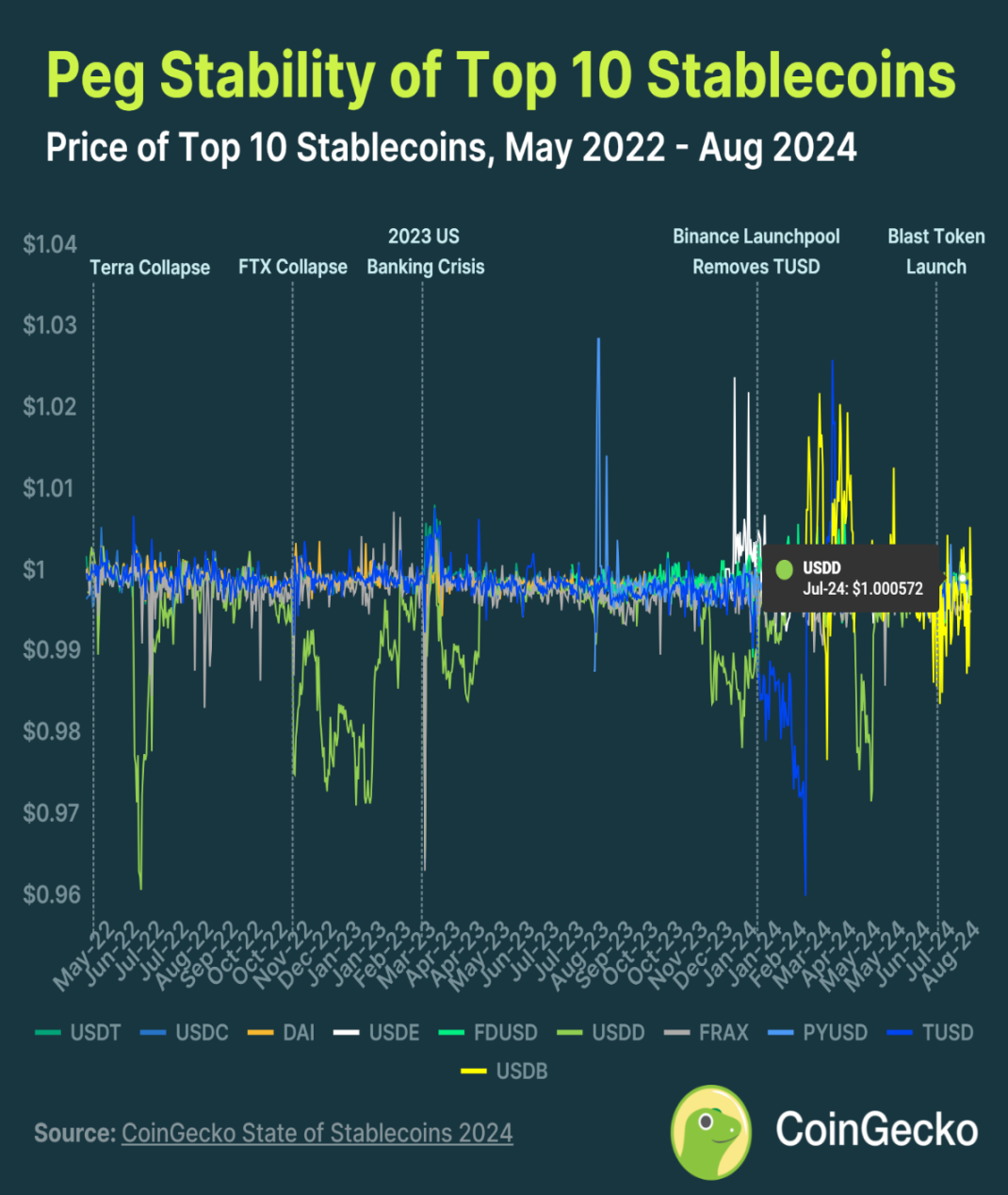

Stablecoins stabilize their prices by pegging them to fiat currencies or commodities, but many stablecoins struggle to maintain their peg during market fluctuations, while mature stablecoins such as USDT, USDC, and DAI perform better.

Written by: CoinGecko

Translated by: Plain English Blockchain

Stablecoins are a type of token whose value is anchored to other assets (such as commodities or fiat currencies) in order to stabilize their prices. By maintaining a peg to specific fiat currencies, assets, or commodities, most stablecoins act as a bridge between real-world assets and cryptocurrencies, mapping these assets onto the blockchain in the form of tokens.

