Original author: Kaori, BlockBeats

Original editor: Jack, BlockBeats

During Token2049, Grab no longer seems to be the first choice for attendees in the cryptocurrency circle. The largest ride-hailing platform in Southeast Asia has been overshadowed by an app called TADA.

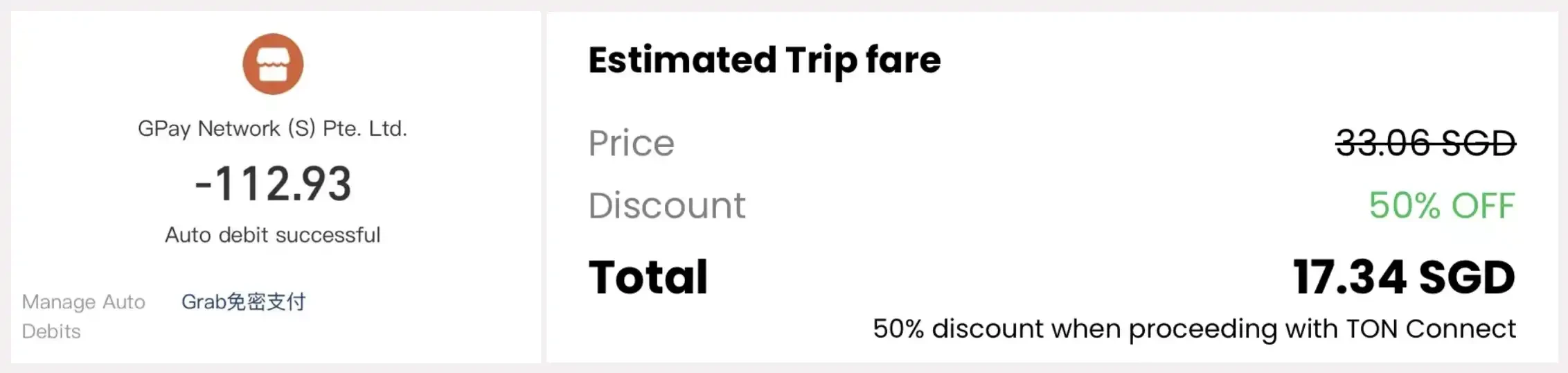

The TADA invitation link circulated in various cryptocurrency groups, and in Singapore, where the starting price is an average of 50 yuan, the cost of choosing TADA is sometimes only a fraction of Grab's. According to BlockBeats' test, taking a regular car from Changi Airport to Marina Bay Sands using Grab would cost about 112 RMB, equivalent to about 20.5 SGD, while using TADA would cost 84 SGD, about 15.4 SGD, which is about 25% cheaper.

