Source: Bankless

Translated by: Peyton, SevenUpDAO Returnee Guild

Bankless is a global community dedicated to helping individuals regain sovereignty over the financial system through cryptocurrency and blockchain technology, freeing themselves from the control of traditional banks and tech companies. By providing educational resources and support, Bankless encourages users to delve into the crypto space, pursue financial independence and self-sovereignty, while also warning about the risks of crypto investments. This community not only focuses on short-term trading opportunities but also aims to establish an internet-based property rights system to address broader social issues.

Michael Nadeau is a cryptocurrency analyst who can help us answer the question "How undervalued is Solana really?" His analytical approach is not technical, nor is he a decentralization extremist, nor does he represent any specific faction. Instead, he focuses on on-chain fundamentals, such as daily active users, fee revenue, and total value locked, to provide insights.

This episode discusses why on-chain fundamentals are crucial in analyzing crypto assets like ETH and SOL. It reviews the data from 2024 to see who is winning and examines the catalysts for ETH and SOL. In addition, Michael shares his price predictions for ETH and SOL in this cycle and provides insights into which assets might perform better in the second half of a bear market.

Is fundamental analysis experiencing a revival in the crypto space?

Ryan: Alright, let's dive into this episode. We are very excited to introduce Michael Nadeau. He is the founder of DeFi Report and has written some of my favorite crypto analyses. He focuses on traditional fundamentals, analyzing tokens and crypto assets in a way similar to stock and capital asset cash flow analysis. He models the demand for crypto assets as currency and focuses more on overall fundamentals rather than attention metrics. This is a wonderful combination of native crypto knowledge and financial analysis. I hope the crypto world can view crypto assets as Michael does in his reports.

Ryan: Let's start with a guiding question. We will discuss the comparison between Solana (SOL) and Ethereum (ETH), which may be a bit controversial for some. You wrote a report titled "Should Solana be trading at an 83% discount to ETH," which is roughly the current situation. We will discuss this question later. First, I want to ask a general question: Is fundamental analysis experiencing a revival in the crypto space? Recall that I define fundamentals as cash flow and how stock analysts might view these crypto assets. We see Maker, a blue-chip DAI token, performing well this year. Is fundamental analysis experiencing a revival in the crypto space?

Michael: I'm glad to hear that. It's interesting to see this narrative starting to appear on Twitter. Everything we do in "DeFi Report" is data-driven, even for meme coins. You can analyze token holder growth and social metrics on platforms like Twitter. Fundamentals is a broad term, easier to understand in a bear market. Today, we will discuss the comparison between Solana and Ethereum, and what initially caught my attention about Solana was studying its performance in a bear market. As Warren Buffett said, when the tide goes out, you can see who's been swimming naked. In a bear market, you can see what might be sustainable. We work with data companies focused on fundamentals and believe this is the direction the industry is heading. It's great to see this narrative being mentioned. MakerDAO is one of the projects with excellent fundamentals.

Ryan: That's great. Interestingly, we mentioned fundamentals as a narrative, which is somewhat ironic because the crypto market is so volatile. What is the overall theory of fundamentals? Is it as simple as Warren Buffett's view that, in the long run, the market is a weighing machine, but in the short run, it's a storytelling game? Are fundamentals important in the long term and reflected in prices over time?

Michael: Yes, that's basically it. The market needs key performance indicators (KPIs) for relative valuation. Today, I don't think anyone would argue that crypto assets are traded based on cash flow. But I think that's where we're headed. Even though we're not trading based on cash flow now, we have benchmarks like Bitcoin and Ethereum, and all other assets are valued relative to them. The market always needs to understand fundamentals and key performance indicators. We are figuring out what these KPIs are. Securities analysis is a socially constructed process, and the market coalesces around a set of shared ideas that we can understand. Discounted cash flow analysis (DCF) applies to stocks and equities. Will it be used for crypto assets? Maybe, maybe not. We are studying this question today.

Ryan: Interestingly, you need to believe in fundamentals and get other investors to believe in them too. It's almost a game of coordination and consensus. One reason to be more bullish on fundamentals over the next few months and years is the increasing participation of traditional finance (TradFi) in the crypto space. TradFi views capital assets from a fundamental perspective and brings that perspective into the crypto space. I'm impressed by the analysis of institutions like VanEck. They delve into crypto assets from a fundamental perspective. You may disagree with their variables and assumptions, but their price predictions and analyses are based on fundamentals.

Michael: Absolutely right. Different types of assets have different fundamentals. You wouldn't use the same metrics to analyze a basket of banks as you would for commodities or other asset classes. Crypto assets, as an emerging asset class, involve data-driven fundamentals, but they are also very social, existing on the internet and crypto Twitter. These subtle differences make fundamental analysis in the crypto space unique.

Ryan: I started with these questions to help our audience understand your views on assets and investment methods. This framework is valuable for our conversation. You released a report last week that caught my attention. It's a great topic, and we can apply fundamental analysis to two assets that have received a lot of attention in this cycle: Ethereum and Solana. Your report titled "Should Solana be trading at an 83% discount to Ethereum" piqued my interest. You approached this issue from a market cap perspective, and currently, Solana's trading price is indeed 83% lower than Ethereum's. It's a data-driven investigation, and I appreciate your objective, data-centric perspective, which avoids the infighting and debate between decentralization and centralization.

Michael: Yes, when we analyze L1 tokens like Ethereum (ETH) and Solana (SOL), we look at various core data points. This comparison can be traced back to the end of 2022, after the FTX crash, when we started to seriously study Solana. We compared it to ETH in January 2018 and found similarities in the data. We analyzed total value locked, user count, trading volume, developers, and application activity. We also considered the flow of venture capital funds. By December 2022, Solana's metrics were similar to Ethereum's in early 2018, which prompted us to delve into Solana when many had already given up on it. Our analysis starts with fundamentals and layers in the unique nuances of crypto.

