dappOS provides a flexible asset called intentUSD. This asset can not only be used as a currency, but also generates interest when idle. This innovative approach allows stablecoins to automatically convert between different forms based on user demand.

By Mike, Foresight Ventures

Revolution of Idle Assets

In 2013, Alipay's Yu'ebao emerged, ushering in a new era of asset management. Before this, ordinary users found it difficult to find a safe and efficient way to manage their idle funds. Bank's demand deposit interest rates were low, and financial products were complex and difficult to understand. The birth of Yu'ebao changed everything.

Birth of Yu'ebao

It was an era when Internet finance was just emerging. The Alipay team realized that users often had idle funds in their payment accounts. If these funds could be invested, it would not only bring profits to users, but also enhance their experience. So, they collaborated with Tianhong Fund to launch a product called "Yu'ebao."

Yu'ebao is easy to operate. Users only need to click a few times in the Alipay app to transfer their account balance to Yu'ebao and start enjoying daily settlement income. This transparent and convenient financial method quickly won the favor of users. Soon, the number of Yu'ebao users exceeded tens of millions, and the scale of managed funds rapidly increased.

Opportunities in Web3

With the development of blockchain technology and Web3, a new era of asset management is emerging. Similar products to Yu'ebao are also emerging in the Web3 field.

Web3 version of Yu'ebao has enormous potential because it can fully utilize the many advantages brought by blockchain technology and the huge market opportunities provided by the large amount of idle assets on the chain:

1. Trillions of dollars in idle assets on the chain

There are a large number of underutilized assets in the blockchain ecosystem, with a total value of trillions of dollars. Many users store their cryptocurrencies in wallets, waiting for market price increases, and these assets do not generate any income during idle periods. The Web3 version of Yu'ebao can effectively utilize these idle assets by providing functions similar to traditional money market funds, providing stable income for users. This model not only increases the utilization of user assets, but also promotes the liquidity and activity of the entire blockchain ecosystem.

2. Decentralization and transparency

The Web3 version of Yu'ebao, based on blockchain technology, has the advantages of decentralization and transparency. Unlike traditional financial institutions, users can directly invest through smart contracts without relying on intermediaries. This decentralized model reduces intermediate links, lowers operating costs, and improves investment efficiency. In addition, all transactions and fund flows are recorded on the blockchain, and users can view and verify them at any time. This transparency enhances user trust.

3. High liquidity and convenience

Compared to traditional financial products, the Web3 version of Yu'ebao typically has higher liquidity. Users can deposit or withdraw funds at any time without worrying about lock-up periods or early redemption penalties. This high liquidity makes the Web3 version of Yu'ebao more flexible and able to meet the diverse needs of users. In addition, through user-friendly interfaces and simple operation processes, the Web3 version of Yu'ebao can provide a convenient investment experience for users.

4. Diversified sources of income

The Web3 version of Yu'ebao can utilize various decentralized finance (DeFi) protocols on the blockchain to provide users with diversified sources of income. For example, users can earn income through participation in lending protocols, liquidity mining, staking, and other methods. Unlike traditional money market funds, these sources of income include not only interest, but also various forms such as platform token rewards, making the investment return more abundant and diversified for users.

5. Wider user coverage

Blockchain technology enables the Web3 version of Yu'ebao to cover global users without being restricted by geographical and national boundaries. Any user with internet access can participate in investment, providing broad market prospects. Especially in some regions with underdeveloped traditional financial services, the Web3 version of Yu'ebao can provide users with a new way of financial management, filling the gap in financial services.

In the Web3 field, the emergence and development of LST (Liquidity Staking Token) and LRT (Liquidity Re-Staking Token) prove the huge potential and opportunities of this market. Although most products can generate stable income, their application scenarios are still relatively limited. Yu'ebao not only supports transfers between friends, but also can be used for shopping on Taobao, with a user experience almost indistinguishable from a bank account. However, the Web3 products currently available on the market have not yet reached the level of widespread application like USDT or ETH.

