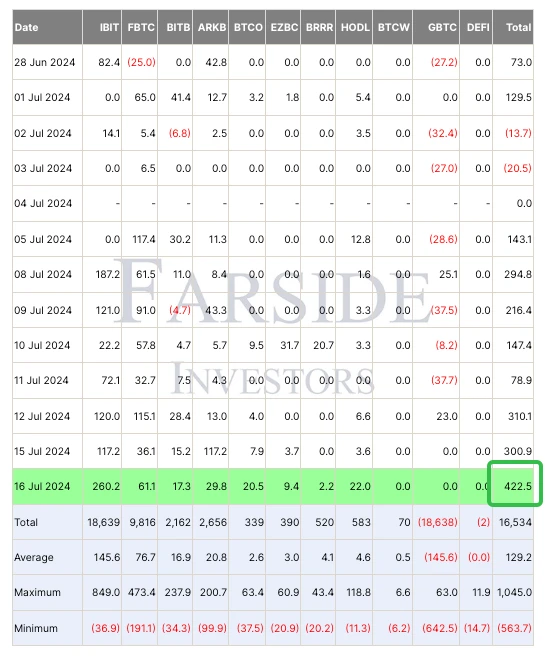

In the past day, the price of BTC has been steadily rising, breaking through $66,000 at one point. The daily inflow of spot ETF reached $422 million, the highest since June, with a cumulative inflow of over $1 billion in three days, indicating increased investor confidence and institutional investment interest. On the other hand, Kraken has begun distributing a total of $3.1 billion in cryptocurrency (BTC/BCH) compensation to Mt Gox creditors, expected to be carried out gradually over the next 7 to 14 days. Despite this, potential selling pressure has been offset by institutional investor support, keeping the price of BTC strong. Some have pointed out that this potential selling is voluntary for creditors and differs from the German government's forced selling plan, thus its impact on the price is expected to be smaller.

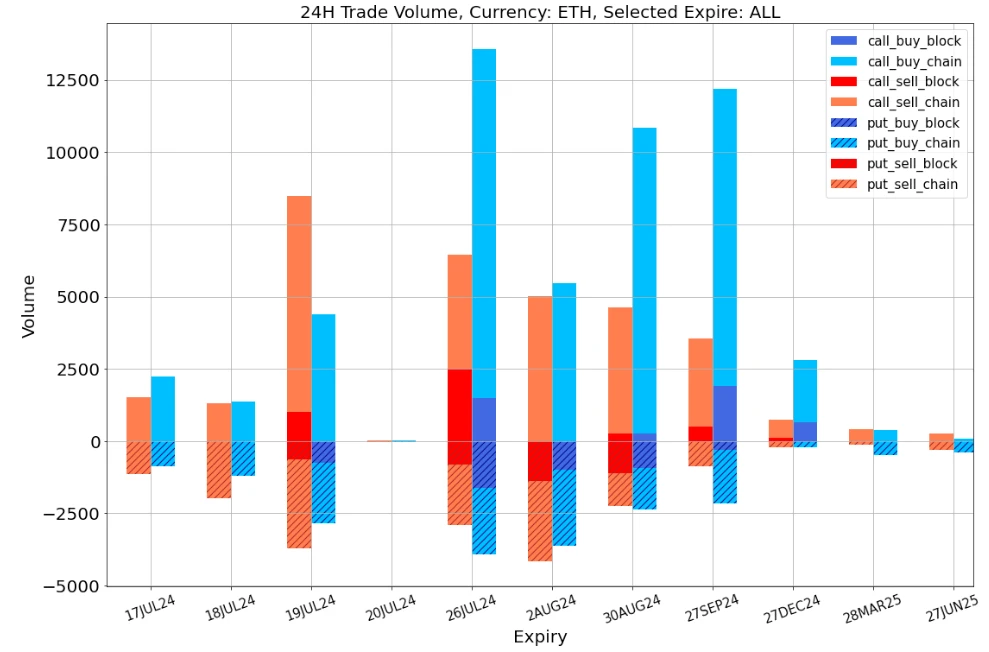

As for ETH, the U.S. Securities and Exchange Commission (SEC) has officially granted preliminary approval for Ethereum spot ETFs to asset management companies including BlackRock and VanEck, with trading set to begin next Tuesday (July 23). This news has once again boosted the cryptocurrency market, with traders purchasing a large number of call options for expiration dates after the end of July, while simultaneously selling call options for 19JUL24 (before the start of ETH Spot ETF trading), forming a calendar spread strategy.

