"Weekly Editor's Picks" is a "functional" section of Odaily Star Daily. In addition to covering a large amount of instant information every week, Star Daily also publishes many high-quality in-depth analysis content, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing you new inspiration from the perspectives of data analysis, industry judgment, and opinion output in the encrypted world.

Now, let's read together:

Investment and Entrepreneurship

A bull market does not mean making money, how to maximize profits in this cycle?

Unrealized gains are not gains. Avoid using leverage. Gradually reduce holdings. Prepare for the downturn. Look for asymmetric investments. When in doubt, focus on the long term. Strictly select investments. Keep the strategy simple. Be a big fish in a small pond. No private key, no cryptocurrency. Bet on the leader. Collaborate as a team. Compare altcoins with BTC. The trend is your friend. Don't be too attached to your highest net worth.

Interpreting the three keywords of the cryptocurrency market: emotion, politics, and expectation

The article elaborates on the three elements in order and provides examples.

Rationally view the market and manage risks well.

The author's views on funds, KOLs, exchanges, VCs, technology, marketing, BD, project parties, and retail investors.

Top-level narrative guides revolution, secondary narrative guides capital, tertiary narrative has a wealth effect, and quaternary narrative is nothing.

Upstream: The basic technology and infrastructure that enable the adoption of blockchain; including protocols and networks (L1/L2), RPC/node infrastructure, execution and consensus clients, execution environment, consensus mechanism, data storage, zkVM, data availability, etc.

Midstream: Platforms built on the underlying blockchain infrastructure; including economic security, automated market makers (AMM), yield derivatives, intent solvers, oracles, as a service (RaaS), staking and restaking, shared sorters, interoperability, decentralized identity (DID), lending markets, chain abstraction, data indexing, etc.

Downstream: Applications supported by upstream infrastructure; including centralized exchanges (CEX), decentralized exchange aggregators, order book decentralized exchanges, trading bots, games, centralized and decentralized finance (Ce-DeFi), on/off ramps, wallets, decentralized physical infrastructure (DePIN), social, gambling/betting, stablecoins, etc.

Upstream cryptocurrency infrastructure is becoming homogenized. The midstream is also becoming homogenized and ultimately commoditized. The downstream cryptocurrency application field still has a long way to go before reaching maturity. Front-end bloated applications are inevitable in seizing market share from midstream back-end applications.

A detailed analysis: An overview of Bitcoin's valuation scenarios in 2050

This analysis adopts a simple equation based on the velocity of money circulation, covering three core factors: the total volume of domestic and international trade settled in Bitcoin (GDP), the active circulation supply of Bitcoin (BTC), and the transaction speed of BTC.

Conclusion on Bitcoin price scenarios in 2050: Base scenario ($2.91 million), bear market scenario ($130,000), bull market scenario ($52.38 million).

After analyzing 581 DAOs, I found four major dilemmas of DAOs

Centralization paradox, technical time bomb, tug of war between democracy and efficiency, token dilemma.

Also recommended: "Web3 job market half-year report: surge in positions after Bitcoin ETF approval".

Ethereum and Scalability

Buyers are becoming increasingly institutionalized, Ethereum's old dreams and new realities

The value of Ethereum lies in its flexibility and its ability to support more complex applications than simple value transfers. Currently, the most prominent applications on Ethereum include stablecoins (payment tokens pegged to the US dollar), decentralized finance (rebuilding traditional financial services on the blockchain, such as lending), and tokenization (issuing financial assets on the blockchain).

In the post-ETF era, the most obvious beneficiaries will be real-world assets (RWA) and decentralized finance (DeFi) protocols, and we should expect ETH to reduce volatility as assets mature.

ArkStream Capital: Forty years of technological development milestones in zero-knowledge proofs

The article introduces the basic concepts and historical background of zero-knowledge proofs; then it focuses on the analysis of circuit-based zero-knowledge proof technology, including the design, application, and optimization methods of models such as zkSNARK, Ben-Sasson, Pinocchio, Bulletproofs, and Ligero.

In the computing environment field, the article introduces ZKVM and ZKEVM, discussing how they improve transaction processing capacity, protect privacy, and increase verification efficiency. The article also introduces the working mechanism and optimization methods of ZK Rollup as a Layer 2 scaling solution, as well as the latest developments in hardware acceleration, hybrid solutions, and dedicated ZK EVM.

Finally, the article looks forward to emerging concepts such as ZKCoprocessor, ZKML, ZKThreads, ZK Sharding, and ZK StateChannels, and discusses their potential in blockchain scalability, interoperability, and privacy protection.

