August 16th Airborne: Be cautious of Bitcoin's volatility, today's market price analysis and operational suggestions

The value of market research lies not in the price levels, but in human nature. Choosing the right position is much more important than choosing the right price level. The market is not suitable for those who are entangled. Those who are entangled will basically fall on the road of entanglement. Be brave, be aggressive. There are no so-called aggressive moves in the market, only what you call aggressive moves, because there is no such thing as aggressiveness in the market, only daring or not daring, not being afraid.

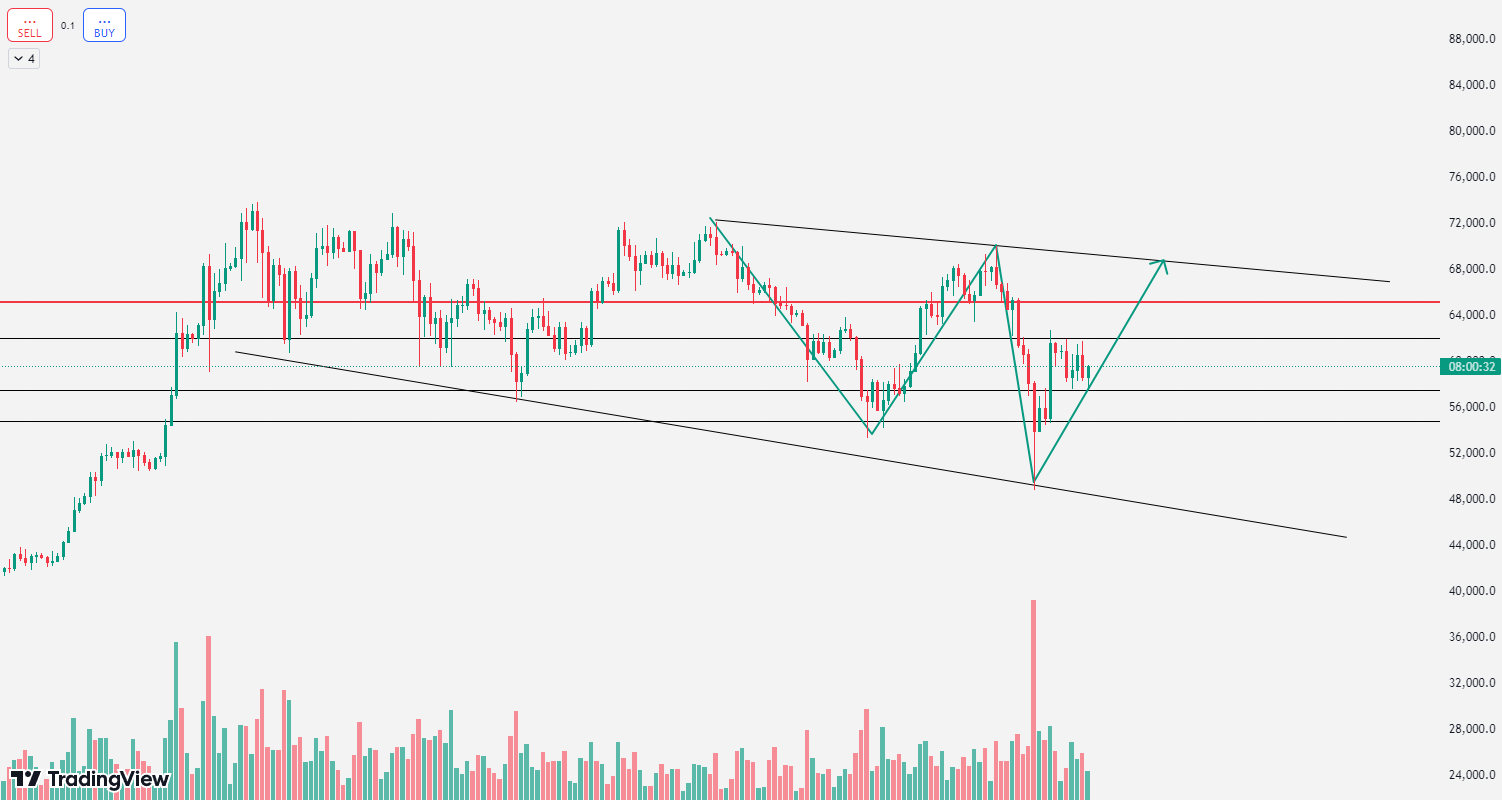

BTC/Daily Chart

On the daily chart of Bitcoin, yesterday's candlestick closed with a bearish tone, seemingly giving the bears time to catch their breath, but caution is required at all times. It is highly likely that there will be intermittent consolidation in the high range to facilitate recovery, but the overall downward momentum is not strong. This morning, there was another round of oscillation and retesting, with the lowest price receiving support near 57500 on Monday. Therefore, after the price drops near 57600 today, it may turn bullish again. The trend has clearly entered a range of oscillation between 57500 and 62000, with fluctuations of about 4500 points up and down. Therefore, it is still necessary to maintain the bullish trend, but buying at around 59500 is now more difficult. The prudent approach is to patiently wait for a retest, and then continue to buy near the short-term support at around 58000 to continue the bullish trend. The key resistance level to watch above is 62000. Once it is effectively broken, a strong upward movement may quickly push it to 63000 to 64000.

