Original author: Jin Kang, crypto KOL

Translated by: Felix, PANews

On July 30th, derivative DEX ZKX announced the cessation of operations, citing the inability to find an economically viable path. However, some community users questioned the shutdown, as just over a month ago, it had announced a financing of $7.6 million, and the TGE had only just begun before the shutdown, which seemed unreasonable.

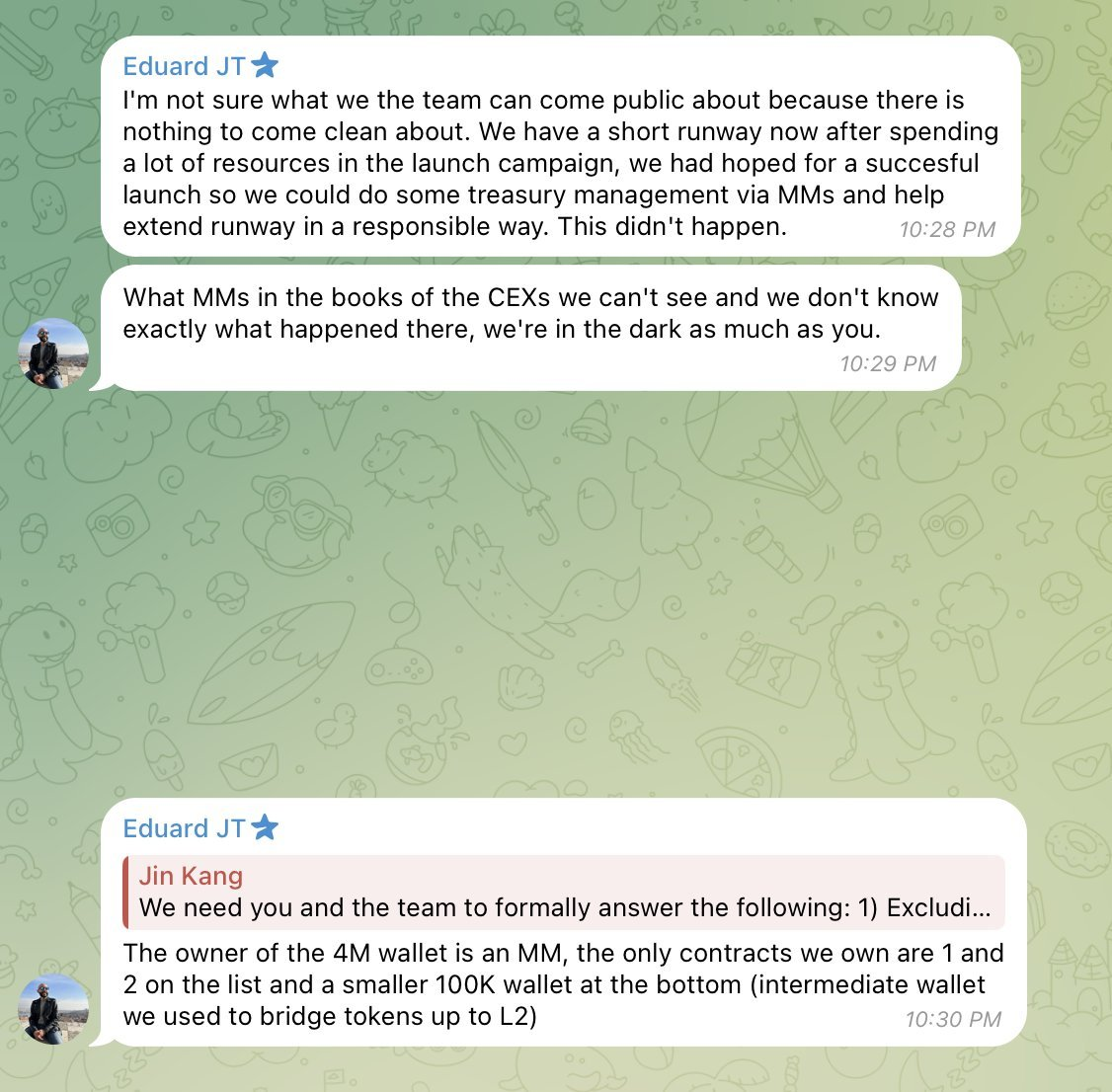

Founder Eduard responded on the X platform that the previous $7.6 million financing was raised from 2021 to 2024 to support a team of 30 people to build a dedicated blockchain for expanding perps, including multiple code audits with Nethermind, TGE listing costs, etc. All user funds have been refunded, and over 80% of users have exited the protocol. The core founders did not sell any of their allocated tokens.