Stalemate of Traditional TVL Model

In the bull market of the first half of this year, "Total Value Locked" (TVL) became the core indicator for promotion and marketing of major projects in the crypto market. TVL is usually used to measure the total amount of assets locked in DeFi projects, reflecting a project's user participation and market trust. It has been a relatively effective indicator in past crypto market cycles because the TVL behind it represents actual "real money," with much higher costs of falsification compared to other data indicators such as address quantity and social media attention. Therefore, projects with high TVL have obvious advantages in market promotion and attracting investors.

In this context, many projects aimed to rapidly increase their TVL data by offering high yields and airdrop incentives to attract users to deposit assets on their platforms. This strategy aimed to showcase the strength and attractiveness of the project. However, this approach has exposed some problems in this cycle.

Stalemate of TVL

As the market developed, investors found significant problems with the TVL narrative in this cycle. After the issuance of coins and listing on exchanges, the TVL of many projects often rapidly declined. These TVLs were not contributed by a wide range of crypto users, but were rapidly increased in the short term by a few large holders or pre-arranged partners through "mining and selling" to cash out. This "stalemate TVL" does not represent the true vitality of the project's ecosystem, but rather a short-term data spike achieved through artificial operations.

This phenomenon has raised broader industry issues, such as some high TVL projects repeatedly delaying airdrop distributions or unlocking user assets, for fear that once realized, these TVLs will quickly flow out. As a result, the credibility and effectiveness of TVL as an indicator of the vitality of an on-chain ecosystem have also been questioned.

Why does TVL stagnate?

The reason for the stagnation of TVL is that for ordinary crypto users, the absolute returns from participating in these projects are limited, and once they encounter market fluctuations, the cost of withdrawing assets or converting them is high, or they need to wait for a long time, potentially missing market opportunities. In other words, the opportunity cost of participating in these projects is too high for ordinary users, so their willingness to participate is low, leading to TVL being dominated by large holders and becoming a tool for their cashing out.

In-depth discussion: TVL projects are difficult to meet users' asset usage needs

Project teams have realized this problem and attempted to optimize, but these measures often have limited effects and are difficult to truly meet the needs of users. Current TVL projects mainly provide two ways for users to withdraw assets: one is for users to actively apply for asset redemption from the project team, and the other is to exchange through derivative assets (such as xxETH) on decentralized exchanges (DEX).

However, in either case, ensuring a good liquidity experience for users requires someone to bear high maintenance costs. For example, in the redemption scheme, the project team needs to bear ongoing maintenance costs, which usually leads to users having to wait a long time to redeem their assets. In the liquidity pool scheme, the LP (liquidity provider) providing liquidity also needs to bear costs, often resulting in insufficient pool depth, high slippage, and even significant price differences between derivative assets and native assets during market fluctuations.

Therefore, when the solution for asset liquidity requires a specific party to bear high maintenance costs, these costs will ultimately be passed on to the users, resulting in a poor user experience. To address this structural problem, fundamental reforms need to be made at the grassroots level. After in-depth research, we found that the Intent Assets recently launched by dappOS can effectively address this challenge.

