Original source Presto Research

Compiled by Odaily Planet Daily Golem (@web3_golem)

Summary

While the regulatory environment for Web3 remains unclear in most parts of the world, Singapore has long been seen as a leader in providing a clear regulatory framework for various businesses and asset managers in the Web3 industry.

In this issue of Presto Research's focus on Asia series, we explore why Singapore is so attractive to crypto businesses by studying the various components of its regulatory environment.

At the end of the article, Alex Svanevik and Hassen Naas, CEOs of Singapore Web3 companies Nansen and Laevitas, share why they believe Singapore remains the most attractive base for crypto companies.

Figure 1: MAS Headquarters, Source: Presto Research

Overview

As the landscape of digital assets continues to evolve, Singapore has become a beacon for crypto businesses and projects looking to establish themselves in Asia. The country's unique regulatory clarity, technological infrastructure, and strategic location make it the most attractive destination for various Web3 entities, from cryptocurrency exchanges and token issuers to blockchain infrastructure providers and decentralized finance (DeFi) protocols.

This report provides a comprehensive guide for crypto entrepreneurs, investors, and seasoned participants considering Singapore as an operational base. Our analysis delves into key aspects of Singapore's crypto ecosystem, examining the regulatory landscape and the real experiences of businesses operating within it.

The hallmark of Singapore's approach to crypto regulation is striking a delicate balance between fostering innovation and mitigating risks. As the primary financial regulatory authority, the Monetary Authority of Singapore (MAS) has established a framework that provides regulatory clarity while still accommodating the rapid changes inherent in blockchain technology and digital assets. This report outlines the roles of key institutions, including MAS and the Singapore FinTech Association, and their impact on various sectors within the crypto industry.

The report explores a range of licensing requirements and regulatory considerations for various crypto-related businesses, including exchanges, payment service providers, token issuers, crypto funds, custodians, OTC trading desks, blockchain infrastructure providers, DeFi protocols, NFT platforms, and stablecoin issuers. Singaporean regulatory authorities have taken a nuanced approach to addressing how different types of digital assets and services are classified and regulated within existing frameworks such as the Payment Services Act (PSA) and the Securities and Futures Act (SFA).

To gain a comprehensive understanding of Singapore's crypto ecosystem, the report integrates insights and experiences from prominent crypto participants in Singapore. Through interviews and case studies, we explore practical aspects of operating crypto businesses in Singapore, including the process of obtaining necessary licenses, meeting compliance requirements, accessing banking services, and leveraging Singapore's gateway status to broader Asian markets.

By combining regulatory analysis with real-world perspectives, this report aims to provide readers with the necessary knowledge and insights to make informed decisions on whether to establish or expand cryptocurrency businesses in Singapore. As the global crypto landscape continues to evolve, understanding Singapore's unique position as a center for crypto innovation and regulation at the crossroads is crucial for anyone looking to capitalize on the opportunities presented by this vibrant market.

Singapore Regulatory Authorities and Their Roles

Singapore's robust and continually advancing regulatory framework has played a crucial role in attracting Web3 founders, protocols, hedge funds, and venture capital firms. The country's approach to digital assets and blockchain technology is characterized by striking a balance between innovation and risk management. There are two main regulatory bodies overseeing the crypto and blockchain space:

Monetary Authority of Singapore (MAS)

MAS is Singapore's central bank and integrated financial regulatory authority. Its jurisdiction includes:

Licensing and regulating digital payment token (DPT) services under the Payment Services Act (PSA);

Supervising crypto derivatives traded on approved exchanges;

Anti-money laundering and countering the financing of terrorism (AML/CFT) compliance for crypto businesses;

Issuing guidelines on digital token offerings and digital payment token services.

MAS has actively collaborated with the industry, regularly updating its regulatory framework to address the risks and opportunities emerging in the Web3 space.

Accounting and Corporate Regulatory Authority (ACRA)

While not specifically focused on Web3, ACRA's regulatory scope relates to entity formation and corporate compliance:

Overseeing the registration and regulation of Singaporean business entities;

Ensuring compliance with corporate governance standards;

Maintaining company registrations, including those in the Web3 space.

