Original author: Frank, PANews

In the field of blockchain, MEV (Maximum Extractable Value) has always been a complex and significant issue. It refers to the phenomenon where miners or validators manipulate the order, insertion, or deletion of transactions in a block to extract additional profits. Common MEV tactics include sandwich attacks, front-running, and liquidation arbitrage.

MEV manifests differently on different public chains, from common arbitrage trading on Ethereum to severe sandwich attacks on Solana, and the gradually emerging MEV potential on Bitcoin, BSC, Tron, and other public chains. This article will take stock of the MEV phenomena on major public chains, analyze their different implementation paths, and the potential impact on users and networks.

Ethereum: Arbitrage is the main focus as sandwich attacks decline

As the public chain with the highest trading volume, Ethereum has always been the public chain with the most concentrated MEV phenomena. This is especially true during periods of active DeFi and NFT trading. In 2023, the Ethereum Foundation suffered a MEV Bot sandwich attack when selling ETH, resulting in a loss of $9,101, with the MEV Bot profiting approximately $4,060.

For ordinary users, MEV mostly brings negative impacts, especially when sandwich attacks and front-running transactions become rampant. However, for miners or validators, MEV is an important additional source of income, especially during periods of declining block rewards. MEV income can supplement the income levels of miners and validators, which is of certain positive significance for maintaining the stability and decentralization of the entire blockchain network.

In the classification of MEV, in addition to harmful transactions such as sandwich attacks and front-running transactions that directly harm user interests, liquidation arbitrage and other behaviors are mostly not considered harmful trading behaviors for maintaining market liquidity. Therefore, how to reduce harmful sandwich attacks and retain liquidation and arbitrage MEV has become a difficult problem for maintaining MEV balance.

To address the fairness issues brought by MEV while balancing the income of validators, Flashbots has introduced the MEV-Boost and Flashbots Protect protocols. MEV-Boost is a relay system that allows validators to obtain optimized blocks from external block builders through relay nodes, maximizing the revenue from transaction ordering through complex MEV extraction strategies. MEV-Boost introduces a transparent block construction process, avoiding traditional front-running and sandwich attacks and other malicious MEV methods.

Flashbots Protect is mainly designed for ordinary users, aiming to protect users' transactions from the impact of front-running and sandwich attacks. Users can submit private transactions through Flashbots Protect, which will not be publicly broadcast to Ethereum's public mempool, but will be directly sent to miners or validators supporting Flashbots through a private channel.

Historically, the proportion of private orders transmitted through MEV-Boost or Flashbots Protect on Ethereum is about 30%, while the proportion of orders transmitted through the public mempool still accounts for about 70%. This means that a large number of users do not prefer to initiate transactions using Flashbots Protect. However, about 70% of transactions on Ethereum DEX are initiated through Flashbots Protect's private orders. Currently, the proportion of MEV income on Ethereum is about 26%, indicating that the main source of income for validators is still block rewards, rather than relying solely on MEV income.

Currently, the number of validators registered with MEV-Boost on Ethereum has reached 1.47 million, accounting for over 81%. Data from September 5th shows that the proportion of blocks generated through the MEV-Boost protocol in the past 14 days reached 89%. However, this does not mean that 89% of Ethereum orders are all MEV orders transmitted through private pools.

