Cryptocurrency News

September 23 Hot Topics:

1. CryptoQuant CEO: The industry should look at CZ with a new perspective after his release from prison, his achievements far exceed his mistakes

2. Silvergate Executive: "Sudden regulatory shift" leads to bank closures

3. Economist: US inflation data may stabilize at the Federal Reserve's target level by the end of next year or early 2026

4. UniSat CEO: The team is actively researching the CAT20 trading market

5. LogX: The airdrop query interface has been launched, and applications will open at 14:00 on September 24th

Trading Insights

One piece of news can be understood as either positive or negative; for example, Ethereum plummeted through the ETF, which is a positive landing, and then, in conjunction with the Ethereum Foundation selling coins and Vitalik Buterin selling coins to create panic. If it surges, it means the ETF brings in funds, and a large number of Wall Street players enter! In fact, the most important factor in price fluctuations is whether the market is bullish or bearish. If the market is mostly bullish, then it falls; if the market is mostly bearish, then it rises! Interests are the fundamental factors driving prices! If good news leads to a big rise, it means the institutions are preparing to sell at high prices. If the institutions don't have enough chips, even with good news, it will turn into bad news, then they will reverse and kill off contracts, continuing to fall and gather chips! Two conditions must be met for a big bull market: first, the overall environment, with global economic stimulus! Second, the institutions have accumulated enough chips during the bear market cycle! Obviously, the first condition has not been met yet, so the main players can only choose to continue gathering chips in the bear market! Only smart money gathering enough chips and meeting the first condition will lead to a big bull market! As retail investors, the correct approach is to follow the main players, accumulate chips at the bottom, and sell with the main players during the big bull market, which will allow us to harvest the "whales" and let new participants in the market take over our positions. The secondary market is essentially a game between retail investors and retail investors, and a game between the main players and retail investors! However, retail investors struggle due to their smaller capital and find it difficult to survive for three years in a bear market, as well as the lack of their own trading system, coupled with human greed, resulting in most people being liquidated, cleared, and returning to zero, becoming cannon fodder for the market! Only a very small number of people can strictly follow their own trading strategies like anchors, not using high leverage or touching contracts! In this round of small rebounds in the altcoin market, I sold each coin for 100 to 200U to solve life problems! Because many people can't hold on in the bear market not because they lack confidence, but because they are forced by life. Especially for those with elderly and young family members, who do not want to lower their living standards, they can only be forced to cut their positions and leave the market! This is why many old investors, who are optimistic about the future of the cryptocurrency industry and believe in a big bull market, still end up without coins when the big bull market arrives, becoming the "leeks" chasing the rise in this market.

LIFE IS LIKE A JOURNEY ▲

Below are the real trading group orders of Da Bai Community this week. Congratulations to the friends who followed. If you are not doing well in your operations, you can come and try.

The data is real, and each order has a screenshot taken at the time it was issued.

Search for the public account: Da Bai Lun Bi

BTC

Analysis

Bitcoin gave a short entry near 64400 yesterday, and is currently in a profitable position. The weekly K-line tested near the MA30 to form pressure. The daily line formed a pin bar yesterday, with the highest point reaching near 64000 and the lowest point dropping to around 62350, closing near 63600. The upper resistance is near the MA200, and a breakthrough could lead to a level near 65000. The lower support is near the MA7 moving average, and a pullback can be made near this level. The MACD is shrinking in a bullish manner. The four-hour support is near the MA14, and a pullback can be made near this level. The top pressure is near 0.786, and there are signs of a bullish crossover in the MACD. A short entry near 63500 can be made, and the rebound target can be seen near 64900-66700.

ETH

Analysis

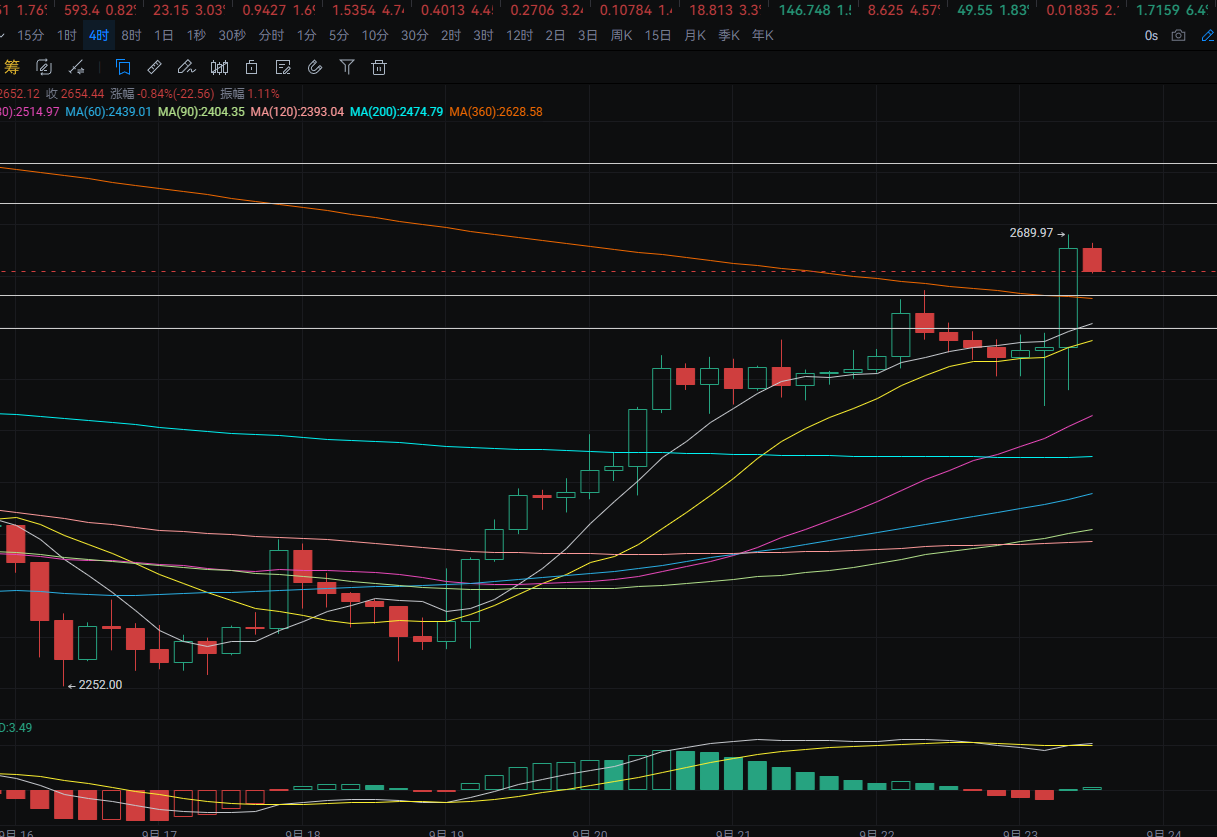

Ethereum closed the weekly K-line near 2580, testing the MA60. The top pressure is near the MA14. The daily line dropped to around 2525 yesterday and closed near 2580. The lower support is near the MA60, and a pullback can be made near this level. The upper resistance is near the MA360. The MACD is increasing in a bullish manner. The four-hour support is near the MA360, and if it falls below, it can be seen near the MA7 moving average. A pullback can be made near this level. The MACD is increasing in a bullish manner, forming a bullish crossover. A short entry near 2632-2600 can be made, and the rebound target can be seen near 2720-2760.

Disclaimer: The above content is for personal reference only and does not constitute specific operational advice, nor does it bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If there is anything you don't understand, feel free to ask for advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。