Since 2014, companies like Tether and Circle have issued tokenized currencies backed by real-world financial assets such as bank deposits and short-term notes. Users can enter the cryptocurrency space directly through these companies, converting real-world deposits into newly minted stablecoins. Conversely, they can also convert stablecoins back into fiat currency.

However, not all stablecoins are fully backed by tangible real-world assets. Decentralized stablecoins such as DAI and AMPL maintain their peg through mechanisms such as over-collateralization of crypto assets or adjusting the supply (rebasing), achieving the minting of stablecoins without the need for a centralized entity while maintaining their peg.

The true value of stablecoins lies in their ability to maintain their peg at all times, even during market fluctuations. Unfortunately, many stablecoins have not passed this test. In this report, we cover the types of stablecoins, total market value, trading volume, and emerging stablecoin models.

Five key points from CoinGecko's "State of Stablecoins 2024" report:

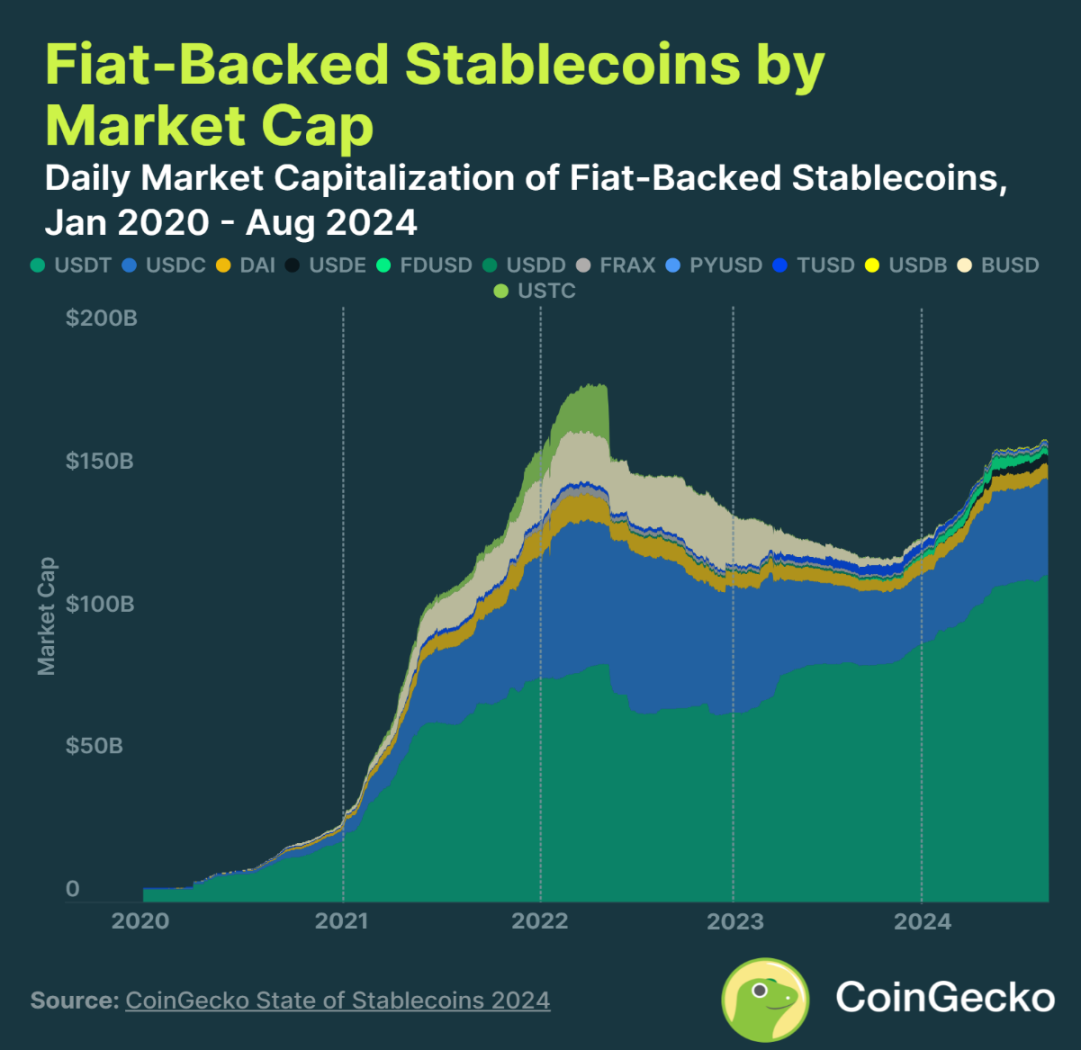

The market value of fiat-backed stablecoins soared to $161.2 billion in 2024, but still below the peak of $181.7 billion in 2021. Despite the growth of the fiat-backed stablecoin market in 2024, with a total market value of $161.2 billion, this figure still falls short of the historical peak of $181.7 billion in 2021.