Source: TradingView

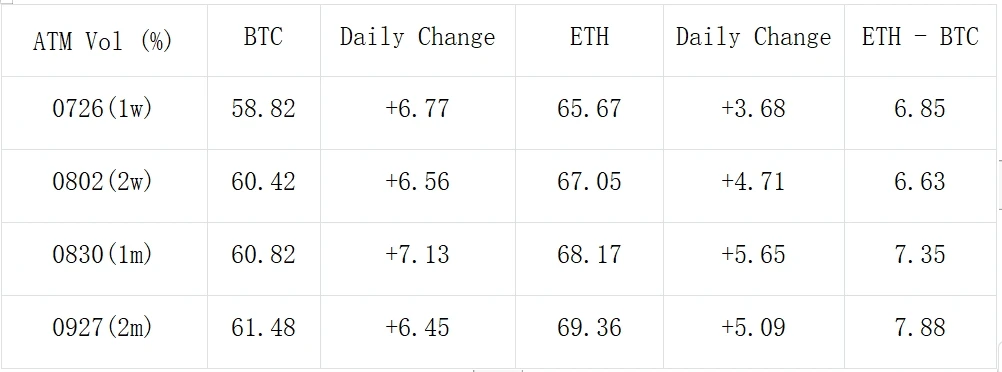

Looking at the volatility, the IV levels at the medium to long end have been significantly raised in the past 24 hours, with a more pronounced trend of the BTC term IV curve flattening. The IV for August and September has reached over 60%, exceeding the 75th percentile of the past three months' historical data. From the IV vs RV chart, it can also be seen that the 30d/60d IV has rapidly risen, showing a substantial Vol Premium compared to RV.

Source: Deribit (as of 17JUL 16:00 UTC+8)

Source: SignalPlus

Data Source: Deribit, ETH trading overall distribution; selling call options for the front end, buying call options for the middle and back end, with 7.23 as the dividing point