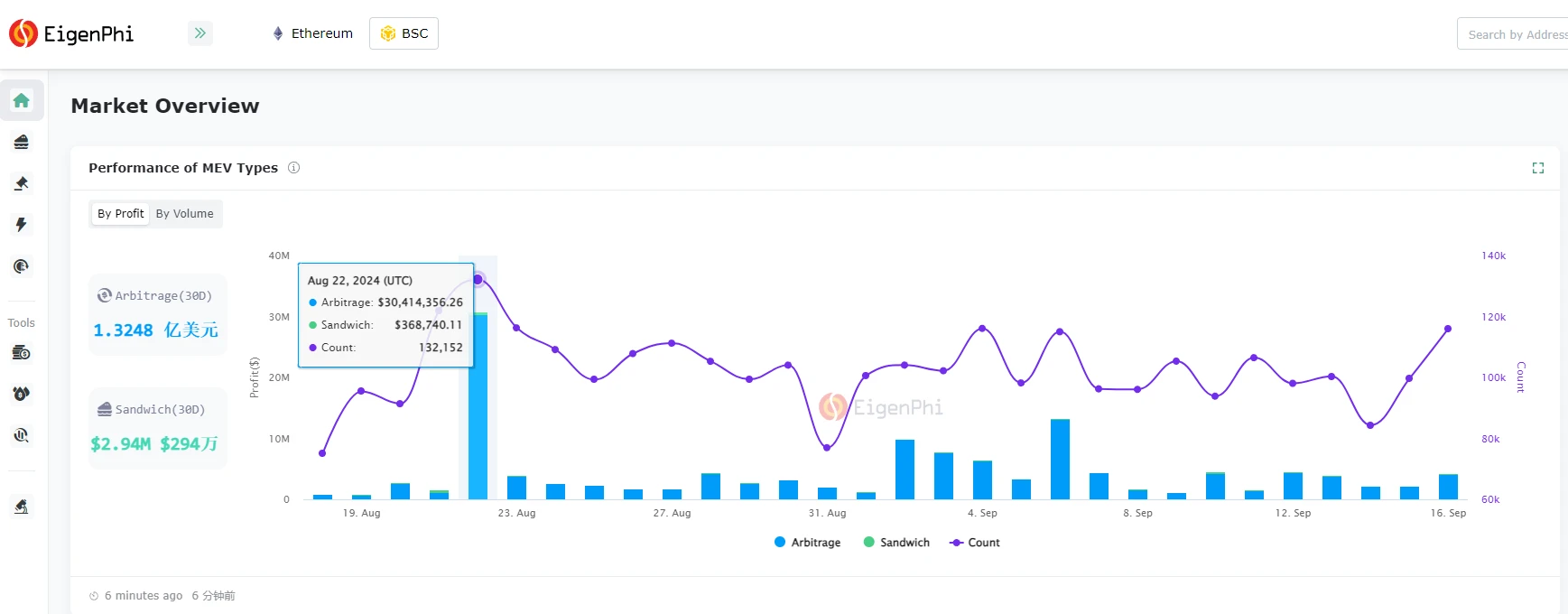

Currently, sandwich attacks on Ethereum seem to have been significantly mitigated. According to Eigenphi data, the total income from sandwich attacks in the past 30 days was $740,000, while arbitrage income during the same period reached as high as $1.72 million.

Solana: MEV issues worsen, sandwich attacks threaten user transaction security

MEV issues on Solana have become increasingly severe during this bull market cycle. According to Blockworks Research, in April 2024, MEV income on Solana has surpassed that of Ethereum. Before November 2023, MEV income on Solana was almost negligible.

