Original from Min Jung

Compiled by | Odaily Planet Daily Golem (@web3_golem)_

Abstract

The secondary OTC market is a place where people can buy and sell various assets, including locked tokens, equities, or SAFT (Simple Agreement for Future Tokens), which are difficult to trade on public exchanges. Today, the term "secondary OTC market" mainly refers to the trading of locked tokens.

The main sellers in the secondary OTC market include VCs, project teams, and foundations, whose motivations are often driven by early profit or managing selling pressure. Buyers are usually divided into two categories: "hodlers" who believe in the long-term potential of tokens and are attracted by token discounts, and hedgers who profit from price differentials through financial means.

The secondary OTC market is increasingly important as it reflects the market's pessimistic sentiment. Due to limited buying interest, tokens are often sold at a significant discount. Nevertheless, the secondary OTC market still plays a crucial role in managing liquidity and reducing direct selling pressure on public exchanges, helping to build a more stable and resilient crypto ecosystem.

Figure 1: Market status, Source: imgflip

Although most retail investors are basically not involved in the secondary OTC market, its importance is rapidly increasing among industry insiders such as VCs, project teams, and foundations. With the dynamic development of the cryptocurrency market, the secondary OTC market is becoming an important way to manage liquidity and lock in profits, especially in situations of high valuation but limited liquidity. Therefore, this article will introduce: 1) What is the secondary OTC market, 2) Who are the participants and their motivations, 3) Some thoughts on the current market situation, and 4) A written interview with Taran, the founder of the OTC trading platform STIX.

What is the Secondary OTC Market

The secondary OTC (over-the-counter) market is a private trading space that allows buyers and sellers to negotiate and execute the trading of tokens, equities, or investment contracts (such as SAFT, Simple Agreement for Future Tokens) directly outside of public exchanges. For various reasons, most assets listed on the secondary OTC market cannot be traded on regular exchanges such as Binance or OKX.

Many crypto projects have tokens locked for a certain period, and the secondary OTC market provides a way for investors and teams to sell these assets before they become tradable (unlocked). Today, the term "secondary OTC market" mainly refers to the trading of locked tokens in TGE (Token Generation Event) or even pre-TGE projects, and this article will focus on the trading of locked tokens in TGE projects.

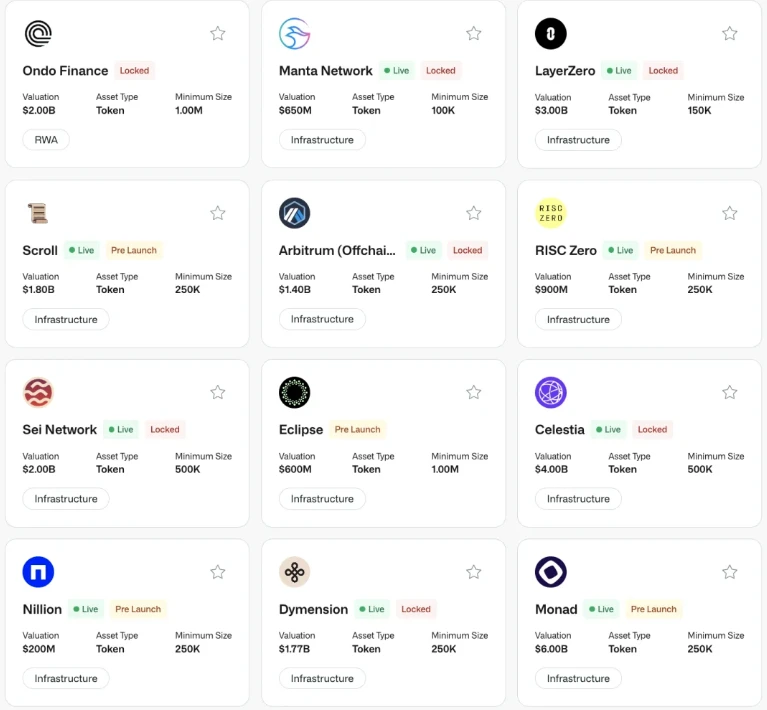

Figure 2: What does the secondary OTC market look like, Source: STIX

Why the Secondary OTC Market is Thriving

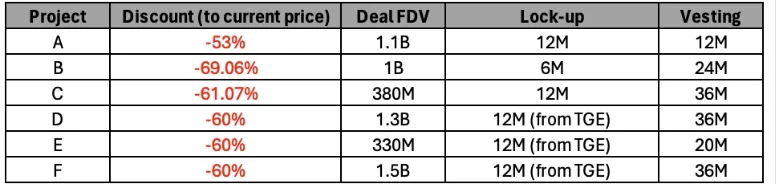

The main driving force behind the thriving secondary OTC market is the strong motivation of stakeholders to sell their held assets. Currently, many tokens in the top 20 are trading at nearly a 50% discount, with a lock-up period of one year, and tokens from projects outside the top 100 are even trading at discounts of up to 70%. For example, a token priced at $1 on exchanges like Binance may only be sold for $0.3 on platforms like STIX, with a lock-up period of one year and an additional two-year monthly unlock period.