However, this response did not "silence the crowd." Crypto KOL Jin Kang today exposed on the X platform, questioning the team's lack of transparency and publicly releasing conversations with the ZKX team, hoping that investors will speak out and requesting explanations from relevant market makers and CEX. The following is the detailed content.

If this is not a scam, then what is it?

- The team closed down 6 weeks after TGE due to "the inability to find an economically viable agreement path"

- Token ownership changed after TGE

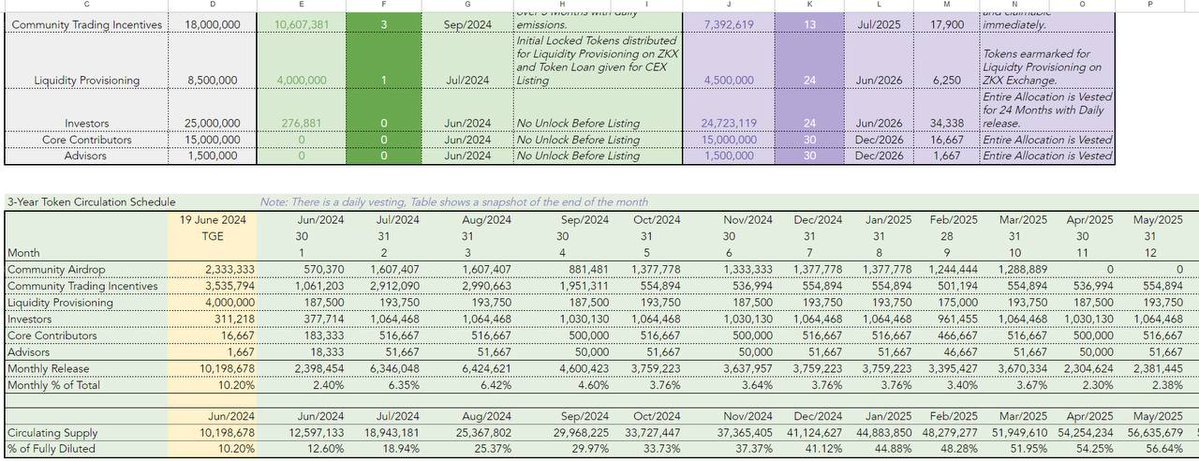

- Circulation increased at TGE (compared to the white paper), leading to a sharp price drop

After ZKX TGE, the price dropped by over 50% in the first 24 hours.

