This article's Hash (SHA1): b5be995ca6de70a97afdd995fe484dc091b3c2dd

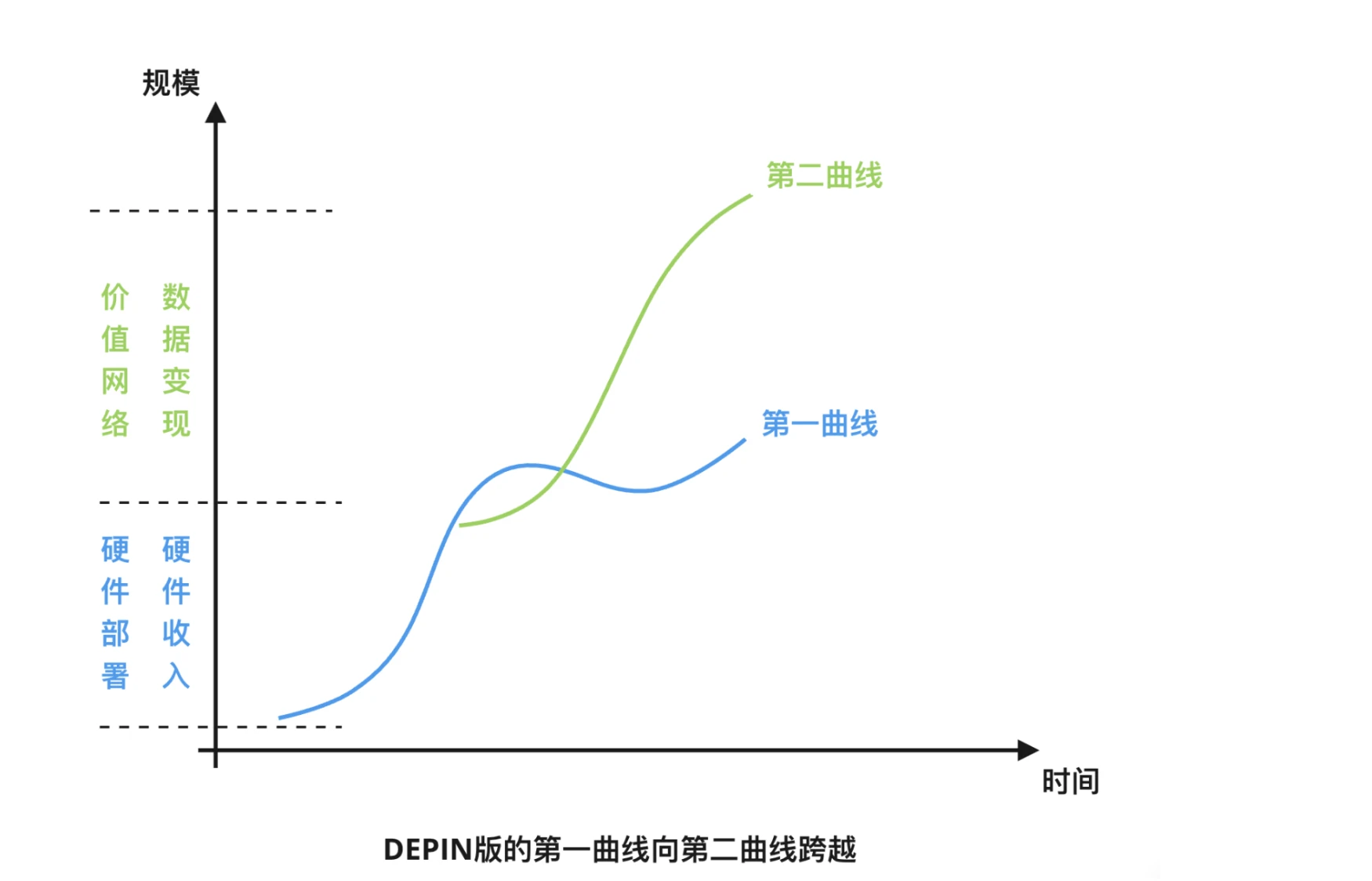

Number: Chain Source Security Knowledge No.011

DePIN (Decentralized Physical Infrastructure Network) is gradually realizing large-scale interaction between the physical world and Web3, and gradually subverting the operating mode of traditional infrastructure. By combining sensors, wireless networks, computing resources, and AI with blockchain technology, and using encrypted economic incentives to drive crowdsourced development, DePIN is forming a decentralized value network. An important feature of DePIN's business model is that it uses hardware revenue as the first growth curve and then adds data service monetization to form the second growth curve. The superimposition of these dual curves is one of the key factors that enable DePIN to lead the current cycle of growth, demonstrating how projects like DePIN create significant wealth effects in the process of building decentralized infrastructure networks, ultimately forming a scalable decentralized value network.

