This article's Hash (SHA1): 63950885fa404927314d9862ec37f81d84e5fc75

Number: Chain Source Technology PandaLY Security Knowledge No.024

On August 23, 2024, the Fed's announcement of an expected rate cut triggered a wave of increases in the cryptocurrency market. However, almost at the same time, the Ethereum Foundation transferred 35,000 ETH to the Kraken exchange in the early hours of August 24. This operation quickly attracted the market's attention and discussion, not only because of the quantity of ETH traded, but also because the Ethereum Foundation has been jokingly referred to as the "top escape master" by the market.

The history of the "top escape master"

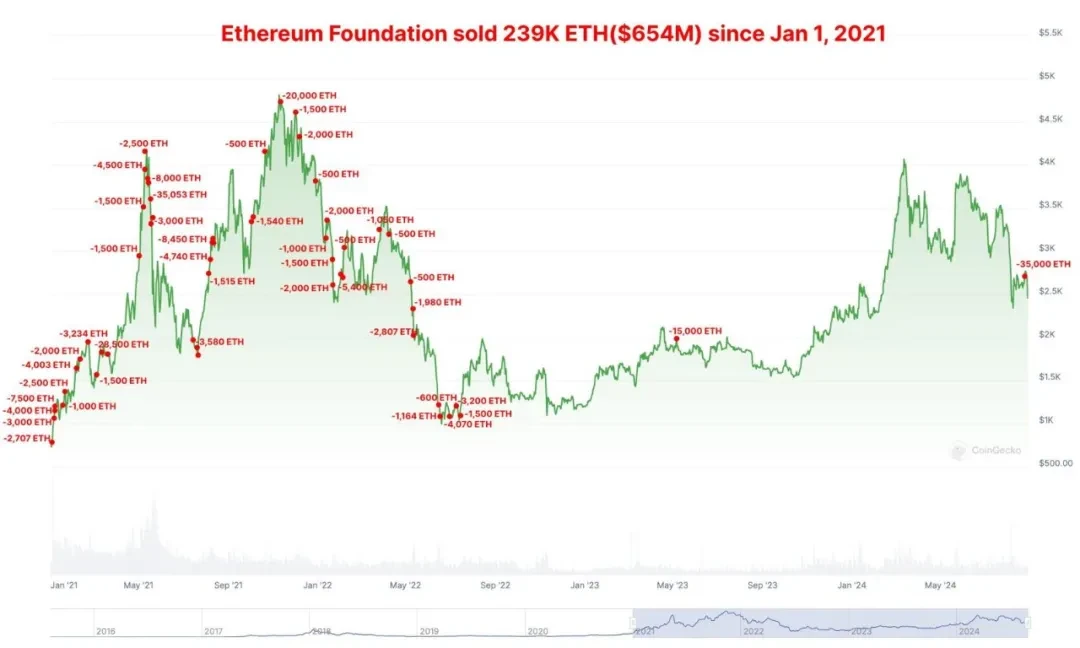

The "top escape" history of the Ethereum Foundation can be traced back to several major market fluctuations. On May 6 of last year, the foundation transferred 15,000 ETH to the Kraken exchange, and within the following 6 days, the price of ETH plummeted from $2,006 to $1,740, a decrease of 13%. In the earlier bull market of 2021, the foundation also successfully sold at the peak twice:

May 17, 2021: The Ethereum Foundation sold 35,053 ETH at an average price of $3,533, followed by the famous "5.19 crash" in the market, with the price of ETH almost halving to $1,800.

November 11, 2021: The foundation again sold 20,000 ETH at an average price of $4,677, after which the market began to decline.

These precise operations have drawn significant attention to the Ethereum Foundation's selling strategy.

What is the truth?

Although the Ethereum Foundation's precise selling at several market peaks is impressive, from a longer-term perspective, the title of "top escape master" is not entirely accurate. According to data compiled by Wu Blockchain, the foundation also missed out on significant subsequent increases when it sold 100,000 ETH at a unit price of $657 on December 17, 2020, and 28,000 ETH at a unit price of $1,790 on March 12, 2021.

