Original | Odaily Planet Daily (@OdailyChina)

On September 14th, Eigenpie announced the economic model of its token EGP. On the same day, Bitget Wallet announced that it will launch the re-staking project Eigenpie (EGP) on the Launchpad platform on September 23rd, and EGP will be listed on the Bitget exchange on September 25th. On September 17th, Eigenpie announced that the dAPP front end now supports querying the airdrop amount and IDO share (click here to go to the query link). According to official Discord community feedback, many early participants are dissatisfied with the EGP token economic model.

TVL once exceeded $1.6 billion, Arbitrum Foundation participated in the investment

Eigenpie is an Ethereum liquidity re-staking protocol that provides re-staking assets and expands the profit potential for Liquid Staking Token holders. By creating a dedicated liquid re-staking version for each LST accepted on the platform, Eigenpie effectively isolates the risks associated with any specific LST.

Eigenpie creates a dedicated liquid re-staking version for each LST

DefiLlama data shows that in July of this year, Eigenpie's TVL once exceeded $1.6 billion, ranking it among the top Ethereum liquidity re-staking protocols. Currently, Eigenpie's TVL is $1.028 billion, ranking it third among Ethereum liquidity re-staking protocols.

In September of this year, Eigenpie announced strategic investment and completed seed round financing, with the specific amount yet to be disclosed. Participants include the Arbitrum Foundation, Robot Ventures, PancakeSwap, Relayer Capital, Bitget CEO Gracy Chen, Frax Finance founder Sam Kazemian, Zircuit co-founder Angel Xu, GMX core contributor coinflipcanada, and others.

Total supply of 11% for airdrop, only 60% unlocked at TGE

Eigenpie's native token type is ERC20, with a total supply of 10 million. EGP can be locked into vlEGP at a 1:1 ratio in Eigenpie to participate in protocol governance. When EGP is locked into vlEGP on Eigenpie, the token will be in an indefinite locked state; users need to click the "Start Unlocking" option and wait for 60 days to unlock vlEGP.