This concept foretells an application scenario full of imagination: common infrastructure around us, including communication base stations, car charging piles, photovoltaic panels, billboards, and the data storage and computing devices behind the operation of the Internet, will no longer be controlled by centralized entities and institutions, but will be divided into equally sized units, held by individuals or scaled miners. Physical infrastructure of the same kind is highly standardized and scaled, forming a carpet-like coverage.

Through decentralized means, the layout and utilization of infrastructure can achieve higher efficiency and lower costs, while enhancing the overall system's security and resilience. From energy production to data processing, various facilities have the potential to transition to a decentralized mode. The combined market size of the related industries involved in DePIN already exceeds $5 trillion. Therefore, Messari predicts that the potential market size of the DePIN field is estimated to be around $2.2 trillion, expected to reach $3.5 trillion by 2028.

DePIN Track Division

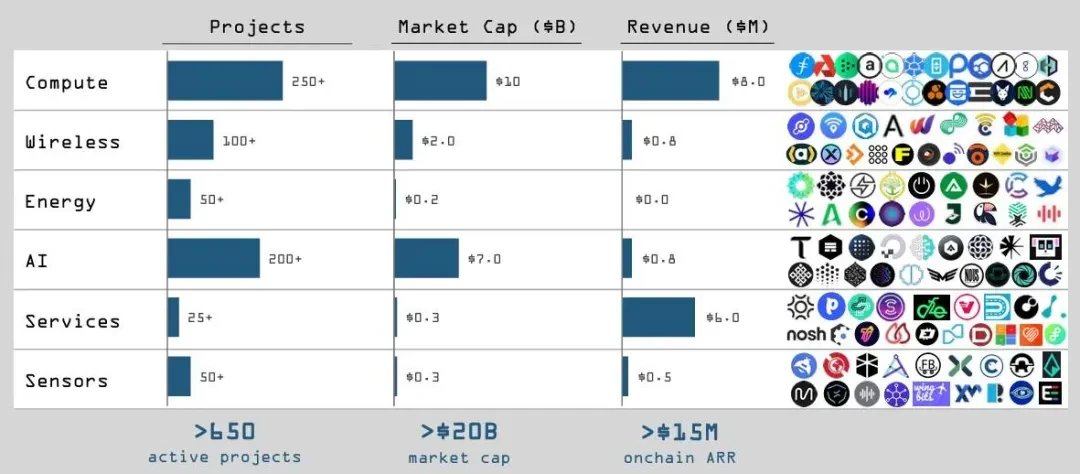

The DePIN track covers six sub-domains: computing, AI, wireless communication, sensors, energy, and services. From the perspective of the supply chain, DePIN can be divided into:

- Upstream: Hardware manufacturers and supply-side users acting as "miners".

- Midstream: Project platforms, blockchains responsible for data verification and token settlement, and layer-two protocols serving DePIN; modular service components for developing and managing DePIN networks (such as platform interfaces, data analysis, and standardized services), DePIN development SDK toolkits, API interfaces, etc.

- Downstream: dApp applications and interfaces connecting to the demand side.

Most DePIN projects choose Solana or IoTeX as the settlement layer for token economics. AI and cloud computing projects in the sub-domains are more focused on on-chain settlement and project platform development and management, with the underlying hardware devices being scheduled through middleware to idle electronic devices, such as smartphones or computers equipped with high-performance consumer-grade GPUs.

Overview of DePIN Industry Development

According to DePIN Ninja's data, the number of DePIN projects that have been launched has reached 1215, with a total market value of approximately $430 billion. Among them, the total market value of projects that have issued coins and are listed in the DePIN sub-section of Coingecko exceeds $250 billion. This number was only $50 billion in October last year, less than a year ago, indicating the rapid growth of the DePIN industry. This indicates that the market's demand for and recognition of decentralized physical infrastructure networks is constantly increasing. With the launch of more projects and the expansion of application scenarios, the DePIN industry is expected to become an important area where blockchain technology is combined with real-world applications.