Conclusion

Michael believes that fundamental analysis is experiencing a revival in the crypto space and is crucial for researching crypto assets. While the crypto market is not yet entirely based on cash flow, fundamentals and key performance indicators (KPIs) are crucial for relative valuation. By comparing the fundamentals data of different assets, such as Solana and Ethereum, Michael advocates for a data-driven approach to analysis, which helps understand the long-term value of crypto assets.

Solana's 83% Discount

Ryan: The reason I started with these questions is to help our audience understand your views on assets and investment methods. This framework is valuable for our conversation. You released a report last week that caught my attention. It's a great topic, and we can apply fundamental analysis to two assets that have received a lot of attention in this cycle: Ethereum and Solana. Your report titled "Should Solana be trading at an 83% discount to Ethereum" piqued my interest. You approached this issue from a market cap perspective, and currently, Solana's trading price is indeed 83% lower than Ethereum's. Should it be this way? This is a data-driven investigation, and I appreciate your objective, data-centric perspective.

Michael: When we analyze L1 tokens like Ethereum (ETH) and Solana (SOL), we look at various core data points. This comparison can be traced back to the end of 2022, after the FTX crash, when we started to seriously study Solana. We compared it to ETH in January 2018 and found similarities in the data. We analyzed total value locked, user count, trading volume, developers, and application activity. We also considered the flow of venture capital funds. By December 2022, Solana's metrics were similar to Ethereum's in early 2018, which prompted us to delve into Solana when many had already given up on it. Our analysis starts with fundamentals and layers in the unique nuances of crypto.

Daily Active Addresses

Ryan: You mentioned using fundamental analysis in the depths of the bear market in December 2022, which allowed you to see the mispricing. At that time, Solana's market cap was only 3% of Ethereum's. You believed this was incorrect, shared your research, and went long on Solana. Since then, Solana's market cap has risen to 17% of Ethereum's, making the ETH-Solana ratio a successful trade in this cycle. The question now is whether this trend will continue. Will Solana continue to establish its position in value relative to ETH?

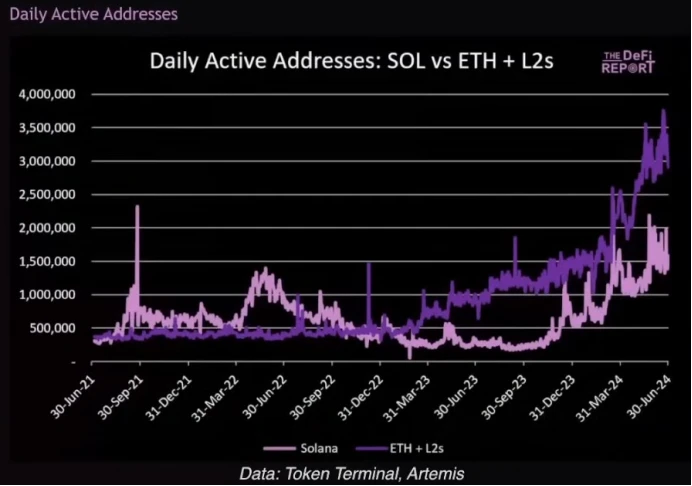

Let's start by discussing the data on daily active addresses. This chart compares Solana with Ethereum and its layer 2s. Can you briefly explain this chart?

Michael: This chart combines Ethereum with its top 12 Layer 2s, starting from June 2021. We are studying the growth of Ethereum relative to Solana. In the second quarter, Solana had an average of 1.3 million daily active users, roughly half the total of Ethereum and its layer 2s.

Ryan: That's very impressive. The chart for Ethereum and its layer 2s is in purple, while Solana is in pink. Currently, Solana's daily active addresses are about half of Ethereum's. How much of this activity is bot or fake activity, and does this affect your analysis?

Michael: Artemis does a good job in detecting fake activity in their data. There is indeed a lot of bot activity, but bots pay fees. While there is a view that bots are not actual users, in traditional finance, over 60% of trading comes from algorithms. Bots are also users, contributing to market fit by using tools and paying fees. So, I wouldn't discount their activity.

Ryan: Yes, we should remember that the definition of users here is similar to active addresses. A bot can have multiple addresses, and a person can also have multiple addresses. Essentially, we consider an active address as a user, similar to an active bank account. An interesting observation from the chart is that during the last bull market cycle in 2021-2022, Solana's daily active addresses were actually higher than Ethereum's, not just slightly higher, but significantly higher.

Michael: Yes, that's correct. During the peak of the previous cycle, Solana's daily active addresses were significantly higher than Ethereum's. This occurred during the peak of the crypto market or just before it, before the Terra Luna crash and its subsequent events. There was a lot of hype around Solana at that time, indicating that there was something substantial there. However, after the FTX crash, Solana's user activity significantly declined. The blockchain underwent a reorganization and has since risen again. Hype often has some underlying signals, and in a bear market, fundamentals often become more apparent.

