First, review the article from yesterday. The Master placed a short position in the 69,000-69,400 range. The market rose to near 69,381 at 10 pm and then fell to 66,624. The first target of 68,200 and the second target of 67,400, as mentioned in the article, were both accurately reached, resulting in a profit of 2,000 points from the short position.

Hot Topics from the Master:

Yesterday, Trump announced that if elected, the United States will retain all the Bitcoin it currently holds and will acquire in the future. This will serve as the core of the strategic national Bitcoin reserve.

This means that the U.S. government will not sell the Bitcoin it holds and will include Bitcoin in the national reserve. This may become the next important narrative after the Bitcoin spot ETF, indicating Trump's positive attitude towards cryptocurrency and potentially bringing more opportunities and less regulation.

After the Bitcoin spot ETF, the inclusion of Bitcoin in the national strategic reserve will create a completely new market narrative.

Trend Analysis from the Master:

BTC 1-hour chart:

Currently, due to the volatility caused by Trump's remarks at the 2024 Bitcoin conference, the upward trend brought by the positive news still exists. Therefore, the bullish view can be maintained.

The current chart analysis does not show significant changes compared to the Master's analysis from the previous day.

Despite the increased volatility, the price is still moving within the support and resistance ranges marked by the Master yesterday.

If you understand the support and resistance levels from yesterday, the current situation is easy to understand.

Resistance Levels:

First Resistance Level: 68,200

Second Resistance Level: 69,000

If the price breaks through and successfully tests the first resistance level at 68,000 and finds support, the Master will continue to maintain a rebound view.

The stability at 68,000 also means breaking through the first resistance level, which can lead to a bullish mindset.

Support Levels:

First Support Level: 66,400

Second Support Level: 65,700

First, in the area where the first support level overlaps with the 60-day moving average, the candlestick formed a lower shadow and a rebound.

If the low point moves up, the Master expects the price to close above the first support level, and attention should be paid to the upward trend of the 60-day moving average.

Today's Trading Suggestions:

In today's trading, given the high volatility, position management should be carried out in the event of sharp declines or rises.

Risk management should be considered first, and the bullish view should be maintained.

The current candlestick chart shows the formation of shadows after sharp rises and falls. Therefore, it is advisable not to chase after sharp rises or falls in the market.

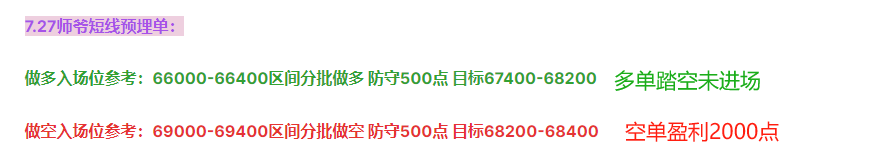

Short-term Pre-set Orders by the Master on 7.28:

Long Position Entry Reference: 66,000-66,400 range, gradually enter long positions, defend 500 points, target 67,400-68,200

Short Position Entry Reference: 69,000-69,400 range, gradually enter short positions, defend 500 points, target 68,200-68,400

This article is exclusively planned and published by Master Chen (WeChat public account: 币神师爷陈). If you want to learn more about real-time investment strategies, how to get out of a predicament, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication. Hopefully, it can help you find what you want in the cryptocurrency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend. Daily updates on macro analysis articles across the web, technical indicator analysis of mainstream and altcoin prices, and long-term replay price predictions for spot contracts.

Friendly reminder: Only the column public account (shown in the image above) is written by Master Chen. The end of the article and other advertisements in the comments section are not related to the author. Please be cautious in distinguishing between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。