Original author: Xiyu, ChainCatcher

Original editor: Marco, ChainCatcher

On July 24th, ChainCatcher reported that the leading decentralized derivatives trading platform dYdX was planning to sell its dYdX V3 trading software.

However, within less than an hour of this news being leaked, the dYdX V3 website (dydx.exchange) was attacked by hackers. The hackers first took over the website and then implanted phishing website links. Once users authorized information, there was a possibility of their assets or information being stolen.

After the news of the planned sale of V3 was exposed, the domain name was attacked by hackers, leading the community to speculate whether this was purely coincidental or a long-planned action.

The sale and security turmoil of dYdX triggered a series of chain reactions, with users and investors showing clear signs of concern. The price of the DYDX token quickly dropped in response to this news, falling from $1.45 to a low of $1.23, a drop of over 15% within the day. At the time of writing, the coin price was fluctuating at $1.27.

Why sell V3? Is the dYdX team trying to cash out? Why did the hackers choose this timing to attack? Can DYDX tokens still be held? These and other questions are flooding the community chat pages.

Intention to sell dYdX V3, unrelated to dYdX Chain

Bloomberg reported that dYdX is in negotiations to sell part of its derivative trading software (dYdX V3) to potential buyers. It is reported that Wintermute Trading and Selini Capital are among the potential buyers of dYdX V3 software, but the specific amount has not been disclosed.

As the leader in the DeFi derivatives field, the rumor of dYdX selling V3 has attracted widespread attention in the crypto community. However, most community users are more concerned about whether the V3 being sold is just the trading software or if dYdX is packaging the entire brand for sale. Could it be that the dYdX team is completely exiting, considering that the V4 version dYdX Chain launched last year is managed by the DAO community? What impact will this event have on the overall dYdX ecosystem? How will it affect the price of DYDX tokens?

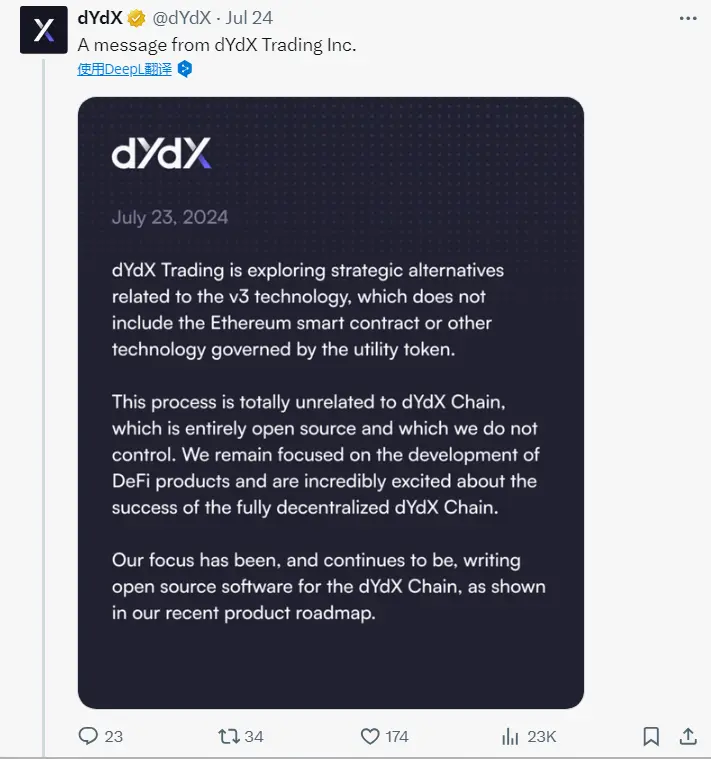

In response to the news of the sale of V3, the official dYdX statement on social media explained that dYdX Trading is exploring alternative strategies related to V3 technology, which does not include Ethereum smart contracts or other technologies managed by the DYDX token, and this process is unrelated to dYdX Chain, which is the focus of future development.

It further explained that the dYdX V3 exchange is supported by the operational entity dYdX Trading's trading engine, and all funds and settlements on V3 occur on smart contracts controlled by DYDX token holders. The trading fees on V3 also belong to dYdX Trading.