Fees

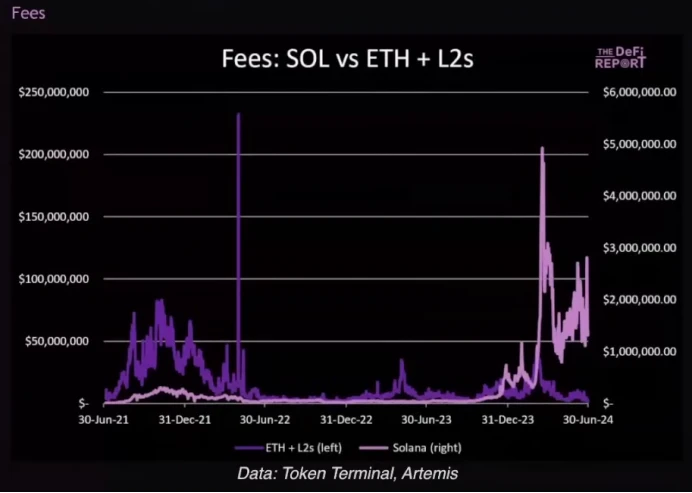

Ryan: Let's discuss another fundamental indicator that we highly value at Bankless: fees. Fees represent purchased block space and essentially show demand for blockchain services. We are looking at a chart comparing Solana with Ethereum and its layer 2 fees. In summary, in the second quarter, Solana generated $15.1 million in fees, accounting for 27% of Ethereum and its top layer 2 fees. Can you explain this chart? It shows Solana's fees (in pink) higher than Ethereum's fees (in purple), but according to your summary, this seems counterintuitive.

Michael: Yes, this chart may be a bit misleading because it uses two different axes. If we were to use just one axis, Ethereum's fees would far exceed Solana's, making Solana's growth less noticeable. Ethereum's fees are still significantly higher than Solana's, but this chart highlights Solana's rapid growth over the past six months.

In the previous cycle, despite high transaction volume (about 20 million transactions per day), Solana's fees were very low, usually only a few thousand dollars per day. Now, we see a significant increase in Solana's fees. In the second quarter, Solana's fees were approximately 27% of Ethereum and its top layer 2 fees. The increase in fees may indicate growing demand and usage for Solana, even as it maintains lower transaction costs.

Interestingly, the narrative around Solana has always been about maintaining low fees. However, with increased activity, we may see fees rise due to potential bottlenecks, similar to Ethereum's experience. This will be particularly noteworthy as Solana's future innovations, such as the Fire Dancer update, come into play in the later stages of the cycle.

Fee Generation and MEV

Ryan: Fees are a fundamental indicator I highly value because they represent actual activity. Users willing to pay for services indicate real demand. Fees also provide relatively strong resistance to front-running attacks. I want to ask about the composition of fees. Blockchains can generate fee revenue in two ways: first, by selling block space; second, by selling transaction ordering within blocks. You previously mentioned MEV in relation to the second method. MEV involves paying for priority access to transactions within blocks. What are the differences in fee generation between Solana and Ethereum? I recall that a significant portion of Solana's fee revenue comes from MEV. How does this compare to Ethereum?

Michael: Yes, over 50% of Solana's fee revenue comes from MEV, primarily facilitated by the Jito validators, who share MEV with participants in the validation process. There is an interesting view that all fees may eventually tend towards zero as first-layer blockchains become commoditized. In this view, MEV will become the primary mechanism for value capture, focusing on priority access to block space. This is similar to traditional finance, where transaction fees are negligible, and value is extracted from transaction ordering.

We are starting to see this dynamic on Ethereum, especially after the implementation of EIP-4844, which significantly reduced the transaction fees on layer 2. This also affected the first-layer fees. Our recent Ethereum quarterly report emphasized the main story of EIP-4844, which greatly reduced L2 fees and impacted L1. New block space supply may be filled as demand rebounds, but MEV is likely to play a key role in the monetization of these networks in the future.

Ryan: So, MEV could become the primary value driver for the development of both networks?

Michael: Absolutely. As transaction fees on the first and second layers decrease, competition for MEV will become more important. This shift reflects the operation of traditional financial markets and may become a key factor in generating value for blockchain networks in the future.

Ryan: This is very interesting and highlights the different design strategies of Ethereum and Solana. While Ethereum has outsourced some of the tasks of execution and block ordering to layer 2, Solana has retained all MEV. This raises questions about the long-term existence of MEV on these chains and how it will shape the future.

DEX Trading Volume

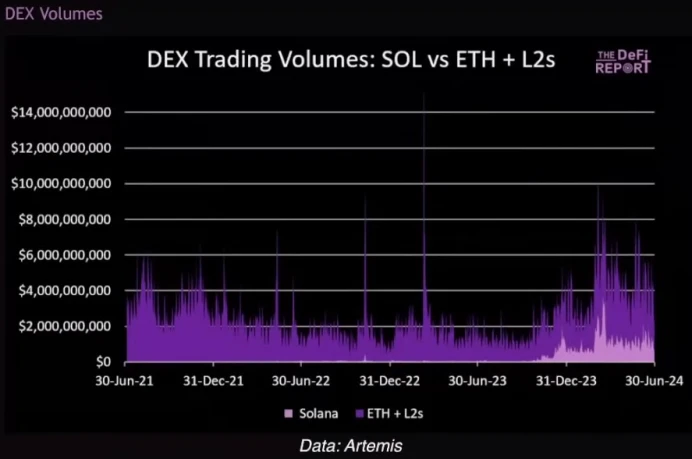

Ryan: Let's move on to the third fundamental indicator, DEX trading volume. We are looking at the DEX trading volume of Solana compared to Ethereum and its layer 2s. Solana's DEX trading volume is significant, reaching $108 billion in the second quarter, accounting for 36% of Ethereum and layer 2s. This is a stark contrast to the almost zero trading volume on Solana in the previous cycle. How do you interpret this chart?

Michael: This chart shows that DeFi on Solana was almost non-existent a few years ago. Today, most activity happens on Jupiter. If you compare Jupiter to Uniswap, Jupiter has about 90% of Uniswap's active users. The significant increase in DEX trading volume on Solana indicates growing user participation and trading activity.