Singapore FinTech Association

While not a regulatory body, the Singapore FinTech Association plays a crucial role in the ecosystem:

Acting as a bridge between the industry and regulatory authorities;

Advocating Singapore as a fintech hub and promoting innovation;

Providing a platform for collaboration between traditional financial and Web3 companies;

Offering educational resources and networking opportunities for blockchain and crypto startups.

The interaction among these entities creates a comprehensive ecosystem, supporting Web3 innovation while maintaining Singapore's reputation for regulatory transparency and financial stability. This balanced approach helps make Singapore the preferred jurisdiction for Web3 founders and businesses.

Regulatory Requirements and Types of Licenses for Various Crypto Businesses

Entities involved in the Web3/crypto industry have various licensing requirements - below, we discuss some types of businesses and their related licenses.

Payment Service Providers (including digital payment token exchanges):

These fall under the Payment Services Act (PSA) and require licensing from MAS. There are two relevant licenses:

Standard Payment Institution (SPI) license: applicable to smaller businesses;

Major Payment Institution (MPI) license: applicable to larger businesses with higher transaction volumes. Currently, 28 entities hold MPIs for digital payment token services, including Blockchain.com, Circle, Coinbase, and others.

Both licenses require compliance with AML/CFT regulations, risk management practices, and customer protection measures.

Token Issuers

The regulatory approach depends on the type of tokens:

Security tokens: fall under the Securities and Futures Act (SFA) and require a Capital Markets Services (CMS) license;

"Utility" tokens: may not require specific licenses, but issuers should consider whether they have other obligations, such as if their tokens are akin to digital payment tokens, which would require compliance under the PSA.

Crypto Funds

Depending on their structure and activities, they may require a CMS license for fund management.

Crypto Custodians

PSA license is required to provide custody services for digital payment tokens.;

Must comply with MAS guidelines for safeguarding digital assets.

OTC Trading Desks

Depending on the products traded, a CMS license may be required to trade capital market products and/or a PSA license to provide digital payment token services;

Must comply with AML/CFT regulations.

Blockchain Infrastructure Providers

Generally do not require specific licenses unless engaged in regulated activities;

Must comply with general commercial laws.

DeFi Protocols

- Currently operating in a regulatory gray area.

NFT Platforms

May require a license, depending on the nature of the NFTs traded (e.g., if NFTs are considered securities) or if the platform has fiat or DPT on-ramps/off-ramps.

Must comply with anti-money laundering/counter-terrorist financing regulations if facilitating financial transactions.

Stablecoin Issuers

Constrained by MAS's stablecoin regulatory framework implemented in August 2023.

Single-currency stablecoins (SCS) pegged to the Singapore dollar or G10 currencies issued in Singapore will be subject to MAS's stablecoin regulatory regime. Other stablecoins will continue to be subject to existing regulatory frameworks under the PSA.

Under MAS's stablecoin regulatory regime, SCS issuers must comply with specific reserve backing, redemption, and disclosure requirements.

Other Key Considerations

All entities must be registered with ACRA and comply with general corporate regulations;

All categories must comply with anti-money laundering/counter-terrorist financing regulations;

Foreign entities may need to establish a local presence to obtain licenses;

The regulatory landscape is constantly evolving, with MAS regularly updating guidelines and introducing new frameworks.

This overview provides a snapshot of the current regulatory environment, but it does not constitute legal advice. Given the rapid developments in the cryptocurrency space, businesses must engage directly with the Monetary Authority of Singapore or seek legal counsel to ensure full compliance with the latest requirements.

Beyond Regulation: Why Singapore Remains Attractive in the Web3 Space

As mentioned earlier, Singapore's regulatory situation is comprehensive and provides clear information for a wide range of cryptocurrency industry participants. But Singapore's advantages go beyond this: its long-standing good reputation among foreigners, world-class education system, national security, family-friendly infrastructure, and strategic location are non-crypto-specific factors, but they are also reasons why Singapore attracts crypto founders. We learned from two founders why they decided to base their companies in Singapore.

