Evening market trends may go how? Little A analyzes for you!

Welcome to ask Little A in the group chat for more analysis: jv.mp/JaQ0CE

dogs

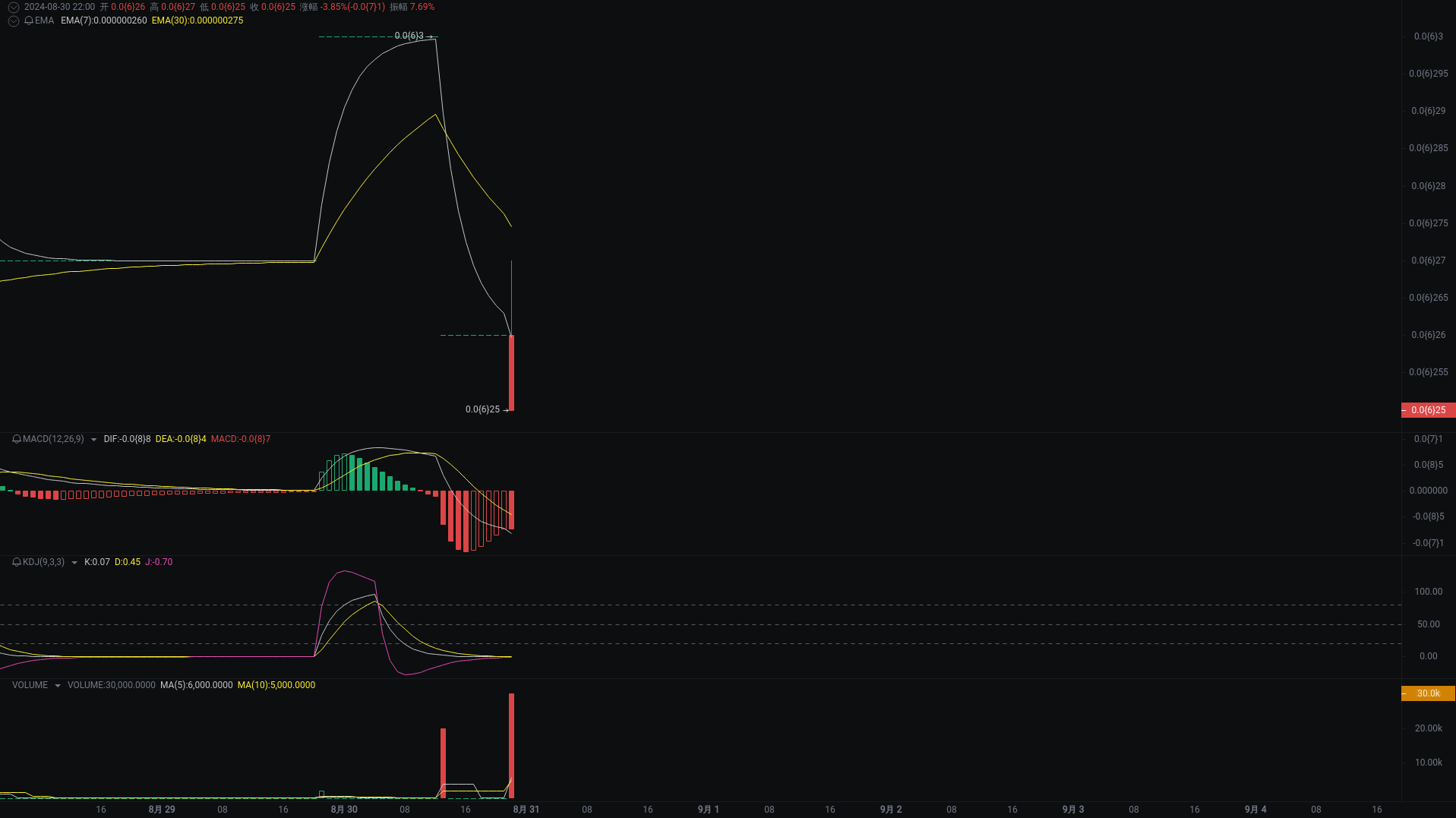

1-hour price trend of dogs: Sideways.

This is a 1-hour OKX Ordinals dogs/BTC K-line chart, with the latest price at: 0.000000250 BTC, including EMA, MACD, KDJ, and volume indicators.

【Buy/Sell Points】

Buy point one: 0.000000260 BTC (Considering the proximity of EMA(7) and EMA(30), this price is a relatively safe entry point, slightly below the current market price)

Buy point two: 0.000000250 BTC (Near the lowest price, if the price retraces to this point, it can be considered a more attractive buying opportunity)

Long stop-loss point: 0.000000240 BTC (Below buy point two, and provides enough space to avoid triggering stop-loss due to small fluctuations)

Sell point one: 0.000000270 BTC (Close to the highest price, if the price rises to this point, it can be used as an initial profit-taking sell point)

Sell point two: 0.000000280 BTC (Exceeding the highest price in the recent period, it is expected that there may be further upward space after the breakthrough)

Short stop-loss point: 0.000000290 BTC (Above sell point two, providing protection to prevent further losses due to continued upward movement of the price)

【Price Trend Analysis】

K-line pattern:

- In the past few periods, the price has been fluctuating around the 0.000000270 level, with no obvious long real body appearing, indicating that the market is relatively stable.

- Since the opening price, highest price, lowest price, and closing price are all the same value, a typical K-line combination pattern has not formed.