Multi-Ecology

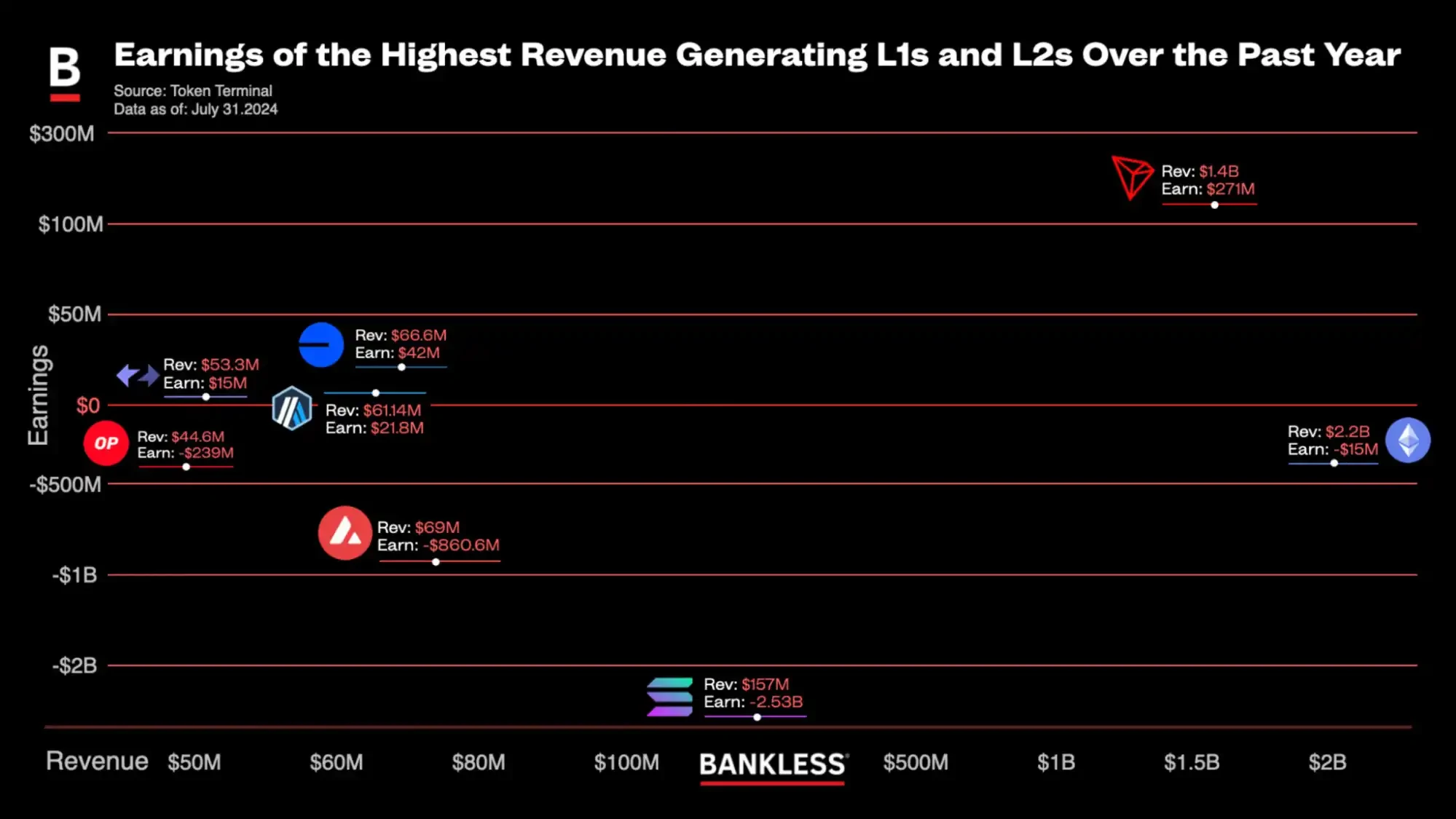

Public chain revenue rankings: Ethereum earns $2.2 billion annually, Optimism deep in the red

SOL Blink decryption: Technical secrets that even novices can understand

The biggest highlight of Blink is its ease of operation. Users only need to connect their wallets and make simple settings to directly engage in on-chain activities such as NFT trading on social media platforms like Twitter. This seamless integration greatly reduces the threshold for user participation and enhances the user experience.

The advantages of SOL Blink include: reducing entry barriers, seamless integration with social media, viral potential, and innovative business models.

SOL Blink's potential risks include mobile adaptation issues and scalability challenges.

The article also includes a detailed explanation of the steps to use SOL Blink.

Worries behind the prosperity: Is Solana possibly a "house of cards"?

False trading data, serious rug issues, unsustainable MEV fee income, losses for retail investors, and certain resistance in the fundamentals.

Another comprehensive research report is recommended: "Gate Ventures: Explaining Solana's technical architecture, is it about to have a second spring?".

Exploring the current development and future prospects of TON: How long can TON remain popular?

USDT plays an important role in the TON ecosystem, providing a stable digital dollar option that allows users to make fast and free payments globally.

The Bitcoin trust bridge is expected to go live this year, and its importance lies in introducing a trustless Bitcoin asset to the TON DeFi ecosystem, increasing the diversity of users and assets.

