Original Author: SanTi Li, Feng Yu, Naxida

As the Web3 industry continues to mature, the ecological potential of Telegram, an instant messaging software, and the growth of its project value are receiving more attention. Telegram is known for its privacy, convenience, and openness, and various projects based on the TON public chain have emerged within its internal ecosystem. This includes BOT software and embedded projects developed based on Telegram chat windows, further enriching the overall value of Telegram. Unlike the embedded window, the Ime Messenger version of TG is more like adding Web3 wings to it, making the entire Telegram more user-friendly, complete, optimized, and enriched. It also resembles the operational experience of WeChat Pay.

This article will interpret its value from the perspectives of project basics, team capabilities, characteristics analysis, valuation analysis, long-term future value, the relationship between Telegram and TON, and points of doubt.

I. Basic Introduction

iMe is a multi-functional Web3 version software developed based on Telegram, which can be quickly understood as a special enhanced version of Telegram for Web3. User accounts can seamlessly communicate with Telegram, with fully synchronized content, but the software needs to be downloaded separately.

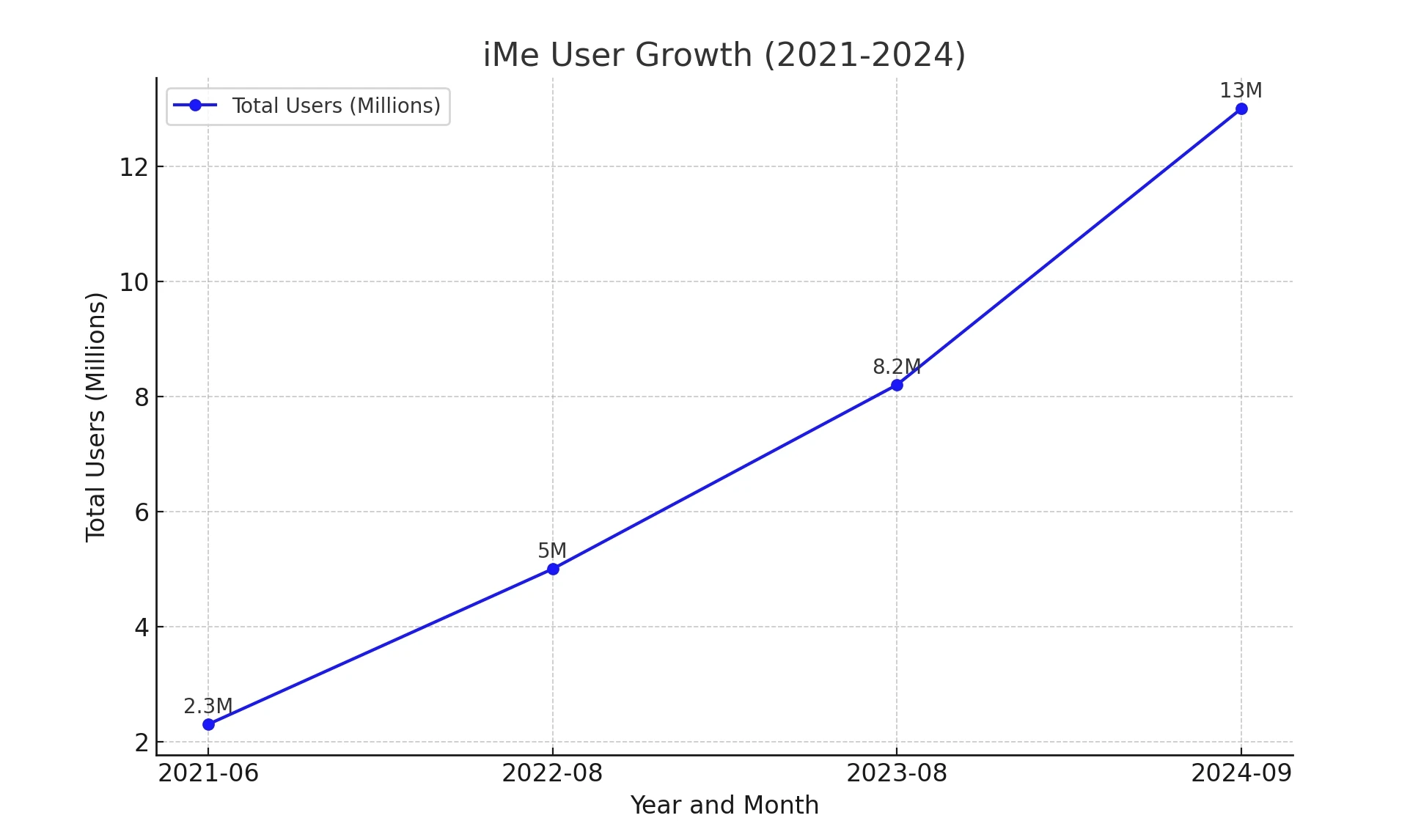

In June 2021, iMe had 2.3 million users, with over 200,000 daily active users. As of September 2024, iMe has reached 13 million users, with a 3-year user growth rate of around 565%. Since iMe accounts and Telegram accounts are fully interchangeable, the 900 million users of TG can seamlessly use the iMe version of TG software at any time.

Fig.1. User growth chart of iMe version over 3 years

Perhaps due to the interchangeability between TG and iMe, as shown in Figure 1, the number of iMe users has increased significantly by over 10 million in 3 years. Functionally, the core differences can be briefly observed from the comparison of the following set of images:

