CoinDesk has made an extremely optimistic prediction about the future of the Bitcoin DeFi ecosystem, believing that in the next 5 to 10 years, the Bitcoin DeFi ecosystem is expected to create a value of over $1 trillion.

Author: Rebbeca Ren (Crypto Kitchen New York Chef)

There are many speculations about this summer, the most topical of which are SocialFi Summer and OnChain Summer. With the announcement of the $70 million financing of the Bitcoin collateral protocol Babylon, the discussion about BitcoinFi Summer has become more intense.

Although the Crypto Kitchen public account has been slow to update recently, we have not been idle, but have had in-depth discussions with infrastructure builders in the Bitcoin ecosystem. They come from all over the world, from the East and the West, from senior players who started in the Bitcoin ecosystem, to new forces coming from other public chains.

Without exception, Paradigm's huge investment in Babylon has brought significant spillover effects, injecting market confidence - these builders believe that this financing not only heralds a prosperous future for infrastructure construction around Babylon, but also signifies the considerable prospects of the BitcoinFi track.

For a long time, Ethereum has dominated the DeFi market, attracting a large number of developers and projects with its powerful smart contract functionality and flexibility. In contrast, Bitcoin, due to its overly simple base layer design, lack of complete smart contract programming capabilities, and extremely slow transaction speed, has mainly been used for value storage - which seems to deviate somewhat from Satoshi Nakamoto's original intention of defining it as a "peer-to-peer electronic cash system" in the white paper.

However, in this cycle, Bitcoin has begun to show new potential. In addition to the approval of BTC ETF attracting inflows from large asset management companies, the out-of-circle effect of the Ordinals protocol has attracted a large number of individual investors - some from the Ethereum ecosystem, and some are new participants in the crypto market.

The popularity of Bitcoin assets has allowed builders to see the feasibility and reliability of building assets around Bitcoin, and they may help Bitcoin to no longer be limited to value storage, but to return to being a "peer-to-peer electronic cash system," and become a part of decentralized finance, or even larger, become an important part of dApps.

Next, we will take stock of some recent projects and feelings for everyone.

?Shell Finance

Shell Finance is a trustless lending and stablecoin protocol built on Bitcoin Layer 1, aiming to meet the decentralized financial needs on the Bitcoin network.

In terms of business model, it is similar to MakerDAO. Users can collateralize assets on the platform and borrow synthetic assets $bitUSD, with Shell Finance acting as an intermediary in the lending process. This model can meet the $bitUSD borrowing needs of a wide range of users, achieving efficient liquidity flow from individuals to the fund pool in the UTXO model.

In terms of development path, Shell Finance has drawn on AAVE's approach, hoping to open the market by building a community from the bottom up, centered on user needs. Compared to mainstream decentralized lending platforms like Compound, which only support a limited range of asset types, AAVE supports a diverse range of collateral assets, increasing the flexibility and diversity of asset utilization, thus AAVE has a better community foundation and can serve more users.

Shell Finance also hopes to reach more users by supporting various Bitcoin assets, including Ordinals NFT, BRC-20, ARC-20, and Runes, not limited to Bitcoin holders.

Unlike other Bitcoin stablecoin projects, all functions and contracts of Shell Finance run on Bitcoin's Layer 1. Founder Tim Hsieh stated that this is mainly due to two considerations:

- The architecture of Layer 1 makes the protocol itself highly secure and decentralized, reducing potential risks and attack surfaces.

- Layer 1 has tens of millions of BTC and the most active, OG, and critical players, allowing Shell Finance to access the broadest market and the largest liquidity.

On the technical side, Shell Finance uses a special technology called Discreet Log Contract (DLC) to make its lending system secure and automated.

DLC, a technology proposed by Tadge Dryja, co-creator of the Lightning Network, aims to implement more complex financial contracts on the Bitcoin blockchain while maintaining privacy and security. DLC ensures that contract details remain private before execution, and relevant information is only disclosed when specific conditions are met.

With the help of DLC technology, the lending process is roughly as follows:

- Users can borrow a certain amount of $bitUSD by collateralizing $ORDI.

- Oracles monitor the market value of $ORDI, and if its value falls below a set threshold, the oracles will issue a sell signal, liquidating $ORDI to repay the $bitUSD loan.

Throughout the process, $ORDI does not need to be transferred to the borrower, but is placed in a "smart safe" that can automatically handle related operations including liquidation, ensuring everything is safe and fair.

In June of this year, Shell Finance issued its own Ordinals NFT - Darkman, with a supply of 5000, and adopted a free minting method. Tim told us that the issuance of NFTs can help Shell Finance find early and core users, and users holding NFTs are equivalent to members of the protocol and can enjoy discounts on lending services.