Looking at the foundation's transfer records over the past year, it is not difficult to find that these operations are basically regular sales. It is unfair to label them as "top escape master" based solely on a few high-level sales.

Reasons for the Ethereum Foundation's sale of ETH

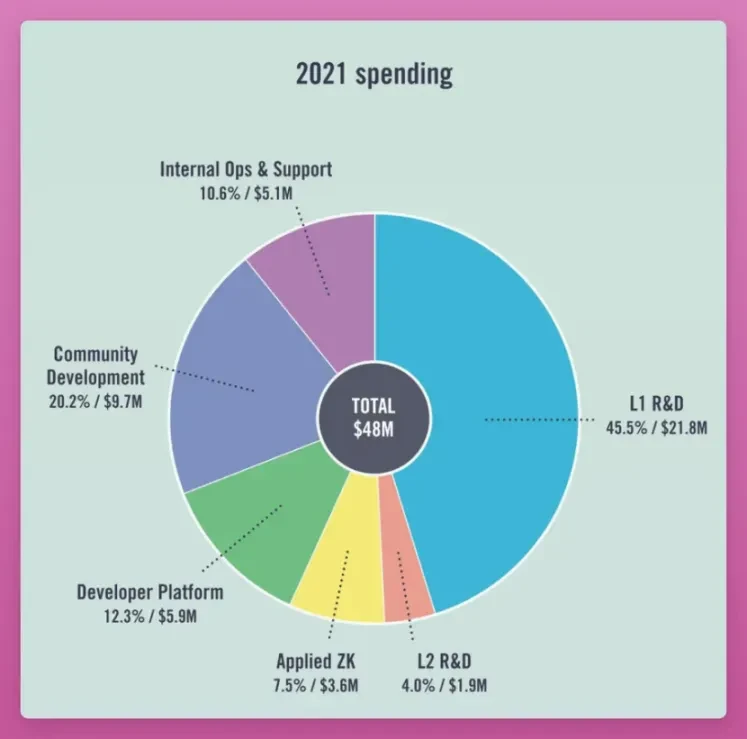

Regarding the transfer of 35,000 ETH to the exchange, Aya Miyaguchi, Executive Director of the Ethereum Foundation, explained, "This is part of the Ethereum Foundation's fund management activities. The Ethereum Foundation has an annual budget of approximately $100 million, mainly used for grants and salary payments, and some beneficiaries can only accept legal tender." She also mentioned that this ETH transfer does not equate to a sale, and there may be planned gradual sales in the future.

According to crypto analyst DefiIgnas's data, after transferring 35,000 ETH, the Ethereum Foundation currently holds approximately 273,000 ETH, accounting for about 0.25% of the total ETH supply. The funds are mainly used for global conferences (such as Devcon and Devconnect), online courses, and innovative projects.