dappOS Intent Assets: Making Yield Assets Available on-chain at Any Time

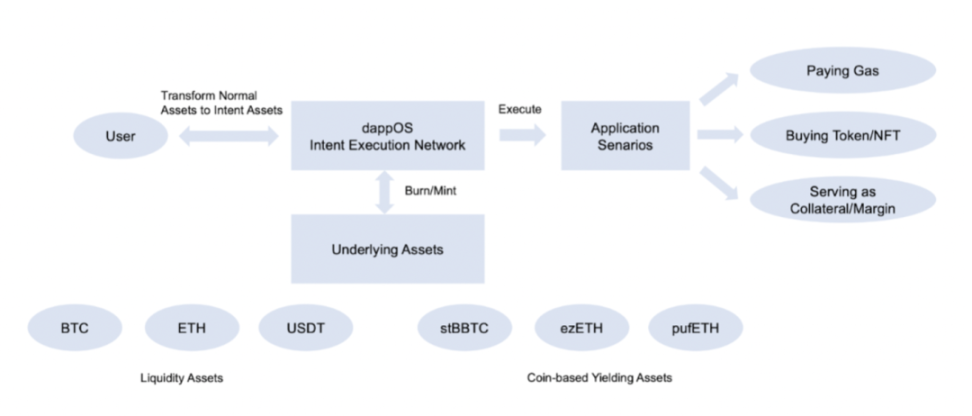

dappOS is an intent execution network that has received investments from top institutions such as Binance Labs and Polychain, with a latest valuation of $300 million, making it a leading project in the intent race. The intent assets launched by dappOS allow users to enjoy high asset yields while ensuring that their assets are available on-chain at any time, whether it's withdrawing intent assets in the form of native assets to an exchange or buying new MEME coins on-chain, users can use them directly. Users can directly use intent assets for trading, transfers, without the need for long waiting times or high slippage.

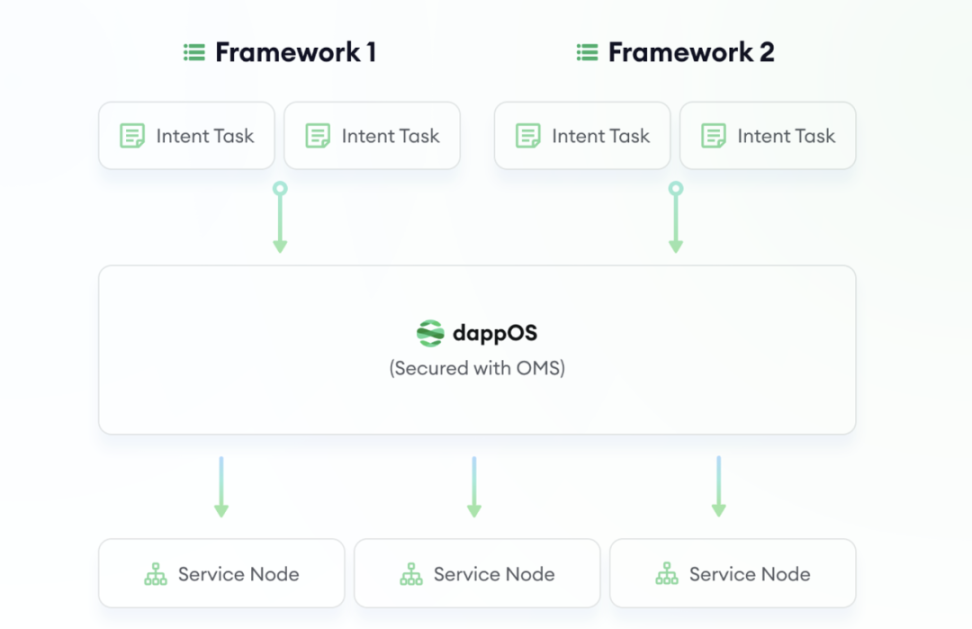

The reason why intent assets can achieve this is due to the dappOS Intent Execution Network behind it. The network has numerous decentralized service providers. When a user expresses the "conversion of intent assets" requirement, the network will request quotes from these service providers and find the most suitable one to complete the task. Each service provider can quote based on their own situation and complete the user's requirements at the lowest cost. The network does not care about the specific methods used by the service providers, only whether the task can be completed within the specified time.

In this way, the dappOS Intent Execution Network eliminates the situation where a single service provider bears high maintenance costs, achieving a dynamic balance between liquidity maintenance costs and actual demand. Since the network allows service providers to use on-chain or off-chain solutions, such as using tools from centralized exchanges, this further reduces liquidity maintenance costs and optimizes the user experience.

What is Intent Asset?

Intent Asset is a new type of asset supported by dappOS that can automatically adapt to different scenarios and generate interest when idle. Similar to the principle of Yu'ebao, by aggregating interest and application scenarios such as Pendle, Babylon, Benqi, Berachain, BounceBit, Ether.Fi, GMX, KiloEx, Manta, Puffer, Pendle, QuickSwap, Taiko, Zircuit, etc., and then executed by the nodes of the intent network on the backend, intent assets can have a wide range of application scenarios.

