In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities. Currently:

Sectors with relatively strong wealth effects: blue-chip public chain sector, Ethereum Layer2 sector, and ETH ecosystem projects

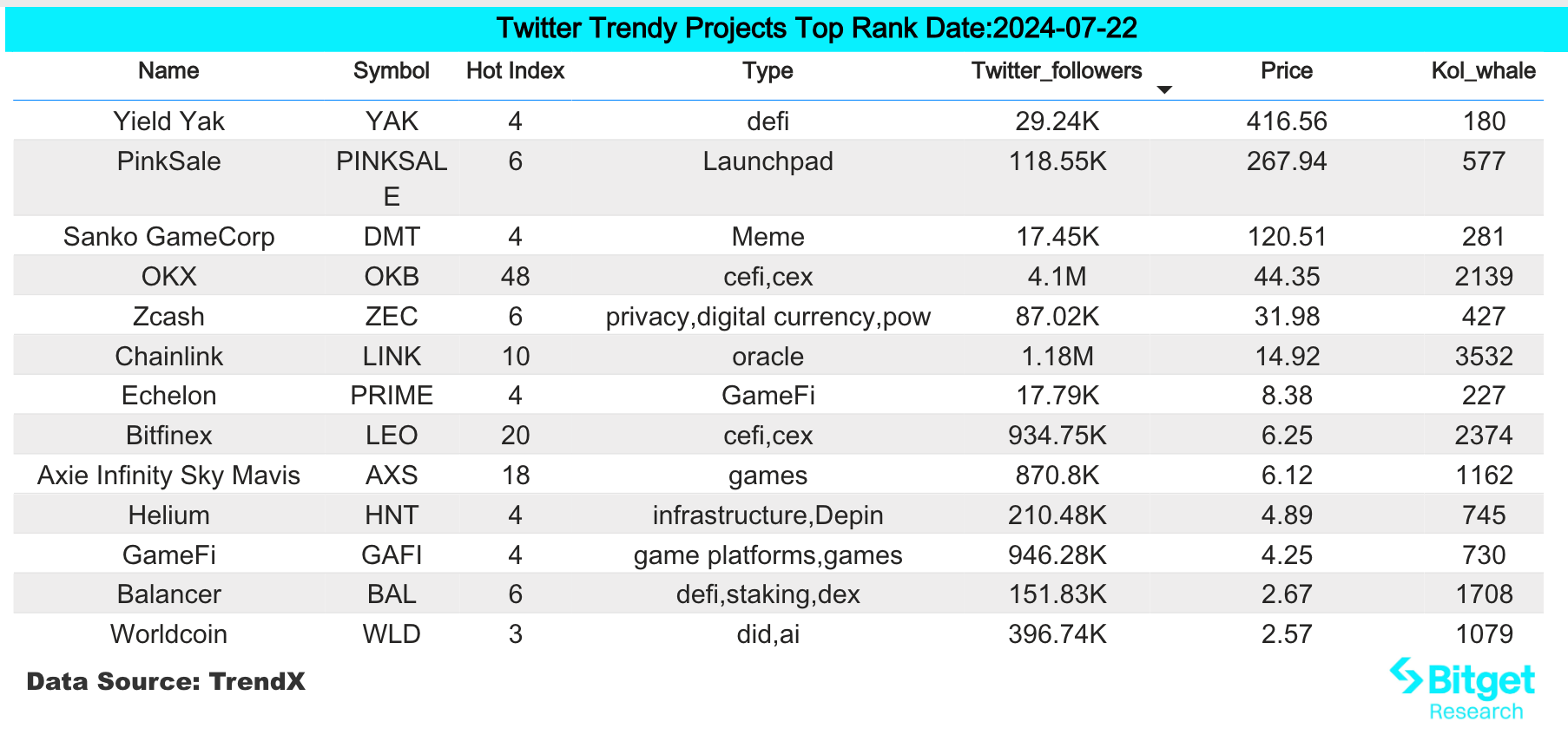

User hot search tokens & topics: Particle Network, Helium

Potential airdrop opportunities: Particle Network, Movement

Data statistics time: July 22, 2024, 4:00 (UTC+0)