Market impact of the sale and improvement direction

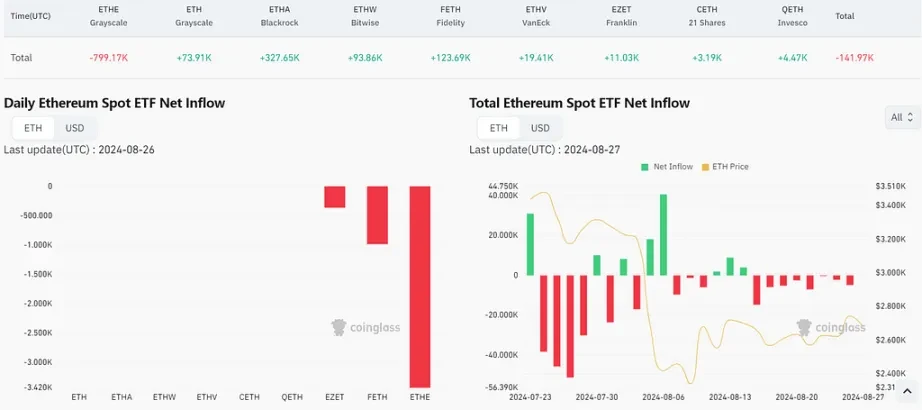

It is worth noting that since the listing of the Ethereum ETF on July 23, as of August 26, Grayscale's ETHE has seen a cumulative net outflow of 799,000 ETH, with an average daily net outflow of 32,000 ETH. In comparison, the recent sale of 35,000 ETH by the Ethereum Foundation is not particularly large.

In fact, the Ethereum Foundation's sale of ETH is understandable, as the team's development operations require financial support. Furthermore, the 273,000 ETH held by the foundation accounts for only 0.25% of the total supply. In terms of market value, the foundation's selling behavior has a relatively small direct impact on market liquidity, with more negative effects reflected in market sentiment, such as undermining the confidence of ETH holders and triggering follow-up sales.

In addition, the Ethereum Foundation had previously disclosed a budget of $100 million, but there is an increasing demand from the community for regular detailed financial disclosures. For example, the foundation could consider regularly releasing detailed reports containing financial and infrastructure updates, including team expenses, the timing of ETH sales (with careful consideration of how to minimize the impact on the market), the use and location of funds, team size and allocation, and other information. These measures will help stabilize community sentiment, enhance understanding and support for the foundation among ETH holders, and thereby promote the development of Ethereum.

Transparency and security challenges for the Ethereum Foundation

Security and transparency have always been core challenges faced by major projects and institutions. The Ethereum Foundation's large-scale ETH sales not only directly affect market price fluctuations, but also pose severe tests on how to effectively manage and protect large-scale digital assets. Case study: Ethereum Foundation's email was hacked, Lido staking scam had no victims On June 23, 2024, the Ethereum Foundation's email server was hacked. The hacker impersonated Lido staking and launched a phishing scam, sending false emails to 35,794 users, claiming that the Ethereum Foundation was collaborating with LIDO DAO to provide a 6.8% staking interest. Clicking the "Start Staking" button in the email would lead users to a malicious website, potentially resulting in their wallets being emptied. Nevertheless, the Ethereum Foundation promptly blocked the attacker and restored the compromised email accounts, ultimately resulting in no user losses. This incident highlights the need for both project parties and users to strengthen their defenses against phishing and other security threats in the current Web3 environment. The following are the main strategies for Web3 security:

- Smart contract security—from prevention to response

Smart contracts are at the core of the Web3 world, and almost all decentralized applications (DApps) rely on the correct execution of smart contracts. However, vulnerabilities and errors in the design and implementation of smart contracts can lead to serious security incidents. For example, the 2016 The DAO incident was caused by a vulnerability in a smart contract, resulting in the theft of over $60 million worth of Ether.

Security prevention measures:

Comprehensive code review and security testing: Smart contract code must undergo multiple rounds of review and testing before release. This includes internal review by the project team as well as independent evaluation by third-party security audit companies. Multiple layers of review can maximize the discovery of potential vulnerabilities.

Use of verified security libraries: When developing smart contracts, it is advisable to use widely verified open-source security libraries as much as possible. These libraries have been extensively used and tested in the community for a long time, reducing potential risks in the code.

Simulated attacks and stress testing: Project teams should conduct simulated attack tests to identify potential attack methods that smart contracts may encounter in actual environments. Additionally, stress testing can assess the performance of smart contracts under high-concurrency transaction conditions to ensure they can operate safely under extreme conditions.

Security response measures:

Rapid response mechanism: Once vulnerabilities in smart contracts are discovered, project teams should immediately initiate emergency plans, freeze relevant contracts, or take other response measures to prevent further losses.

Vulnerability reward program: Encourage the community and external security researchers to discover and report potential vulnerabilities, thereby improving overall security through bug bounty programs.