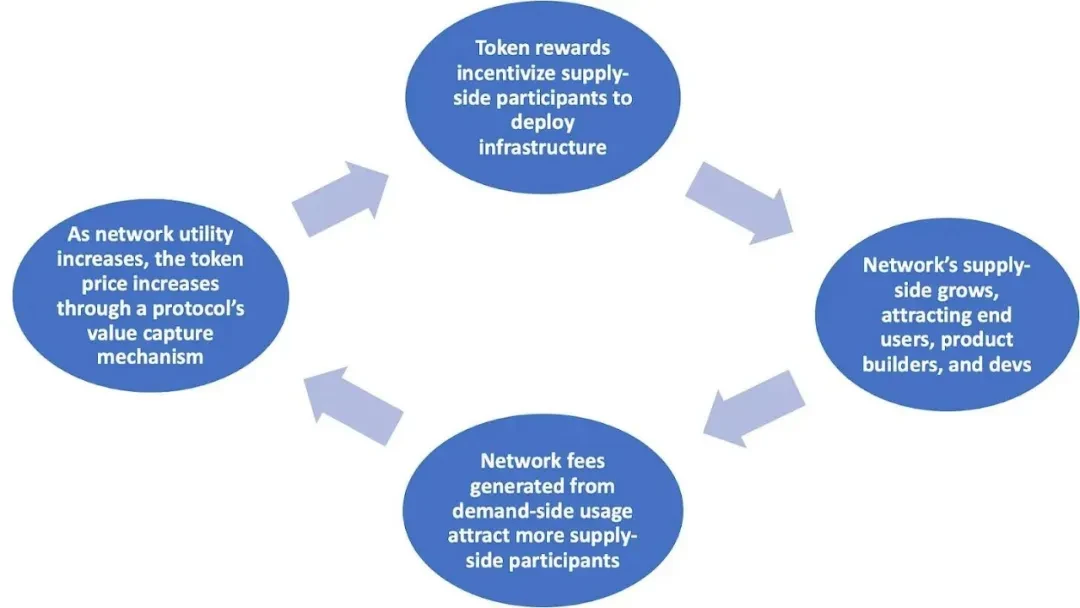

Insights from the DePIN Business Logic

The prototype of DePIN can be traced back to the concept of the last cycle of the Internet of Things + Blockchain (IoT + Blockchain). Projects like Filecoin and Storj transformed centralized storage into a decentralized operating mode through an encrypted economic model, and have been practically applied in the Web3 ecosystem, such as on-chain NFT storage and front-end and back-end resource storage for DApps.

The Internet of Things + Blockchain only reflects the decentralized ("De") characteristics, while DePIN emphasizes the construction of physical infrastructure and the scaled interconnected network. In DePIN, "PI" represents physical infrastructure, and "N" represents network, which is the value network formed after the DePIN hardware reaches a certain coverage scale.

The most typical example is Helium, founded in 2013, which did not confirm the use of blockchain as an incentive for decentralized deployment of the Internet of Things until 2018. So far, Helium has almost met all the elements of DePIN: node economy, miner model, value network, crowdsourced incentives, and is a leading project in the field of DeWi (Decentralized Wireless Communication). In addition, the $20 communication package service launched by Helium Mobile in cooperation with T-Mobile not only earns token rewards but also enjoys reliable communication services, solving the signal coverage problem in remote areas of the United States, forming a win-win situation for all three parties. Both Helium and Filecoin belong to the DePIN category, but the difference between the two lies in Helium's emphasis on hardware, enabling it to support the growth of data services through hardware revenue and build an independent ecosystem.

The Explosive Growth of DePIN is Based on the Theory of Dual Curves

The "second curve" is a concept in management and innovation theory, originally proposed by management scholar Charles Handy. It refers to the need to introduce new innovations or changes when an organization, product, or business reaches the peak of its traditional growth curve, in order to initiate a new growth curve and avoid stagnation or decline.