This trend is closely related to the recent high FDV (Fully Diluted Valuation), low circulation, and the increasing market aversion to VC coins. As explained in the article "Is FDV a Meme?," although there are currently a large number of new projects entering the market, there are not enough new users or liquidity to support this massive supply. Therefore, as more tokens are unlocked, token prices will naturally decline.

Additionally, many of these tokens provide little value to the market and are often overvalued relative to their actual user base and utility. The project teams and VCs who initially invested in these projects have recognized this, choosing to sell at a discount now rather than risk holding on for a potential future lower value.

Figure 3: Existing trades in the market, Source: Presto Research

Participants and Their Motivations

Sellers and Reasons

- Project Teams

Even with token sale discount rates of 50-70%, project teams can still be profitable. These project teams are not large in number, usually consisting of 20-30 people, and they may have built the project in just 2-3 years. Although the development cycle is relatively short and the initial investment is limited, the FDV valuation of these projects can reach as high as $3 billion or more.

In Web2, it was almost impossible for such a small team to create a company worth $1.5 billion in such a short time. Given this situation, many projects tend to sell their tokens at a discount because they know that now is the best opportunity to profit, rather than risk holding on for a potential future decline in value.

- VCs

VCs face a situation similar to project teams. The recent market conditions have led to rapid valuation increases, with seed round financing occurring six months after the pre-seed round and at a threefold valuation. In some cases, VCs even conduct multiple rounds of financing simultaneously, providing different valuations for concurrent investments. Therefore, many VCs can still make substantial profits even by selling at a 50% discount in the secondary market unless they invested in the final stages before TGE.

The current market environment drives VCs to sell tokens and seize the opportunity to lock in profits. Furthermore, in the current market environment, limited partners (LPs) in venture capital funds have started to pay more attention to the DPI (Distributed Profit Interest) metric, further incentivizing VCs to realize returns, thereby enhancing the trend of selling in the secondary OTC market.

- Foundations

The motivations of foundations participating in the secondary OTC market may be slightly different. While some foundations may recognize that their tokens are overvalued and want to sell quickly, others may strategically take over. A common strategy is to sell unlocked tokens at a discount to investors and lock them for a year.

This approach reduces direct selling pressure on the public market while still allowing foundations to raise the necessary operational funds. In many cases, this type of transaction can be seen as one of the positive uses of the secondary OTC market, as it meets the operational funding needs of the foundation while maintaining market stability.

Buyers and Reasons

- Hodlers

The first type of buyers in the secondary OTC market are those who believe in the long-term value of the tokens. These individuals are often referred to as "hodlers," who believe in the success of the project, are willing to purchase tokens at a 50% discount, and intend to hold them for several years.

For these buyers, the opportunity to purchase tokens at a discount is very attractive because they plan to hold their investment in the project for the long term and expect the value of the tokens to increase as the project develops. The high discount rate provides them with a favorable entry point, allowing them to accumulate more tokens at a lower cost.

- Hedgers

The second type of buyers are driven by the opportunity to profit from token discounts through strategic financial strategies. These buyers, known as hedgers, use perpetual contracts and other financial instruments to lock in profits from discounted tokens. By purchasing tokens at a 50% discount and simultaneously shorting, they can achieve returns equivalent to the discount.

Additionally, they can earn funding rates, and if the rate is positive, they can further increase their returns. This approach allows hedgers to take advantage of price differentials between the secondary OTC market and the public market, which is a profitable strategy for those skilled in managing financial risks.

Why can't sellers become hedgers themselves?

While it may seem logical for sellers (such as VCs and project teams) to hedge their positions instead of selling at a significant discount, several factors make this approach impractical, such as regulatory barriers and liquidity constraints.

On the regulatory front, VCs typically face strict rules that limit their ability to engage in certain financial activities, such as shorting tokens, which is an important component of an effective hedging strategy. In addition to these regulatory limitations, hedging itself requires a significant amount of capital to avoid liquidation risk. Sellers need to provide a large amount of collateral, usually exceeding the value of the tokens they are trying to hedge, as while the downside potential of token prices is limited, the upside potential may be unlimited. This creates a situation where the financial requirements for hedging are too high, especially considering that the majority of the wealth of VCs and project teams is tied to the tokens themselves, rather than liquid cash.

Furthermore, hedging is not as simple as it may seem. There are many complex factors to consider, such as counterparty risk (the possibility of platform failure or bankruptcy) and risks associated with funding rates, which can turn negative, complicating the strategy further and potentially leading to unexpected losses.

What does the current situation in the secondary OTC market imply?