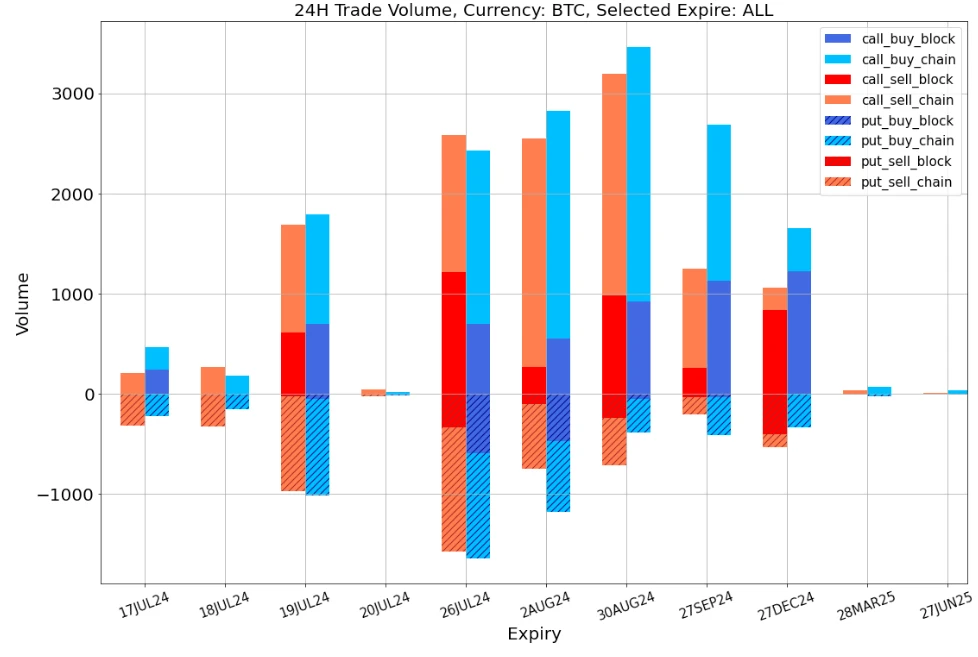

Data Source: Deribit, BTC trading overall distribution

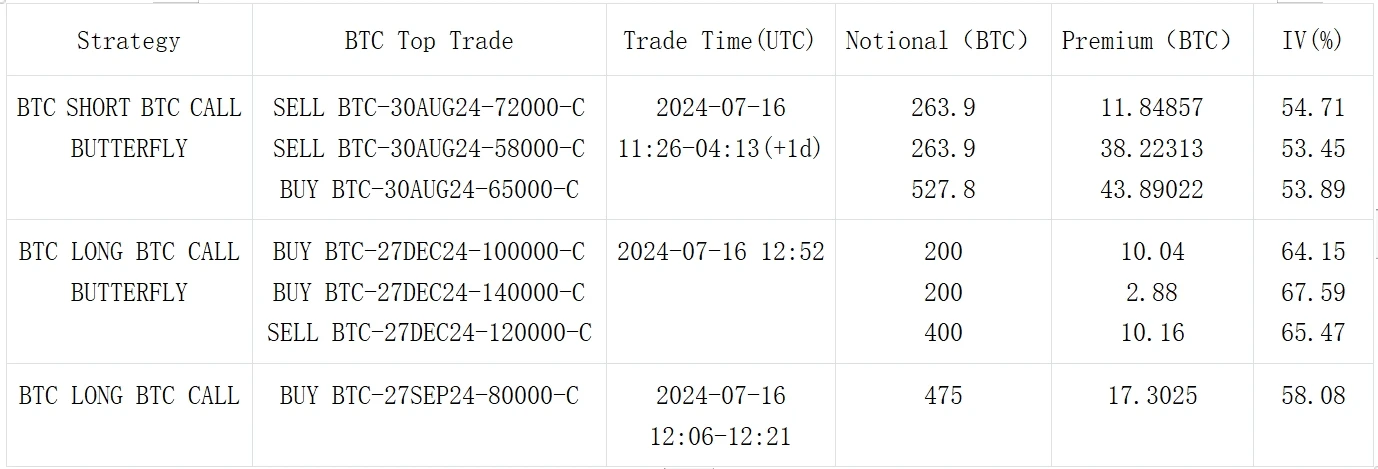

Source: Deribit Block Trade

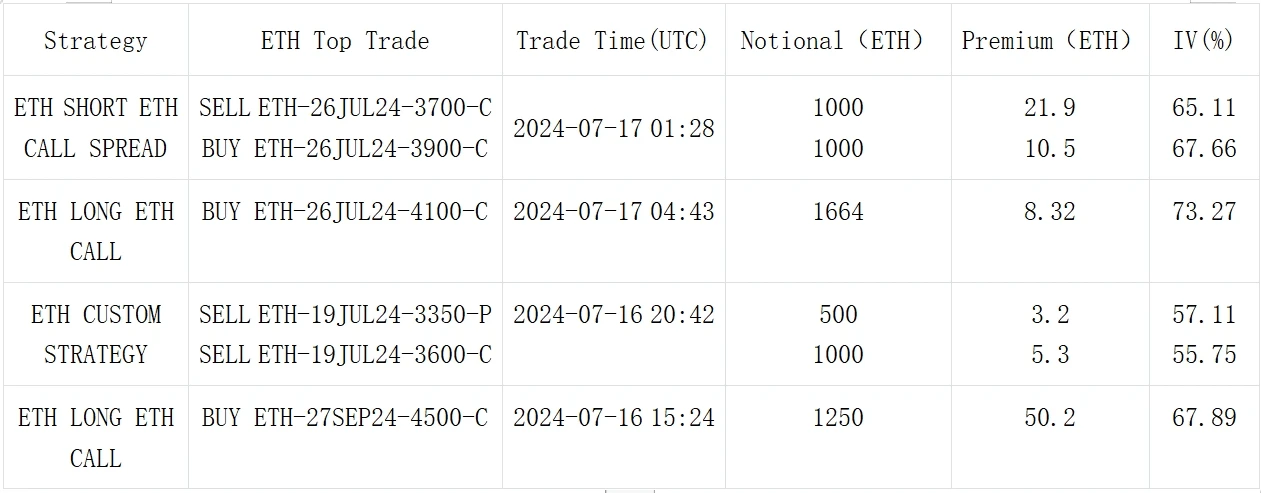

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。