On an overall level, Solana's DEX trading volume is still significantly lower than Ethereum and its layer 2s, but the growth is noteworthy. I personally use Jupiter for trading assets on Solana because of its smooth user experience, avoiding many of the UX challenges and bridging issues faced by Ethereum. This may attract more retail users to directly turn to Solana instead of using centralized exchanges like Coinbase. We need to monitor the development of this trend.

Ryan: So, the increased DEX trading volume on Solana may indicate a preference for decentralized platforms on Solana due to its better user experience, which could impact how new users enter the crypto space?

Michael: Absolutely. If Solana continues to improve user experience and attract more DEX trading volume, it could become a more attractive choice for new users looking for decentralized trading platforms. This could pose a challenge to centralized exchanges and even influence how new users enter the crypto space.

Ryan: What are your insights into the composition of traders on Solana and the assets they trade? There is an impression that activity on Solana leans more towards retail traders, with smaller trade sizes but a larger number of participants. The asset composition also seems to be heavily skewed towards memecoins. How does this compare to other networks?

Michael: Indeed, there is more memecoin trading on Solana, primarily driven by speculative bull market assets. However, there is also a significant amount of stablecoin activity, which we will discuss later. This indicates high trading velocity. Solana's total value locked (TVL) has always been lower than Ethereum, but its trading velocity is higher. This reflects Solana's user experience—low fees and usability—encouraging smaller, more frequent trades, including meme trading in low volume.

Stablecoin Trading Volume

Ryan: Since you mentioned stablecoin activity, let's delve into that. In this cycle, Solana's stablecoin trading volume has significantly increased compared to the previous cycle. In the second quarter, Solana's stablecoin trading volume reached $4.7 trillion, surpassing Ethereum's stablecoin trading volume. This seems to highlight the high speed of trading on Solana. Can you explain these numbers in detail?

Michael: The second quarter's $4.7 trillion stablecoin trading volume is indeed a staggering figure, driven primarily by DEX activity on Solana. This wave of surge, especially in the past six months, highlights the high speed of trading on Solana. Solana users seem to be engaging in much more frequent trading compared to Ethereum users.

Ryan: This $4.7 trillion figure is twice that of Ethereum and its layer 2s during the same period. You mentioned that a significant portion of this activity involves memecoins and algorithmic trading. Why do you think this is a positive signal rather than a cause for concern?

Michael: My view is that bots and algorithms are core parts of the trading ecosystem. In traditional finance, over 60% of trading volume is algorithm-driven. In Solana, this reflects high-speed, automated trading similar to traditional finance. Solana aims to create a blockchain version of NASDAQ, and high trading volume—even from memecoins and speculative assets—indicates that the system is being widely tested and used. This activity, regardless of its speculative nature, is a positive signal of network participation and functionality.

Total Value Locked (TVL)

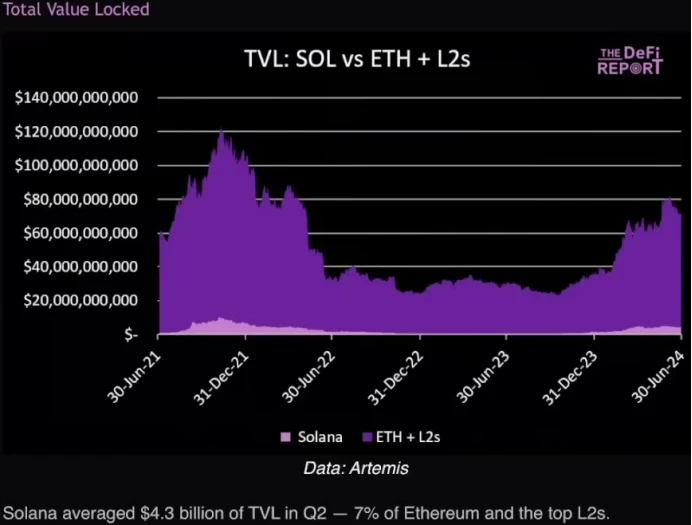

Ryan: Bots are also people, and meme coins are assets—this is somewhat the narrative of Solana. Let's discuss this chart, which more effectively demonstrates the complex situation compared to other bullish indicators. This chart shows the total value locked (TVL) of Solana compared to Ethereum and its Layer 2 over a period of time. It's worth noting that Ethereum and Layer 2 TVL (purple line) have not yet returned to their historical highs from the previous cycle, indicating room for growth. However, Solana's TVL (pink line) has not experienced explosive growth like other indicators. In fact, Solana's TVL is roughly equivalent to Ethereum and Layer 2 TVL in percentage terms from the previous cycle. Solana's average TVL is $4.3 billion, accounting for 7% of Ethereum and top Layer 2s. How do you view this situation?

Michael: This indicates that the Ethereum ecosystem is more mature and capital efficient than Solana. The amount of ETH locked in DeFi on Ethereum is much larger than on Solana, reflecting its more advanced stage. One reason is that Ethereum was initially launched as a proof-of-work blockchain and later transitioned to proof-of-stake, while Solana has been proof-of-stake from the start. Currently, Solana's staking rate is about 80%, while Ethereum's staking rate is 27%, a ratio that has been rising from near zero in recent years.

The high staking rate on Solana means a large amount of SOL is locked with validators rather than circulating in DeFi. Solana has been trying to move value into DeFi through liquid staking solutions and incentives. To increase its TVL, Solana needs to mobilize more staked SOL into DeFi.

Overall, the difference in TVL highlights the maturity of Ethereum and its ecosystem relative to the progress of Solana.