Before starting his own business, Tim had been working in the traditional financial industry and was well aware of the operation of traditional finance and the pain points in payment settlement. These experiences led Tim to choose BCH (Bitcoin Cash) as a solution to improve Bitcoin TPS (transactions per second) and achieve fast payments when he first entered the crypto world. However, this entrepreneurial endeavor was not ideal.

With the development of technology, BCH's approach of increasing block size to improve TPS has exposed many problems, such as limited scalability, inability to solve fundamental problems, leading to centralization trends and reduced security, and lack of community support. In contrast, technologies such as the Lightning Network and Roll-up provide better scalability solutions, making BCH appear outdated.

In 2023, the explosive popularity of Ordinals and the BRC-20 token Sats made Tim realize the strong consensus of people on Bitcoin on-chain assets. He said, "Sats have been minted 21 million times, which is like a social experiment that has achieved unexpected results, indicating that there are opportunities to provide services to these people." This is exactly the original intention of his founding Shell Finance. After chatting with Shell Finance, we coincidentally met another company using DLC technology—

?DLC.Link

DLC.Link is headquartered in New York and was founded by serial entrepreneur Aki Balogh. In 2013, Aki co-founded the AI-driven marketing company MarketMuse in Boston with partners and successfully raised $10 million. In 2023, driven by his love for Bitcoin and his pursuit of high decentralization and security, Aki began a new entrepreneurial journey and naturally invested in the construction of the Bitcoin ecosystem.

This time, Aki and his team aim to launch a more secure BTC packaging method for users to participate in cross-chain DeFi transactions, namely dlcBTC, to replace wBTC (Wrapped Bitcoin).

wBTC is an ERC-20 token based on Ethereum, representing the value of Bitcoin on the Ethereum network, allowing Bitcoin to participate in DeFi applications on Ethereum. In the wBTC ecosystem, BitGo acts as the "custodian," responsible for storing encrypted assets. When users convert Bitcoin to wBTC, the Bitcoin is stored in BitGo's custodial wallet, and BitGo ensures that each wBTC is backed by a 1:1 Bitcoin endorsement.

BitGo was founded in Silicon Valley in 2013 and is the first qualified custodian dedicated to storing digital assets. It protects about 20% of on-chain Bitcoin transactions (by value) and supports over 700 types of digital assets on its platform. Despite being a well-known and compliant cryptocurrency custodian service provider, this centralized custodial model still carries trust risks. If it is attacked or has security vulnerabilities, users may face the risk of losing custodied Bitcoin.

Therefore, Aki's team hopes to enable users to self-custody Bitcoin (without any third party) to participate in DeFi.

dlcBTC is based on DLC technology, allowing users to lock Bitcoin in multi-signature contracts and maintain complete control over their assets. Even if the system is hacked, the locked Bitcoin can only be returned to the original depositor and cannot be stolen.

On the other hand, dlcBTC supports multiple chains. Currently, users can use dlcBTC in the Ethereum and Arbitrum ecosystems, and in the future, DLC.Link plans to further expand to more blockchains such as Solana.

?How do Oracles play a role in Bitcoin DeFi?

As individual cryptocurrency traders or holders, we may not see the existence of oracles in our daily lives, but they play a crucial role in every transaction.

DeFi relies on smart contracts to operate, as smart contracts can provide automated, intermediary-free, transparent, efficient, low-cost, and flexible financial operations. Since smart contracts themselves cannot directly access off-chain data, oracles are needed as a bridge to obtain data from external sources and transmit it to the blockchain, enabling smart contracts to make decisions and execute based on this external data.

We have repeatedly mentioned that the Bitcoin blockchain itself does not support smart contracts, so how do oracles play a role?

This requires relying on Layer 2 solutions - built on top of the Bitcoin blockchain to enhance its scalability, speed, and functionality without changing the base layer. By transferring some transaction processing to the secondary layer, Layer 2 solves the limitations of slow Bitcoin transactions and high fees.

APRO Oracle is an oracle system built on Bitcoin Layer 2, aiming to build a secure and trusted computing platform through the combination of off-chain computation and on-chain verification, to expand data access and computing capabilities, and provide customized computing logic services for DeFi applications.

Its oracle system consists of two layers:

① OCMP network (off-chain message protocol): the oracle network itself, composed of network nodes. The nodes in the first layer monitor each other, and in the event of widespread anomalies, they can report to the backup layer for judgment by the nodes in the backup layer.