I. Market Environment

BTC rose and briefly broke through $68,000 in the past 24 hours, with a 0.8% increase. The US Bitcoin spot ETF saw a net inflow of $1.196 billion last week, marking its third consecutive week of net inflows. Of this, $300.9 million, $422.5 million, and $383.6 million flowed into the US Bitcoin spot ETF on Monday, Tuesday, and Friday of last week, respectively. The net inflow of the US Bitcoin spot ETF since the beginning of the year has reached $17 billion for the first time, and these ETF products were only launched six months ago. Currently, the trading volume of BlackRock's Bitcoin ETF IBIT is close to $1.2 billion, and Fidelity's FBTC has a daily trading volume of over $410 million. These figures all indicate that investors' confidence and recognition of Bitcoin spot ETFs are continuously increasing, driven by the accumulation of real demand from investors rather than market speculation.

During the process of BTC leading the rebound of the overall market, there has been no strong rebound track. The AI sector, Solana ecosystem, and public chain sector, which have performed well in previous rebounds, have shown some rebound momentum in recent days. Meanwhile, the likely approval of the Ethereum spot ETF tomorrow will mark a new shift in crypto regulation, and the performance of the Layer2 sector led by Ethereum is worth looking forward to.

II. Wealth Creation Sectors

1) Sector Dynamics: Blue-chip Public Chain Sector (AVAX, APT, SOL)

Main reasons:

With BTC returning to the $68,000 mark, the market's wealth effect has spilled over to major head public chain tokens, and some L1/L2 projects have seen favorable cashing out, which will circulate the wealth effect within their ecosystems, constituting potential buying pressure for these public chain assets.

Rise situation: APT rose by over 5% in the past 24 hours; AVAX rose by 12% in the past 24 hours; SOL rose by over 5% in the past 24 hours.

Factors affecting future market:

Continued increase in TVL: Defillama data shows that Solana's TVL has reached $5.15 billion, second only to Ethereum and Tron, with a 7-day increase of 13.7%. The NFT sales on the Solana chain in the past 24 hours were close to $6 million, surpassing Ethereum's ranking. According to reports, the NFT sales on the Solana chain in the past 24 hours reached $5,821,706, an increase of 55.7%, while Ethereum's was $3,666,892, a decrease of 21.53%; Bitcoin ranked third, with sales of approximately $2.902 million, a decrease of 19.89%. Avalanche's TVL is $710 million; NFT sales exceeded $28.3 million, a tenfold increase; the total market value of stablecoins reached $1.6 billion, with USDT and USDC increasing by 10.1% and 4.4% respectively compared to the previous period.

Continued ecosystem development: In the second quarter, although Solana's DeFi TVL decreased by 9% in USD terms to $4.5 billion, ranking fourth in the network, the DeFi TVL in SOL terms increased by 26%, indicating that capital still has confidence in Solana in the second quarter, and there has been no large-scale outflow. At the same time, the appearance of Blinks at the end of the second quarter represents that the Solana ecosystem is still continuously expanding and strengthening.

2) Sector Dynamics: Ethereum Layer2 Sector (ARB, OP, STRK)

Main reasons:

Affected by the news that the Ethereum ETF will start trading on July 23, Ethereum Layer2 tokens have generally risen. Currently, the market interprets the Ethereum ETF's approval as a positive for Layer2 tokens, so investors can also pay attention to investment opportunities in related Layer2 tokens when focusing on the approval of the Ethereum ETF.

Rise situation: ARB rose by 8% in the past 7 days; OP rose by 8.5% in the past 7 days; STRK rose by 7% in the past 7 days.

Factors affecting future market:

Whether the ETH ETF will be successfully listed: The market generally expects the Ethereum ETF. If there is an unexpected event when the Ethereum ETF is listed tomorrow, the market will generally see a reversal.

Development of Layer2 projects: The future development of Layer2, as a widely used ecological public chain, depends on its cooperating projects and user expansion.

3) Sectors to Focus on in the Future: ETH Ecosystem Projects (UNI, LDO)

Main reasons:

The S-1 document for the ETH spot ETF may officially go online in the US capital market on July 23, and ETH ecosystem assets may have speculative space. The president of ETF Store stated that the approval of the Ethereum spot ETF by the US Securities and Exchange Commission "strongly implies that ETH is a commodity, not a security." This is a milestone moment because it indicates that crypto assets can transition from being classified as securities to commodities over time.