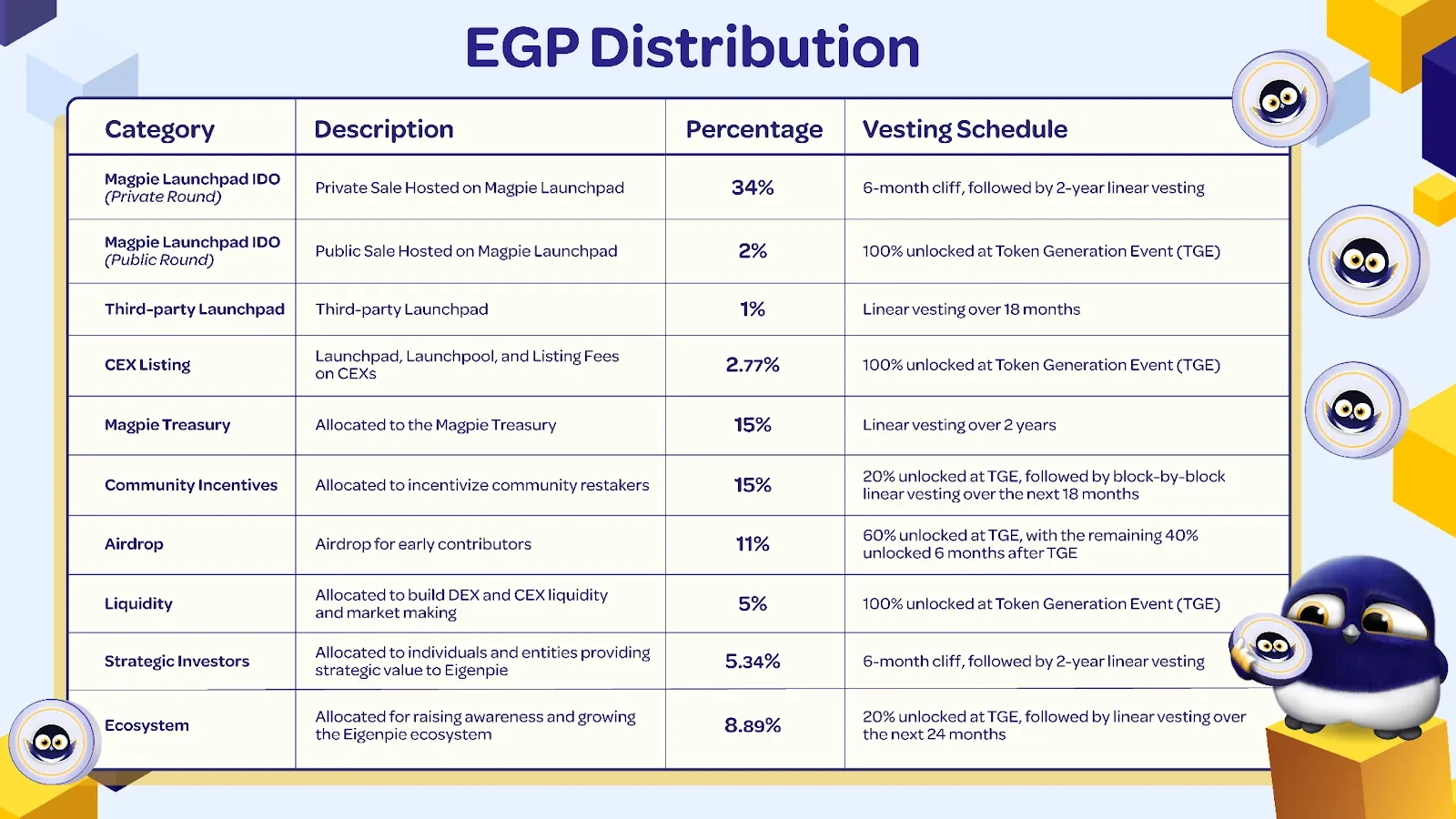

The specific allocation of Eigenpie's native token EGP is as follows:

34%: Magpie Launchpad IDO (private round), with a 6-month lockup period, followed by a linear unlock over 2 years;

2%: Magpie Launchpad IDO (public round), fully unlocked at TGE;

1%: Third-party Launchpad, with an 18-month linear unlock;

2.77%: CEX listing (including Launchpad, Launchpool, and listing fees), fully unlocked at TGE;

15%: Magpie Treasury, with a 2-year linear unlock;

15%: Community incentives, 10% unlocked at TGE, followed by a linear unlock over 18 months;

11%: Airdrop, 60% unlocked at TGE, the remaining 40% locked for 6 months after TGE;

5%: Liquidity, fully unlocked at TGE;

5.34%: Strategic investors, with a 6-month lockup period, followed by a linear unlock over 2 years;

8.89%: Ecosystem, 20% unlocked at TGE, followed by a linear unlock over 24 months.

According to the EGP token economic model published by Eigenpie, there are two points that have attracted the attention of community members.

First, although the airdrop portion accounts for 11% of the total supply, only 60% is unlocked at TGE, and the remaining portion needs to be locked for half a year before being released. The project delays the release of a portion of the airdrop tokens to reduce post-TGE selling pressure, stabilize the token price, and contribute to the long-term development of the project.

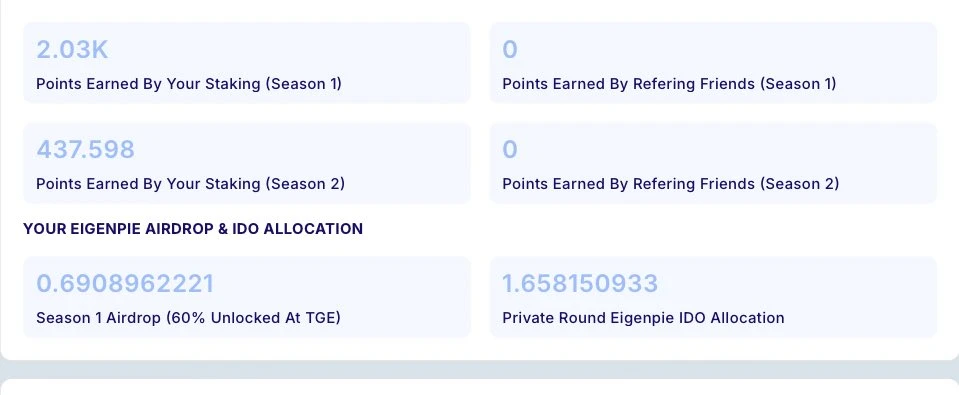

However, several community members have reported that they received only a small amount of tokens when participating in the first season of staking. According to community feedback on the official Discord, early participants staked LST-related assets for nearly half a year, but only received a small amount of tokens. One member reported staking LST assets worth about 1 ETH for 3 to 4 months and only receiving 1.5 tokens when checking. In addition, only 60% of the tokens were unlocked at TGE, and the remaining airdrop tokens will be released after half a year.

A community member's token airdrop quantity

Second, 6 months after TGE, the tokens will face significant selling pressure. The token economic model shows that the private round, remaining unlocked 40% of airdrop tokens, and strategic investors will start unlocking after being locked for 6 months at TGE. Although all tokens except the airdrop tokens are subject to linear unlocking, the market will still face significant selling pressure daily.