With the launch of V4 dYdX Chain, all dYdX transactions will eventually migrate to this chain, and all transaction fees paid on this chain will belong to validators and DYDX stakers.

It emphasized that the dYdX Chain code is open-source and completely decentralized, aligning more with the development philosophy of DeFi products, and the focus in the future will be on building products around dYdX Chain.

In response to this statement from the dYdX official, community user Bobo summarized to ChainCatcher, "It seems that the rumor of dYdX selling V3 is true, but only V3 trading software is being sold, which does not have a significant impact on dYdX Chain. Currently, the main business focus of dYdX is also on dYdX Chain, and the price of DYDX is directly related to the transaction fee income of dYdX Chain."

User @atg1688 also expressed that dYdX is only selling the V3 trading software, which is owned by the organization dYdX Trading, while dYdX Chain is operated by dYdX Foundation, and the impact is not significant.

Long-anticipated V3 domain vulnerability finally breached by hackers

However, within less than an hour of the news of dYdX V3 being in negotiations for sale, the V3 domain was found to have been attacked by hackers.

On July 24th, the dYdX official statement warned that the dYdX V3 website domain (dydx.exchange) had been compromised and advised against visiting the website or clicking on any links. However, dYdX V4 was not affected.

The hackers successfully exploited the vulnerability, tampered with the domain's DNS records, and redirected users to a malicious website when accessing dYdX V3. Users encountered phishing attacks when visiting the malicious website, and there was a high possibility that some users' private keys and assets would be stolen.

Fortunately, this hacking attack only targeted the network domain name, and the underlying smart contracts were not affected. The funds of users on the dYdX platform were not impacted. The V3 domain vulnerability has been fixed, and the website has been restored to normal operation. dYdX stated that dYdX Chain, dydx.trade website, and V3 protocol were not attacked.

However, some community users are not satisfied with dYdX's handling of the vulnerability.

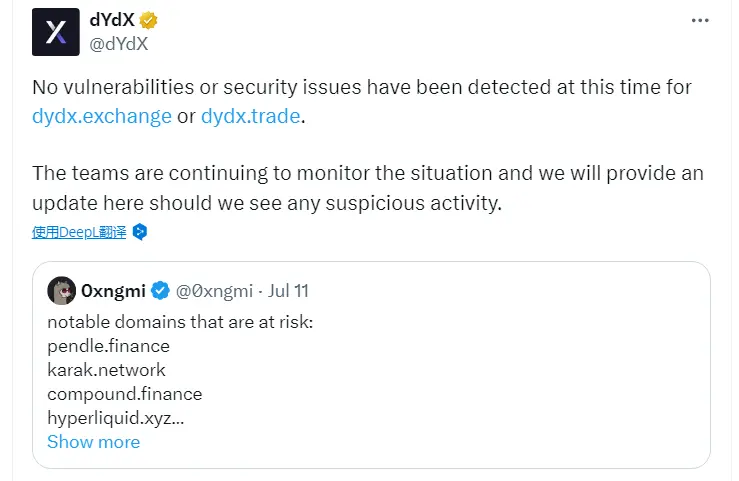

This is because as early as July 11th, a user had warned that dYdX's domain had the same vulnerability as Compound and Celer protocols. However, after the dYdX official response that no vulnerabilities or security issues had been found, there was no further communication or early deployment of related countermeasures.

As a result, some users view this hacking attack as a warning of dYdX's negligence.

The timing of the hacker's attack on the dYdX V3 domain, coinciding perfectly with the news of the V3 sale being leaked, has led the community to suspect whether it was a long-planned action.

Some users expressed that dYdX V3 faced a security crisis and a potential business transaction at the same time, making dYdX hit two birds with one stone.

Is dYdX selling V3 for "cashing out" or for ecosystem development?

Compared to the security attack, users are more puzzled by dYdX's decision to sell V3. According to dYdX's original plan, with the launch and operation of the V4 version dYdX Chain last year, all transactions were supposed to transition to V4, and V3 was to be gradually phased out. However, dYdX is now attempting to sell V3.

In the DeFi field, overall project buyouts and sales are rare because most projects use open-source software, meaning that others can use, modify, and rebuild without the need for a purchase.

A DeFi OG player expressed to ChainCatcher, "In the DeFi industry for so long, I've seen platforms shut down, coins sold off, and exits. dYdX directly selling a trading platform is truly unprecedented."