Technical indicators:

- The MACD indicator shows a small difference between DIF and DEA, and the MACD histogram is close to the zero axis, suggesting that the current market momentum is not strong and the trend is not obvious.

- The J value in the KDJ indicator has extreme fluctuations, but since most of the time the K, D, and J values are 0 or very close, this may be due to abnormal data or very low trading activity.

- The values of EMA(7) and EMA(30) are very close, and the change is very small, indicating that the short-term and long-term trends are closely related, and there is currently no obvious trend development.

Volume:

- The volume is 0 for most periods, indicating that there is almost no trading taking place during this period.

- There was a volume increase (20000) at 13:00 on August 30, but then it fell back to 0, which may indicate a brief trading activity, but it did not last.

SOL

1-hour price trend of SOL: Sideways.

This is a 1-hour Binance SOL/USDT K-line chart, with the latest price at: 129.398 USDT, including EMA, MACD, KDJ, and volume indicators.

【Buy/Sell Points】

Buy point one: 130.00 USDT (The current price is close to EMA(7) and KDJ may indicate a short-term rebound, which can be considered as an initial buying point)

Buy point two: 127.50 USDT (This price is close to the recent low of 126.756, if there is further retracement, this position may provide good support)

Long stop-loss point: 125.50 USDT (Providing enough space to avoid stop-loss triggered by small fluctuations, while being below buy point two and the recent low)

Sell point one: 132.00 USDT (A resistance area that has been tested multiple times recently, suitable as an initial selling point)

Sell point two: 135.00 USDT (Close to the 30-period EMA, a potential downward pressure area in the long-term downtrend)

Short stop-loss point: 137.00 USDT (Above sell point two, leaving some space to reduce the risk of triggering stop-loss due to small upward movements)

【Price Trend Analysis】

K-line pattern:

- Recent K-lines show large price fluctuations, with multiple long upper and lower shadows, indicating intense competition between buyers and sellers in this price range.

- There was a significant price drop from 06:00 to 07:00 on September 2, followed by a rebound, which may constitute a brief bottom rebound.

Technical indicators:

- Both DIF and DEA in the MACD indicator are in the negative zone, and the MACD histogram is showing a shrinking trend, indicating that the current downward momentum is weakening, but an effective buy signal has not yet formed.

- The J value in the KDJ indicator is higher than the K value and D value in the latest data, and both K and D values are below 50, which may indicate a certain rebound space in the short term, but the overall trend is still unclear.

- The 7-period EMA is lower than the 30-period EMA, indicating a relatively weak short-term trend, but the difference between the two is converging. If the short-term EMA crosses above the long-term EMA, it may be an early signal of a reversal.

Volume:

- The volume increased significantly when the price fell sharply, such as the significant increase in volume at 06:00 on September 2, which usually indicates heavy selling pressure.

- Subsequently, the volume gradually decreased, indicating a relief in market panic, but caution is needed for the possibility of price fluctuations when the volume increases again.

ETH

1-hour price trend of ETH: Downward.

This is a 1-hour Binance ETH/USDT K-line chart, with the latest price at: 2462.16 USDT, including EMA, MACD, KDJ, and volume indicators.

【Buy/Sell Points】

Buy point one: 2435 USDT (Considering the support near the lowest price of 2397.23, and the narrowing gap between EMA(7) and EMA(30), there may be a rebound opportunity)

Buy point two: 2400 USDT (Close to the lowest price at 07:00 on September 2, if the price tests this area again and does not break through, it can be seen as a strong support level)

Long stop-loss point: 2380 USDT (Leaving enough space to avoid stop-loss triggered by small fluctuations, while being below the previous low of 2397.23 to provide protection)

Sell point one: 2500 USDT (The recent high points have failed to break through the level above 2500 multiple times in the past few hours, it can be used as an initial resistance level to take profits)

Sell point two: 2520 USDT (Close to the highest price of 2528.76, if the market can rise to this level, it may face greater selling pressure)

Short stop-loss point: 2535 USDT (Exceeding the highest price in the recent period, providing a safety cushion for short positions, and leaving some space to prevent accidental triggering)

【Price Trend Analysis】

K-line pattern:

- Recent K-lines show large price fluctuations, with multiple long lower shadows (such as 07:00 on September 2, 06:00 on September 1), indicating buying interest at the lows, but upward pressure still exists.

- The K-line at 17:00 on September 2 has a short real body with upper shadow, suggesting indecision in the current market, possibly leading to a reversal or sideways consolidation.

Technical indicators:

- Both DIF and DEA in the MACD indicator are in the negative zone, and the MACD histogram has changed from positive to negative, indicating a strengthening bearish momentum in the short term.

- The J value in the KDJ indicator is higher than the K and D values, and all three are above 50, indicating that the market still has some upward momentum, but caution is needed as the high J value may lead to overbought conditions.

- The EMA(7) has always been below the EMA(30), the short-term moving average has not been able to break through the long-term moving average, showing a bearish trend in the short term.

Volume:

- The volume peaked at 06:00 on September 2 and gradually decreased, consistent with the price decline, indicating that the downward trend is supported by volume.

- The volume has been stable in the past few hours, with no significant increase, indicating that market participation has not significantly increased, and there is a lack of effective price momentum.

※All content is provided by the intelligent analysis assistant Little A, and is for reference only, and does not constitute any investment advice!

Little A's intelligent analysis is the industry's first intelligent analysis tool recommended by AICoin, which easily helps you interpret the trend of currencies, analyze indicator signals, and identify entry and exit points. You can experience it on the APP or PC.

PC & APP Download: https://www.aicoin.com/download

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。