Zhou Yanling: Being Bullish on 9.9 But Not Going Long, Beware of Main Players' Manipulation. The Latest Operation Strategy for Bitcoin and Ethereum Today

Currently, the market's probability of the Federal Reserve cutting interest rates by 25 basis points on September 18 is 73%, and the probability of a 50 basis point cut is 27%. This change in expectations directly affects the trend of Bitcoin prices. The debate and uncertainty over the size of the interest rate cut are putting pressure on the cryptocurrency market. As an asset that does not generate interest income, Bitcoin's attractiveness usually increases with a decrease in interest rates. A rate cut will lower the opportunity cost of holding Bitcoin, thereby providing support for Bitcoin prices. However, the uncertainty of the Federal Reserve's policy is intensifying market volatility in the cryptocurrency market, and market participants' speculation about future policies is constantly changing.

Looking ahead, the market's focus will shift to the upcoming US August inflation data. The market generally expects the CPI and core CPI to rise by 0.2% month-on-month. If the actual data is higher than expected, it may push up US Treasury yields, putting pressure on Bitcoin prices. Conversely, if the data is lower than expected, it may provide support for the coin price. In addition, the European Central Bank will announce its latest monetary policy decision on Thursday this week. Although this event has limited direct impact on the cryptocurrency market, it may indirectly affect the performance of the US dollar, thereby indirectly impacting the cryptocurrency market. Therefore, everyone still needs to maintain a certain level of attention at that time.

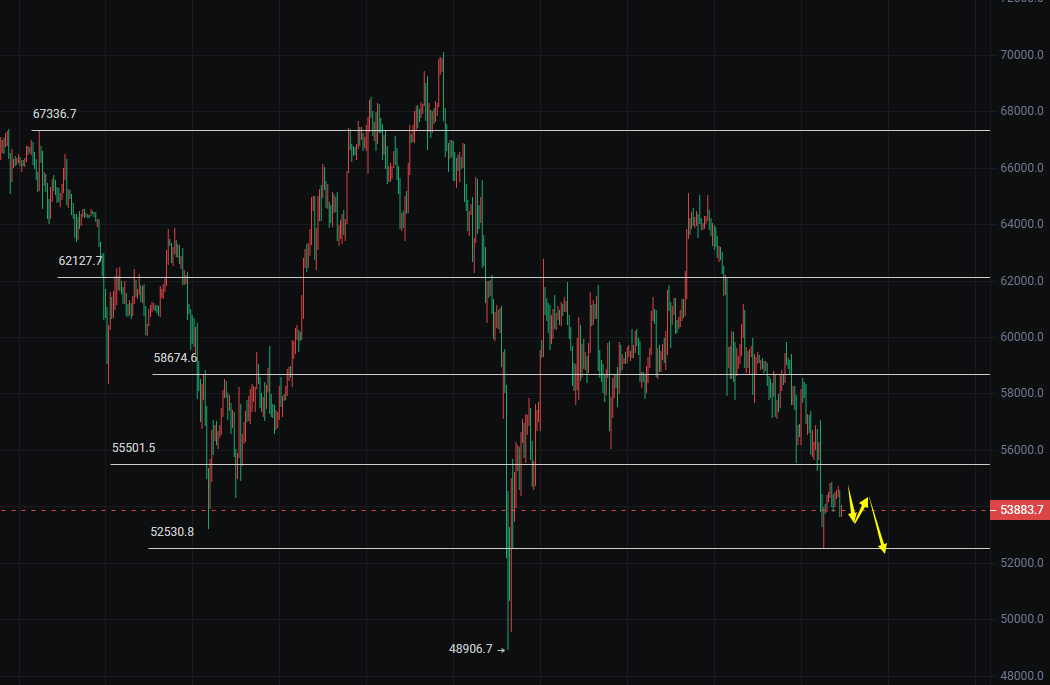

From a technical perspective, the daily MACD indicator for Bitcoin shows a high-level golden cross with shrinking volume, and the dynamic indicator STO's fast line is showing a downward pressure, indicating a sign of a short-term price decline. Therefore, until the 55500 level is broken on the daily chart, it is still advisable to mainly short on rallies; the best position is near 55000 or slightly below. The current Bollinger Bands on the 4-hour chart are narrowing, indicating a range compression, while the MACD indicator shows a high-level death cross with increasing volume, and the dynamic indicator STO's two lines are gradually converging, combined with the daily chart's bearish engulfing pattern. Therefore, at the beginning of this new week, it is also advisable to mainly short on rallies. The hourly chart shows a short-term rebound trend, with the focus on the position near the moving average MA60 and the middle rail resistance. In addition, in terms of trading volume, currently 80% of the market is bullish, so at this time, everyone should use reverse thinking to consider the next operation, that is, to be cautious of the main players manipulating the market and to be prepared for an unexpected sharp drop followed by another bullish trend.

9.9 Bitcoin Operation Strategy:

Short at 54800-54300, stop loss above 55300, target 53300-52800, and look at around 51400 if the level is broken.

Long at 52500-52900, stop loss below 52000, target 53600-54000.

9.9 Ethereum Operation Strategy:

Short at 2300-2270, stop loss above 2340, target 2200-2150, and continue to look at around 2070 if it breaks below.

Long at 2160-2200, stop loss below 2110, target 2250-2285.

【The above analysis and strategies are for reference only. Please bear the risks on your own. The article's review and release may have a lag, and the strategies do not have timeliness. Specific operations should be based on Yanling's real-time strategies.】

This article is exclusively authored and shared by senior analyst Zhou Yanling (WeChat: Zhou Yanling). The author has been engaged in financial market investment research for more than ten years, mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV and other cryptocurrency contract/spot operations. If you need to know more about real-time community guidance, de-risking consultation, and chart reading skills, you can follow the author's WeChat account: Zhou Yanling to find the author.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。