As the price of SOL tokens continues to rise, the Solana ecosystem has once again become a hot topic. Many new novice users do not know how to operate. I will introduce in detail through an article how to play in the Solana ecosystem and how to issue coins.

1. Determine the Direction of Coin Issuance

First, you need to figure out where you want to issue coins for your project within the Solana ecosystem. There are currently two main directions for issuing coins in the Solana ecosystem: traditional coin issuance and PUMP coin issuance.

Traditional coin issuance: After issuing a token normally, create a pool on a decentralized exchange and then trade. This process is similar to BSC and ETH chains.

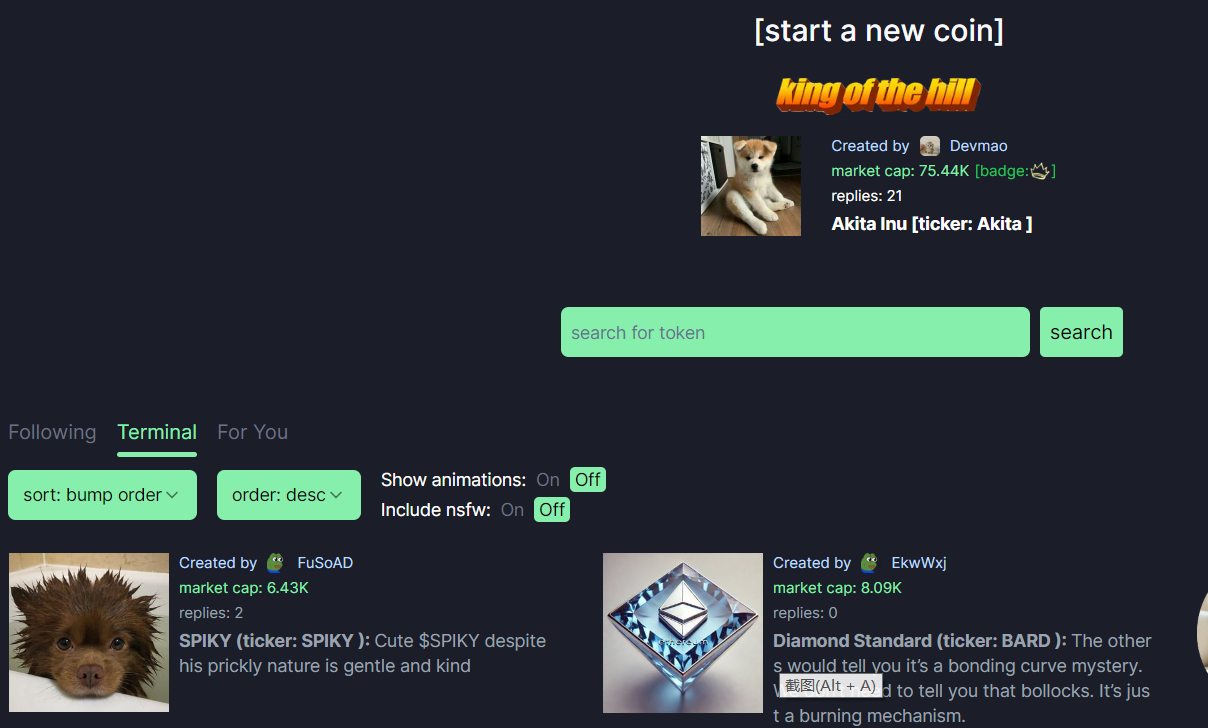

PUMP coin issuance: PUMP.fun is a platform for issuing MEME coins, and there are many meme projects on it that are very popular with foreigners. After issuing coins on this platform, there is no need to create a pool, and trading can be done directly on PUMP. When there are 85 SOL in the PUMP pool, PUMP will help you launch it on Raydium.

Each of these two directions has its own advantages and disadvantages. Traditional coin issuance is more suitable for regular operations and management, but it requires some costs. PUMP coin issuance has lower costs, but it is not as popular, and many people do not understand it. The specific direction to choose depends on how your project operates.