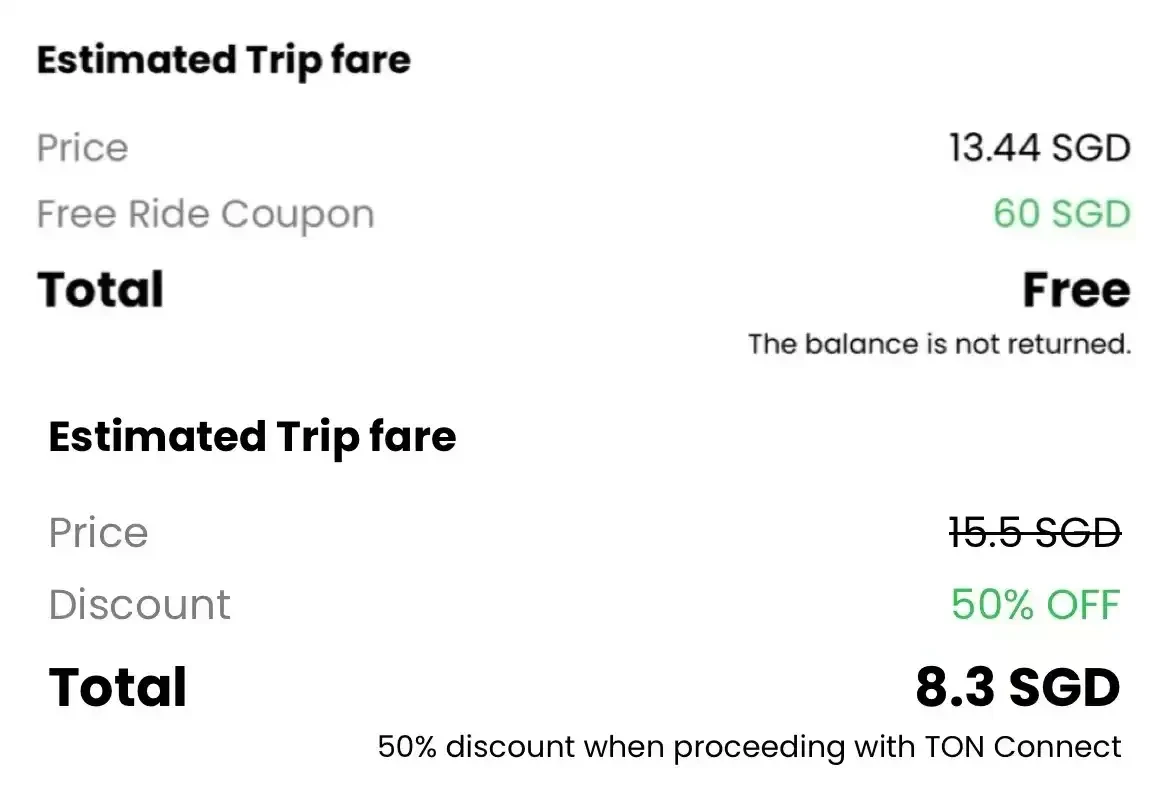

Top: New users have a free ride credit of 60 SGD; Bottom: The second and subsequent transactions enjoy a 50% subsidy, to divert traffic to the TG Mini Program

According to TADA's official policy, the first 4,000 users who use the TADA Telegram Mini App for rides during the Token2049 conference will enjoy a first-ride credit of 60 SGD, and subsequently, all Mini App users will also enjoy a 50% ride subsidy. According to BlockBeats' preliminary calculation, TADA's subsidy cost during the 5-day period is at least 600,000 SGD, equivalent to about 3 million RMB.

For a small ride-hailing platform, it is rare to invest millions of dollars in cash subsidies in a short period of time. However, interestingly, the large subsidies did not drive traffic to TADA's mobile app. In order to receive ride subsidies, users must use TADA's recently launched Telegram Mini App and pay through the TON wallet using $TON or $USDT.

