Strength does not need to be overly demonstrated, the key is to gain more recognition from others. On the investment road, it is more important to do well on your own than to prove your strength to others. Whether it's a mule or a horse, you'll know once you take it out for a walk.

As a senior figure in the cryptocurrency circle, I have always been committed to providing helpful advice to everyone, hoping that people will take fewer detours and make fewer mistakes in this market. Although I advise earnestly, the path of investment still needs to be explored by oneself, and learning is endless. The experience gained is the real wealth!

Here, I wish my fans to achieve financial freedom in 2024. Let's cheer together!

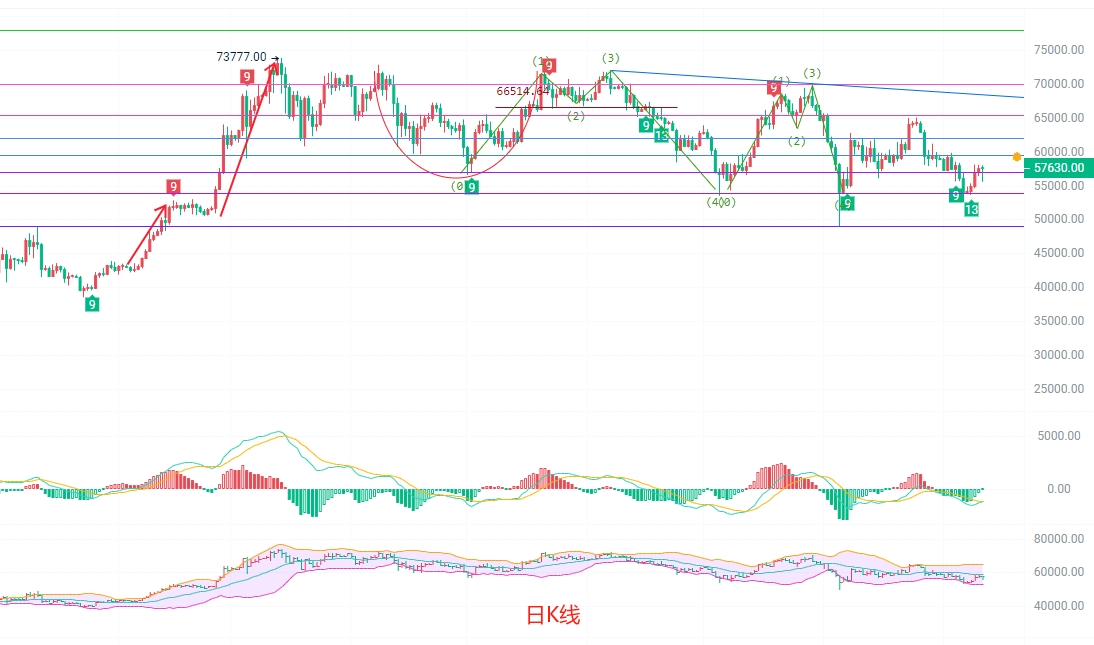

Cryptocurrency Academician: September 12, 2024 Bitcoin (BTC) Latest Market Analysis Reference

Bitcoin was at 57600 before the publication. It is now four o'clock in the morning Beijing time, the US market has just closed, and there is less than four hours before the daily closing. There is a high probability that it will break the previous high. Yesterday afternoon, I urgently updated an article to enter long positions near 56200. Many people were liquidated at 55800, and I was also liquidated in real time. After falling back to 55500 without breaking, it rebounded and broke through 56000, and I continued to enter the market. Currently, I am still holding. The defensive point has already emerged, and the target is still to look at the order book for the previous high.

The highest and lowest points of the daily K-line are currently 58000 and 55550, respectively. There is a very long hanging man line, which is also a hammer line with a very long lower shadow, clearly a wave of bear trap. After it fell below 56000, I chose to exit the long position with a small loss instead of chasing the short position, and then continued to enter the market after returning to 56000. It has now returned to above the EMA15 fast trend indicator at 57500, and the MACD volume has decreased and is about to start to increase. The DIF and DEA are shrinking below the 0 axis and are about to form a golden cross. The resistance point in the Bollinger Bands is at 58700. After stabilizing above the EMA15, it is expected to pull back and then challenge the middle rail pressure level. You can pay attention to not exiting the long position if it does not break 58700. If it breaks, continue to hold.

The short-term trend indicator on the four-hour chart is starting to show a slight bearish divergence, which has not appeared for a long time. The EMA trend indicator is shrinking, and the short-term bullish trend is obvious. The Bollinger Bands have formed a channel in the range of 55500 to 58000, and the KDJ is showing an upward divergence, indicating that the bullish space has not been fully utilized. The strategy is mainly long and partly short. Those who have not entered can wait for a pullback near 56000 before entering.

Short-term strategy reference: Since the market is not guaranteed, it is important to set a good stop loss. Safety comes first, and small losses lead to big gains.

Long: Buy between 56500 and 56300, defend between 55500 and 55200, add positions, target between 57500 and 58000, if broken, look at 58500 to 59000, stop loss at 500 points.

Short: Sell between 59500 and 59000, defend between 60200 and 60500, add positions, target between 58500 and 58000, if broken, look at 57500 to 57000, stop loss at 500 points.

Specific operations should be based on real-time market data. For more information, please consult the author. The article is published with a delay, and it is recommended for reference only. Please bear the risks.

This article is exclusively provided by the Cryptocurrency Academician and represents the exclusive views of the academician. Due to the timing of the article's release, the above views and suggestions are not real-time and are for reference only. Reprinting requires attribution. Please control your positions reasonably and do not overexpose or fully expose yourself. The academician also hopes that investors understand that the market is always right. If you are wrong, you should summarize your own problems and not let the potential profits slip away. There is no need to be smarter than the market in investment. When the trend comes, follow it; when there is no trend, observe and be patient. It is not too late to act after waiting for the trend to become clear. Tomorrow's success comes from today's choices. Heaven rewards hard work, earth rewards kindness, people reward sincerity, business rewards trust, industry rewards precision, and art rewards heart. Gains and losses are all in the details. Develop the habit of strictly setting stop-loss and take-profit for each trade. The Cryptocurrency Academician wishes you a pleasant investment journey!

Friendly reminder: The content above is created by the author's public account. The advertisements at the end of the article and in the comments section are not related to the author. Please discern carefully and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。