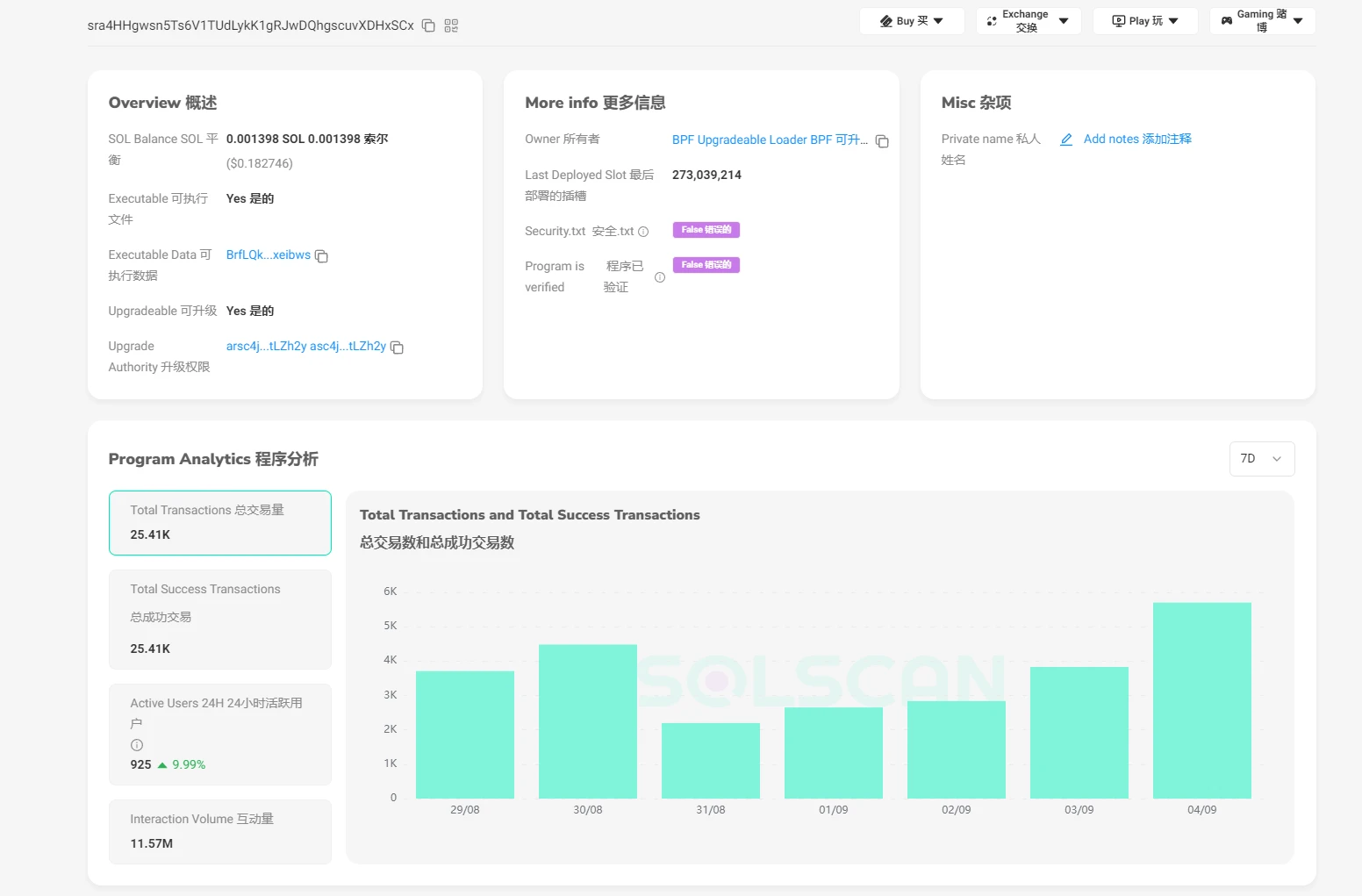

Compared to Ethereum, the reason why MEV on Solana is more discussed in the community is that sandwich attacks have severely affected ordinary users' transactions. Previously, PANews conducted in-depth research on this topic, where a sandwich attack robot with an address starting with "arsc" made $30 million in just 2 months, compared to Uniswap's income of only $31 million in nearly a month. (Related reading: Making $30 million in 2 months, Solana's largest sandwich attacker earns $570,000 a day, sparking public outrage)

Regarding MEV on Solana, it is necessary to mention Jito Labs, which developed Jito-Solana on Solana, which can be considered as the Solana version of MEV-Boost. Although the implementation paths of the two are different, the overall idea is similar, aiming to help validators maximize MEV income. Jito has introduced a block space auction mechanism, allowing transaction initiators to pay a separate fee to validators to ensure that bundled transactions are executed with priority. In addition, in March, Jito announced the temporary closure of its running mempool to reduce sandwich attacks, as this memory pool could be used by sandwich attackers to monitor the content of transactions initiated by users, but MEV robots can still listen to transactions by running an RPC node.

Therefore, Jito's closure of the mempool did not eliminate sandwich attacks on Solana, but rather raised the threshold. Teams specifically seeking to profit from sandwich attacks have become even more cunning under community scrutiny.

According to PANews observations, the notorious "arsc" robot has not stopped, but continues to conduct sandwich attacks through rebranding, and the scale of the attacks is even larger than before, almost monopolizing sandwich attacks on Solana. "sandwiched" is a platform developed by the Ghost team specifically to monitor Solana sandwich attacks. PANews carefully observed that the actual control addresses of the active sandwich attack programs on Solana are all "arsc". In simple terms, "arsc" has written the logic used for sandwich attacks into multiple smart contracts, each of which deploys hundreds of addresses to execute attacks. Therefore, if only tracking addresses, the correlation cannot be seen. Rough observations indicate that the average number of addresses under each smart contract is around several hundred to about a thousand, so "arsc" may have tens of thousands of addresses used for sandwich attacks.

In the past year, Tips income (MEV fees) received by Jito has exceeded 1.53 million SOL (worth about $198 million), while Ethereum's MEV income during the same period was about $600 million.

BSC: Introducing MEV solutions similar to Flashbots, with arbitrage as the main focus

BSC and Ethereum have many similarities in the MEV extraction mechanism, and BSC has also introduced a MEV solution similar to Flashbots. On BSC, the bloXroute MEV Relay is used. This solution protects user transactions from being targeted by MEV robots in the public mempool by using private transaction bundles, thereby reducing user losses.

However, from a data perspective, the overall MEV profit on BSC is much higher than on Ethereum. According to Eigenphi, the total MEV income on the BSC chain in the past 30 days is about $133 million, with arbitrage income accounting for about $130 million and sandwich attack income only $2.8 million. On August 22nd, the arbitrage income reached $30 million, which seems somewhat unusual. The total transaction volume on the entire BSC chain in August was only $20 billion, so the high MEV income data is indeed questionable.

