Economic Crisis Analysis 2: The Internet Bubble in 2000

In 2000, compared to 2008, the market value of Nasdaq was 6.6 trillion, while the real estate market value was 30 trillion, more than twice the GDP. Additionally, the impact of housing affects everyone, while the stock market only affects a portion of the population. Therefore, the bursting of the stock market bubble in 2000 had little impact on the real economy.

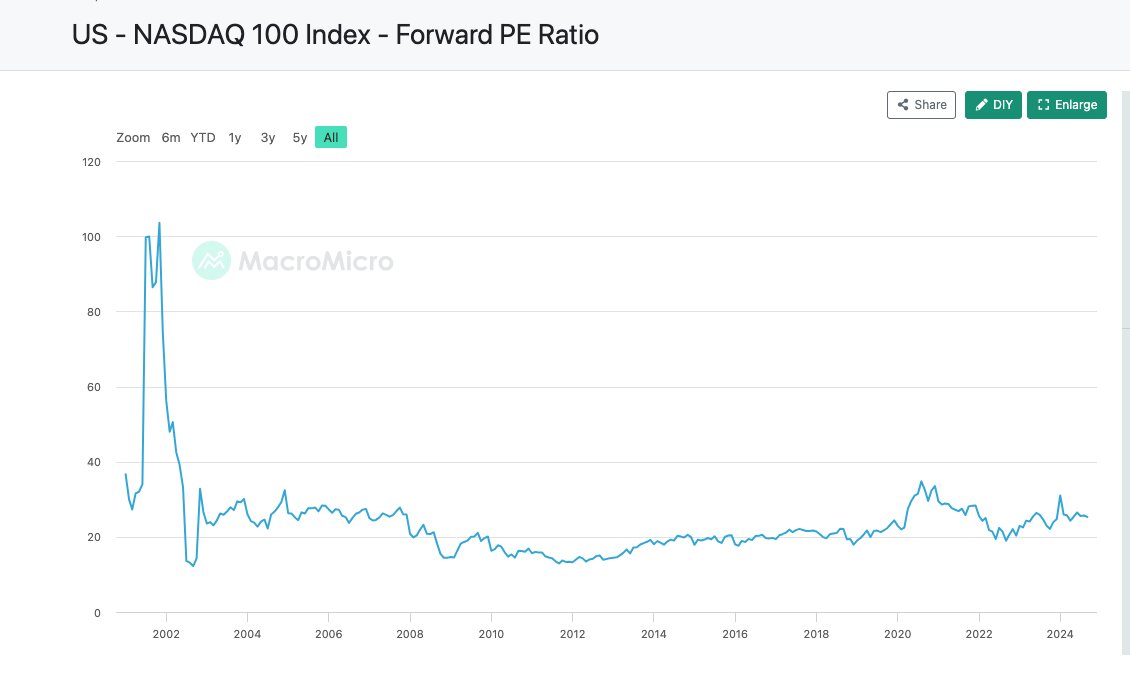

Furthermore, the current bubble level is far from that of 2000. As can be seen from the chart below, the Nasdaq 100 forward PE ratio reached 100 times in that year, while now it is only 25 times.

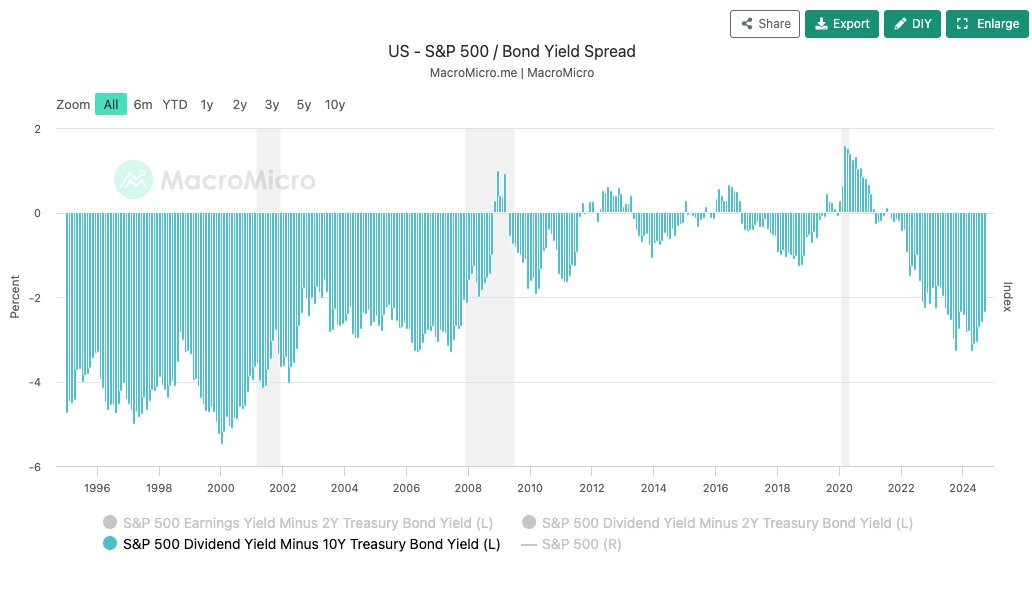

Another perspective is the S&P PE ratio. The current PE ratio looks similar to that before 2000, but I believe the overall valuation of the stock market has shifted upwards, as interest rates have been consistently declining since the 1980s, leading to an increase in PE ratios.

Looking at the S&P dividend yield minus the 10-year Treasury bond yield, it can be seen that it is relatively higher now compared to 2000, indicating that the bubble is not as significant as it was back then.

Conclusion: Although the current stock market valuation is not low, it cannot be considered significantly overvalued.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。