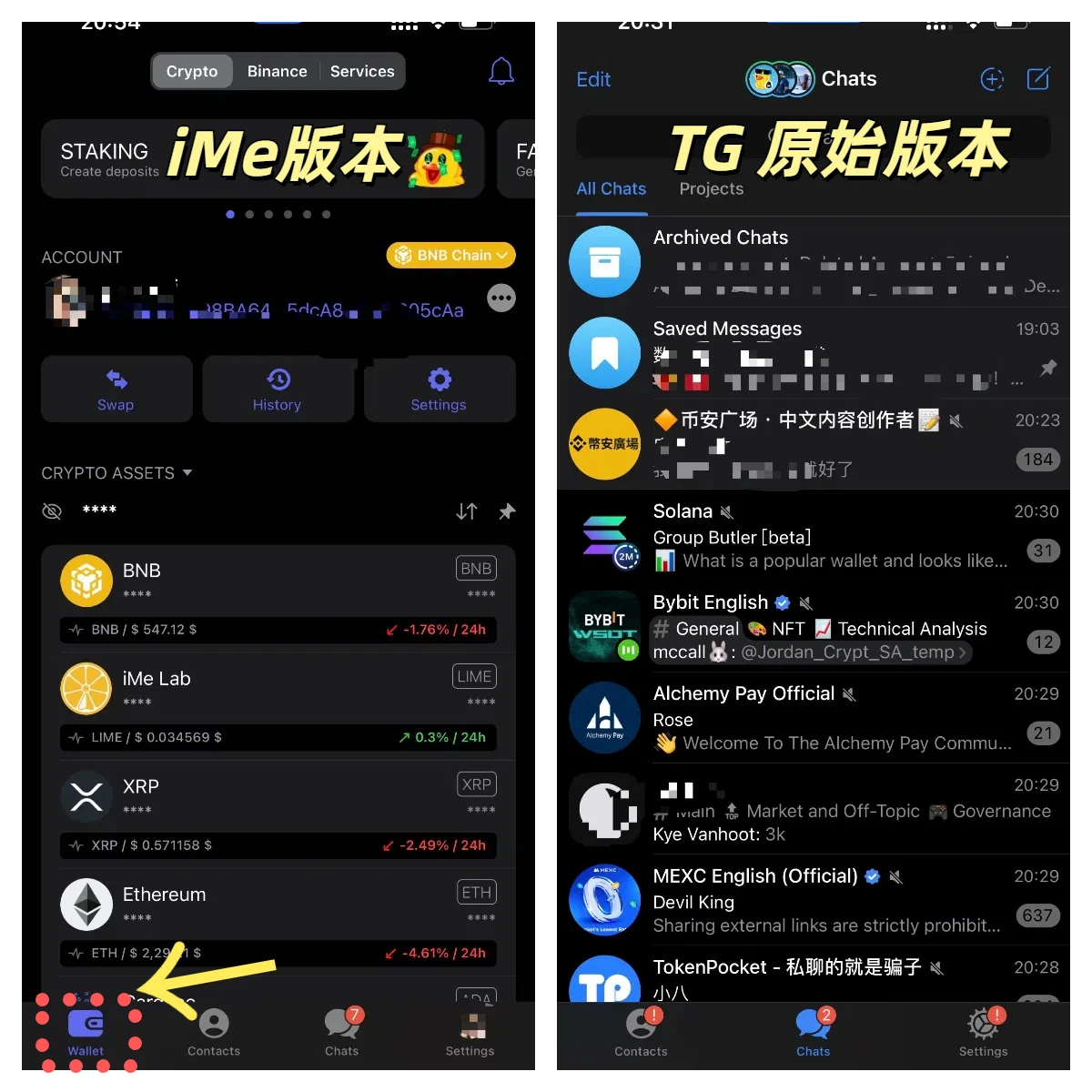

Fig.2. Comparison between iMe version of TG and the Original version of TG

From the brief comparison in Figure 2, it is evident that iMe has added an additional multi-chain Wallet function developed on top of the original version of Telegram, integrating multi-chain assets and related DeFi, Staking, payment, or Binance Pay trading services. This allows users to easily apply Web3 functionality in the TG software. (Currently supporting assets from 18 public chains including BTC, BSC, ETH, SOL, TON, Base, Arb, Matic, TRON, ZKsync, OP, Manta, RON, Celo, Fantom, Blast, etc.) Users can directly send these assets to iMe TG friends' wallets and can interact with different assets in group services. For example, through the Cryptobox function, users can conduct airdrops and send crypto red packets in Telegram groups.

This development model has also provided iMe with the space to continuously develop rich features for the software and complement the optimization of TG's original version, which lacks the convenience of optimization in areas such as organization, AI functions, voice-to-text functions, real-time translation, and more.

