Key Indicators (Hong Kong Time September 19th, 12:00 AM -> 12:00 PM):

BTC/USD spot +4.5% ($59,400 -> $62,100)

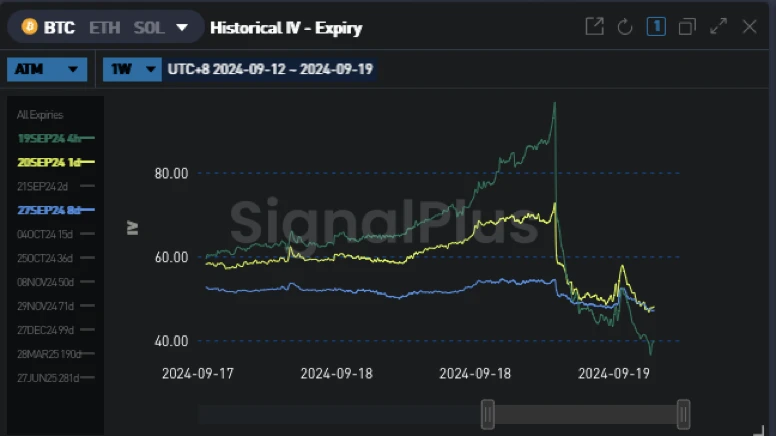

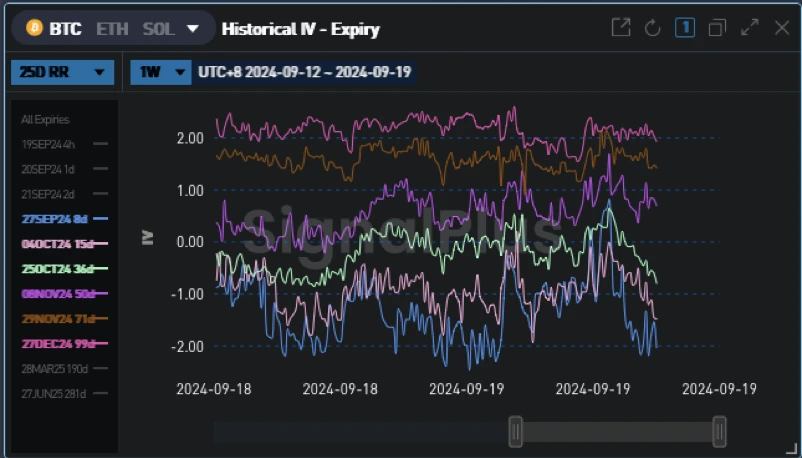

BTC/USD September 27th ATM Volatility -7.0v (54.5 -> 47.5); December (Year-End) ATM Volatility -1.4v (59.6-> 58.2), December 25d Risk Reversal Volatility -0.3v (2.3 -> 2.0)

FOMC Meeting Minutes

The Federal Reserve has initiated a rate cut cycle, announcing a 50 basis point cut. Chairman Powell expressed confidence in the US economic situation ("If you ask most market participants, they would say the economic situation is good")

The immediate market reaction was a rise in US stocks, a decline in the US dollar (relative to fiat currencies and gold), and a decrease in yields. However, most of the gains and losses were readjusted by the market after the meeting. BTC/USD and ETH/USD remained relatively calm during the meeting, but saw a 4% rebound during the early Asian session. Driven by risk appetite, altcoins generally rose

The overall market response was subdued, with cross-market implied volatility under pressure. The US presidential election becomes the next important event for the market in October. Meanwhile, the market and the Federal Reserve will closely monitor the upcoming economic growth data

BTC/USD Volatility Review

- At the beginning of the week, the market was relatively calm. However, as the meeting approached, market attention to event risk increased significantly, and trading in implied volatility also increased. Overnight volatility rose from 65 to 90 last night, indicating that the breakeven point for overnight straddle options was 3.5%. Ultimately, due to this morning's volatility, the spot price reached the breakeven point, but the price movement itself was subdued. By 5 PM New York time, the spot price stabilized around $60,000. Due to increased demand for Gamma in the market, volatility in the slightly longer term was also pushed higher. The volatility for September 27th expiration briefly rose from 51.5 to 54.5, but quickly fell back to the current 47.5.

- Trading volume at the far end of the curve was relatively subdued, and implied volatility gradually declined before and after the event, as the market continues to seek new narratives to break the current range-bound trading. The brief volatility caused by this morning's spot price breakthrough was quickly absorbed by the market. The morning price breakthrough briefly caused IV to rise, but was quickly sold off by those with Long Vega positions at that time

- Volatility skew pricing is very stable, and despite the rise in spot prices, bullish sentiment in the market has not yet returned. As expected, implied volatility has struggled to show significant fluctuations on both sides of the spot price (in fact, there was some selling pressure at the top when the spot price rose)

Cryptocurrency Volatility Outlook

In the short term, unless there is a new breakthrough in spot prices, we expect front-end implied volatility to continue to be under pressure, with actual volatility indicators remaining low (high-frequency and fixed-term averages around 45), and no imminent event risks. Market participants are likely to sell short-term call options at the top during the uptrend in spot prices as a hedge for their core long spot positions (some of these operations were observed this morning)

As front-end volatility continues to be under pressure until the weekend, the market may underestimate the pricing of options expiring after the US presidential election; we estimate the total variance of the current market pricing for the US election date to be around 5-6%. Considering its importance to the cryptocurrency cycle, this pricing level seems low (the market priced FOMC at around 4% last night (breakeven point), and priced the Bitcoin 2024 peak in August at around 5.5%)

Given the market's 50:50 probability for the election, we expect volatility skew to remain relatively stable before the event. Because initially, regardless of the outcome, the market's reaction to the two possible results may be relatively symmetrical (i.e., disappointment with the Harris/'status quo' result versus bullish expectations for Trump).

Good luck to you!

You can use the SignalPlus trading wind vane function at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact with more friends. SignalPlus Official Website: https://www.signalplus.com0

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。