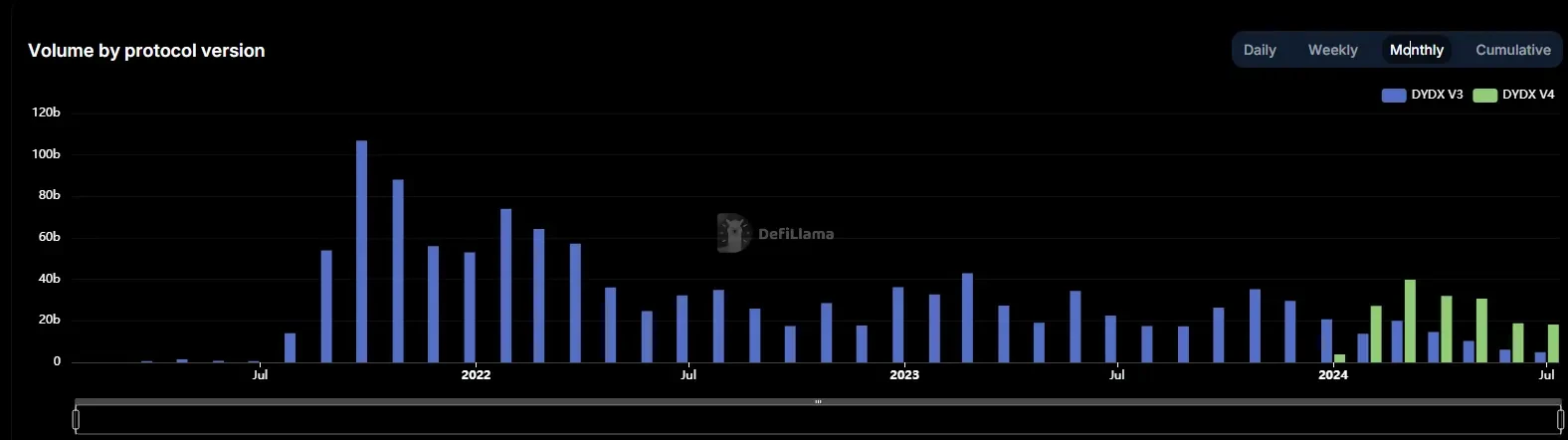

Although dYdX V3 is an older version of the product, the platform's trading data still performs impressively. According to DeFiLlama data, the V3 platform is expected to generate approximately $18.67 million in revenue this year.

In a report from VanEck in March of last year, it was estimated that the V3 platform generated $137 million in fees in 2022.

DeFiance Capital also publicly stated last year that despite the lack of new trading pairs and features on the dYdX V3 product for over a year, its market share still exceeds 50%.

According to DeFiLlama data, the average weekly derivative trading volume on dYdX V3 is still around $1.5 billion, while the weekly trading volume on V4 dYdX Chain is approximately $5 billion.

