-2630.

Disclaimer: The above content is for personal reference only and does not constitute specific operational advice, nor does it bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If there is anything you don't understand, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。