Specific coin list:

UNI: The first DeFi Swap project on the blockchain, Uniswap's average daily revenue has been around $1 million, making it profitable.

LDO: A leading LSD project in the ETH ecosystem, with a TVL of up to $29.6 billion and a valuation of less than $1.8 billion, it is relatively undervalued.

III. User Hot Searches

1) Popular Dapp

- Particle Network

Modular blockchain Particle Network announced the completion of a $15 million Series A financing, with Spartan Group and Gumi Cryptos Capital jointly leading the round, and SevenX Ventures, Morningstar Ventures, Flow Traders, HashKey Capital, and others participating. This round of financing brings Particle's total financing amount to $25 million.

2) Twitter

Helium:

The Helium project is a decentralized wireless network project aimed at providing low-power Internet of Things (IoT) device connections through a distributed network. Helium uses blockchain technology and token incentive mechanisms to build a community-operated wireless network. The network consists of devices called "hotspots," which provide wireless network coverage and blockchain mining functions. Hotspot owners receive HNT (Helium Token) as a reward for providing network coverage. With the recent popularity of the DePin concept, Helium has also received widespread attention from investors.

3) Google Search & Region

From a global perspective:

Tapswap

Tap-2-Earn Telegram mini-app TapSwap was recently launched on the TON blockchain. Ton stated that TapSwap was launched on February 15, 2024, allowing users to earn in-game tokens by clicking and completing tasks. The app now has over 50 million users globally, with nearly 1 million active users online. Yesterday, they announced an upcoming AMA event with OKX Wallet on Twitter. Many users also participated in the USDT-USDC exchange activity on TapSwap, causing a lot of buzz on Twitter and high search volume.

Looking at the hot searches in various regions:

(1) There are no significant trends in Google Trends hot searches in Asian countries. Tokens with strong wealth effects such as Doge and RWA have become the focus of the market, and assets like BTC and ETHFI also appear in the hot searches in Asian countries.

(2) Hot searches in the CIS region include Tapswap and Blum, while hot searches in European and American countries mainly include MAGA, AI tokens, and SOL.

IV. Potential Airdrop Opportunities

Particle Network

Particle Network is a development platform that connects multiple blockchains (such as Bitcoin, EVM, and IBC) through a unified account system, providing modular interfaces to enhance wallet connectivity and transaction execution capabilities. The platform focuses on chain abstraction, wallet abstraction, liquidity abstraction, and gas abstraction, aiming to simplify the development and deployment process of Web3 applications.

Particle Network announced the completion of a $15 million Series A financing, with Spartan Group and Gumi Cryptos Capital jointly leading the round, and SevenX Ventures, Morningstar Ventures, Flow Traders, HashKey Capital, and others participating. This round of financing brings Particle's total financing amount to $25 million.

Specific participation method: Visit the website https://pioneer.particle.network/, bind your social account, and claim test tokens. Sign in daily, complete related tasks, and trade with Universal Gas. You can use test tokens from the Little Fox wallet to interact with the Particle Network wallet.

Movement

Movement Labs was founded in 2022 and previously completed a $3.4 million seed round of financing in September 2023. In addition to its flagship product Movement L2, Movement Labs will also launch Move Stack, an execution layer framework compatible with rollup frameworks such as Optimism, Polygon, and Arbitrum.

Recently, Movement Labs completed a $38 million Series A financing, led by Polychain Capital, with participation from Hack VC, Foresight Ventures, Placeholder, and many other well-known institutions.

Specific participation method: Visit the Movement zealy task interface (Note: social tasks have time periods and continuously updated tasks), and you can interact with DEX. Interact with a few test transactions and wait for further actions on the official website.

Original article link: https://www.bitget.com/en-US/research/articles/12560603813062

【Disclaimer】The market is risky, and investment should be cautious. This article does not constitute investment advice, and users should consider whether any opinions, views, or conclusions in this article are suitable for their specific situation. Investing based on this is at your own risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。