Nansen Founder Alex Svanevik: Government Leadership and Openness to Foreign Talent

Nansen is a Singapore-based on-chain analytics company. Co-founder and CEO Alex Svanevik discussed his reasons for deciding to base the company in Singapore:

"Singapore is where East meets West, where the private sector meets the public sector, and where finance meets technology. It is one of the few countries in the world that has been run in a 'founder mode' for decades (until recently) - governed by Lee Kuan Yew. It is still managed by one of the most capable governments in the world. For these reasons, I think it's a good place to do business."

Svanevik's mention of Lee Kuan Yew's leadership highlights a key aspect of Singapore's success: its openness to foreign talent. Lee Kuan Yew himself emphasized this strategy, stating, "If Singapore relies on the talent nurtured from 3 million people, it cannot achieve superlative performance… Singapore's economy is vibrant because we have been attracting talent from all over the world, from South Asia, Northeast Asia, China, India, and beyond what 3 million Singaporeans can nurture."

This embrace of global talent has been a cornerstone of Singapore's economic strategy, greatly enhancing its appeal to entrepreneurs and businesses, including those in the Web3 space.

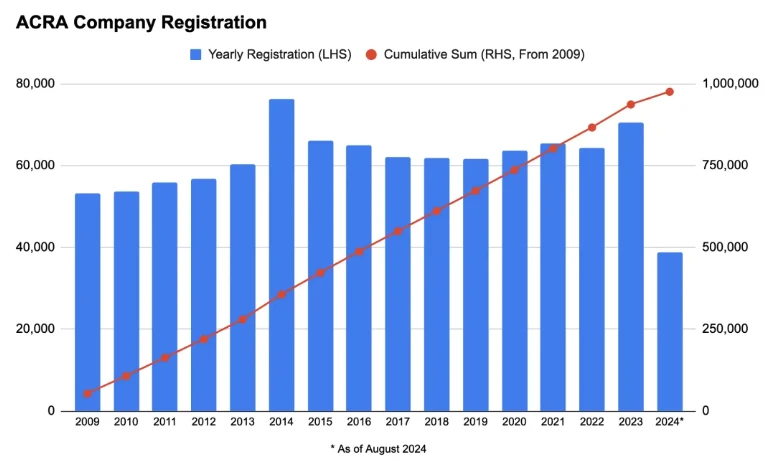

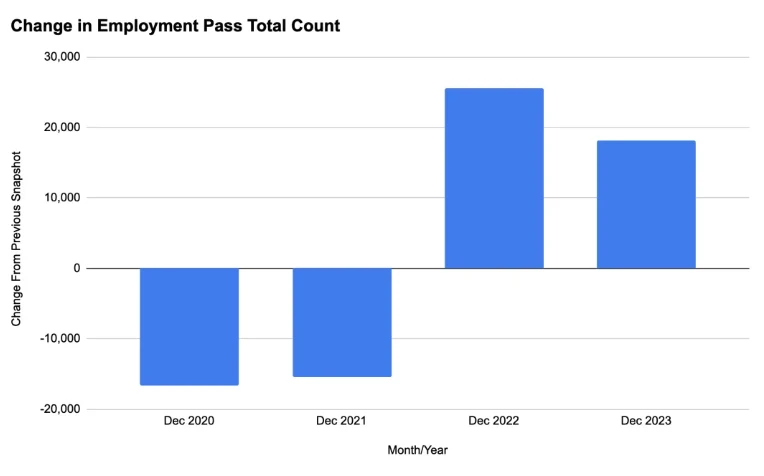

The attractiveness of Singapore as a business hub is not just hearsay. Data from the Accounting and Corporate Regulatory Authority (ACRA) shows a continuous increase in the number of registered companies in Singapore (Figure 2). And data from the Ministry of Manpower (MoM) shows a strong rebound in Employment Pass (EP) growth post-COVID-19 (Figure 3):

Figure 2: The number of registered companies in Singapore has been steadily increasing, Source: ACRA via data.gov.sg

Figure 3: Despite a decline in EP numbers during the pandemic, there is a strong rebound, Source: Ministry of Manpower (MoM)

Laevitas Founder Hassen Naas: Experienced Unexpected Benefits Since Relocating to Singapore

Laevitas is a quantitative data analytics company focused on crypto derivatives. Hassen, as the founder and CEO who relocated the company's headquarters to Singapore, also provided a unique perspective on Singapore.