Hardware value is the first curve of value creation

On the first growth curve, businesses experience initial rapid growth, and then gradually reach their peak. The growth momentum of the first curve of DePIN projects comes from the revenue and profits generated by selling hardware. The business logic of centralized service providers or entities in traditional infrastructure, especially in areas such as data storage and communication services, is linear: early-stage business requires investment in infrastructure construction, and then provides services to end users (consumers) after the facilities are completed. Therefore, the development of such businesses often requires the participation of giant enterprises to bear high costs in the early stages of business operation.

DePIN projects split the centralized supply side and turn it into a crowdsourced form to establish a hardware network. DePIN projects attract supply-side users to participate by promoting themselves, transferring the massive infrastructure construction costs to the supply side users, and achieving low-cost lightweight startup. Supply-side users become "shareholders" of the project by holding hardware and help the project deploy hardware networks with the expectation of mining and earning money in the future.

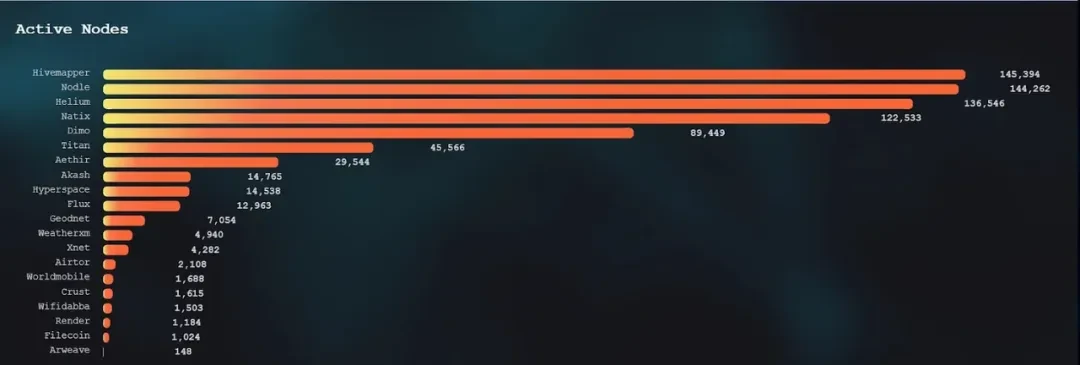

For example, the business performance of Hivemapper and Helium is very impressive:

- Helium: A decentralized wireless network, with main businesses including Helium Hotspot and Helium Mobile. Helium Mobile is a mobile communication service launched in cooperation with T-Mobile, which gained 93,000 subscribers within 5 months.

- Hivemapper: A decentralized map drawing platform, with the main business being HiveMapper Dashcam. Priced at $549, based on the current number of node deployments, Hivemapper's hardware sales revenue alone has exceeded $60 million.

Other projects such as Jambo and OORT have also achieved good growth in hardware revenue. For example, Jambo has achieved excellent sales performance in the African market with its focus on mobile phones, and OORT has achieved significant hardware sales revenue through its innovative model in cloud computing and edge computing.

Monetizing Data Value and Network Value is the Second Curve of DePIN Growth

After accumulating a certain income by selling hardware in the early stage, DePIN projects open the second curve before the first curve of device sales growth reaches its critical point. The core of the second curve growth lies in the data value network established on top of the matured hardware network at scale.

By aggregating a series of value chains, DePIN splits the centralized supply side and aggregates multiple demand sides using public chains, ultimately forming a data value network under the DePIN model.

Although DePIN projects emphasize physical nature, their core business logic revolves around extracting value from data. Data is stored on the blockchain storage layer.

Conclusion

DePIN has efficiently deployed and managed physical infrastructure through decentralization, demonstrating tremendous market potential and growth space. Despite facing challenges in technology, demand, economy, and regulation, the decentralized nature and innovative business model of DePIN provide a solid foundation for its future development. The PandaLY team will continue to monitor the trends of DePIN and delve deeper into it in subsequent posts.

Chain Source Technology is a company focused on blockchain security. Our core work includes blockchain security research, on-chain data analysis, and asset and contract vulnerability rescue, and we have successfully recovered multiple stolen digital assets for individuals and institutions. At the same time, we are committed to providing project security analysis reports, on-chain tracing, and technical consulting/support services for industry institutions.

Thank you for reading, and we will continue to focus on and share blockchain security content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。