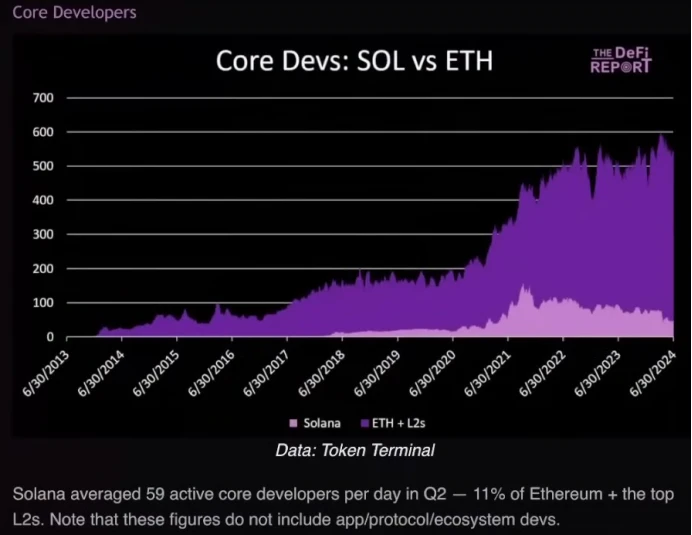

Core Developer Count

Ryan: This is an off-chain metric in your report: core developers. For Solana, there were 59 active core developers in the second quarter, which is approximately 11% of Ethereum and its top Layer 2s. This number has increased for Solana compared to earlier, but has not yet reached the peak of the previous cycle. What insights can we gain from this metric?

Michael: These data come from Token Terminal and focus solely on core developers—those directly involved in working on the blockchain protocol itself, rather than the broader ecosystem or applications. The number of core developers for Solana has grown but still lags behind Ethereum. If ecosystem developers are included, Solana's total is approximately one-third of Ethereum's.

In general, the growth in the number of core developers can indicate the maturity and expansion of an ecosystem. However, a high number of core developers is not always a necessary condition for a healthy ecosystem. Once the core infrastructure of a project is stable, much of the development work can shift to building applications and protocols on top of it. The improvement in Solana's number indicates ongoing development work, although it still lags behind Ethereum. The continuous increase in Ethereum's core developer count reflects its ongoing expansion and maturity.

For me, the core developer metric serves as a warning signal. If an ecosystem performs well in other metrics but has very few developers, it may raise concerns. However, there are no warning signals for Solana and Ethereum; both demonstrate robust development activity.

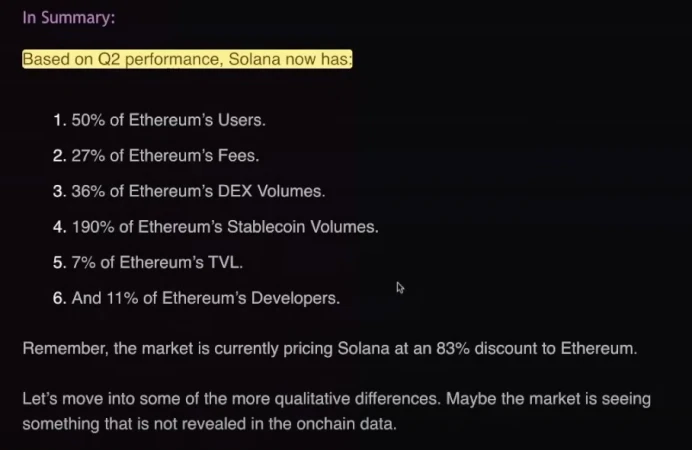

Q2 Performance Summary and Value Accrual

Ryan: Let's summarize the performance of the second quarter and then discuss value accrual. The indicators for Solana in the second quarter are:

50% of Ethereum users (daily active addresses)

27% of Ethereum fees

36% of Ethereum DEX trading volume

190% of Ethereum stablecoin trading volume

7% of Ethereum total value locked (TVL)

11% of Ethereum core developers

Solana's trading price is approximately 83% discounted compared to Ethereum. Considering these fundamental factors, let's turn to the discussion of value accrual. When evaluating how blockchain captures value, it's crucial to note that creating value doesn't always mean being able to capture it. For example, early peer-to-peer protocols like BitTorrent or Napster created a lot of value but failed to effectively capture that value in their business models. This distinction is crucial in evaluating the value accrual of assets like Solana and Ethereum.

Michael: Absolutely, you put it well. The key difference in value accrual between Ethereum and Solana lies in their architectural approaches:

1. Ethereum is evolving into a modular technology stack. Users interact with Layer 2 (L2) solutions, which have their own independent fee structures. These fees are allocated: a portion goes to the L2 sequencer, and the rest settles to the Ethereum Layer 1 (L1). As an Ethereum validator or ETH holder, you get a piece of this pie.

2. In contrast, Solana operates as a more singular technology stack. Validators directly capture 100% of the fees, without an intermediary layer like L2. The current setup of Solana means that all the value created by transactions on the network is directly captured by validators and their extended SOL tokens.

3. In summary, Solana's model provides a clearer, more direct way of capturing value. However, Solana may face scalability challenges in the future, which may require L2-like solutions similar to Ethereum's. Both ecosystems are building strong network effects, with Ethereum's effect being more mature, followed closely by Solana.

Bull Case for Ethereum

Ryan: Let's delve into the core issue. One reason Ethereum has performed relatively flat in the bull market is its architectural decision. Ethereum has outsourced the execution layer to Layer 2 (L2) solutions like Arbitrum and Optimism, while Solana has kept execution within its own ecosystem. As a result, Solana's token directly benefits from settlement, execution, and fee capture, while Ethereum, through L2, has sacrificed some revenue in decentralization and scalability. Ethereum aims to become a more neutral settlement layer, enabling it to serve as the foundational layer for settlement while allowing Ether to function as a currency asset in emerging L2 economies. This approach is seen as a strategic bet on long-term interests, leaning towards decentralization and neutrality rather than short-term revenue generation. This difference is crucial for understanding the current market landscape.

