Original author: dpycm.eth

Original translation: Deep Tide TechFlow

In the past decade, cryptocurrency has experienced rapid development, evolving from an initial niche technical experiment to a mainstream financial tool. The Web3 payment system, based on blockchain technology, ensures the transparency, security, and tamper resistance of transactions. These systems are increasingly integrated into e-commerce platforms, point-of-sale systems, and peer-to-peer payment applications, making the use of cryptocurrency in daily life more convenient.

As of 2023, the Web3 payment market is estimated to be valued at $12 billion, with a projected compound annual growth rate of over 15% from 2024 to 2032. Web3 payments are expected to become an important pillar of the digital economy, bringing new opportunities and challenges to the global financial ecosystem, similar to traditional payment systems.

Current Web3 Payment Infrastructure

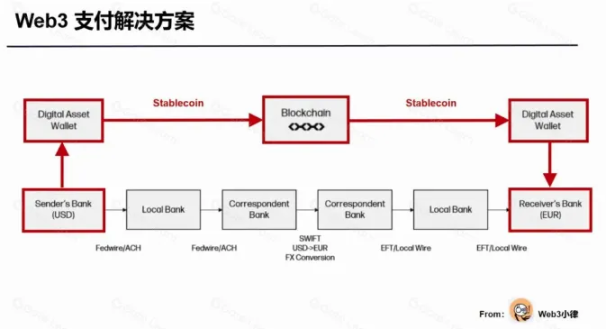

Web3 Payment Infrastructure

The existing Web3 payment infrastructure has greatly simplified the traditional payment process. Typically, a payment transaction involves only three parties: the payer, the payee, and the blockchain (as a mediator). Since the blockchain itself does not have consciousness, it can be said that only two parties are actually needed, making transactions more advantageous in terms of speed and cost. All Web3 payment protocols are based on the same infrastructure, with specific implementations varying slightly due to the protocol's conversion requirements.

Sphere Pay and Loopcrypto.xyz are two unique payment infrastructure protocols that allow businesses to integrate Web3 payment functionality, and we will explore their features in detail later.

What is PayFi?

With the integration of payments and decentralized finance (DeFi), PayFi has emerged as a financial market centered around the time value of money. PayFi provides a way to meet current needs with future money, which traditional finance cannot achieve.

PayFi includes various forms of payment:

- Payment Tokens, such as tokens representing the time value of tokenized US Treasury bonds or interest-generating stablecoins;

- Financing real-world assets (RWAs) through DeFi lending to achieve on-chain returns in real payment scenarios;

- A new type of Web3 payment system seamlessly integrated with DeFi protocols;

- Moving traditional payment logic to the blockchain, aiming to build a comprehensive Web3 payment framework.

A typical example of PayFi is Ondo Finance. This protocol aims to make institutional-level financial products accessible to more people by tokenizing US Treasury bonds. Ondo Finance brings low-risk, stable-yield, and scalable financial products, such as US Treasury bonds and money market funds, onto the blockchain, allowing stablecoin holders to generate returns from their assets.

Ondo Finance offers two products: OUSG and USDY. OUSG is a tokenized US Treasury bond fund, while USDY is an interest-bearing stablecoin backed by short-term US Treasury bonds. As of August 23, 2024, the total locked value of these two products has reached $556 million.

Through USDY, holders can not only denominate in US dollars but also earn returns. Therefore, Ondo adds practical utility to payment tokens, further driving the development of PayFi in Web3.

Interesting Payment Innovations

This section will introduce some interesting or lesser-known innovations in the payment field, excluding encryption cards and conversion functions.

Karrier One (Payment x DePIN)

The combination of payments and DePIN has reasonable applications in the telecommunications network. Karrier One is an operator-level decentralized network that integrates payment and DePIN functions. The Karrier One network consists of three modules: telecommunications, blockchain, and the Karrier Numbering System (KNS). They collaborate with global telecommunications providers to provide seamless global communication coverage. The network is managed by Karrier DAO, and token holders can participate in governance decisions.

Through KNS, users can obtain a Web3 wallet directly associated with their phone number. This integration allows users to participate in DeFi activities, send and receive cryptocurrencies, and facilitate smooth payment processes, effectively integrating PayFi and DePIN. With 7.1 billion mobile users worldwide, this provides enormous potential for the growth of Web3 telecommunications networks.