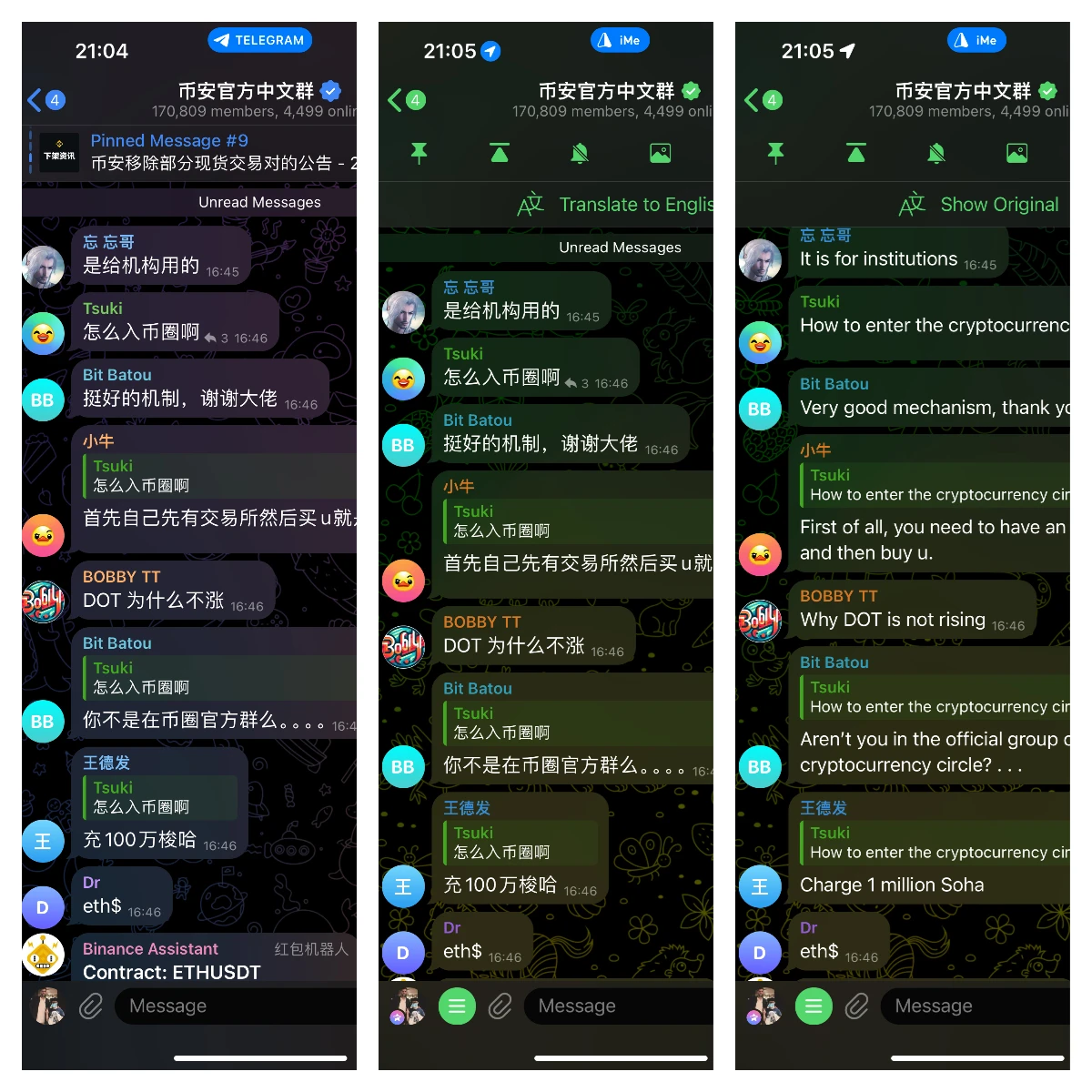

Especially with the real-time translation feature based on Google Translate and Chatgpt, iMe has perfectly solved the language barrier for many Web3 workers, directly addressing language translation issues within the Telegram software, greatly increasing communication efficiency. The image below shows the translation feature in the app version:

Fig.3. Demonstration of the real-time translation feature added to the iMe version of TG

In the image, we can see that the original version of Telegram currently does not provide real-time translation in conversations, while users in the iMe version of Telegram can directly use the one-click translation feature for entire group conversations. The PC version has also been updated with a one-click translation feature, which is very practical for users with language barriers. Therefore, the enhanced version of TG by iMe is more like a Web3 version of the WeChat ecosystem.

The iMe team has made many detailed contributions to the entire Telegram, such as operational optimizations. Due to space limitations, it is not convenient to elaborate on detailed comparisons here. Interested readers can experience it in more detail on their own.

II. Token Economics Analysis

The total supply of $LIME is approximately around 1 billion, with a circulation rate of about 61%. Since June, the lime token has entered a period of regular burning activities, and the tokens obtained by the project through gas fees and provided services will be frozen and regularly destroyed, gradually reducing the total supply. Early-stage selling pressure from VCs and others has been completely released. In early 2024, after more than 2 years of deep washing, the FDV of the project experienced a relatively strong valuation rebound, rising from a low point of around 8 million to about 120 million, followed by a market-wide correction.

As of around September 18, 2024, the FDV of $Lime fluctuates around 37.5 million.

Functional analysis of the token:

- Participation in various DeFi services such as staking

- Gas fees for transactions and operations, as well as Telegram internal friend transfers

- Purchase of Telegram upgrades and Ime special version services