Michael: Indeed, that's the case. Ethereum's approach may have caused some confusion in the market. Analyzing the Q2 data indicates that the impact of EIP 4844 significantly increased the supply of block space. Historically, surplus resources are eventually utilized, often leading to new developments and innovations. This situation is akin to Ethereum's "broadband moment," where the increase in block space may be filled by new entrepreneurial activities. Currently, the low fees and increased competitiveness of Ethereum may create uncertainty for investors in direct investment in Ethereum versus its L2 solutions. Despite this short-term confusion, I believe Ethereum's strong network effects will ultimately lead to value accrual across the entire tech stack, including value from L2 and other protocols. I remain optimistic about this long-term narrative, although it may seem confusing in the short term.

Ryan: This is a striking long-term perspective. However, current on-chain fundamental data may imply that Ethereum is struggling inadvertently by outsourcing the execution layer. From a fundamental perspective, this shift may be viewed as a negative decision by the end of the second quarter of 2024. It seems like Ethereum is inadvertently cannibalizing its revenue opportunity by outsourcing execution. In this scenario, the bull case for Ethereum should be scrutinized, especially in terms of value accrual compared to Solana's token.

Supporters of Ethereum may argue that the execution layer is becoming a commoditized space, with various solutions competing for Ethereum's position in this space. Ethereum's role as the primary settlement layer may put it in a unique position, as competition intensifies for execution between different L2s and rollups. For example, the rollup Base, backed by Coinbase, is competing with Solana for the execution market. This competition may make execution a more commoditized aspect within the ecosystem. What are your thoughts on this?

Michael: I believe this viewpoint is valid. Ethereum's focus on decentralization and long-term interests may indeed give it a strategic advantage. Involvement by platforms like Coinbase through Base and potentially other platforms, such as Robinhood's collaboration with Arbitrum, may bring more users into the Ethereum ecosystem and decentralized finance (DeFi). These developments may contribute to Ethereum's bullish narrative. Solana aims to compete in the traditional asset space and become the NASDAQ of the blockchain world, but it also faces significant competitive pressure. Both ecosystems have their unique strengths, and competition will play a crucial role in shaping their futures.

Ryan: Michael, did you have a chance to watch the debate a few weeks ago between Anatoly from the Bankless channel and Justin Drake?

Michael: Yes, I watched some parts of it, although I didn't watch the entire debate. It was a great discussion, and I followed the key segments.

Ryan: An interesting theme in that debate was about predictions. I challenged Justin and Anatoly to make a prediction and revisit it in 3 to 5 years to see which viewpoint would be proven correct. As a supporter of Ethereum, Justin believes that Solana's centralized design, due to its monolithic structure, may weaken its ability to serve as a truly decentralized, anti-corruption foundation for Layer 2 solutions. He suggests that while it may seem advantageous in the short term, this centralization may be detrimental in the long run. On the other hand, the Solana camp might argue that Ethereum's focus on decentralization is a narrow interpretation, and Solana also has decentralization in its own way. What are your thoughts on this?

Michael: Undoubtedly, Ethereum is more decentralized. Setting up a node on Ethereum is easier and cheaper than on Solana, as Solana has higher hardware requirements. The higher decentralization of Ethereum is evident. However, considering the number and geographical distribution of Solana's validator nodes, Solana still maintains sufficient decentralization. While I may not have the in-depth technical knowledge as Anatoly and Justin Drake in these debates, I appreciate the depth and importance of these discussions. From an investor's perspective, decentralization is important, but it's not currently the primary factor in my evaluation. I agree that these debates are valuable for long-term considerations, although there may be issues not apparent at the moment.

Ryan: Let me present an idea and see if you agree. My theory is that the trade-offs and decisions made by each network will ultimately be reflected in its fundamentals. For example, if Solana faces transaction attacks or centralization issues that distort economic incentives, it may lead to a decrease in activity and revenue generation. Conversely, if Solana maintains sufficient decentralization and attracts significant activity, this will also be reflected in its fundamentals. While I support decentralization, I recognize the crucial role that fundamentals play in investments. In my view, these debates may be temporary, and the real impact will be reflected in the long-term fundamentals. What are your thoughts on this?

Michael: I think that viewpoint is reasonable. Users, especially those new to the space, may not be too concerned with these technical debates. More important is how these factors affect the overall availability and performance of the network. While we in the crypto community may focus on technical details, broader adoption will depend on actual outcomes. When I hear Anatoly and Justin debate these topics, I'm primarily looking for potential warning signals that I may not be fully aware of. Regarding Solana, I find it interesting that Jump Crypto's involvement as a major market maker participating in developing the Fire Dancer validator node. The involvement of market makers in validator node development raises concerns about potential risks of market manipulation. This, along with other factors, indicates that there are still unresolved issues that need attention.

Summary

Michael's views can be summarized as follows: Ethereum outsources the execution layer to Layer 2 solutions, which may lead to short-term revenue reduction, but its strategic aim is to maintain decentralization and neutrality in the long term, which helps strengthen the network effects and overall value of the tech stack. Although current market data may show challenges for Ethereum, he remains optimistic about its long-term potential. Solana, on the other hand, keeps the execution layer within its own ecosystem, directly benefiting from settlement and fee capture, but also faces significant competitive pressure. Michael believes that while Solana may not be as decentralized as Ethereum, its sufficient decentralization and high performance still hold value. He points out that while technical discussions are important, the ultimate impact will be reflected in the actual performance and fundamentals of the network.