Huma Finance

Huma Finance is an income-based lending protocol. It allows borrowers to collateralize future income for lending by matching with global on-chain investors. The protocol has common credit facilities and is equipped with decentralized signal processors and assessment agents, which are important infrastructure for integrating income sources, conducting credit assessments, and ongoing risk management.

As of August 23, 2024, Huma has financed nearly $900 million, with $883 million successfully repaid, and the current credit default rate is 0%.

Sphere Pay

Sphere is a payment API designed for digital currencies. By providing an all-in-one payment experience, Sphere connects ordinary users with stablecoins, accelerating the development of Web3 payment systems.

Sphere provides customizable or preset front-end and user experiences for merchants to easily apply Sphere Pay. In addition, Sphere offers various pricing models to meet the different needs of merchants for products or services. Sphere does not charge software usage fees but instead collects a fixed fee of 0.3% per transaction, making the software freely available to all users. This makes Sphere an ideal choice for small businesses, especially those with low transaction volumes or low startup costs.

Loopcrypto.xyz

Loop is a Web3 payment infrastructure that helps companies arrange or automate receipts and payments. By offering automated payment functions, Loop improves operational efficiency and reduces customer churn. The platform supports all ERC-20 tokens and allows settlement in cryptocurrencies or fiat, reducing the complexity for businesses in fund conversion.

Loop provides plug-and-play software, minimizing resistance for businesses during implementation. It also integrates with top platforms such as Stripe, Zapier, and Xero, allowing business owners to seamlessly integrate Loop into their existing financial management systems. Therefore, businesses using traditional invoicing systems can easily add cryptocurrency as an additional payment option for their customers without the need for extensive system overhauls.

Orbita

Orbita is a decentralized L1 payment protocol developed based on Cosmos, currently under development and not yet launched on the testnet. As the team may still be writing documentation and whitepapers, this information has not been made public.

The core features of Orbita will include direct irreversible payments, reversible payments, decentralized subscriptions, and e-commerce integration. As an L1 protocol focused on payments, this represents a new direction in the payment industry and may bring interesting changes.