The TON Foundation plans to continue increasing TVL through rewarding liquidity providers and developers, introducing new DeFi products and use cases, and expanding community participation. The foundation is also researching ways to reduce dependence on TVL rewards to ensure the long-term stability and development of the ecosystem.

The number of developers on the TON blockchain has rapidly increased from the first quarter to the second quarter of 2024. The influx of talent is just the first step, and high-quality projects are on the way. The entire ecosystem is about to enter a period of prosperity. Developers bring good projects, which in turn attract more funds to the TON blockchain. The ecosystem is expected to flourish in one or two quarters.

Many excellent and experienced teams are deeply cultivating various tracks, not limited to DeFi, DEX, Yield Farming, or lending products, but also including DApps with practical value. Most importantly, Telegram Stars play a crucial role throughout the ecosystem.

Currently, interesting projects are emerging. The path to success for TON may not follow past experiences. Although DeFi is still relevant, the killer application for TON may be a combination of "gaming + finance".

CGV Research: More than just casual games, a deep analysis of TON's "ambition" in the payment track

The outbreak of TON's DeFi ecosystem still lacks the following conditions: onboarding of assets such as BTC, ETH, more diverse liquidity staking products, and more secure wallet infrastructure.

In comparison to Tron, TON has more advantages in the payment business, and the TON Foundation is actively promoting the application of USDT on TON. Payment will also serve as a key primitive, empowering the Telegram Mini App and serving various types of Social Web3 use cases.

Web3

Account abstraction is a framework and standard that can greatly enhance the functionality of encrypted wallets (accounts). Contract accounts integrate the unlimited functionality of smart contracts into wallets, significantly enhancing their functionality. These wallets can still hold funds but are no longer dependent on a single private key.

On the EVM, we have proposals such as ERC-4337 and EIP-7702, laying the foundation for AA.

Compared to "chatbots," AI Agents are more capable of autonomously completing tasks.

Representative projects for Web3 x AI Agent include GaiaNet (without on-chain operation capabilities) and Spectral (with on-chain operation capabilities).

Other early AI projects include: Zotto, AgentLayer, Olas Network, Theoriq, AgentCoin, Giza, Olas Network.

Security

Ultimate guide to Telegram security and anti-theft

Common pitfalls: social engineering to obtain verification codes, fake software, fake group verification SafeGuard.

Preventive measures include: not displaying phone numbers, enabling two-step authentication, setting accounts to not be pulled into unfamiliar groups by non-friends, and prohibiting non-friends from sending private messages, not storing large amounts of funds in bots, and clearing unused groups and contacts.

Weekly Hot Topics Recap

In the past week, Donald Trump delivered a speech at the 2024 Bitcoin conference: on the first day in office, he would dismiss Gary Gensler and establish a strategic Bitcoin reserve; the overall cryptocurrency market declined; following SEC approval, Grayscale Bitcoin Mini Trust began trading;

In addition, in terms of policy and macro markets, the Harris campaign team is establishing relationships with cryptocurrency companies such as Coinbase, Circle, and Ripple; Federal Reserve Chairman Powell: considering a rate cut in September, the committee's consensus is gradually leaning towards a rate cut; SEC announces Terraform compensation notice: prioritizing compensation for investors and creditors;

In terms of opinions and voices, Elon Musk: does believe that Bitcoin and some other cryptocurrencies have value; Vitalik: in the next ten years, we need to consider not only the first layer network but also its real impact on the world; Vitalik: the low point of cryptocurrency practicality is over, and Polymarket is performing well; QCP Capital: poor performance of ETH after the launch of a spot ETF, possibly due to factors such as lack of staking; ETF expert: SEC no longer considers tokens like SOL as securities and this does not increase their ETF approval probability; Coinbase Q3 2024 outlook: significant upward trend, decreasing relevance to cryptocurrencies; Matrixport research: bullish on BTC Q4 market, Cantor Fitzgerald CEO announces a $2 billion Bitcoin financing business and expresses support for Tether.

Institutions, major companies, and leading projects: FTX initiates the next phase of the liquidation process, and customers need to choose between the Bahamas or the United States process by 4:00 on August 17th; Polymarket adds a "Olympics" category; Eclipse mainnet goes live; the new Shiba Inu, Neiro, makes a multi-chain debut.

In terms of data, Solana's total market value surpasses BNB, ranking fourth; in July, Raydium, pump.fun, and Jito became the main sources of Solana fee income; Bitget report: TON ecosystem users play an average of 5 T2E games, with approximately 86% of respondents stating that they are playing Hamster Kombat.

In terms of security, a Google Chrome password manager error caused about 15 million users to lose saved passwords, the issue has now been fixed; Compound faces governance attack controversy, with a whale forcing through a $24 million proposal… Well, it's been another eventful week.

Attached is the "Weekly Editor's Picks" series link.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。