For example, a DeFi platform requires real-time market price data to determine lending rates. Oracle nodes in the OCMP network can obtain current price data from multiple exchanges and verify the accuracy of this data through a consensus mechanism. Finally, the verified data is transmitted to the smart contract on the blockchain to automatically adjust the lending rates.

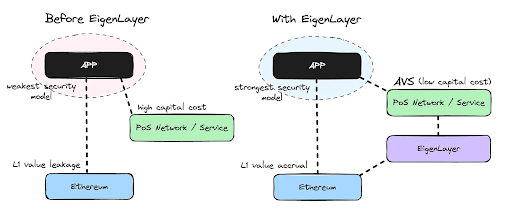

② Eigenlayer network serves as the backup layer.

This means that oracles can obtain higher-level security guarantees through EigenLayer. Specifically for APRO Oracle, if there is a dispute in its first-layer OCMP network, Eigenlayer will verify and adjudicate. EigenLayer's social consensus mechanism is designed to complement Ethereum's objective consensus mechanism rather than replace it. It is mainly used to handle special cases that require human judgment.

This two-layer structure increases security and reduces the risk of nodes being bribed or attacked.

APRO Oracle told us that it is the first decentralized oracle designed specifically for the Bitcoin ecosystem and has played an important role in supporting Layer 2 projects such as Merlin and Bitlayer.

?Using Ordinals to build a Data Availability (DA) layer for Bitcoin DeFi

In the DeFi ecosystem, the Data Availability (DA) layer significantly increases the transaction throughput of the blockchain and reduces transaction costs by moving some data storage and processing off-chain.

For example, on a blockchain network, every transaction requires payment of miner fees. When the network is busy, transaction fees can rise sharply. However, if users submit large batches of transaction data through the DA layer, they only need to pay a small portion of the main chain fees, achieving lower-cost transactions and operations.

The DA layer is responsible for ensuring the integrity and availability of data, ensuring that critical transaction records and operations are always accessible and secure. Although some blockchain main chains do not support complex smart contract functionality, the DA layer can handle complex calculations and logical operations, providing support for DeFi applications.

There are several mainstream ways to build a DA layer on the Bitcoin blockchain:

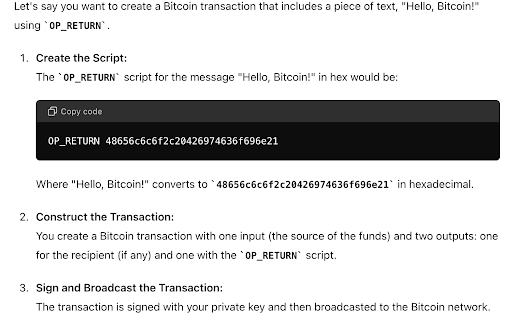

① Using OP_Return Outputs

OPReturn is a Bitcoin script opcode used to store arbitrary data in transactions. Each OPReturn output can store up to 80 bytes of data. Although the capacity is limited, it provides a simple and direct method for data availability.

ChatGPT shows what OP_Return is

- Advantages: Data is stored on the Bitcoin blockchain, ensuring data immutability and high security; any node or user can easily access and read the stored data without the need for additional infrastructure.

- Disadvantages: Each OP_Return output can only store 80 bytes of data, which is a significant limitation for applications that require storing large amounts of data; frequent use of OP_Return to store data increases the size of the blockchain, requiring nodes to store more data, thereby increasing the burden on nodes.

② Building on Sidechains

Sidechains are independent blockchains that interoperates with the Bitcoin main chain, allowing for more experimentation and innovation without affecting the performance and security of the main chain.

- Advantages: Sidechains can typically handle and store more data, providing greater data availability capacity; they can be customized to meet the specific needs of applications, offering more functionality and flexibility.

- Disadvantages: Building and maintaining sidechains requires additional development and operational resources, including nodes, consensus mechanisms, and security protocols; the security of sidechains depends on their own consensus mechanisms and node networks, requiring the security of the sidechain to be no less than that of the main chain to avoid potential risks.

Well-known sidechain solutions include Liquid, RSK (Rootstock), and Stacks.

③ Layer 2 Solutions

- Advantages: Layer 2 solutions can significantly improve transaction processing speed and throughput, addressing the scalability issues of the Bitcoin main chain; by moving most transaction processing off-chain, Layer 2 reduces the burden on the main chain, making the blockchain more lightweight and efficient.

- Disadvantages: The design and implementation of Layer 2 solutions are typically complex, requiring additional protocols and technology stacks; some Layer 2 solutions may introduce a certain degree of centralization, especially in settlement and data availability. Well-known Layer 2 solutions include BitLayer, BitVM, Merlin Chain, and Botanix, among others.

