Strength does not need to be overly demonstrated, the key is to gain more recognition from others. On the investment road, it is more important to do well on your own than to prove your strength to others. Whether it's a mule or a horse, you'll know once you take it out for a walk.

As a senior figure in the cryptocurrency circle, I have always been committed to providing helpful advice to everyone, hoping that people will take fewer detours and make fewer mistakes in this market. Although I am earnest, the road to investment still needs to be explored by oneself, and learning is endless. The experience gained is the real wealth!

Here, I wish my fans to achieve financial freedom in 2024. Let's cheer together!

Cryptocurrency Academician: September 10, 2024 Bitcoin (BTC) Latest Market Analysis Reference

It is now 1:30 AM Beijing time, and the current price of Bitcoin is 56500. Yesterday, I mentioned that if 55500 was broken, then the long position near 53000 should continue to hold and look at 56500. Now that 56500 has been reached, it can be exited. The 3500-point space has been secured, congratulations to the readers who followed the article. Those who did not follow can also refer to it. For more practical details, please follow the updates in the Moments.

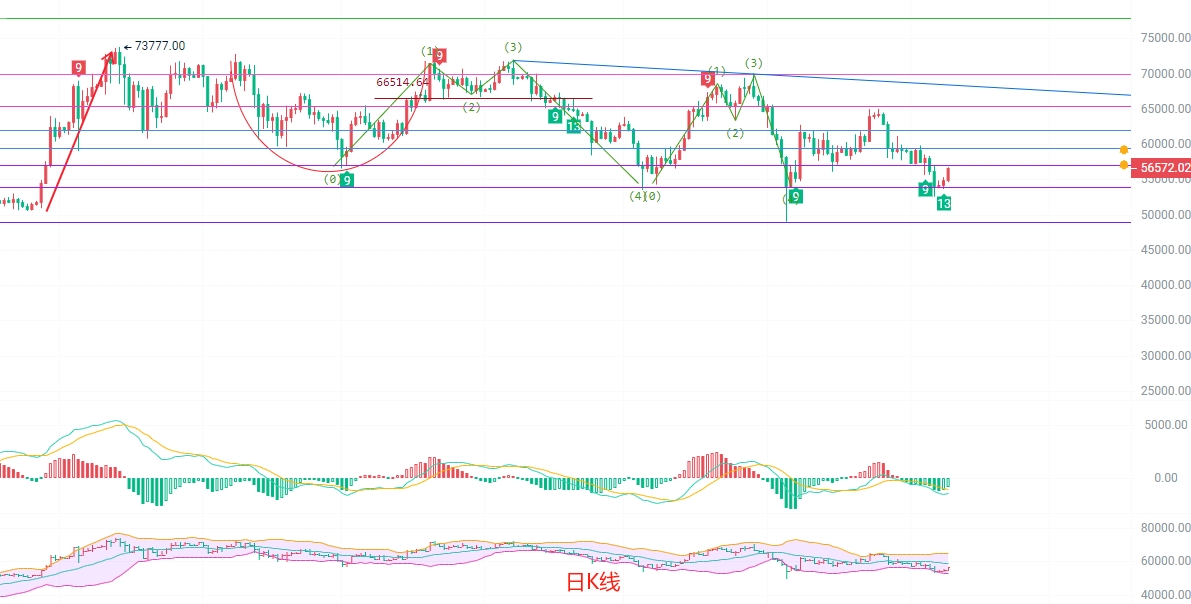

Currently, the daily K-line is about 1000 points away from the EMA15 trend fast line pressure level of 57350. If it is broken, the next pressure level is at 58700. The MACD volume is shrinking and the DIF is powering up close to the DEA below the 0 axis, which should not be underestimated. The resistance point of the Bollinger Band is 59000. The KDJ golden cross trend is forming, so the upper pressure range is found between 58700 and 59000. This is the daily K-line's pressure range.