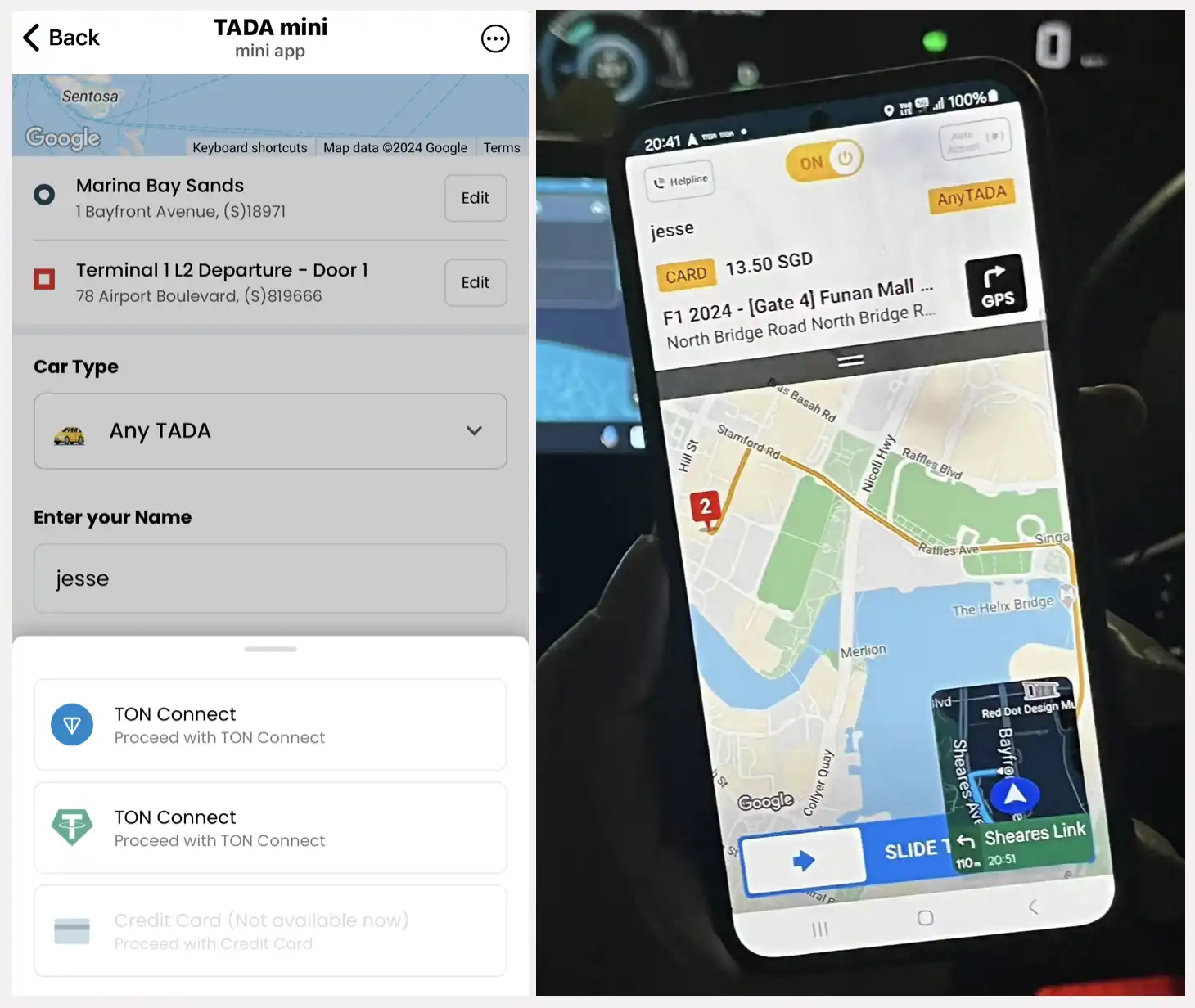

Using TADA's Telegram Mini App for rides is no different from using WeChat Mini Program in terms of user experience. Users can choose the car type and payment method. It is worth noting that users cannot choose credit card payment on the user end, and the platform's drivers' terminal shows the user's payment type as "bank card payment."

Left: TADA's Telegram Mini App ride interface; Right: TADA driver's mobile interface

According to TADA's official website, the platform does not charge drivers a commission, except for financial payment fees such as bank cards, and all ride fares go to the driver. However, some platform drivers told BlockBeats that TADA actually still charges a certain percentage of commission, but its percentage is the lowest among all ride-hailing platforms in Singapore.

According to BlockBeats' understanding, TADA's charging standard for drivers is: no platform fee for fares below 7 SGD, a platform fee of 0.6 SGD for fares between 7 and 18 SGD, and a platform fee of 0.8 SGD for fares over 18 SGD. This means that drivers only pay a maximum of 8.6% of their income for each trip, and can retain a larger proportion of their income on long trips. In comparison, mainstream ride-hailing platforms such as Grab charge a commission of around 20%.

The "zero commission" model has gained recognition among ride-hailing drivers in Singapore. According to Channel News Asia, many drivers from platforms like Grab or Gojek have expressed that their income has decreased recently due to the low prices of platform orders, and although the number of orders for TADA platform drivers has decreased, their income has not been significantly affected. During Token2049, the original price for using the TADA Mini App to travel from the city to the airport was about 30 SGD, 60% more expensive than the average cost of 20 SGD on the Grab platform, and users need to enjoy a 50% discount to get a more favorable price.

Left: Grab ride fare; Right: TADA ride fare

The high platform income and low ride fares have raised questions about the source and sustainability of TADA's subsidies. Many users understand that the situation will not last forever unless TADA finds a way to profit from other sources. At the time of writing, Singapore users can no longer enjoy a 50% ride subsidy by paying through the TON network.

Annual revenue of 21 million USD, has the Web3 consumer app succeeded?

Interestingly, many people mistakenly consider TADA a traditional ride-hailing platform the first time they use it, only to discover at the main venue of Token2049 that TADA is actually a blockchain company.

TADA's parent company, Mass Vehicle Ledger (MVL), was established in 2018, and its founder Kay Kyeongsik Woo previously founded the Korean travel app easi6. Unlike traditional ride-hailing platforms, MVL has positioned itself as a blockchain company from the beginning, exploring the ride-hailing business through models such as no platform commission and token-based incentives. With the growth of the TADA business, MVL has gradually grown into a company with over 300 employees, with business covering travel services, car manufacturing, energy, and data.

TADA's booth at Token2049; Image source: X

The competition in the Singapore ride-hailing market is extremely fierce. According to data from the Land Transport Authority of Singapore (LTA), since the peak of 28,736 taxis in 2014, the current number of taxis has decreased by more than half, reaching a new low of 13,330 in May of this year. At the same time, the number of private hire cars (including self-drive rentals and ride-hailing) has increased from 18,847 to 84,413 during the same period, a 347% increase.