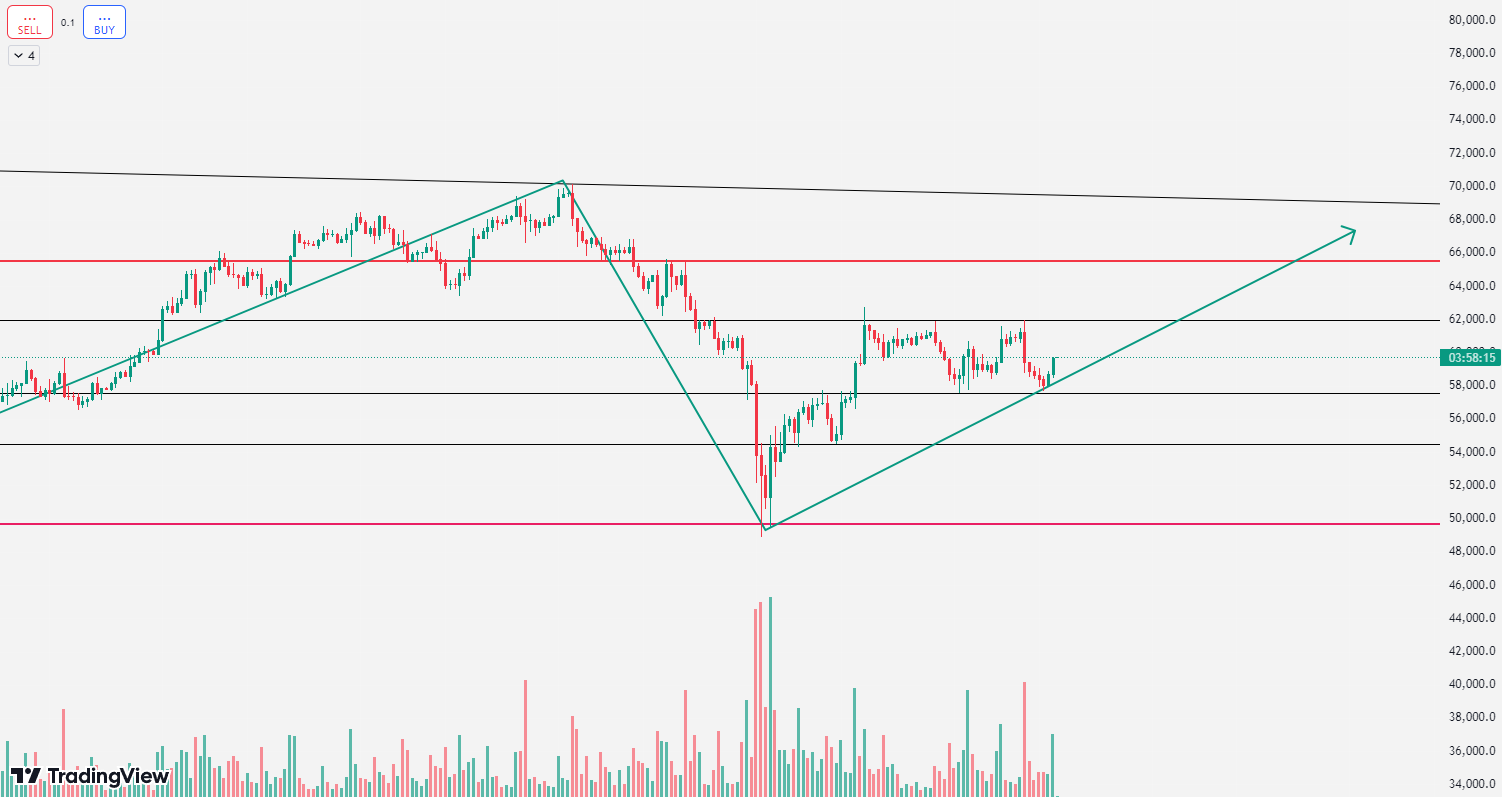

BTC/4h Chart

On the 4-hour chart of Bitcoin, it is currently temporarily under pressure below the high point of 62000, but it is also above the Monday support of 57600, maintaining a range consolidation pattern. The key pressure points during this period should be 62000 and the important support at 57500. If either side effectively breaks through, there is a high probability of a one-sided movement next. Hopefully, this won't happen, because if it does, it may be difficult to find opportunities for a bullish retest, and chasing after a strong upward movement would require sufficient volume, which may raise concerns about sudden profit-taking. Therefore, in this market, it is important to set a good stop-loss, unlike the slow pace of the daytime market, it is more prudent.

BTC/1h Chart

On the 1-hour chart of Bitcoin, from the comprehensive chart indicators, the bulls and bears are in a dilemma, and both sides are struggling to gain the upper hand. This situation will maintain a sideways movement or a converging triangle pattern, with support around 57500 and resistance between 62000 and 64000. Both long and short strategies can be considered when these levels are reached.

Strategy 1: It is recommended to short in batches/light positions from 62000 to 61500, with a stop-loss at 62400, and a target around 59000 to 58500.

Strategy 2: It is recommended to buy in batches from 58500 to 58000, with a stop-loss at 57500, and a target around 61500 to 62000. If the level is broken, consider a range around 63500.

The above are personal suggestions, for reference only. Investment involves risks, and trading should be cautious.

There may be delays in publishing, and the market changes rapidly. The price levels mentioned in the article do not serve as a basis for following orders. For more information on the market and order execution, please refer to the real-time strategies of "Airborne"

Scan and follow the official account below for comprehensive guidance: Band Airborne

Comprehensive guidance time: 7:00 AM to 2:00 AM the next day

This article is original content by "Airborne," with over ten years of investment experience, having managed funds at the level of tens of millions, familiar with the operation of main funds, washing and absorbing chips, and boosting techniques. It can grasp the integration of fund management, position control, investment portfolio, and investment mentality. Proficient in judging and analyzing the overall market trend, and well-versed in various candlestick technical strategies, with deep insights into wave theory, pattern theory, and indicator theory. Learn about technical market trends and exchange scans by following the official account above

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。