Upcoming Catalysts

Ryan: I have similar concerns about the Fire Dancer client, although Solana supporters assure me that it is open-source and can undergo public audits and reviews. Hopefully, the fundamentals will eventually reflect the results of these decisions. Now, let's discuss some upcoming catalysts for both networks. For Solana, you mentioned the Fire Dancer client as a short- to mid-term catalyst. What are the key points of this development?

Michael: The Fire Dancer client, developed by Jump Crypto, is significant because it introduces redundancy to Solana's blockchain infrastructure. Currently, Solana relies on a single validator node client, which brings the risk of a single point of failure. Fire Dancer aims to address this issue and may improve the reliability of the blockchain over time. If it proves stable and continues to operate effectively, it may help Solana overcome early issues and gain long-term credibility. If Solana demonstrates higher security and reliability over an extended period, it may attract more institutional interest, such as BlackRock.

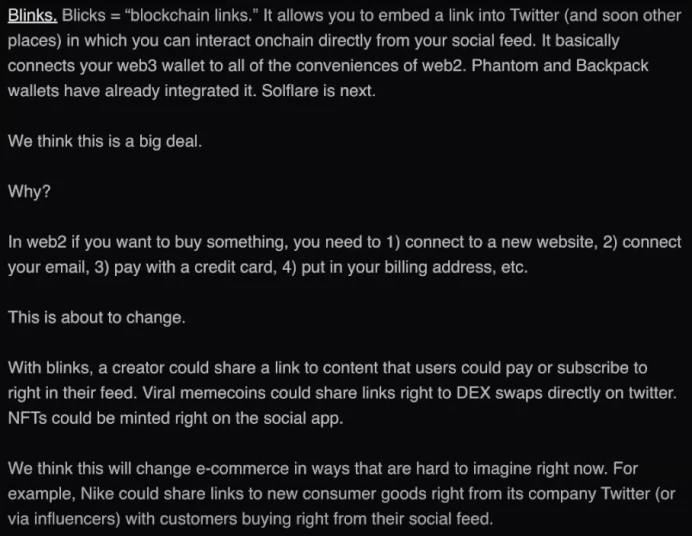

Ryan: Now, let's discuss "Blinks." What are they? Why might they be a bullish catalyst for Solana?

Michael: Blinks are similar to what we've seen in products like the Farcaster framework. They bring the Web3 wallet experience directly into the browser, especially on social media platforms. For example, Blinks allow for stablecoin payments directly through the social media interface. This may gain attention during another hype cycle, as users may share links involving meme coins and other assets. Key opinion leaders (KOLs) may share links that facilitate direct trading from the social media feed. In the long run, "Blinks" may have a significant impact on consumer behavior and e-commerce, changing the way users interact with Web3 technology.

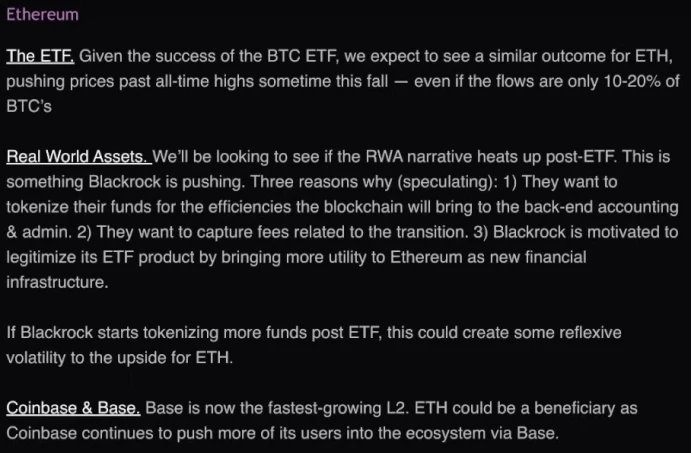

Ryan: There are other notable catalysts, but we don't have time to delve into all of them. The Decentralized Physical Infrastructure Network (DePIN) opens up a unique niche market on Solana, as well as the development of other social applications. Shifting the focus to Ethereum, the prospect of an Ethereum ETF is a major catalyst. I hope this is the last week without an ETF. The potential launch of an Ethereum ETF is a significant development. If Solana gets an ETF, that will be a longer-term goal. The impending launch of an Ethereum ETF could have a significant impact, similar to the effect of Bitcoin.

Michael: An Ethereum ETF is indeed a major development that will significantly impact this cycle. I expect the effects of the ETF may exceed expectations. According to forecasts from institutions like Bloomberg, I anticipate that the inflow into Ethereum may reach 10-20% of Bitcoin. The narrative around Ethereum is not fully understood yet, but the concept of Ethereum as an open-source app store with cash flow potential is compelling. While the ETF may initially not include staking rewards, in my view, Ethereum's market potential is greater than Bitcoin's. As institutional investors on Wall Street gain a better understanding of Ethereum, this may enhance its market presence. Our Ethereum Investment Framework Quarterly Report may gain attention upon the ETF launch. The Ethereum story is very compelling, and once trading begins, its impact may be surprising.

Ryan: Another important catalyst is the focus on Real World Assets (RWA). You mentioned BlackRock's involvement in tokenizing national debt and other financial products on Ethereum. This activity highlights Ethereum's role in handling significant assets. Can you elaborate on how this could serve as a catalyst for Ethereum?