Commodity-backed stablecoins grew by 18.1% in 2024, reaching $1.3 billion, accounting for only 0.8% of the market value of fiat-backed stablecoins. While commodity-backed stablecoins have seen growth, their scale remains relatively small, with a market value of $1.3 billion in 2024, accounting for only 0.8% of the total market value of fiat-backed stablecoins.

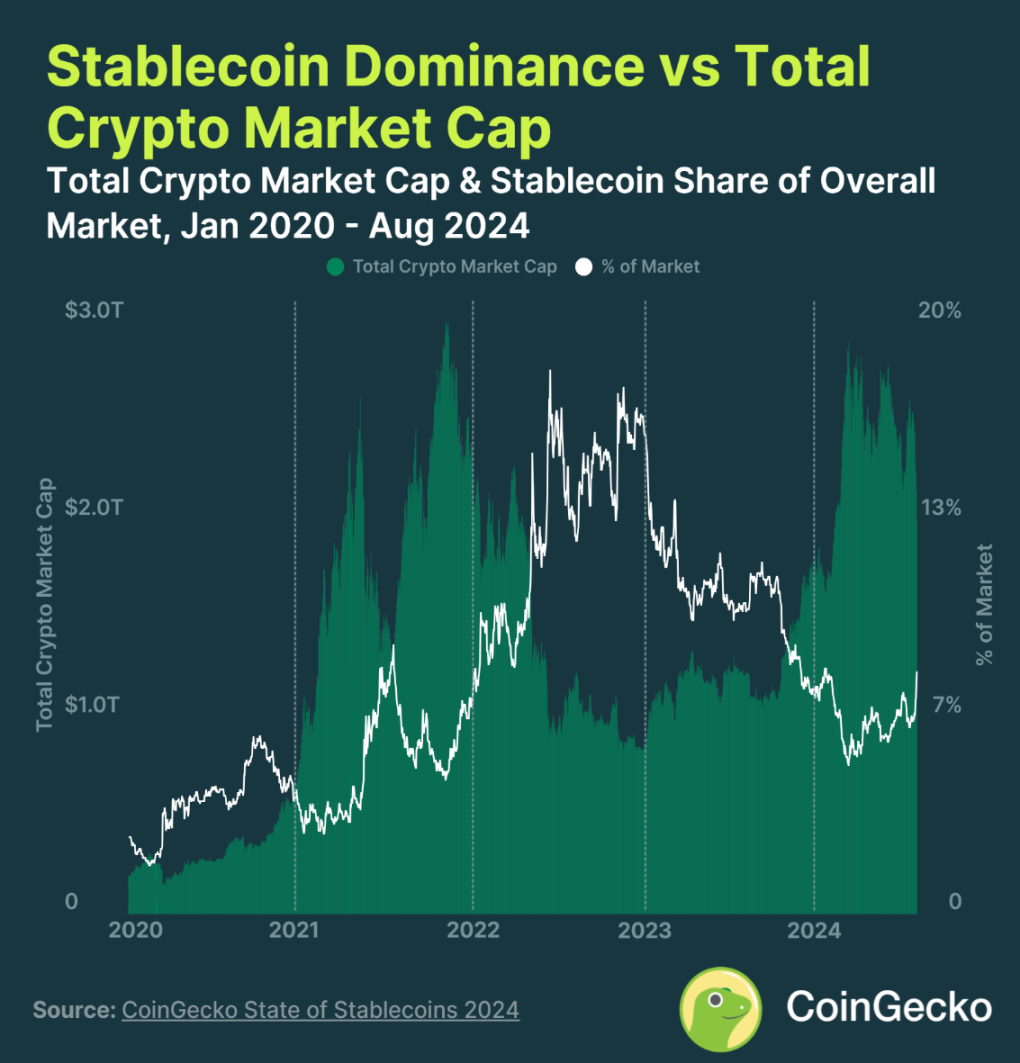

Stablecoins account for 8.2% of the total market value of the global crypto market, and their dominance has increased during market downturns. Stablecoins hold a 8.2% share in the global crypto market, particularly during market downturns, their market dominance has further increased.