2. Find the Hotspot for Coin Issuance

When issuing coins on Solana, it is basically all about MEME coins, with no burning, destruction, or dividend mechanisms. So before issuing coins, you need to find a hotspot or event. Then, based on this hotspot event or figure, promote it to gradually gain traction.

For example, animal coins like PEPE (frog), SLERF (sloth), CAT (cat), and so on, are one direction. Or celebrity coins, such as Trump, MASK (Elon Musk), are also a direction. Or feature coins, like MAGE (Trump attack event), Olympic, iKUN (Aikun), and so on, are also possible.

In short, it's about chasing hotspots and finding figures, and doing whatever is trending.

Once the direction is determined, you can officially issue coins. Generally speaking, issuing coins on Solana is quite complex and requires the use of coin issuance tools to complete. There are many coin issuance platforms in the market for Solana, and I recommend using PandaTool. It is mainly because of its good service, and volunteers are available for consultation if you have any questions. Some other overseas platforms are also good, but it's difficult to find customer service for assistance.

Traditional coin issuance tool: https://solana.pandatool.org/ Traditional coin issuance is actually quite simple. Open the coin issuance tool, fill in the relevant token information such as name, abbreviation, quantity, logo, etc., click create, and confirm with your wallet.

PUMP coin issuance tool: https://solana.pandatool.org/createpump

PUMP coin issuance may be a bit more complex. In addition to filling in token information, you can also bind your wallet to buy tokens at a low price at the same time as issuing coins, in order to target the bots.

It is important to note that the coins issued through PUMP have no permissions, and there is no authority for additional issuance or blacklisting.

4. Create a Liquidity Pool

Taking traditional coin issuance as an example, if you want the token to be tradable, you need to create a liquidity pool. This liquidity pool can be created on decentralized exchanges, and there are three main places on Solana to create liquidity pools: Raydium, Metaora, and ORCA. Currently, Raydium is the most popular. Now, let me briefly explain the differences:

Raydium V2: All K-line market websites and bots support it, but the creation cost is relatively high, with a one-time pool creation cost of about 0.5 SOL, and at least 0.55 SOL for ID creation.

Raydium V3: The new version of Raydium, with lower costs and no need to apply for an ID, but there are not many bots that support it.

Orca: No need to create an ID, the cost of creating a pool is about 0.55 SOL, but the trading price cannot fluctuate too much, and there is a certain protection mechanism.

Metaorca: A new exchange, with low creation costs, but the interactive UI is not well done, making it not particularly convenient to use.

In my opinion, it is still more suitable to create a pool on Raydium V2, as it is an established, stable, and well-ecosystem platform. If you want to create an ID at a lower cost, you can also do it here: https://solana.pandatool.org/market

5. Marketing and Promotion

After creating the pool, the next step is to carry out marketing and promotion, which basically involves doing the following:

Website: Create an official website to promote project information.

Telegram group: Create a Telegram group for users to communicate and exchange ideas.

X account: Almost all projects in the crypto community promote on X, and through X, you can regularly disseminate major developments of the project.

Logo placement: Although Solana tokens will display logos in browsers, platforms like Ave and Dextool do not display logos, so you need to apply to these platforms to display the logo.

If the budget allows, you can also find some KOLs and media to report and promote the project, in order to increase the project's visibility and attract more peripheral users.

6. Airdrops and Market Value

Airdrops are actually a good way of promotion, by conducting marketing activities and airdropping tokens to users to expand influence. If you find it troublesome to airdrop to hundreds or thousands of addresses at once, you can use a bulk transfer tool to improve efficiency: https://solana.pandatool.org/multisend

In addition to airdrops, it is also necessary to effectively manage the market value of the project and control the price trend of the token to avoid significant deviations. Typically, we would use a market value management tool to accomplish this, such as: https://solana.pandatool.org/swapbot

Basically, the entire project operation introduction ends here. From coin issuance to market value management, it requires comprehensive and meticulous operation to complete. I hope that after reading this article, everyone can better carry out the operation of Solana projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。