Michael: The involvement of major financial institutions like BlackRock is crucial. BlackRock's upcoming ETF is aimed at making Ethereum a platform for financial products. They have already tokenized a money market fund on Ethereum, and I expect to see more similar initiatives. BlackRock CEO Larry Fink may discuss the benefits of on-chain assets on platforms like CNBC, which could attract significant attention. The real-world application of blockchain technology—creating efficiency and improving market liquidity—is a core use case for cryptocurrencies. BlackRock's endorsement and mainstream media attention could trigger a positive feedback loop for Ethereum, potentially leading to significant price volatility and market performance in the later stages of the cycle.

Ryan: Retail participation is also a factor that has not fully materialized yet. Once retail investors start participating, they are likely to do so through exchanges, and platforms like Coinbase will guide them to Ethereum's Layer 2 solutions, such as Base. While Solana has gone through several years of execution, including an entire bull market cycle, Base has not yet experienced a bull market cycle in the retail market. Could this be an important catalyst for Ethereum?

Michael: Yes, Base represents another important catalyst for Ethereum. While we haven't seen meme coin trading on Base reach the levels seen on Solana, there is indeed significant activity, especially in high-volume applications like Uniswap. As Base develops and Coinbase facilitates user migration to on-chain solutions, this could provide significant momentum for Ethereum.

Qualitative Differences

Ryan: Lastly, let's discuss qualitative differences. Currently, Solana's user experience is considered superior to Ethereum's Layer 2 solutions, with fewer issues. Ethereum faces fragmentation across various Layer 2 solutions, leading to a lack of cohesion. In contrast, Solana's information and user experience are more unified. The Solana ecosystem has a more centralized Silicon Valley style, while Ethereum is more open-source and decentralized, similar to Linux. Feedback from ETHCC suggests that the Ethereum community may also feel divided, with various Layer 2 solutions vying for attention. In contrast, Solana's unified approach, focusing on applications and tokens, may provide a more consistent experience. What are your thoughts on these qualitative differences?

Michael: You've described it well. From a user perspective, Solana's wallet experience is currently more streamlined, avoiding the need for bridging. It is expected that Ethereum will address these issues through account abstraction and integration with platforms like Robinhood. While Ethereum's current experience may not be as user-friendly as Solana's, it should improve over time. The centralized, well-organized approach of Solana contrasts with Ethereum's more decentralized, fragmented structure. Large financial institutions may find it easier to interact with Solana because its support channels are more direct. However, Ethereum's broader philosophy and potential improvements may ultimately address these challenges.

Price Targets

Ryan: We've come to the moment we've been waiting for: evaluating whether Solana (SOL) should be trading at an 83% discount relative to Ethereum (ETH). Historically, in November 2022, Solana's market cap was only 3% of Ethereum's market cap. Currently, it stands at 17%, still at an 83% discount. Should Solana be trading at this level with Ethereum? What are your predictions for the next 6 to 18 months?

Michael: My conclusion is that Solana's current discount is excessive. I believe Solana's market cap may rise to approximately 25% of Ethereum's market cap in this cycle. This is a speculative view, not investment advice. In my personal investment portfolio, I have increased my investment in Solana but have not sold any Ethereum. Many have swapped Ethereum for Solana, but I believe Ethereum will outperform Solana in the short term due to the ETF. In the later stages of the cycle, Solana may perform better during the altcoin rotation. Ethereum typically performs well in the later stages of the cycle, but new market participants like Wall Street may change this dynamic. Assuming the total crypto market cap is $10 trillion, Ethereum's market cap may reach around $1.8 trillion, translating to approximately $15,000 per ETH. Solana's market cap may reach $400-500 billion, resulting in a price of around $900 per SOL. While Solana may not surpass Ethereum, it may perform better relative to its current discount.

Ryan: So, you have a slightly higher allocation to Solana than Ethereum, but you don't believe Solana will surpass Ethereum in this cycle. Your target is to position Solana's market cap at approximately 25% of Ethereum's. This means that if Ethereum's market cap reaches $1.8 trillion, the potential high point for SOL would be $900, while ETH would be at $15,000.

Michael: That's correct. I don't expect Solana to surpass Ethereum. Ethereum may eventually surpass Bitcoin, but the competition between Solana and Ethereum will continue. I believe there will be four to five major Layer 1 platforms, with three being investable. Solana may outperform Ethereum in this cycle but will not surpass it.

Ryan: You have a higher allocation to Ethereum than Bitcoin and a higher allocation to Solana than Ethereum. That's interesting. Finally, could you provide an estimate of the prices for ETH and SOL based on the market caps you mentioned?

Michael: Certainly. For an Ethereum market cap of $1.8 trillion, the price per ETH may be slightly below $15,000. For a Solana market cap of $450 billion, the price of SOL may exceed $900. These estimates are based on a strong second half of the bull market cycle. You can adjust these estimates based on whether the market cap reaches $8 trillion or if Ethereum outperforms Bitcoin.

Ryan: What is the probability of this cycle deviating from historical patterns, such as AI attracting more attention, or the crypto market not experiencing the expected bull market? Do you think there's a chance the crypto market could be marginalized? Or are you betting on a cycle similar to the past?

Michael: The crypto market tends to reflect human behavior. Even if retail investors were hurt in the previous cycle, they usually return when prices rise. In this cycle, Wall Street may experience similar FOMO. I'm not concerned that AI will overshadow the crypto market. Historically, the market peaks in the fourth quarter, and we are still in the phase of preparing for a strong finish. Factors like the election cycle, global liquidity, and potential rate cuts by the FED contribute to creating a favorable crypto environment. I suggest not overthinking and betting on historical patterns and human behavior.

Ryan: So, you're betting on historical patterns and human psychology, which often repeat. By the way, I've also noticed increased interest in crypto among family members. Finally, could you share where everyone can access the DeFi report and your podcast?

Michael: All our research can be found at https://thedefireport.io/, where we have written reports and podcasts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。