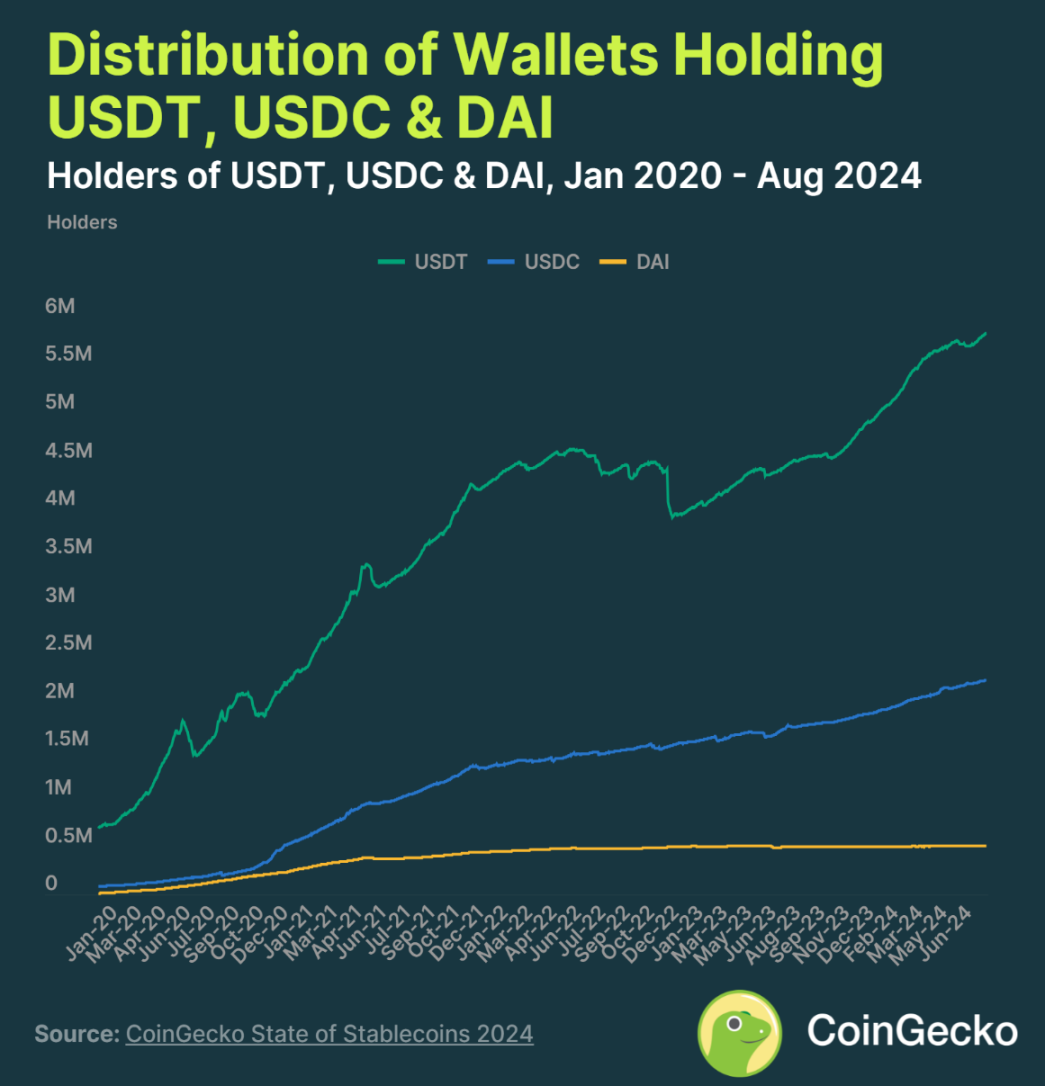

8.7 million addresses hold stablecoins, with 97.1% holding USDT, USDC, or DAI. The majority of stablecoin holders are concentrated in USDT, USDC, and DAI, with approximately 97.1% of addresses holding these three types of stablecoins.

Stablecoins still face difficulties in maintaining stability during uncertain periods, especially during market volatility. Despite stablecoins aiming to maintain the stability of their pegged prices, many stablecoins still face challenges in maintaining stability during market turmoil and uncertainty.