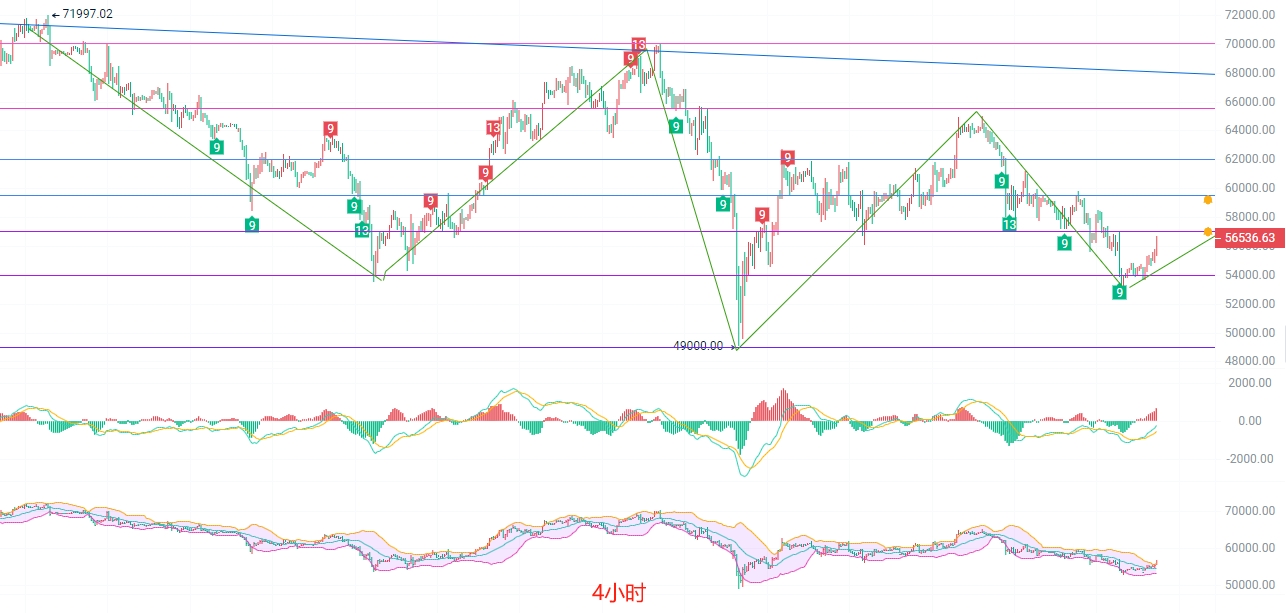

Let's take a look at the short-term four-hour K-line market. It has already broken the EMA60 pressure point of 56500, and the K-line was supported at 55500 and pulled up to the EMA30. The MACD volume has been continuously increasing, and the golden cross of DIF and DEA is spreading close to the 0 axis. Pay attention to the pressure at the 57400 level. The upper rail of the Bollinger Band has been breached at 56000, and the KDJ is upward and spreading, indicating the appearance of an upward channel in the short term. The strategy is to buy on the pullback at the channel support and short at the high position as a supplement.

Short-term strategy reference: Since the market is not guaranteed, it is important to set a good stop-loss. Safety first, small losses and big gains are the goal.

Long: Buy at 55500 to 55700, target 56500 to 57000, if broken, look at 57500 to 58000, stop loss at 500 points.

Short: Sell at 58500 to 59000, target 58000 to 57500, if broken, look at 57000 to 56500, stop loss at 500 points.

Specific operations should be based on real-time market data. For more information, please consult the author. The article is published with a delay, and it is recommended for reference only. Please bear the risks.

This article is exclusively provided by the Cryptocurrency Academician and represents the exclusive views of the academician. There is in-depth research on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of the article's release, the above views and suggestions are not real-time and are for reference only. Please bear the risks. Reprinting should indicate the source. Reasonably control your positions and do not overexpose or fully expose your operations. The academician also hopes that investors understand that the market is always right. If you are wrong, you should summarize your own problems and not let the potential profits slip away. There is no need to be smarter than the market in investment. When the trend comes, follow it; when there is no trend, observe and be patient. It is not too late to act after waiting for the trend to become clear. Tomorrow's success comes from today's choices. Heaven rewards hard work, earth rewards kindness, people reward sincerity, business rewards trust, industry rewards precision, and art rewards heart. Gains and losses are all in the blink of an eye. Develop the habit of strictly setting stop-loss and take-profit for each trade. The Cryptocurrency Academician wishes you a pleasant investment journey!

Friendly reminder: The content above is created by the author's public account. The advertisements at the end of the article and in the comments section are not related to the author. Please discern carefully, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。