EGP token IDO will start on September 20th

According to official information, the EGP token IDO is scheduled to start at 9:00 pm Beijing time on September 20th and end at 9:00 pm on September 24th. The IDO will be held on the Magpie Launchpad via Arbitrum, with a snapshot taken between September 18th and 20th to determine the IDO quota allocation for vlMGP holders, MGP, and vlMGP burners. The IDO will consist of two rounds, with the specific details as follows:

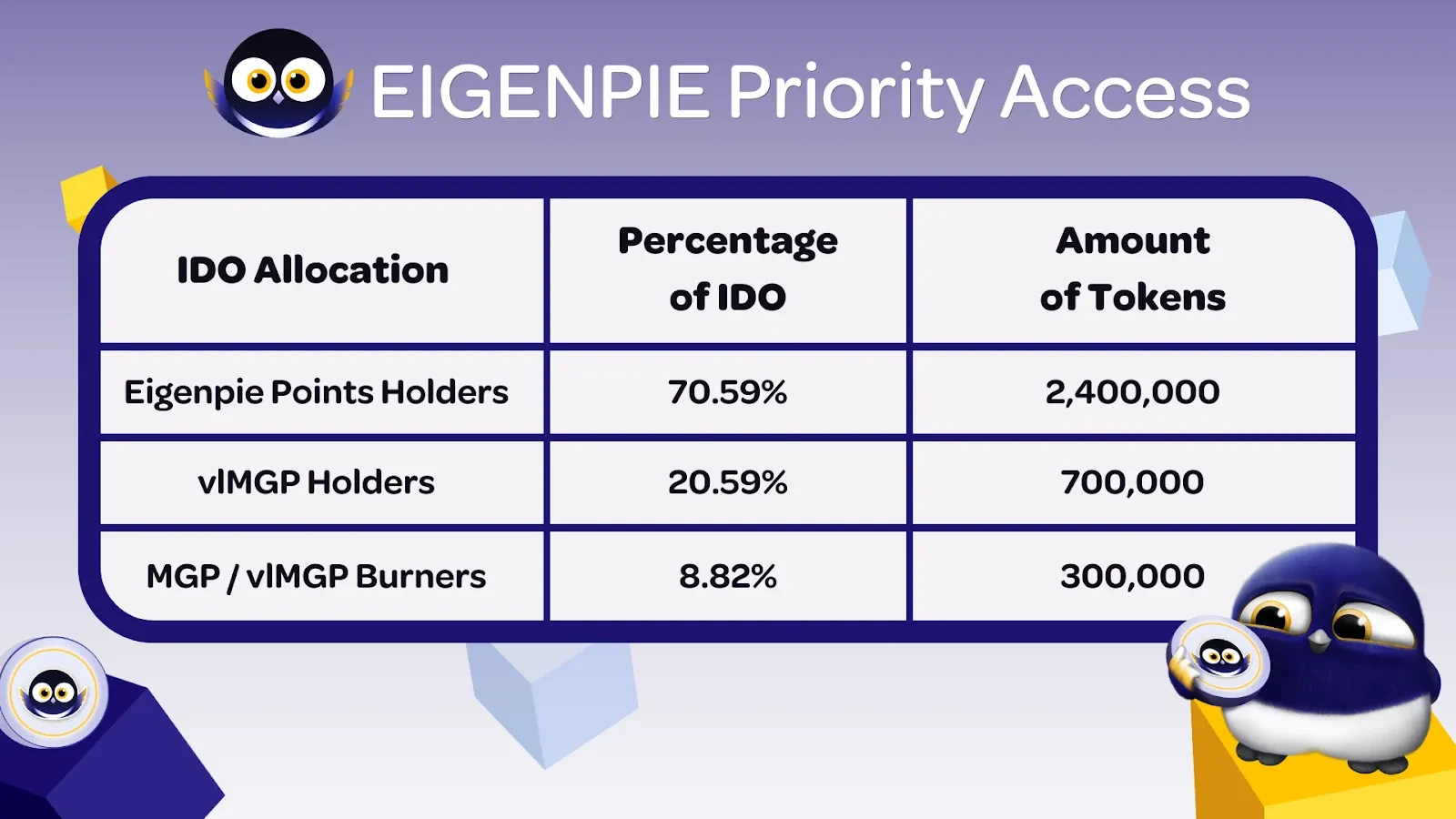

- Private round (FDV $3 million): Price $0.3, duration 24 hours, 70.59% of the tokens will be allocated to Eigenpie token holders, 20.59% of the tokens will be allocated to vlMGP holders, and 8.82% of the tokens will be allocated to MGP/vlMGP burners;

Private round IDO token allocation

- Public round (FDV $6 million): Price starting from $0.6, duration 72 hours, open to everyone, final price determined by the total amount raised divided by the total amount of tokens sold in this round.

The community also has many complaints about the upcoming token IDO. The allocation share in the private round is relatively small and requires a six-month lockup, with the unlocked tokens not being released all at once, but gradually unlocked over the next two years. Although the tokens in the public round will be fully unlocked at TGE, the initial price is $0.6 (compared to the fixed price of $0.3 in the private round), and the final price is proportional to the amount raised, meaning the more funds participated, the higher the price of the tokens in the public round.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。