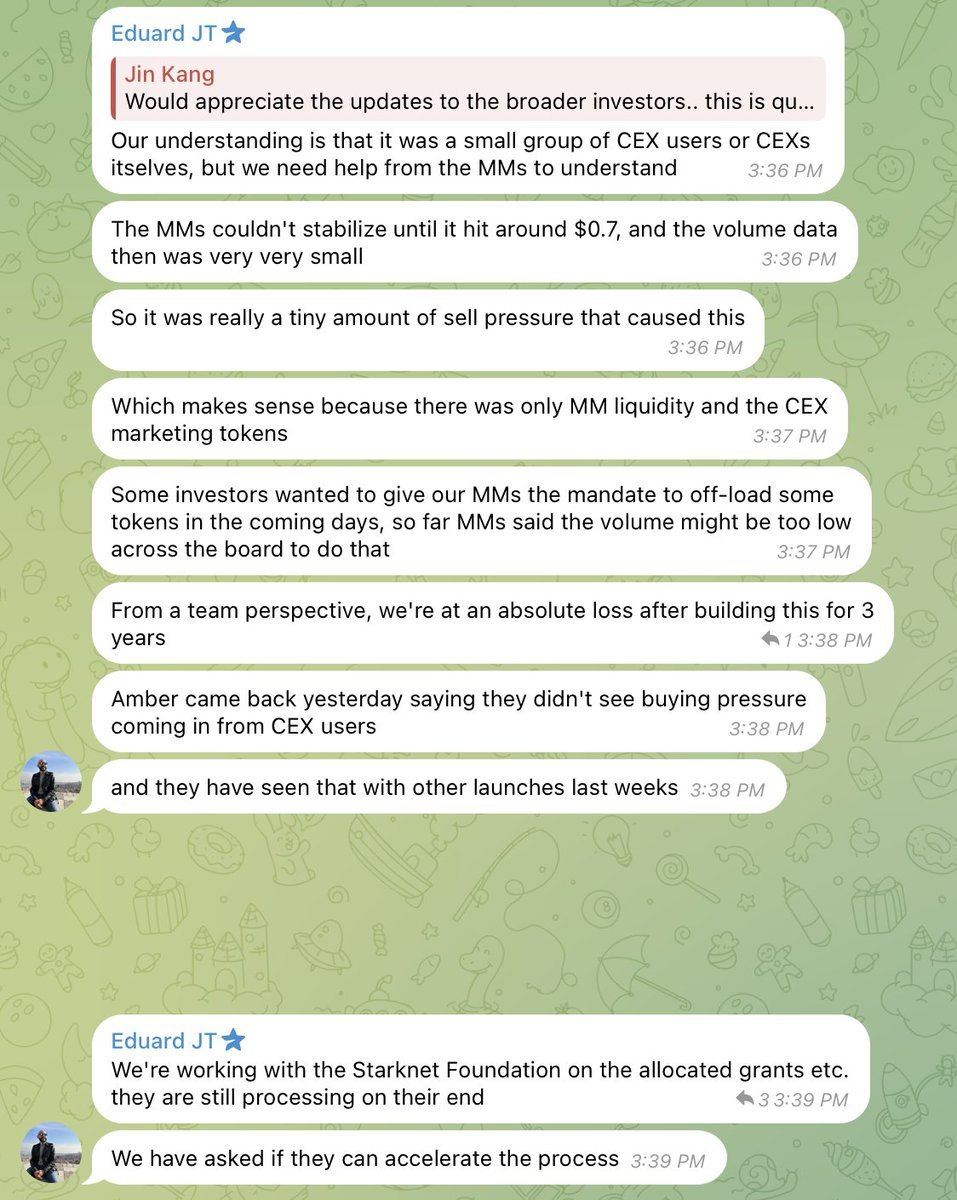

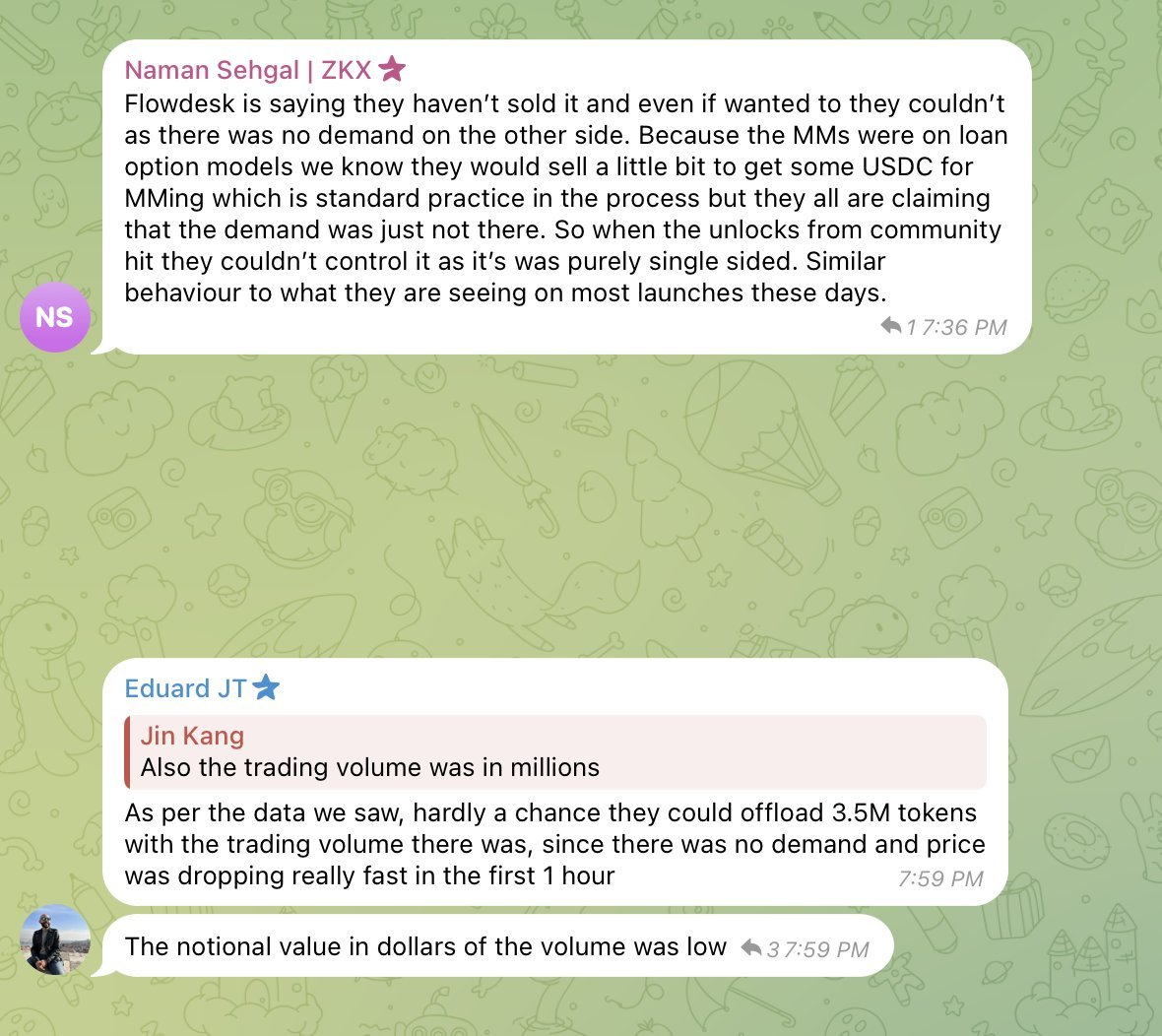

The team's explanation was that market makers such as Amber Group, Flowdesk, and IMC were unable to stabilize the price at $0.7 because of a small number of users selling off.

They claimed to be waiting for funding from the Starknet team to resolve this issue.

The team mentioned that they are working with the Berachain team for potential migration and hinted that if necessary, they could spend $1 million, but in any case, they are willing to conduct a guided launch.