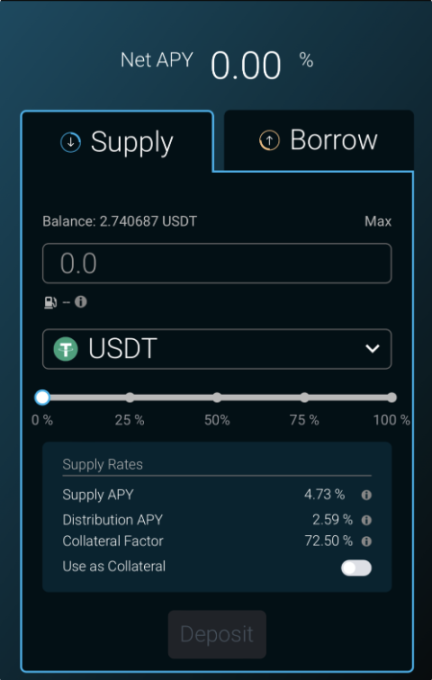

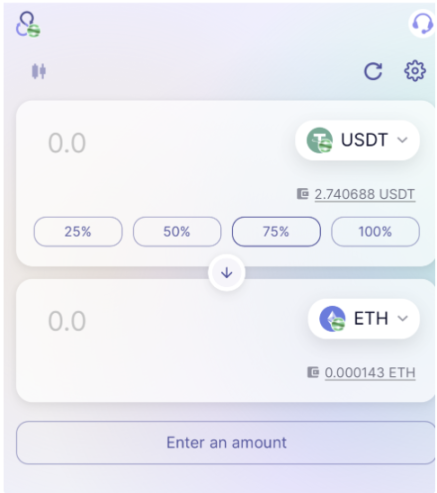

Taking stablecoins as an example, dappOS provides a flexible asset called intentUSD. This asset can not only be used as a currency, but also generates interest when idle. This innovative approach allows stablecoins to automatically convert between different forms based on user demand. For example, when USDT is needed, intentUSD can be used as USDT; and when conducting USDC transactions, intentUSD can be converted to USDC.

dappOS helps users with the pledging, unpledging, and conversion of yield assets through its intent execution network, ensuring direct availability in different scenarios. This way, intent assets are functionally equivalent to native assets such as USDT or ETH, but also continue to generate income when idle.

Key advantages include:

- Instant redemption: No waiting period or lock-up period required.

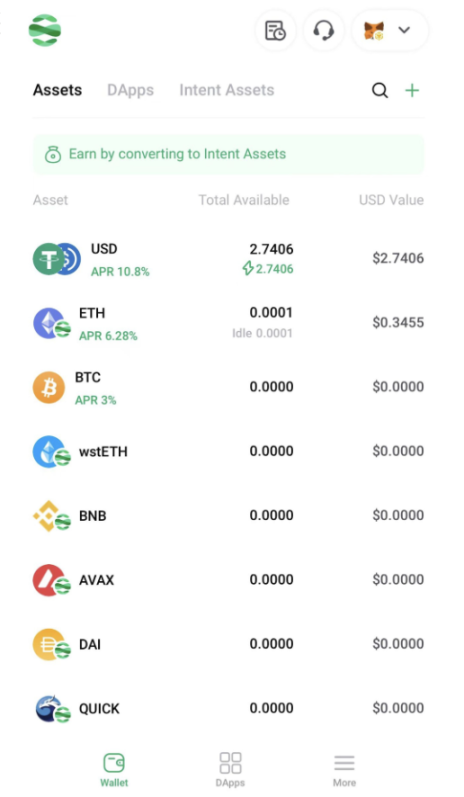

- High yield: For example, the annual yield for USDT/USDC is 12%, and for ETH it is 7%, with real-time distribution of yields, without waiting for token issuance.

- Convenient usage: When interacting with dApps or withdrawing to exchanges, the USDT/ETH balance is directly loaded, providing a user experience no different from native USDT/ETH.

In this way, intent assets are not only functionally equivalent to native assets, but also continue to generate income when idle, greatly increasing the efficiency and level of user asset utilization.

