CeDeFi narrative is heating up, but in the eyes of many DeFi OGs and Degens, "decentralized finance with a centralized style" has a surrealistic feel popular in the Latin American region. However, objectively speaking, decentralization is a neutral term in technology, and carrying too much liberal ideology will only alienate it into an abstract slogan or a marketing term to create "others," such as the recent argument in the MeMe community about whether uppercase NEIRO or lowercase Neiro is more decentralized.

Therefore, for long-term Web3 builders, the first step is to dispel the charm of the word "decentralized." After all, Web3 uses a decentralized technological paradigm to solve real-world problems. Trump's pragmatic attitude towards crypto is quite fitting. Trump can use NFTs to issue digital commemorative cards for personal gain and promise crypto-friendly policies for fundraising in elections, but he always defends the supremacy of the US dollar and does not allow CBDCs to challenge it, and opposes Meta's former stablecoin project Libra. This nakedly pragmatic attitude is actually worth considering and learning from for VCs and developers in the crypto industry.

CeDeFi is an instantiation of this pragmatic philosophy in crypto, as it is neither the simple digitization of traditional finance in the Web2 era nor the pure decentralized utopia pursued by Native DeFi. Instead, it seeks a practical balance between the two. CeDeFi overlaps conceptually with RWA, but compared to RWA, CeDeFi focuses more on the extension from on-chain to off-chain. Representative projects include SKY (Maker DAO), AAVE, Velo (not the DEX Velodrome on the OP chain), Bouncebit, and World Liberty Financial, supported by Trump, and others.

Velo, backed by Thailand's Charoen Pokphand Group and Stellar, as a veteran DeFi project launched in 2018, has provided an interesting window for observing the development of the CeDeFi track with a series of CeDeFi layouts in the Southeast Asian market in the past 24 years.

First, let's summarize Velo's main actions:

1⃣ Cooperating with the Laotian government to develop a digital gold (gold tokenization) ecosystem. VELO signed a strategic cooperation memorandum with the Laotian PTL Holdings to promote the digital economic revival in Laos. This cooperation aims to establish a complete digital gold ecosystem in Laos, rather than just a simple label.