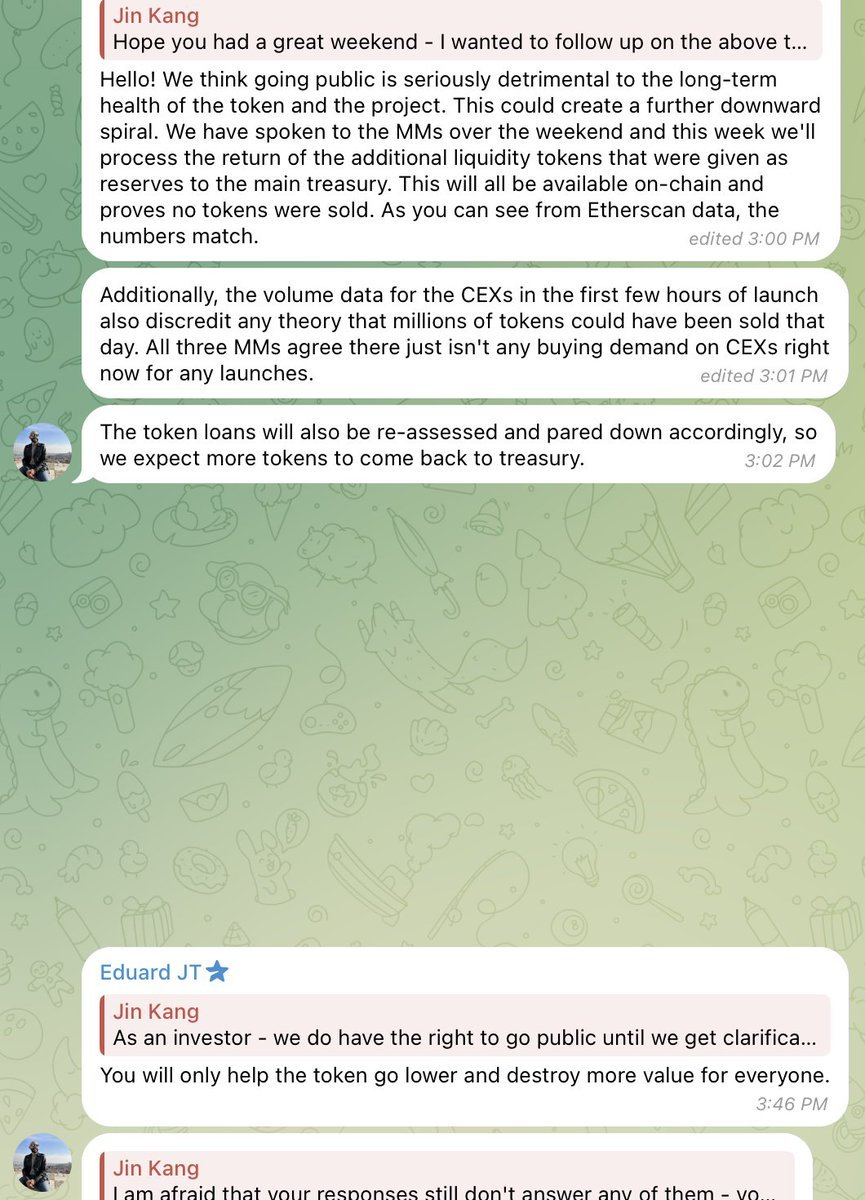

But in less than 6 weeks, they announced the shutdown of the project.

The ZKX team concealed key facts and attributed the price drop to market makers:

