Hot Spot

sats is currently running in a bullish channel and can be bought and held appropriately.

wld can be paid attention to, as it has bottomed out multiple times.

Market Analysis

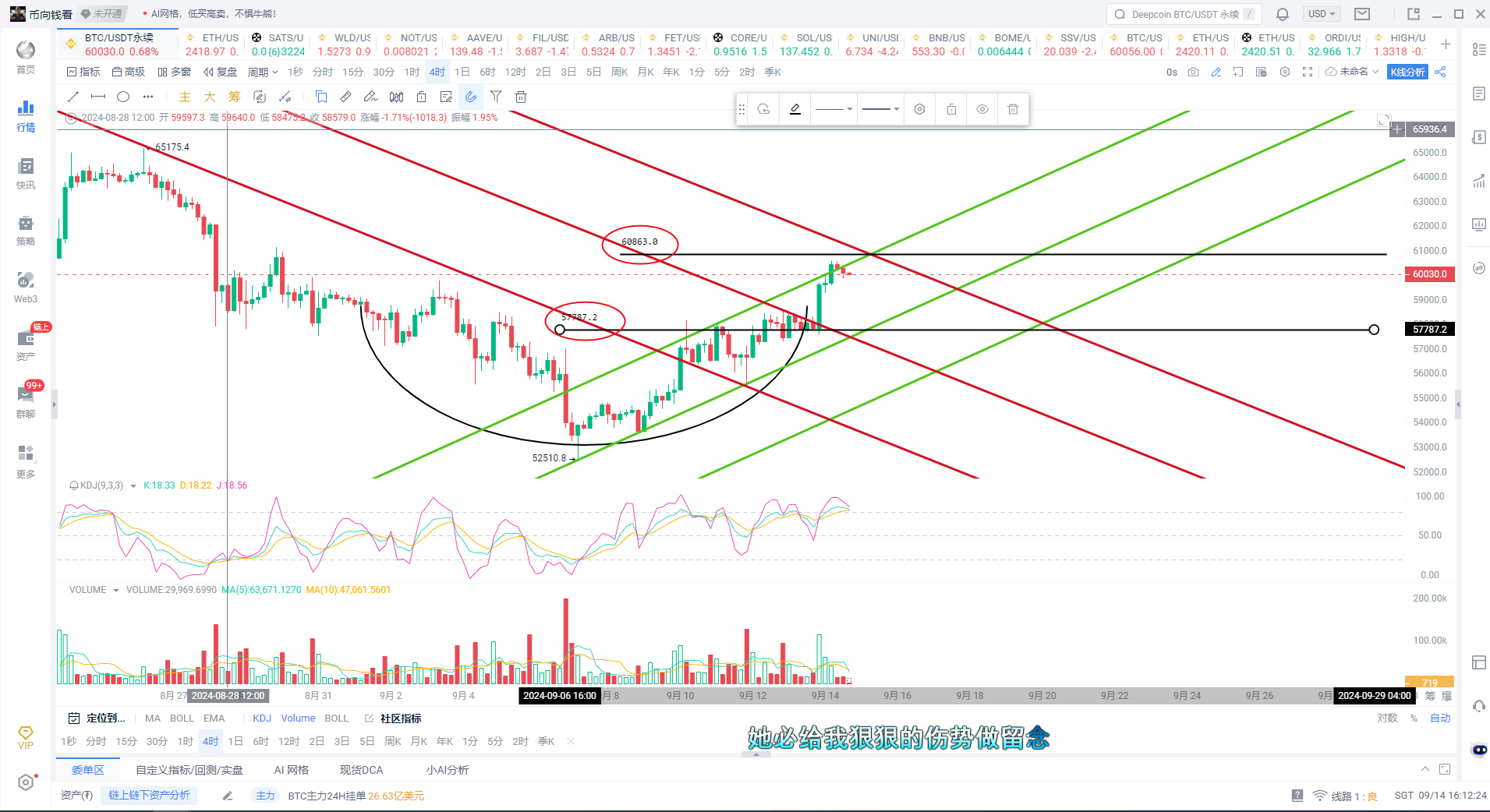

Bitcoin (BTC) broke through the strong resistance line of 58500 last night, reaching a high of 60597. The new intraday range to watch is 57782-60863. In the previous article, I mentioned that if the breakout cannot be chased, the continuation will be bearish. The layout strategy needs to be adjusted next, and the range operation can be bullish or bearish. Personally, I still see the bearish momentum intensifying. This is because the high-level chips are increasing, and the news is gradually deceiving the market. Under the gradual breakthrough of the high-level pressure, the main reference for the upper line is 60863-61624, and the main reference for the bottom line is 585-559. Always remember to defend and avoid being manipulated by the "whales". Learn to think from a different perspective. Previously, it was like a mother's hand holding a thread, now pay attention to the big drop at the high level!

Resistance: 60863-61624

BTC Support: 58500-559

Ethereum (ETH) is still overall weakly bullish, and the recent rise has been purely driven by Bitcoin. The upward channel has not been broken for several days, and the intraday high reached 2463. Although I laid out a short position yesterday, the defense was only 20 points due to the strong rise of Bitcoin. In the short term, I still personally go short at the upper line suppression range of 2423-2567, with a defense of 30 points. There is no stable bottoming sign at the bottom, so everyone should take it as a reference. As the saying goes, "When others are greedy, I am fearful; when others are fearful, I am greedy." The bottom line support range remains at 2326-2209, with intensified capital and chip risks. For more accurate entry and exit timing, you can follow the live broadcast with the same name or scan the QR code to join the group for the same entry and exit! All I can do is to eat meat together and avoid getting cut 😂

ETH Resistance: 2423-2566-67

ETH Support: 2326-2209

Key Data and News Analysis in the Coin Circle

Macro Economy: The three major U.S. stock indexes closed higher, and the Federal Reserve will meet next week

The three major U.S. stock indexes closed higher, with the S&P 500 index up 0.75% at 5595.76 points, the Dow Jones index up 0.58% at 41096.77 points, and the Nasdaq index up 1.00% at 17569.68 points. The benchmark 10-year U.S. Treasury yield is 3.68%, and the 2-year U.S. Treasury yield, which is most sensitive to the Fed's policy rate, is 3.64%.

