August 27th Airborne: Bitcoin and Ethereum rebounded and shorted during the day

BTC/Daily Chart

On the daily level of Bitcoin, it closed with a full big yang last Friday. After two days of weekend oscillation adjustment, the price fell from 64500 today and is currently running above the 5 moving average. Combined with technical indicators, this kind of decline is not expected to continue too much. Therefore, the next move may see a small level rebound in the oscillation. As a result, only a rebound to short, and less probing for long positions. It is expected that there will be two ways tonight. The first is to continue to oscillate around the range of 63000 to 64500, and the second is to rebound near 64000 and then turn down again. In the medium-term, holding the high-level band short position is sufficient.

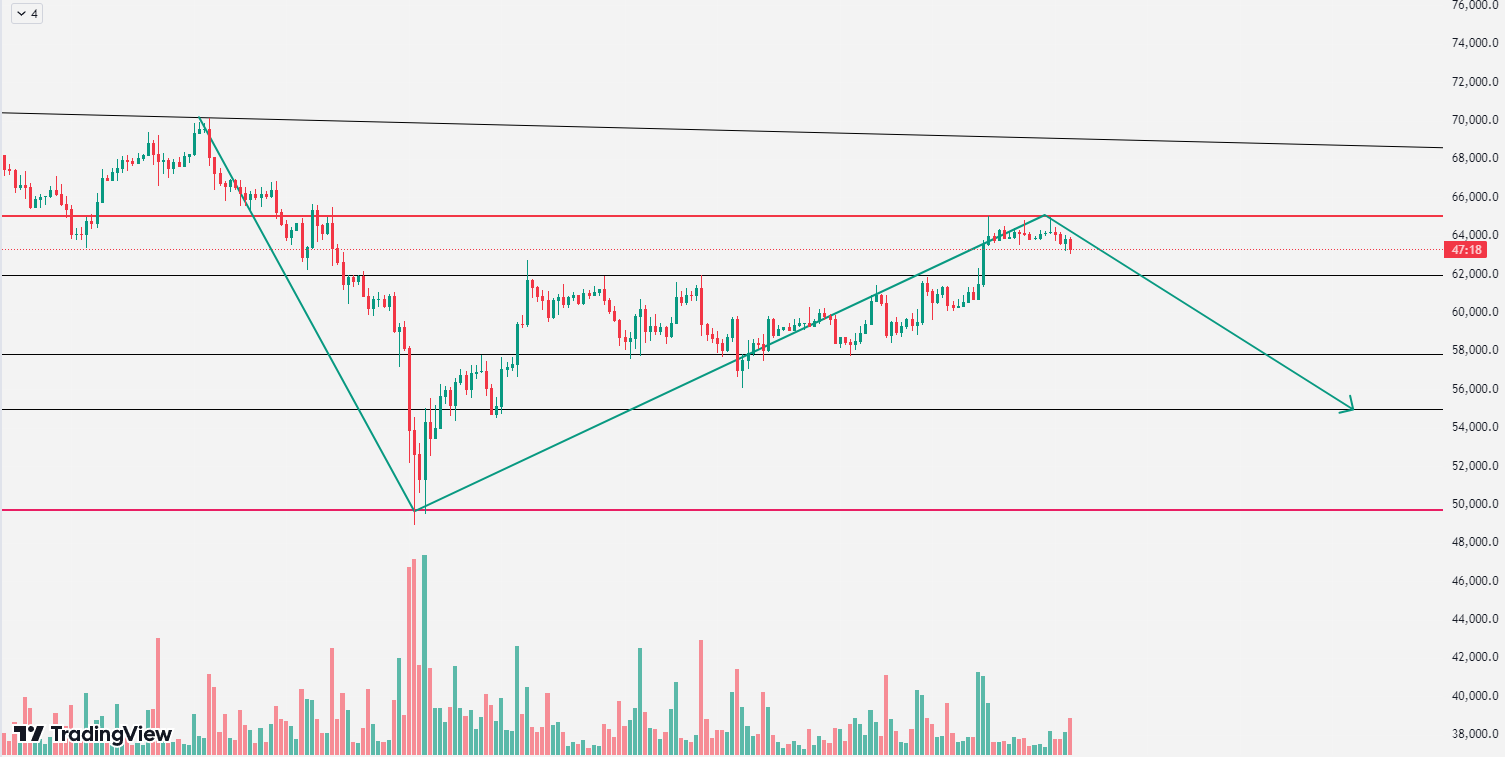

BTC/4H Chart

On the 4-hour level of Bitcoin, the price continued to test the resistance at 65000 in the early morning today, showing a double top pattern in the chart. Therefore, the next step is to wait for the stimulus of tomorrow's news. Regardless of how the data turns out, whether it is a rebound or a direct decline, the bearish trend cannot be changed in the short term. Today, the focus is on the situation above the 10 moving average at 64000. If this average is not effectively lost, the pressure will be maintained.

Strategy 1: It is recommended to go short with a light position at 64000 to 63500, stop loss at 65000, and target around 62300 to 60000.

The above is a personal suggestion, for reference only. Investment involves risks, and trading should be cautious.

There is a delay in posting, and the market is changing rapidly. The points mentioned in the article do not serve as a basis for following orders. For more information on the market and order execution, please refer to the real-time strategy of Airborne.

Scan the QR code below to follow the official account: Airborne

Comprehensive guidance time: 7:00 AM to 2:00 AM the next day

This article is original by Airborne, with over ten years of investment experience, having handled funds at the level of tens of millions, familiar with the operation of main funds, washing and absorbing chips, and boosting techniques. It can achieve the integration of knowledge and action in fund management, position control, investment portfolio, and investment mentality. It is good at judging and analyzing the trend of the overall market, proficient in various candlestick technical tactics, and has a deep understanding of wave theory, form theory, and index theory. Scan and follow the official account above for learning technical market exchange

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。