Interactive Example:

The following image shows the interface for intentUSD earning interest in DappOS.

When switching to Benqi, we find that Benqi automatically recognizes intUSD as USDT and can be used normally.

In the syncswap interface, intUSD is also recognized as USDT/USDC. In different dApps, intUSD can be used as the USD asset supported by the dApp.

Intent assets have a wide range of applications and unique advantages in different customer groups and scenarios:

DeFi Player: Alex

Alex is an experienced DeFi player, familiar with various decentralized finance protocols and tools. One day, he discovered the Intent Assets of dappOS and saw it as an excellent opportunity to utilize his existing assets.

Alex has some idle ETH, and he decides to convert these ETH into intentUSD and use it to generate income. He stakes intentUSD in dappOS's liquidity pool to start earning staking rewards. Later, he sees a new liquidity mining project offering high returns, so he transfers some intentUSD to the project's liquidity pool to earn additional rewards.

Shortly after, Alex needs some stablecoins to participate in a new DeFi project. He converts some ETH into intentUSD and directly uses it in this DeFi project. This way, he maintains the flexibility of his assets and maximizes his returns on different DeFi platforms. Or Alex wants to add collateral on GMX in Arbitrum for perpetual contract trading. He finds that he can directly use intentUSD as USDC without additional conversion steps.

New Player: Lisa

Lisa is not very familiar with Web3 and cryptocurrencies, but she has heard many stories about digital assets and DeFi and decides to give it a try. She buys some USDT but doesn't know how to better utilize these assets.

Through a friend's recommendation, Lisa learned about dappOS's Intent Assets. She decided to convert her USDT into intentUSD. Initially, she simply kept the intentUSD in her wallet and checked the interest income it generated every day. She was satisfied with this simple and convenient way of financial management because the returns were significantly higher compared to traditional bank deposits, and there was no need to exchange it for other assets or perform complex cross-chain and staking operations.

One day, Lisa wanted to withdraw some interest to buy groceries. Unfamiliar with on-chain operations, she tried to directly withdraw IntentUSD to the exchange and then use the exchange's debit card for purchases. Despite her lack of understanding of on-chain operations, she was surprised to find that IntentUSD could be smoothly withdrawn to the exchange and magically converted into USDT/USDC, and she discovered that gas fees could be settled with IntentUSD.

Institutional Investors

Imagine a traditional large investment institution responsible for managing billions of dollars in assets. They have a strong interest in the blockchain and DeFi space and are looking for stable and efficient investment opportunities.

They noticed dappOS's Intent asset and saw it as a good opportunity to optimize fund management. The institution decided to allocate some funds to intentUSD to obtain stable returns without affecting liquidity. They used dappOS's Intent Execution Network to convert and diversify intentUSD across different chains to reduce risk.

The institution also used intent assets to participate in various high-yield DeFi projects. For example, they used some intentUSD for liquidity mining to earn additional rewards. Additionally, in the event of market fluctuations, they could withdraw intent assets at any time to ensure quick conversion to fiat for emergency handling, ensuring instant access and flexibility for entering and exiting, achieving stable income growth. Due to the characteristics of the intent network, security was also ensured, efficiently managing and optimizing their asset portfolio.

Whether it's experienced DeFi players, newcomers to Web3, or large institutional investors, dappOS's Intent Assets provide solutions to meet different needs. Through these stories, we can see the widespread application and enormous potential of Intent Assets in various scenarios, helping users efficiently manage assets and maximize returns in the blockchain world.