In popular U.S. stocks, Apple rose 0.05%, Microsoft rose 0.94%, Nvidia rose 1.91%, Amazon rose 1.34%, Google C rose 2.23%, Google A rose 2.34%, Meta rose 2.69%, TSMC rose 0.72%, Tesla rose 0.74%, and AMD rose 0.61%.

The important news at present is the Federal Reserve meeting next week. During this period, the Fed is in a silent period, and Fed officials cannot make public statements. Important economic data has also been released, and Jerome Powell has made a speech. Therefore, the market's positive sentiment will continue until after the rate cut next week and the speeches of Fed officials. If the Fed only cuts rates by 25 basis points, it is believed that it will not have a significant impact on cryptocurrencies. Instead, the number of rate cuts by the Fed for the rest of the year needs to be watched. Based on the current inflation figures, the market estimates there will still be 2-3 rate cuts. However, this still needs to be observed, as U.S. inflation remains uncertain.

Summary

The current market shows some signs of recovery, especially driven by the GameFi and AI sectors. However, the overall market sentiment is still relatively low, and investors need to remain cautious in their operations. Bitcoin's stable performance and the relatively low AHR999 index provide a good buying opportunity, while the rebound of altcoins also provides opportunities for short-term investments. Macroeconomic factors such as the performance of the U.S. stock market and the dynamics of the Federal Reserve will continue to affect the market, and investors need to closely monitor the changes in these factors.

Personal Introduction

Graduated from the Finance Department of Nanjing University, formerly worked as a risk management expert at Shanghai Yimeng Securities and a private wealth advisor.

First invested in BTC in 2015 and has been focusing on the coin circle for nine years, experiencing multiple bull and bear markets.

Integrates deep financial expertise and sufficient industry experience into practical combat.

Helps students quickly master trading skills and improve their trading systems.

Trading style: Good at building structured thinking, self-created financial trading course "Naked K Fighting Method," etc.

Business Negotiation: Search for the same name on the V public account or follow the live broadcast with the same name "币向钱看"

Join the group for learning

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Search for the same name on the V public account "币向钱看"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。