Compared to public exchanges, the secondary OTC market currently exhibits a more pessimistic sentiment, as even with tokens being sold at significant discounts (sometimes up to 70%), it is difficult to find buyers in the secondary OTC market. This contrasts sharply with public exchanges, where investors typically receive returns from shorting tokens through positive funding rates. While understanding the intentions of participants in the secondary market is crucial, this trend may reflect the cautious approach taken by insiders in responding to the current situation.

Figure 4: Most tokens have a positive 1-year funding rate, Source: Coinglass

The Role of the Secondary OTC Market

Despite the bearish sentiment, the activity in the secondary OTC market is not entirely negative. In fact, the presence of an active secondary market plays a crucial role in the overall health of the wider crypto ecosystem. By facilitating the transfer of tokens between sellers and buyers, the secondary market allows traders to profit outside of traditional exchanges. This process can help mitigate the impact of large-scale token unlocks, which are often seen as bearish factors, as they bring greater selling pressure to the market.

By conducting these transactions off-exchange, the secondary market reduces the direct selling pressure that retail investors face when tokens are unlocked. This shift helps to build a more stable and resilient market, where token unlocks no longer inevitably lead to significant price declines, but instead support a healthier, more balanced market environment.

Interview with STIX Founder Taran

STIX is an over-the-counter trading platform for private cryptocurrency trading, and Taran is its founder. STIX was established in early 2023, and the main sellers on the platform are team members, early investors, and treasuries looking to sell locked token positions, while the main buyers include whales, family offices, and hedge funds. Below is a written interview with Taran.

How do you see the evolution of the secondary OTC market in the crypto industry?

The recent decline in new altcoins indicates that the prices of these protocols soared in early 2024, mainly because of their low circulation (demand exceeding supply). However, once the market turned to risk aversion in the second quarter, these altcoins were hit hard, with most of them falling by over 75%. Many of these altcoins experienced large and continuous unlocks, and the unlocked altcoins were almost immediately sold in the market, further affecting prices. Examples include Arbitrum, Starknet, Worldcoin, Wormhole, and others.

In the first and second quarters, these altcoins were also traded in large volumes off-exchange, mainly because early investors sought to reduce risk and allocate funds to more liquid assets (BTC, ETH, etc.) at prices 70-80% lower than their peaks. These data indicate that most altcoins were overvalued by at least 5 times, and as the circulating supply increased, prices further declined.

We increased the transparency of off-exchange trading prices in 2024, which drew attention to the actual importance of the OTC market. Buyers have various opportunities to purchase distressed positions, and sellers have various opportunities to conduct off-exchange trades without affecting the market. However, these trades involve a third party, the project team, which can prevent off-exchange trading for certain reasons.

The secondary market plays an important role in the following aspects:

Removing active sellers from the equity structure to prevent them from selling on public exchanges

Introducing new positive holders with a higher cost basis

Increasing the average cost basis of private holders

Controlling future supply (introducing new unlock periods, etc.)

Ensuring no private trades and full understanding of off-exchange trades

What major trends do you currently see in the secondary OTC market?

Two major trends:

1) **Treasuries of protocols that have not over-raised funds are now seeking to build their cash positions. We have supported multiple protocol treasuries to raise funds in the OTC market, where buyers buy at lower prices (with unlocks over a certain period) and treasuries increase their cash reserves. This allows for diversification, risk reduction, and ensures that the team has enough funds to surpass competitors.

2) **There are clear arbitrage opportunities for savvy trading firms: buying at lower prices off-exchange and hedging on exchanges, usually also consuming funding rates. This funding rate/off-exchange arbitrage exists in hundreds of altcoins and is a very profitable market-neutral trade for mature trading firms.

Do you think the buyer's market advantage will continue? What are your short-term and long-term views?

I don't think the funding rate/off-exchange arbitrage for most altcoins will end soon, as they still have 2-3 years left in their vesting periods, and most of them have positive funding rates.

The secondary market is very cyclical. In 2023, the vast majority of off-exchange trading volume was for pre-issued assets, mainly because many VC-funded protocols had not yet launched. Now that they have all launched, the market has shifted to trading locked tokens, which are generally lower risk due to their spot/perpetual markets and abundant data for analysis.

As monthly unlocks continue, sellers can also choose to continue selling on exchanges to reduce risk, rather than necessarily conducting off-exchange trades. However, assets that are still at risk prices (Ethena, Layerzero, IO.net, Aethir, etc.) still favor the buyer's market.

If altcoins see an uptrend in September and October, many sellers will contact us at STIX hoping to sell, as they have realized that reducing risk is always wise. Many sellers who did not want to sell in the OTC market in the first quarter will now want to sell at lower prices than in the second and third quarters. However, I don't think buyers are very optimistic about these premiums, so I believe the buyer's market will continue until 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。