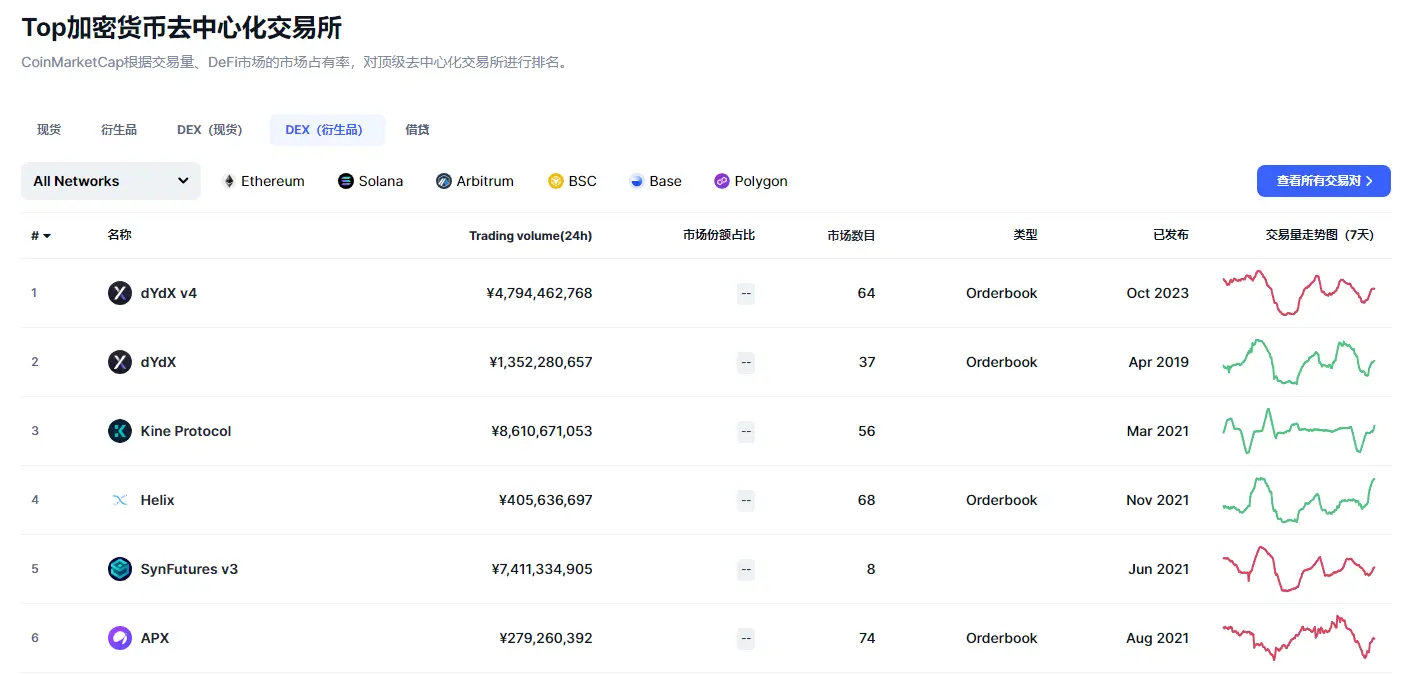

CoinMarketCap data shows that currently in the decentralized derivatives space, dYdX V3 still ranks in the top two in terms of trading volume.

According to analysis from the crypto risk firm Gauntlet, the V3 platform still holds appeal for traders because certain tokens on the platform have higher liquidity, resulting in less slippage for traders in large transactions.

User Bobo also mentioned to ChainCatcher that he still primarily uses the V3 version and rarely uses V4 because the asset trading volume and liquidity seem to be low on the latter version.

From this perspective, dYdX V3 is still a continuous cash cow. It is reported that the business transactions from the sale of V3 will reach hundreds of millions of dollars.

Since its launch on the Ethereum network in 2017, during the DeFi Summer period of liquidity mining incentives, the business has grown rapidly. The dYdX product has undergone numerous major changes, upgrading from the initial V1 to the current V5 version, and launching dYdXChain after leaving Ethereum, establishing its dominance.

However, the business development of dYdX is in stark contrast to the trend of the DYDX token price. The DYDX token price has plummeted from its high point of $27 in 2021 to a low of around $1.005, and is currently fluctuating around $1.25, representing a 95% decrease from its peak.

Despite the launch of V4 dYdX Chain, where all on-chain transaction fee revenue goes to DYDX token stakers, providing more empowerment, it has had no impact on the token price.

Regarding the sale of V3 by dYdX, there are two main viewpoints. One is a negative view that the project team is trying to cash out, while the other is a positive view that the funds obtained from the sale will be beneficial for the overall development of dYdX.

Bobo stated that if dYdX invests the sale proceeds into the dYdX ecosystem, it would undoubtedly be a good thing.

He explained that as a rapidly growing DeFi company, dYdX needs a large amount of capital to support its technological development and market expansion. Selling the V3 platform can raise a substantial amount of funds to help concentrate its efforts and resources, enhancing overall competitiveness.

In the long run, the sale of the V3 platform may also have a positive impact on the value of the DYDX token. By obtaining a large amount of funds, dYdX can further enhance its technology and services, strengthen its market competitiveness, and thereby increase the long-term value of the DYDX token.

He also cautioned that currently, the official statement from dYdX regarding the sale of V3 does not specify whether the funds obtained from the sale will go to the team's own pockets or be used for other purposes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。