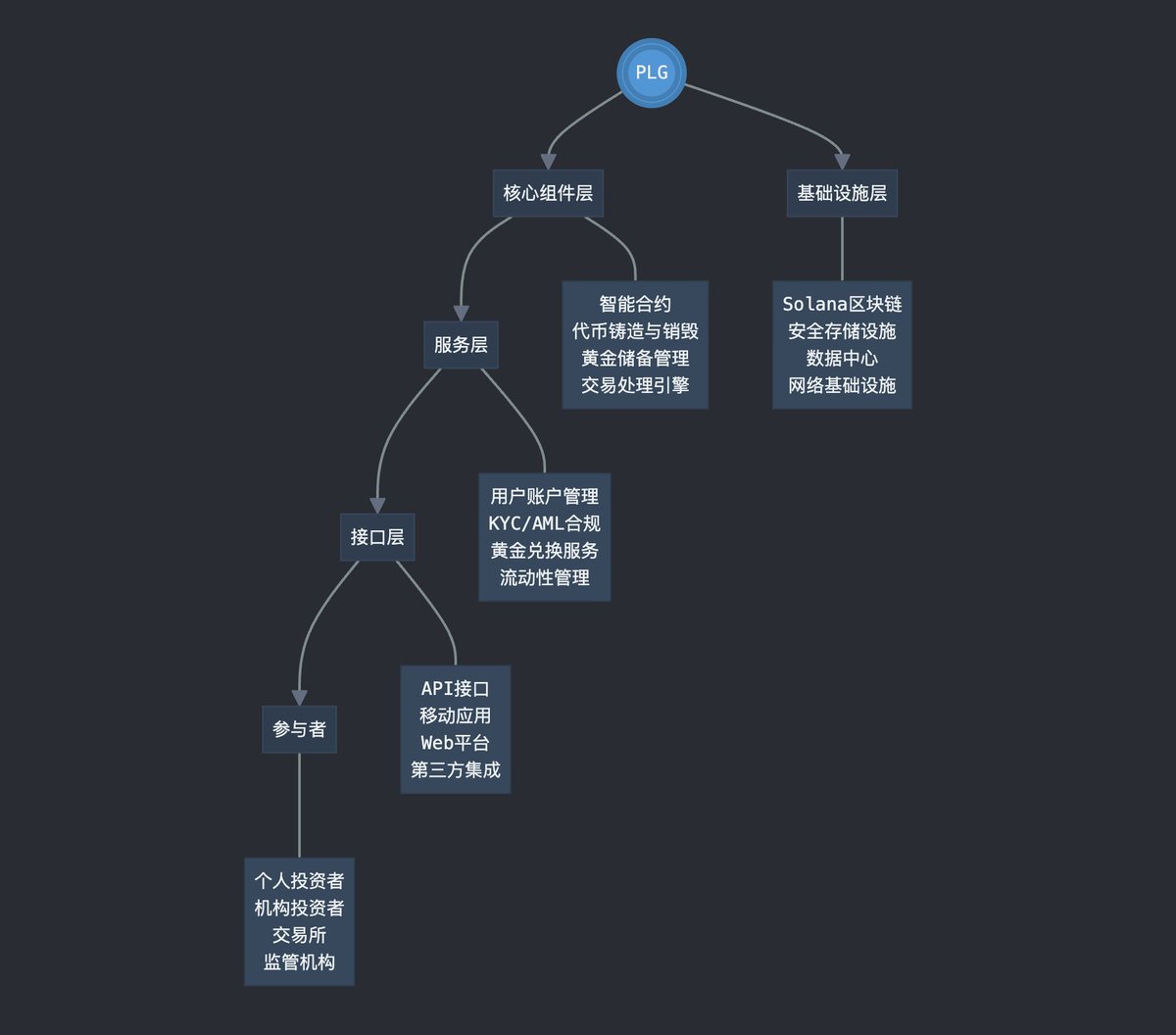

2⃣ Released the white paper for the digital gold "Pacific Lightnet Gold Token (PLG)." The characteristics of this scheme include: a) 1:1 anchoring of physical gold, with each PLG representing one troy ounce of investment-grade gold; b) 24/7 trading, breaking the time constraints of the traditional gold market; c) support for physical redemption, enhancing transparency and trust; d) low transaction costs, high liquidity, making gold investment more accessible; e) using blockchain technology to ensure security and transparency.

3⃣ Cooperating with the Solana Foundation to use Solana as the blockchain settlement layer, with Velo serving as the infrastructure layer and designated clearinghouse.

4⃣ Cooperating with the US compliant RWA institution @Securitize to include the BUIDL token for short-term US debt from BlackRock into the reserve assets of USDV (the stablecoin of the Velo ecosystem). This will enhance the security, stability, credibility, and additional income-generating capabilities of the USDV asset side.

It can be seen that Velo's CeDeFi business layout has two product lines: one is licensed gold tokenization + trading clearinghouse, and the other is US debt tokenization + stablecoin payment.

In the case of bulk assets, gold, as the former king of currency and a reserve asset of central banks around the world, is comparable to US Treasury bonds in terms of liquidity, market consensus, and value storage, making it very suitable for the RWA scenario. Especially as the Merrill Lynch clock of the US economy is about to point to a recession, tokenized gold provides institutions and retail investors in the crypto market with a new asset type for diversified portfolio management. However, tokenizing gold is much more difficult than tokenizing standard assets like US Treasury bonds. For example, Tether Gold, promoted by Tether, has not achieved the desired liquidity enhancement and promotion despite the company's significant industry resources.

Therefore, Velo's product strategy and market strategy for the tokenization of gold assets PLG are different from Tether's, as it attempts the path of CeDeFi.

In the product architecture design, Velo integrates DeFi paradigm modules such as AMM Swap, liquidity pools, oracles, and yield farming with CeFi asset custody, KYC/AML, and insurance modules.

In terms of market strategy, Velo focuses on emerging markets, choosing Southeast Asia as the main battlefield to avoid direct competition with large Western financial technology companies, while attaching importance to cooperation with governments to obtain compliance and market access directly.

Velo's US debt tokenization + stablecoin payment product line uses USDV as an intermediary and carrier to provide cross-border transfers, value storage without a bank account, 24/7 local fiat withdrawals, and enhanced on-chain real income for users in Southeast Asia. Velo's PayFi front-end Orbit payment app has been used by over 1 million users and merchants in Southeast Asia.

There is a vague intuition that CeDeFi may trigger a new wave of application layer innovation at some point in the next two years, which also explains why Y-Combinator invested heavily in CeDeFi startups in the last cycle, and Velo's transformation is just a microcosm of this new trend.

Why is it said that the next evolution of DeFi is likely to be CeDeFi? There are five reasons: technological maturity, regulatory attitude change, demand from traditional financial institutions, market demand, and infrastructure improvement.

Technological maturity: After years of development, blockchain technology now has the capability to support complex financial applications. Innovations such as smart contracts, cross-chain technology, and Layer 2 scaling solutions provide a technical foundation for CeDeFi.

Regulatory attitude change: Global regulatory agencies are beginning to recognize the potential of blockchain finance and are starting to formulate relevant regulations. This change in attitude provides compliance space for CeDeFi projects. Here, particular attention is paid to the timing of the "crypto president" Trump's election and when the US FIT21 bill can be officially passed.

Demand from traditional financial institutions: Faced with challenges from FinTech, traditional financial institutions need innovation to maintain competitiveness. CeDeFi provides them with a way to integrate new technology while maintaining a certain level of control.

Market demand: Users have a strong demand for more efficient, transparent, and inclusive financial services. CeDeFi has the potential to meet these needs while lowering entry barriers.

Infrastructure improvement: The emergence of fiat-backed stablecoins, institutional custody solutions, and other infrastructure paves the way for the large-scale application of CeDeFi.

In summary, the CeDeFi track is at a critical stage of development. It is attempting to combine the efficiency and compliance of centralized finance with the innovation and inclusiveness of DeFi.

In the future, we may see more traditional financial institutions and native Web3 projects attempting this track. The key question is who can truly find the best balance between efficiency, security, and decentralization.

VELO

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。