Since 2020, the total market value of the top ten fiat-backed stablecoins has grown significantly. During the bull market of 2020-2021, the market value surged by 3121.7%, from $5 billion at the beginning of 2020 to $181.7 billion in March 2022. With the collapse of Terra and its UST stablecoin, the market value of stablecoins briefly declined, but saw a reversal in November 2023. As of August 2024, the total market value of fiat-backed stablecoins has grown by 35.4%, from $119.1 billion to $161.2 billion.

The top three USD stablecoins—Tether (USDT) with a market value of $114.4 billion, USDC with a market value of $33.3 billion, and Dai (DAI) with a market value of $5.3 billion—account for 94% of the total stablecoin market value. Meanwhile, USDT's market share has solidified to 70.3%, while USDC's market share has continued to decline since the US banking crisis in March 2023. Stablecoins pegged to other currencies (such as the euro, yen, and Singapore dollar) only account for 0.2% of the market share.

1. Commodity-backed stablecoins grew by 18.1% in 2024, reaching $1.3 billion, accounting for only 0.8% of the market value of fiat-backed stablecoins

As of August 1, 2024, the market value of commodity-backed stablecoins reached $1.3 billion. Despite new entrants such as Kinesis and VeraOne, Tether Gold (XAUT) and PAX Gold (PAXG) still account for 78% of this market value. Although commodity-backed stablecoins have grown 212 times since 2020 and increased by 18.1% in 2024, they only account for 0.8% of the market value of fiat-backed stablecoins.

Precious metals are the preferred backing for these stablecoins, but in recent years, stablecoins backed by other commodities have also been introduced. The Uranium308 project launched a stablecoin pegged to the price of each pound of U308 uranium compound, but the project has since ceased operations.

2. Stablecoins account for 8.2% of the total market value of the global crypto market, and their dominance has increased during market downturns

As of August 1, 2024, stablecoins account for 8.2% of the total market value of the global crypto market. At the beginning of 2020, stablecoins had a very small share in the crypto industry, accounting for only about 2% of the total global market value, but reached a peak of 6% during the early stages of the DeFi boom.

The dominance of stablecoins rapidly increased from November 2021 to May 2022, mainly due to the rapid growth of Terra's UST stablecoin, which increased its market share from 4.8% to 15.6%. However, after the collapse of UST, the market share of stablecoins sharply declined, but then quickly rebounded to a high of 18.4% as investors sought stability during the bear market.

3. Stablecoins account for 8.2% of the total market value of the global crypto market, and their dominance has increased during market downturns

As of August 1, 2024, stablecoins account for 8.2% of the total market value of the global crypto market. At the beginning of 2020, stablecoins had a very small share in the crypto industry, accounting for only about 2% of the total global market value, but reached a peak of 6% during the early stages of the DeFi boom.

The dominance of stablecoins significantly increased from November 2021 to May 2022, mainly due to the rapid growth of Terra's UST stablecoin, which increased its market share from 4.8% to 15.6%. However, after the collapse of UST, the market share of stablecoins sharply declined, but then quickly rebounded to a high of 18.4% as investors sought stability during the bear market.

4. 8.7 million addresses hold stablecoins, with 97.1% holding USDT, USDC, or DAI

The top ten stablecoins have a total of 8.7 million holding addresses, with the top three stablecoins—USDT, USDC, and DAI—occupying 97.1% of the holding addresses.

USDT has the highest number of holding addresses, with over 5.8 million wallets, which is 2.6 times more than its closest competitor, USDC. The remaining eight stablecoins have fewer than 1 million holding addresses, with DAI being held by just over 505,000 wallets.

These stablecoins experienced rapid growth in 2020, but after the collapse of Terra in 2022, the growth rate slowed significantly due to concerns about the solvency of other stablecoins.

5. Stablecoins still face difficulties in maintaining stability in their pegged prices, especially during periods of market uncertainty

In the past, stablecoins struggled to maintain their pegged prices during periods of volatility. However, mature stablecoins like USDT, USDC, and DAI are now better able to maintain their peg to the US dollar. Stablecoins typically experienced de-pegging during market fluctuations, such as during the banking crisis in March 2023, due to market uncertainty about the security of Silvergate and Signature bank deposits.

Newer stablecoins, especially some algorithmic stablecoins like USDD, DAI, and FRAX, have greater volatility and rely on market arbitrage to maintain their peg. However, there have also been many cases of failure, such as Iron Finance and Basis Cash, where these projects failed to successfully maintain their pegged prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。