- New: Users holding 10,000 tokens can receive free premium membership services for the Ime version

- Advanced AI function development in progress

- Cryptobox application (a multi-chain version of WeChat group red packets and airdrops)

- DAO voting

- Other functions such as advertising and gaming services

CMC link: https://coinmarketcap.com/currencies/ime-lab/

Token security audit agency: Certik

III. Team Analysis

The personnel structure of the iMe project team is somewhat similar to that of the Telegram team, with many top engineering and technical talents from Russia and Ukraine. The founding team of the Telegram team is not particularly large, providing good space for iMe to expand and complement. Russian development technology enjoys a strong reputation globally, providing strong technical support and product stability for these projects.

The team maintains a close relationship with the core team of Telegram, including but not limited to holding some tokens, negotiating equity, and the possibility of collaborative development. Since some information is not publicly announced, this analysis should be treated as personal analysis. Due to the high privacy of Telegram-type projects, there is not much publicly available resume analysis of the founding team. From personal contact and understanding, the team is strong in technology and product, but may need reliable PR agencies to help more people understand the situation for better market performance.

IV. Long-term Value Analysis

For the long-term value analysis of iMe lime, exploration can be conducted from the following perspectives:

1. Relationship between iMe and Telegram

From our above description and research experience, it seems that iMe and Telegram are more like deeply integrated products, as the core essence of iMe is Telegram itself. However, on top of this, iMe has added a layer of Web3 convenience and functionality to Telegram, making the entire TG software architecture appear more complete. It is more like a Web3 multi-chain version of WeChat with payment functionality. Using the iMe version of TG is equivalent to allowing users to use a more powerful version of Telegram, and the seamless account synchronization and cloud storage also eliminate the learning curve for users.