- Transparency in fund management—building trust and preventing internal risks

Fund management is another major security challenge faced by non-profit organizations such as the Ethereum Foundation. The centralized management of a large amount of digital assets may become a target for attackers or lead to fund misuse due to poor management.

Specific measures:

Multi-signature Wallet: The foundation should use a multi-signature wallet to manage large funds. This way, even if the private key of a single signer is stolen, attackers cannot easily transfer funds and must obtain authorization from multiple signers.

Decentralized storage and management: To reduce the risks of centralized management, funds can be stored in multiple addresses or accounts. Each account's permissions and usage should be clearly defined to reduce the possibility of single point failure.

Real-time transparent financial disclosure: Through the transparency of blockchain technology, the foundation can disclose the flow of funds in real-time on its official website or community platform, ensuring that every fund transfer is publicly transparent. Through such transparency, the foundation can not only prevent internal risks but also enhance the community's trust in it.

- Market operations and compliance—balancing market impact and legal requirements

Large transactions often have a huge impact on the market, especially in the still uncertain regulatory cryptocurrency market. The foundation's large-scale sales may cause market turmoil and even be seen as market manipulation. Therefore, the foundation needs to be extra cautious in its market operations and ensure that its actions are compliant with the law.

Specific measures:

Gradual sales and market prediction models: When making large asset transfers or sales, the foundation can adopt a strategy of gradual sales to reduce the impact on market prices. At the same time, market prediction models can be introduced to assess the potential impact of different sales scenarios on the market and choose the optimal solution.

Collaboration with regulatory agencies: The foundation should proactively collaborate with regulatory agencies in various countries to ensure that its operations comply with local laws and regulations. At the same time, the foundation should actively participate in industry self-regulatory organizations to promote the formulation of reasonable market operation guidelines and maintain market fairness and stability.

Market notices and information disclosure: Before making large operations, the foundation can release advance notices to the community through official channels, explaining the reasons and purposes of the operations. This can reduce market panic and avoid unnecessary fluctuations.

- Education and community interaction—building security awareness

In addition to technical and management security measures, education and community interaction are also important for enhancing overall security. The foundation can enhance the security awareness of developers and users through various means, helping them acquire basic security knowledge and operational skills.

Specific measures:

Conducting security training and seminars: The foundation can regularly hold security training and seminars for developers and ordinary users, sharing the latest security threats and prevention techniques. This can not only increase participants' security awareness but also promote experience exchange and cooperation within the industry.

Publishing security guides and tools: The foundation can write and publish security operation guides to help users avoid common security risks. At the same time, it can develop or recommend some security tools to help users better manage their digital assets.

Establishing an emergency response community: The foundation can establish an emergency response team in the community to promptly handle security incidents and provide assistance. This interaction can not only improve the efficiency of emergency response but also enhance community cohesion and trust.

Conclusion

The Ethereum Foundation's fund operations and transparency have always been a focus of community attention. Since 2015, the foundation has allocated over $170 million through various funding programs, supporting hundreds of projects. However, the community's demand for financial transparency from the foundation is increasing, especially against the backdrop of frequent large-scale sales of ETH.

In the future, if the Ethereum Foundation can be more open in financial transparency, such as regularly releasing financial reports, explaining specific details of fund usage, and interacting and communicating more frequently with the community, it will help enhance the healthy development of the entire ecosystem and ensure that Ethereum continues to maintain its leading position in the blockchain field. Through continuous research and development, community operations, and market education, the foundation can make a greater contribution to the security and development of the Web3 world, further consolidating its important position in the industry.

Chain Source Technology is a company focused on blockchain security. Our core work includes blockchain security research, on-chain data analysis, and asset and contract vulnerability rescue. We have successfully recovered stolen digital assets for individuals and institutions. At the same time, we are committed to providing project security analysis reports, on-chain tracing, and technical consulting/support services to industry institutions.

Thank you for reading, and we will continue to focus on and share blockchain security content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。