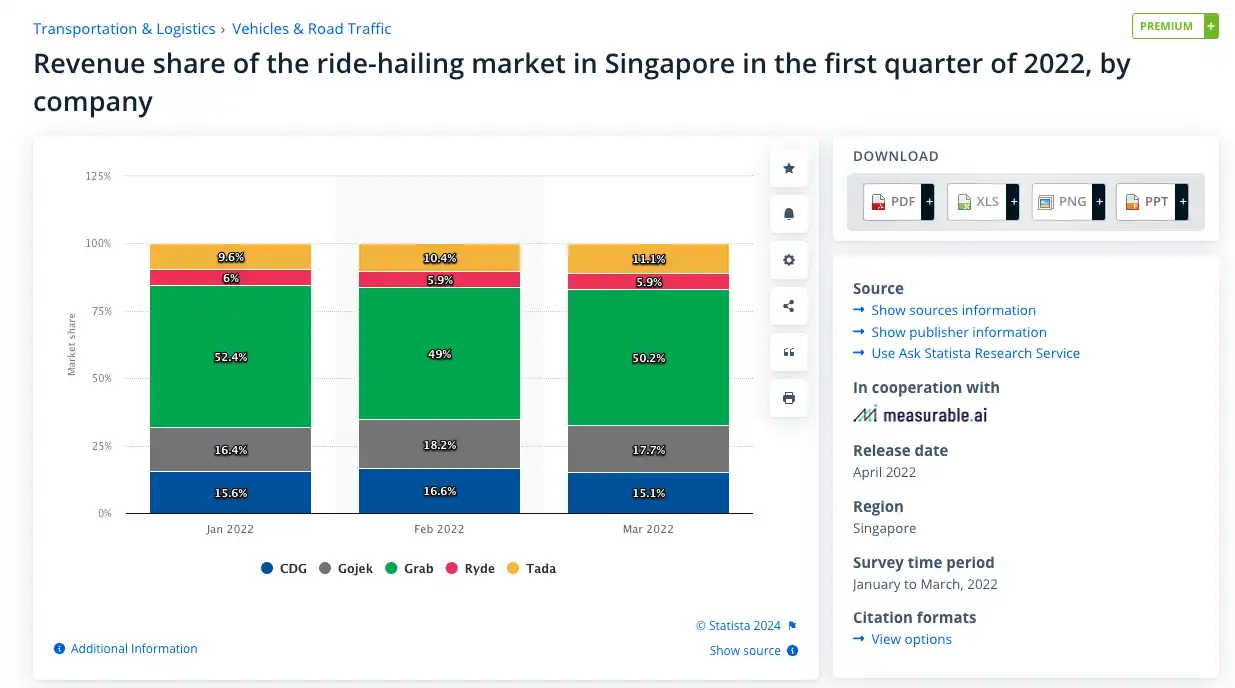

Currently, the five ride-hailing platforms licensed by LTA are Grab, GoJek (GoTo), Zig (CDG), TADA, and Ryde. In the first quarter of 2022, Grab's market share reached 50%, while TADA only had about 10%.

Market share of ride-hailing in Singapore in the first quarter of 2022

However, TADA's market position has gradually found an advantage in the competition. In 2023, according to documents submitted to the Accounting and Corporate Regulatory Authority of Singapore, TADA's parent company, Mass Vehicle Ledger (MVL), saw its revenue increase from 6.3 million SGD in 2021 to 27.5 million SGD in 2022, and the company's loss decreased from 9.7 million SGD in 2021 to 5.4 million SGD in 2022, a reduction of nearly 45%. Over half of the revenue comes from travel and delivery services, with the cryptocurrency business accounting for 37% of the total revenue. In the first quarter of 2024, with the expansion into the Thai market, TADA's CEO Sean Kim announced that TADA has become the second largest ride-hailing platform in terms of the number of trips in Singapore. Additionally, TADA's expansion plans also include the Hong Kong and South Korean markets.

In the exploration and promotion of cryptocurrency application scenarios, MVL can be considered a pioneer in the industry. However, in the development of "Web3 consumer applications," TADA's business has not been smooth sailing.

The successful attempt of the Telegram Mini App is a new project launched by TADA in recent months, targeting participants in various Web3 activities in Southeast Asia. Prior to this, TADA had tried various user acquisition activities such as "Ride with TADA and earn Bitcoin" and "Invite friends to join TADA and earn Bitcoin." However, the team found that convincing a user who has never dealt with cryptocurrency to buy cryptocurrency solely for taking a ride is a very difficult and costly task.

Before launching the Telegram Mini App, MVL considered providing Web3 services to ride-hailing drivers as its main business, including providing multi-chain wallets and DeFi products to drivers, providing better routes through data analysis with the DePIN data map, and offering reasonably priced vehicles to drivers through the RWA vehicle project, but it has always been difficult to make a splash in the market.

Therefore, starting from Web3 users and promoting on-chain payments became the core appeal of the Telegram Mini App launched by the MVL team during the TOKEN2049 conference. As the saying goes, demand leads to application development. On the one hand, there is a significant increase in travel demand during the conference, and on the other hand, the pricing of platforms like Grab is higher than TADA under the subsidy policy, giving users the motivation to seek value for money. However, as the subsidy activities end, although the higher ride prices compared to Grab will bring higher income to drivers, where does TADA's competitiveness lie for consumers?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。