Ethereum L2: MEV has not yet formed on a large scale, with liquidation income as the main focus

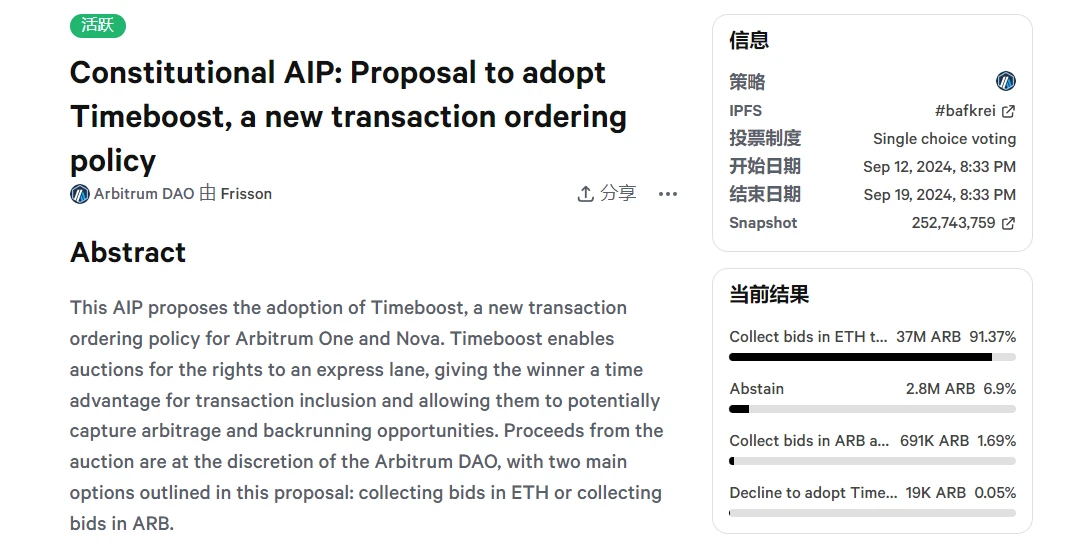

There is currently almost no specific data on the MEV situation on Ethereum Layer2 platforms. According to a research paper by Arthur Bagourd and Luca Georges Francois, as of June 2023, the MEV income on Ethereum L2 (Polygon, Arbitrum, Optimism) is about $213 million. Polygon contributes the highest proportion, at about $213 million, mainly due to a few large transactions increasing overall profits. Arbitrum's total MEV extraction profit is about $250,000, and Optimism's data is about $250,000. Overall, excluding extreme data, MEV on Ethereum L2 has not yet formed a large-scale stable income, mainly due to the significant fluctuations in transaction volume on Ethereum L2. In addition, MEV income on Ethereum L2 mainly comes from liquidation income rather than sandwich attacks. Recently, Arbitrum passed a transaction sorting mechanism called Timeboost, a relay system similar to MEV-Boost.

Tron: Limited MEV opportunities under the DPoS mechanism

As one of the public chains with the largest transaction volume, Tron has recently seen increased trading volume due to the hype around MEME coin. However, many users have raised concerns about the presence of a large number of robot attacks on Tron. Subsequently, Tron founder Justin Sun stated that Tron does not have a MEV mechanism, and the robot attacks currently occurring are probabilistic attacks.

Tron uses the DPoS (Delegated Proof of Stake) consensus mechanism, under which there is usually no public mempool similar to traditional PoW and PoS. In the DPoS system, transactions are not first broadcast to public network nodes for miners or validators to select. Instead, transactions are submitted by users to Super Representatives (SRs) or delegated nodes, which have the authority to generate blocks and confirm transactions. Unless these Super Representatives actively participate in MEV transactions, the probability of MEV occurring is generally low.

Bitcoin: MEV gradually emerging, mainly relying on script and miner behavior

Due to the different design of Bitcoin, which uses a simple UTXO model, where each transaction mainly involves the transfer of Bitcoin from the sender to the receiver, transaction ordering does not lead to complex arbitrage or liquidation opportunities as in Ethereum. In addition, the Bitcoin network does not have complex smart contracts, which means that miners cannot use arbitrage or liquidation to extract MEV as they can on Ethereum.

However, with the emergence of script, runes, Layer 2, and other Bitcoin ecosystem developments, the potential for MEV on Bitcoin is also emerging. For miners, more MEV opportunities will compensate for the reduction in mining rewards. However, as the MEV behavior in the Bitcoin ecosystem has not yet formed a large-scale, standardized pattern, relevant data has not been seen for the time being.

Overall, MEV manifests differently on various public chains, from the mature arbitrage mechanism on Ethereum to the rampant sandwich attacks on Solana. Each ecosystem faces unique challenges and opportunities. As DeFi, NFT, and smart contract technologies continue to evolve, the MEV phenomenon will continue to develop, and different public chains will constantly explore solutions to balance MEV income and user experience. In the future, effectively managing MEV will become an important issue for maintaining decentralization and network fairness in public chains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。