The launch of the Ethereum spot ETF is expected to have a positive impact on the price of ETH and the entire cryptocurrency sector. However, the trap of "buying on rumors, selling on news" has been executed very well, as the price hit a low of nearly $3000 before the daily close. In addition, the price of BTC has shown significant strength, so if the bulls manage to push Bitcoin above a key range, a strong upward trend may begin.

Bitcoin (BTC) Price Analysis

Shortly after breaking through the temporary resistance, the market began to speculate that BTC would fall below the lower support level of $63,500. However, with the price receiving significant bullish momentum, liquidity seems to have flowed back into the leading token, pushing the price above $65,600 once again. The price is now close to reclaiming one of the key resistance levels, signaling the possibility of continued bullish activity, paving the way for a bullish close this month.

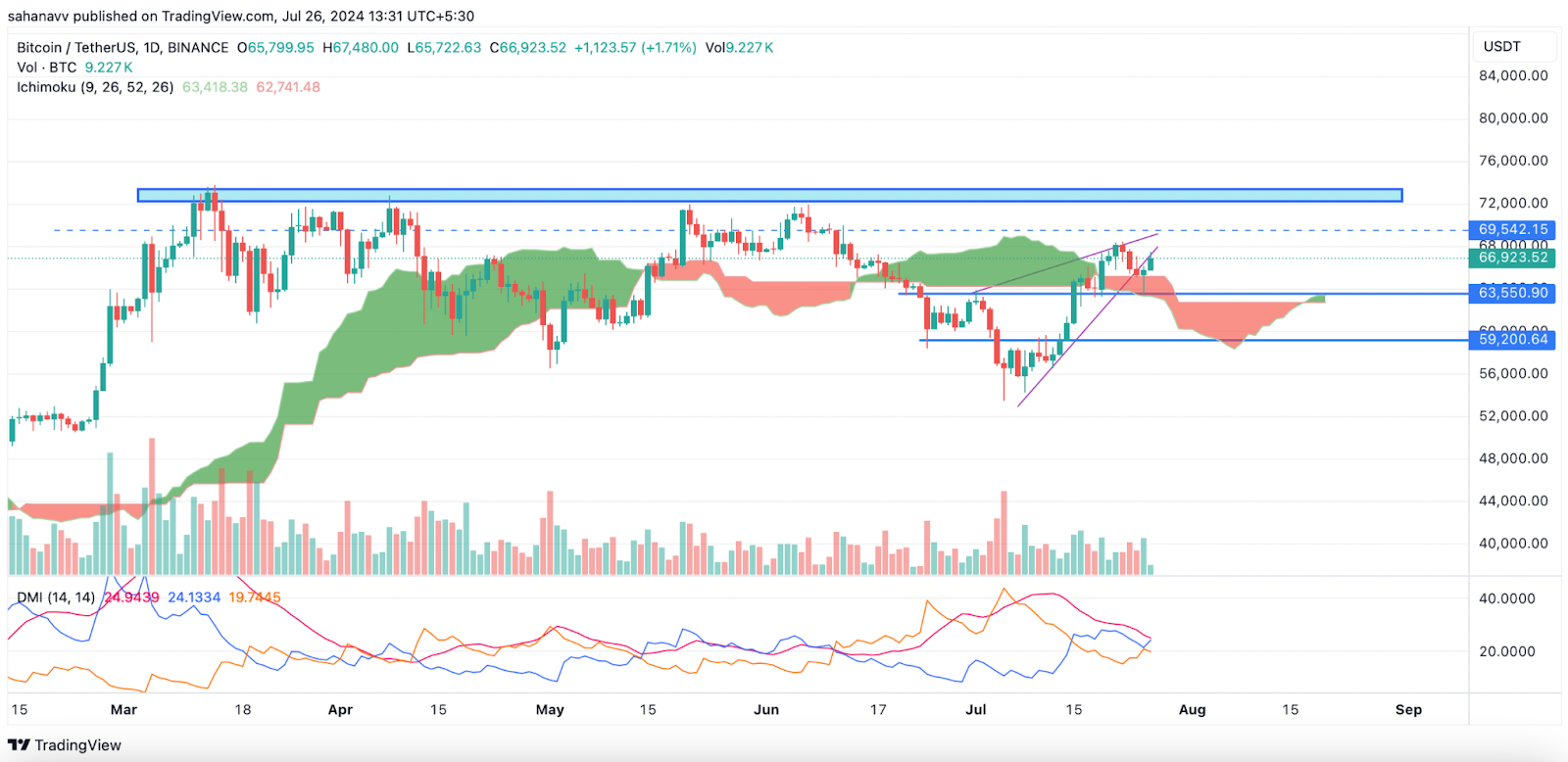

As shown in the above chart, BTC price is trapped in an ascending wedge, and after completing a retracement, the token is ready for a new round of bullishness. After weeks of continuous bearishness, the Ichimoku cloud has turned bullish, and the DMI level has rebounded before issuing a bearish signal. Therefore, the likelihood of continued bullishness seems quite high, as Bitcoin bulls appear to be ready to lead a breakthrough above $68,000 in the coming week.

Ethereum (ETH) Price Analysis

Following the recent launch of the ETH ETF, traders took advantage of the opportunity to profit, leading to a significant price drop. The token rebounded from $3000, falling from around $3500 during the consolidation period to the current level of around $3150. However, the current trading pattern has opened the door to more bearish action, as the bulls seem to have not taken the lead despite recent bullish divergences.

ETH broke through a key support area, signaling bearishness for the second largest token. Buyers have entered, but sellers have enough dominance, leading to the possibility of falling below $3000. The MACD has issued a "sell" signal as selling pressure increases, but the RSI rebound shows bullish potential. However, the likelihood of lower highs is greater, activating lower targets. If the bulls manage to push the level up to the area between $3265 and $3322, turning the support level into a resistance level, the bearish narrative may be suppressed.

For more information, you can follow AICoin's official WeChat account!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。