Principle of Intent Asset

Intent Assets utilize the unique capabilities of dappOS's execution network to take users' ordinary or intent assets as input and outsource complex settlement tasks to the network's service providers to achieve the user's expected results. Users do not need to worry about the underlying operational processes, but can focus on the final results of their transactions, such as earning returns, interacting with dApps, and withdrawing to centralized exchanges.

dappOS's OMS (Intent Management System) mechanism gives nodes a high degree of freedom to optimize costs and efficiency without affecting user security. The OMS mechanism allows nodes to flexibly adjust resources based on actual conditions to achieve optimal performance and cost-effectiveness for each intent task. This ensures that user intent tasks are executed at the fastest speed and lowest cost, ensuring a smooth and efficient user experience while maintaining a high level of security for user assets.

dappOS's Intent Execution Network not only handles different types of intent tasks but also ensures that these tasks seamlessly integrate with different blockchains and decentralized applications. Users can freely use Intent Assets in a multi-chain environment without worrying about compatibility issues between different assets. For example, users can withdraw intentUSD as USDT on an exchange when needed, or use it as USDC on GMX in Arbitrum. This flexibility and compatibility enable Intent Assets to be flexibly used in a wide range of scenarios, providing unparalleled convenience.

Users earn returns based on USDT, ETH, and BTC by holding intent assets (such as intentUSD, intentETH, intentBTC). These returns mainly come from the steady appreciation of underlying assets (such as wstETH, sUSDe, sDAI, and stBBTC) and participation in yield-generating activities in decentralized finance (DeFi) protocols. The underlying assets are designed to steadily appreciate, ensuring stable and growing returns, allowing users to maximize returns while maintaining asset liquidity.

Potential Future Challenges

Although dappOS's Intent Assets have shown tremendous potential in on-chain liquidity and global access, their success faces challenges in user acceptance, technical complexity, market competition, regulatory compliance, liquidity management, and user experience. Only by continuously optimizing and improving in these areas can it truly achieve widespread application and long-term development in the blockchain financial ecosystem.

1. Regulatory Pressure

As the scale of funds expands, regulatory agencies will impose higher requirements for risk management of Intent Assets. As a new type of on-chain fund, Intent Assets attract a large number of individual investors, which means that their fund liquidity and risk management need to be more stringent. To prevent systemic risks, regulatory agencies may introduce more restrictive measures, such as limiting the investment amount for individual users and increasing liquidity requirements. These measures may affect the yield and user experience of Intent Assets.

2. Intensified Market Competition

As Intent Assets gradually gain attention, they will attract a large number of competitors, and various ecosystems may launch their own Intent Assets to enter this field, attracting users by offering higher APY, strategies, and even expected airdrops. However, dappOS's first-mover advantage in the intent network and the team's forward-looking vision will raise the barrier to entry.

3. Decline in Yield

With changes in the market and the expansion of fund size, the yield of Intent assets may experience fluctuations. Although the yield of Intent Assets remains competitive, the downward trend compared to early high yields may affect user investment enthusiasm, leading to fund outflows. DappOS can maintain its leading position in yield by aggregating more protocols or seeking new yield opportunities off-chain. DappOS's advantage lies in the fact that every time a new opportunity arises, eager MEV searchers will actively fill the market gap, absorb new yields, and feed them back into users' wallets.

4. Liquidity Management

As a highly liquid fund-like asset, Intent Assets need to be able to meet users' withdrawal demands at any time. This requires maintaining a certain yield while ensuring sufficient high liquidity assets. This balance is a complex challenge, especially in times of significant market fluctuations, and ensuring sufficient liquidity is a key focus for Intent Assets.

5. Diverse User Needs

With the increase in the number of users, their financial management needs have become more diverse. Different users have different preferences for risk, returns, liquidity, and other aspects, requiring Intent Assets to provide a more diverse range of financial products and services. However, too many product choices may increase operational complexity and risk. Finding a balance between meeting user needs and controlling risk is a difficult challenge for Intent Assets.

6. Technical and Security Risks

As a financial product relying on the Solver network, Intent Assets face technical and security risks. With a constant stream of on-chain hacker attacks, rug pulls in DeFi protocols, and the resulting MEV, ensuring the security of user funds becomes an important challenge for Intent Assets. In addition, the rapid development of technology requires dappOS to continuously upgrade its Solver system to remain competitive.

7. User Acceptance and Education

Although Intent Assets provide a flexible way to generate returns, users need time to understand and accept this new type of asset, especially for users unfamiliar with crypto assets and blockchain technology. In the long-term development of Web3, dappOS still needs to conduct extensive user education and promotion activities to help users understand how to use Intent Assets and their advantages.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。