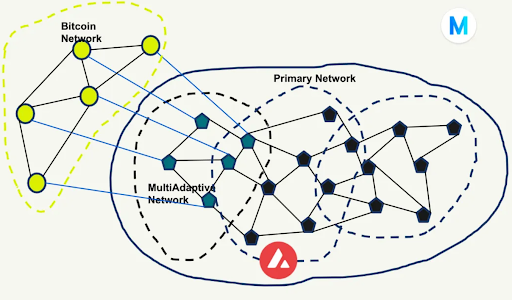

In a recent conversation with us, MultiAdaptive has adopted a unique approach—using Ordinals in the Bitcoin protocol to publish data.

This process allows users to engrave unique data on the smallest unit of Bitcoin, satoshis, enabling each transaction to contain specific data content. Users first send Ordinal transactions similar to NFTs to MultiAdaptive nodes for verification, with these nodes responsible for off-chain data availability support, ensuring the integrity and legitimacy of the data.

The verified data is then sent to the Bitcoin network for storage and broadcast, with the Bitcoin network acting as a "witness" in this process.

By leveraging the most secure and decentralized blockchain, Bitcoin, MultiAdaptive can ensure the immutability and long-term storage of data. This approach avoids the complexity of bridging between chains, simplifies the system architecture, and reduces potential security risks.

Additionally, the off-chain data availability support provided by MultiAdaptive nodes has improved the speed of data verification and processing, while still relying on Bitcoin for final storage and witnessing, ensuring high availability and reliability of the data.

However, using the Bitcoin network for data storage and broadcast may incur higher transaction fees, especially during network congestion, and this cost issue needs to be carefully addressed.

Initially, MultiAdaptive was a data availability network on Ethereum, but quickly added support for the Bitcoin blockchain after seeing the development of the Bitcoin DeFi ecosystem.

?Conclusion

In an article titled "Over $1 Trillion Bitcoin DeFi Opportunity," CoinDesk points out that the value creation of the Bitcoin DeFi ecosystem is driven by three key needs:

- The preference for using the Bitcoin blockchain as the base layer for tokenized assets

- The demand for higher productivity of Bitcoin assets

- The demand for a financial system that reflects the decentralized principles of Bitcoin

The rise of the Ordinals protocol embodies the first need. Since its launch on the Bitcoin mainnet in January 2023, Ordinals has grown from less than $100 million to over $15 billion in total value in less than six months, demonstrating the enormous potential of Bitcoin as the base layer for tokenized assets.

The greatest opportunity lies in the second need: enhancing the productivity of Bitcoin assets through yield-generating tools and decentralized financial systems. Compared to other blockchains such as Ethereum and Solana, the value of fungible tokens (FT) on Bitcoin is still in its early stages.

However, with the development of sidechains, Layer 2, and other emerging technologies, the functionality of Bitcoin is significantly improving. In the first quarter of 2024, the total value locked (TVL) in the Bitcoin ecosystem surged from $492 million to over $2.9 billion, more than sixfold increase, demonstrating the significant expansion potential of Bitcoin DeFi—various applications such as payments, lending, decentralized exchanges (DEX), GameFi, and SocialFi are under construction.

CoinDesk has made an extremely optimistic forecast for the future of the Bitcoin DeFi ecosystem, suggesting that it has the potential to create over $1 trillion in value in the next 5 to 10 years.

?Final Thoughts

Tim from Shell Finance mentioned in a conversation with Crypto Kitchen:

"Bitcoin has shown different trends in different stages of development—from the initial 'peer-to-peer digital cash' to later 'digital gold,' and even in the future, it may return to its original intention, as history always repeats itself. However, the change in these titles is not the most important. The key lies in the actions we take at each stage, the direction of the industry, and the demand. The core point of the current Bitcoin halving cycle is that we need to find a new growth point at this stage to maintain the security of the entire Bitcoin network, and building a decentralized financial (DeFi) ecosystem around Bitcoin may be a feasible path."

The security and decentralization of Bitcoin provide a solid foundation for DeFi, and the advancement of various related technologies makes it possible to achieve more complex financial applications on the Bitcoin network.

By introducing DeFi into the Bitcoin ecosystem, we can not only increase the productivity of Bitcoin but also expand its use cases, enabling faster payments, lending, decentralized exchanges (DEX), GameFi, and SocialFi, among other functionalities.

This not only aligns with the current industry development direction but is also crucial for maximizing the value of Bitcoin. Through continuous technological innovation and ecosystem expansion, Bitcoin may lead the trend of cryptocurrency and decentralized finance, competing with Ethereum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。