Market Data and Updates

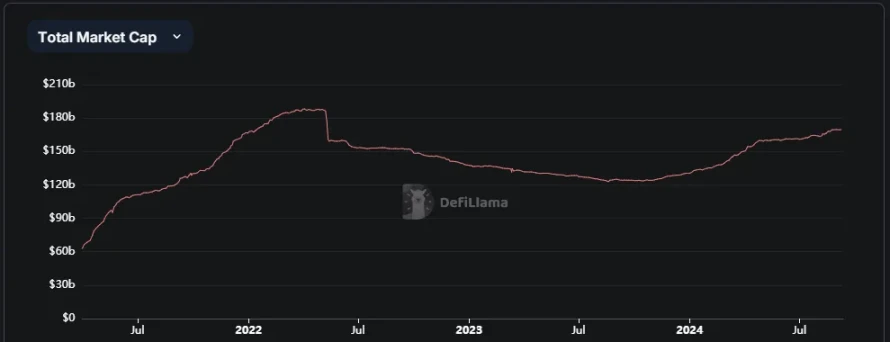

Total market value of stablecoins

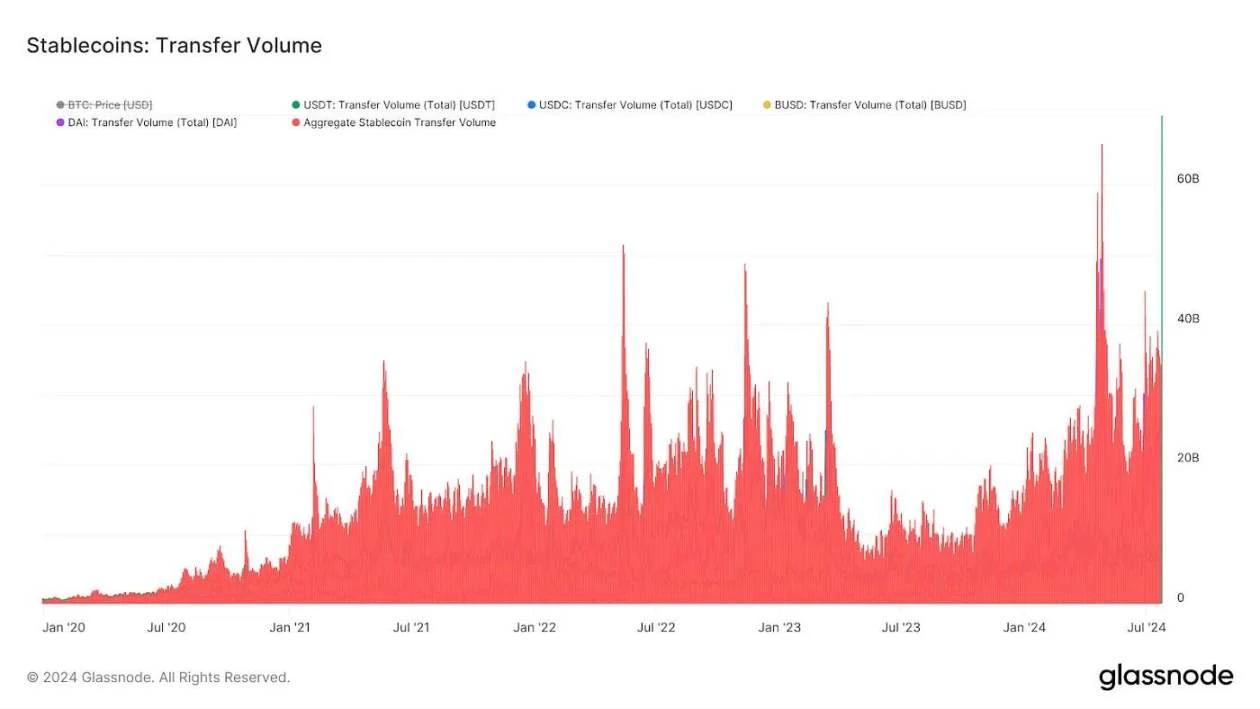

Stablecoins: Transfer volume

With the prosperity of cryptocurrencies over the past decade, stablecoins have also experienced rapid development. The total market value of stablecoins surged from $20 million in 2017 to $170 billion in 2024. By 2024, the total transfer volume of stablecoins reached a peak of 60 billion. As the transfer volume continues to grow, the use of stablecoins for payments and other purposes is becoming increasingly widespread. As stablecoins gain widespread acceptance, the demand for payment systems will also increase.

Major stablecoin providers are actively expanding their markets. Tether recently announced the launch of a dirham-backed stablecoin fully supported by local reserves in the UAE, aiming to become the preferred digital payment token in the UAE. Circle's CEO Jeremy Allaire also stated that they plan to develop an instant payment method using USDC on the iPhone. This plan was proposed after Apple allowed third-party developers to use the iPhone secure payment chip. This will make using USDC for payments as simple and seamless as using traditional banks and credit cards.

Since entering the stablecoin market in August 2023, Paypal has been actively promoting PYUSD. About a year after its launch, PYUSD has risen to become the sixth largest stablecoin, surpassing established currencies such as FRAX and BUSD. Paypal's expansion on Solana and its incentive program with Kamino have also been strong attractions. In addition, Paypal recently partnered with Anchorage Digital to offer rewards to institutions holding PYUSD, further attracting inflows of funds.

Reflection: The Impact of Web3 Payments

One of the major advantages of Web3 is its ability to achieve secure, low-cost, and almost instant global transactions. Although the Web3 industry is still in its early stages, institutions, businesses, and individuals have already begun using blockchain for payments.

However, if Web3 payments become mainstream, how will banks react as intermediary fees are reduced? In order to compete for market share, we see banks starting to build their own private blockchains, but even so, their income will be much lower than the current transaction fees. Resistance can be expected, and retail adoption may still take time. It is evident that the opacity and centralization of private blockchains will perpetuate the characteristics of traditional banks.

Furthermore, Web3 payments have advantages in global transactions, especially in import and export, but have little impact on the needs of ordinary local people. If there is little difference between paying with cryptocurrency and traditional bank cards at my local grocery store, why would I choose cryptocurrency? The allure of self-management? For most people, such minor benefits are not attractive. Therefore, conversion costs may hinder the adoption by ordinary users in the short term.

I believe that as Web3 and the payment market continue to develop, the stablecoin market will continue to grow over the next decade. Innovations such as telecommunications network innovations like Karrier One and future income financing innovations like Huma Finance will undoubtedly promote the emergence of more innovations and drive market adoption. Therefore, if there are appropriate catalysts such as regulatory approval, the prosperity of Web3 payments will be inevitable. In fact, as we have seen in the past few years, the market may continue to grow with or without regulatory clarity. I remain optimistic and look forward to Web3 payments becoming the natural choice without further questioning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。