Therefore, in terms of the long-term valuation of iMe, it will benefit from the growth of Telegram's own software valuation. Currently, the valuation of Telegram as a social software before its listing was $30 billion, but with its increasing popularity, its valuation may further increase. As a conservative valuation method, I lean towards using only about 10% of the core valuation for iMe (5% existing customers + 100% interchangeable customers + additional feature expansion).

2. Relationship between iMe and TON and Mode Differences

This is also a point that many people have not fully understood before. The relationship between iMe and TON is similar to the relationship between Telegram and TON. TON itself is a public chain developed based on the underlying technology of TG, so the valuation model for TON can also be based on traditional public chain valuation and the valuation of mini-apps in the APP Center. Whether in the original version of Telegram or in the iMe version, TON and related mini-projects are used normally.

However, unlike the original TG, the integrated system of iMe has also added support for the TON chain on the main interface, making the user experience more like using a wallet in WeChat or daily life (such as I'm token, TP, etc.). The embedded wallet in the basic TG chat box can still be used normally, but because the embedded chat box-style wallet is easily confused with group chats and other daily conversations, I prefer this development mode that adds functionality to the UI. Due to its complementary and independent functional development for traditional TG, the additional development space for TON and iMe has also been further enhanced.

3. Comprehensive Future Value Analysis Summary

From the above content, it is evident that the long-term value of iMe is mainly bound by comprehensive, multi-faceted factors such as product development, the trend of TG itself, optimization and additional development of the core software, and the application of its own blockchain Web3 token. For its valuation model, it can also be a combination of traditional software valuation, public chain L2 valuation, Payment and other DeFi valuation models, AI, Wallet, and other additional types of valuation.

Considering multiple factors, a FDV of 3-5 billion may not be an exaggerated long-term valuation. Even a conservative approach of using only 10% of the current TG valuation model can already reach a FDV of 3 billion. However, it also needs further demonstration and application usage. Whether it can reach a valuation of 10 billion or more at the peak of the bull market will depend on the subsequent market, AI functionality, payment applications, and whether TG continues to attract strong buying, among many other comprehensive factors.

Therefore, I personally believe that the current total valuation of the project at 37.5 million is still undervalued. The reason for the severe undervaluation of the project may be the lack of adaptation and familiarity in terms of marketing in the past. Due to excessive emphasis on social media and internal community, and a lack of media coverage, there are not many in-depth reports on this project in the market, leaving room for undervaluation. However, over the past 3 years, it has also experienced a long bear market, and has continued to update and develop, which is a quality that a good product and project team should have. The buried value will gradually be discovered by institutions that are good at catching the tide, and gradually enter the right track. However, the possibility of Telegram API failure and extreme black swan events in the financial sector also require readers to make extreme judgments, including the fact that the overall Telegram ecosystem team has a certain level of anonymity, making it difficult to conduct thorough due diligence. Therefore, making objective and calm judgments to select high-quality projects is also a test of the researcher's ability.

V. Conclusion

This article has elucidated the unique features, characteristics, multi-chain configuration, and potential for optimization and value expansion of iMe Messenger, a special Web3 version of Telegram. It also provides an interpretation of its token economy and the reasons for its undervaluation. Telegram, as a representative of privacy and openness in the social and instant messaging ecosystem, fully demonstrates its potential and value in the Web3 domain.

For users familiar with WeChat Pay, the pillar functions of WeChat, such as payment, community applications, various entry functions, and mini-program expansion, also closely resemble the product logic of the iMe version of Telegram. iMe has focused on the development of payment and friend transfers, group applications, additional exchange operations, AI, and more. From another perspective, a calm analysis suggests that Telegram may indeed favor this kind of model. However, the lack of explanatory content has led to a large number of users in the ecosystem, but a lack of objective reviews, which is one of the reasons for its undervaluation. Discovering the value of undervalued projects is an interesting and meaningful endeavor.

Investment carries risks, and even the most stable assets, such as gold, have experienced significant declines in extreme situations. It is always important to have a respectful attitude towards the market and the changing economic landscape. I also hope that everyone can discover more high-quality undervalued projects.

(P.S. The valuation inference is for analysis and sharing purposes only and is not a purchase recommendation.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。