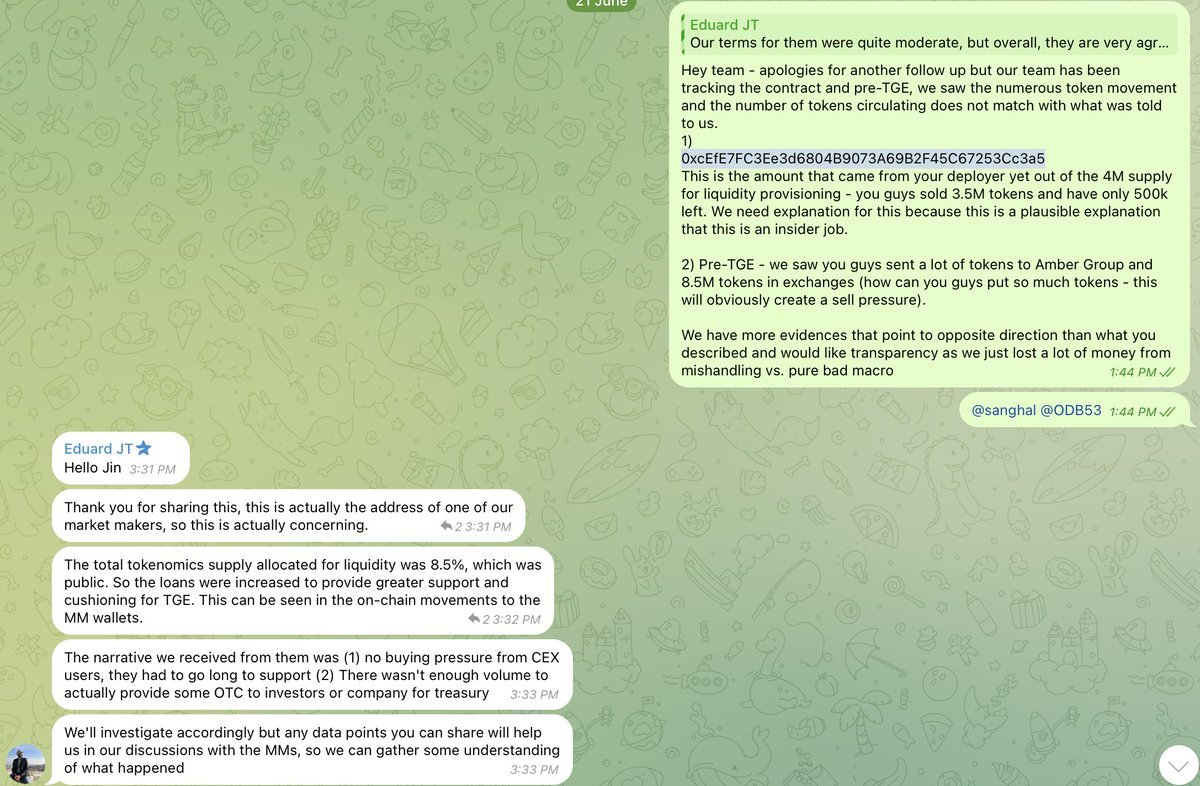

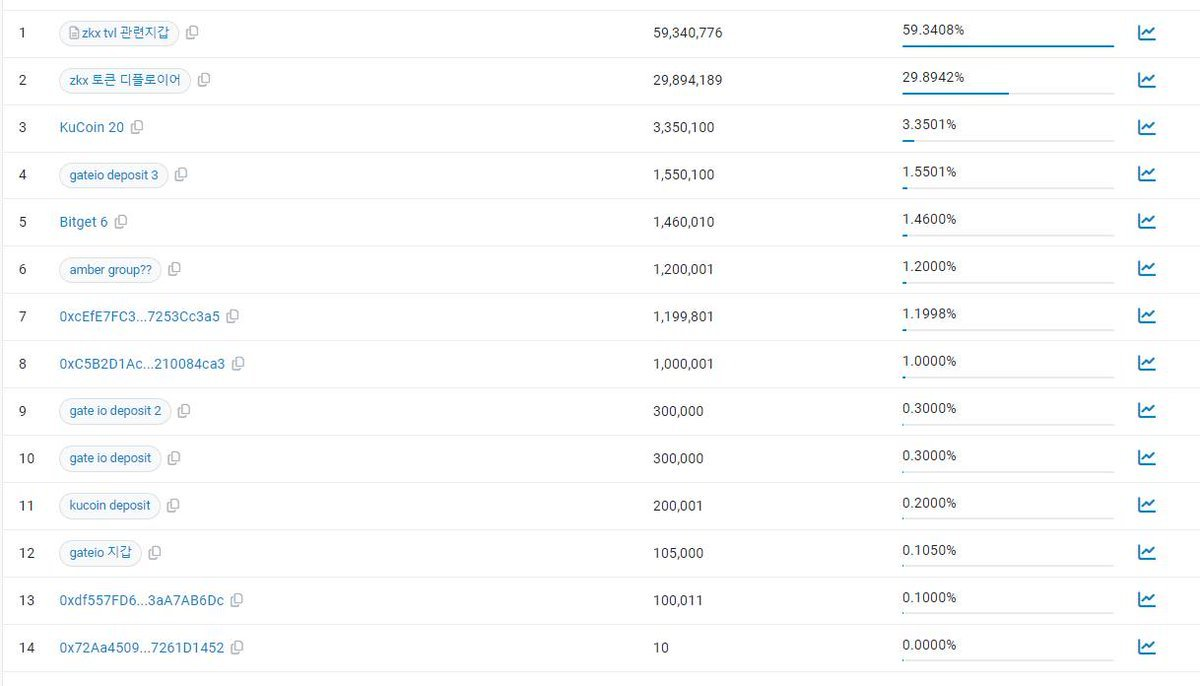

- Claimed that one market maker sold 3.5 million out of 4 million tokens during TGE: https://etherscan.io/address/0xcEfE7FC3Ee3d6804B9073A69B2F45C67253Cc3a5#tokentxns