"Deciding to relocate the company's headquarters was not easy, especially for companies in the Web3 space, as the industry is viewed with suspicion in many jurisdictions. I think Singapore has this self-fulfilling drive to continue strengthening its position as a center for entrepreneurial technology (now Web3): companies relocate to Singapore because of its advantages, such as clear regulations, convenient living, thriving financial and tech sectors, ample talent pool, and tax incentives, which encourage regulatory authorities and the government to provide clearer regulatory and business frameworks. It also in turn motivates more companies to set up in Singapore, strengthening further improvements by regulatory authorities, and so on.

Singapore has a vast network of businesses and funds, both crypto and non-crypto, and since relocating to Singapore, we have experienced all the benefits we expected, and even more. We have many updates and upcoming releases, such as alert systems for market structure changes, order book imbalances, and TWAP changes, and we are proud to continue operating in Singapore."

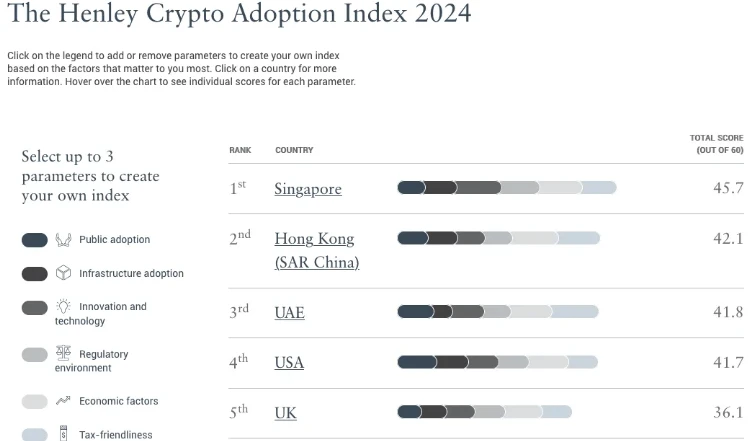

Hassen's mention of a supportive regulatory environment has led to high adoption of cryptocurrencies. As recently highlighted by investment immigration consultancy Henley & Partners, Singapore leads the world in cryptocurrency adoption (Figure 4). Henley emphasized that a strong regulatory environment, innovation, and technology were key factors driving the country to the top of the 2024 list.

Figure 4: Singapore leads in overall cryptocurrency adoption, Source: Henley & Partners

Conclusion

Singapore's emergence as a leading cryptocurrency center in Asia is no accident. The country has carefully nurtured an environment that balances innovation and regulation, creating fertile ground for the thriving of Web3 businesses. The clear regulatory framework provided by the Monetary Authority of Singapore, coupled with Singapore's strategic location, world-class infrastructure, and pro-business policies, continues to attract founders and companies from around the world.

As the cryptocurrency industry evolves, Singapore's adaptable regulatory approach allows it to maintain a competitive edge. The testimonials from Alex Svanevik and Hassen Naas emphasize the tangible benefits of operating within this ecosystem. While challenges still exist, especially in emerging areas like DeFi, Singapore's track record suggests that it will continue to refine its approach, striking a balance between innovation and prudent risk management.

For entrepreneurs and established businesses, Singapore combines Eastern and Western cultures, financial acumen, and technological prowess. As the global cryptocurrency landscape continues to evolve, Singapore's role as a stable and innovative beacon in the Web3 space seems to be growing stronger.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。