- Increased loans to market makers to support liquidity

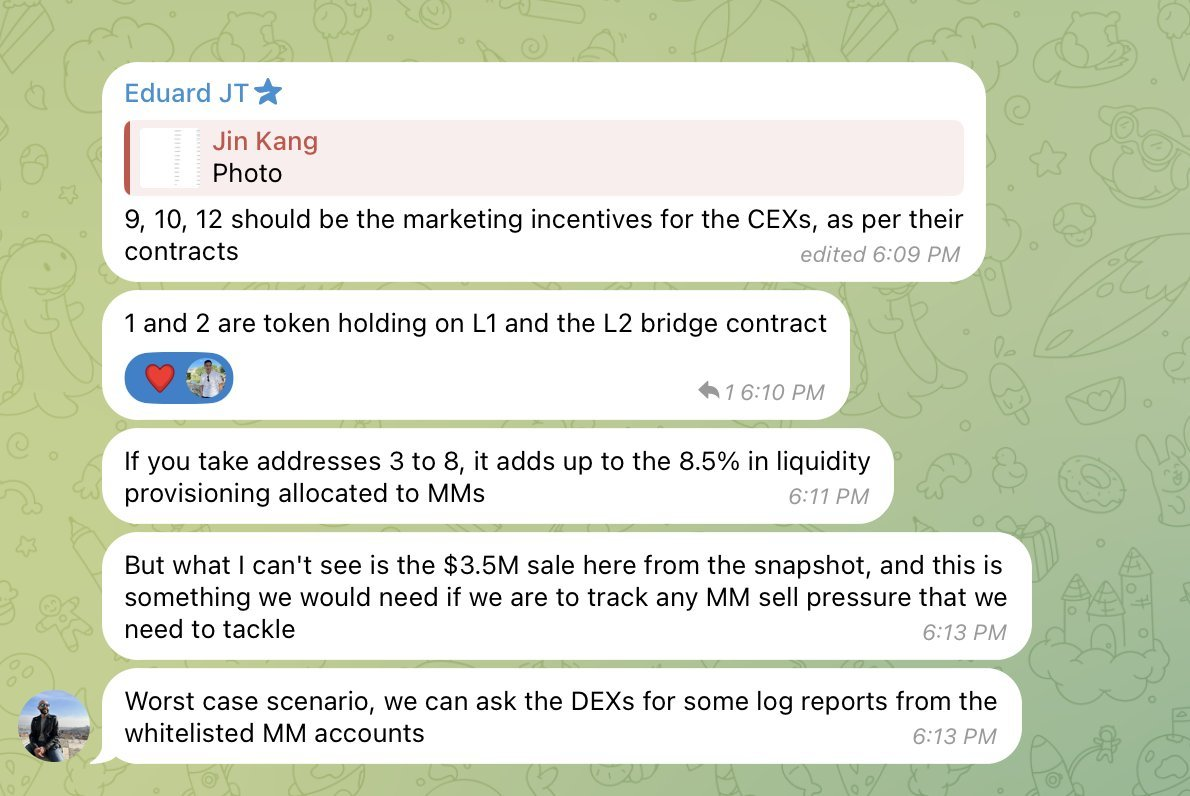

The first image below is a wallet snapshot before TGE. The second image is the token economics, showing that over 10 million tokens were in circulation before TGE (inconsistent with the token economics). The third image is CEX marketing incentives, which require confirmation from Gate, KuCoin, and Bitget.

It is worth noting that in the first 9 hours after TGE, the ZKX team blocked all transfers from Starknet to the mainnet.

All transactions during this period came from the team/market makers/CEX. During this time, approximately 1 million tokens were sold off. The team denied this.

As market makers require liquidity, they changed the token economics at the last moment of TGE, increasing the market maker's allocation from 4% to 8.5%.

During the first 9 hours after TGE, when only CEX/market makers/teams owned ZKX, the reasons for the CEX price collapse were unknown. Investors were not informed throughout the process.

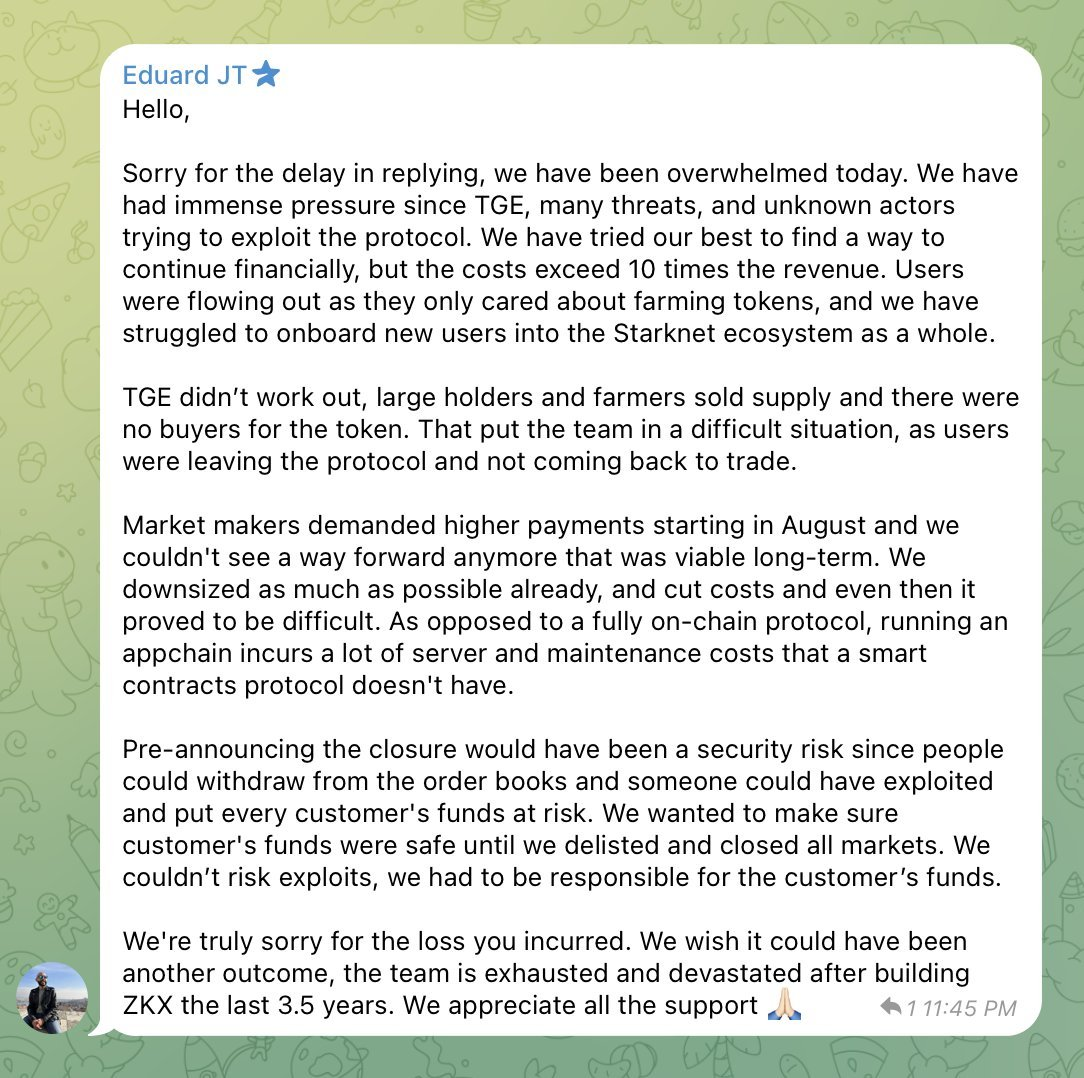

What's worse is that they were given time to clarify. But a month later, they closed the project due to insufficient funds, claiming to have been dealing with various threats (the source of the threats is unknown).

The team did not explain how the $7.6 million was spent over the past three years, nor did they explain why the TGE failed.

If the loans requested by market makers Amber Group, Flowdesk, and IMC were actually double (overloaned), then these market makers should provide an explanation.

CEX platforms CoinEx Global, Gate, KuCoin, Bitget should provide an explanation on whether they sold off marketing incentive tokens.

If not, then the ZKX team is lying.

In the communication with the team, the ZKX team was not transparent.

Due to high costs (no subsidy from Starknet?) and a payroll of over 30 people, how did they spend $7.6 million in less than 3 years? This is unheard of.

Hope that other ZKX investors can come forward to express their opinions. The crypto industry needs to eliminate such opaque behavior, and the Starknet team needs to explain why they support this project.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。