- [Review] -

Omitted.

- [Today's Market Analysis] -

Liquor Trading Diary: Daily Interpretation 7.15

① Intraday ultra-short-term - Resistance: 63400-63900

It is probably difficult to break through this level in the next two days. On the contrary, encountering resistance and falling back will create a greater possibility of a 4-6 hour level retracement. Therefore, I will be ready to take a short position in this area at any time.

② Intraday ultra-short-term - Support: 61400-61800

If the price effectively falls below 62300, it will probably come to this area. It should be possible to go long. At the very least, there should be a rebound. After all, the next strong support is between 60400-60600.

Summary: Key resistance positions to lay out short positions. Try not to chase short positions in the middle. Buy on dips or add to long positions.

- [Cryptocurrency News] -

Bitcoin and Ethereum Lead Cryptocurrency Inflows, Reaching $17.8 Billion!

So far this year, the inflow of funds into digital asset investment products has set a new record of over $17.8 billion, greatly exceeding the record of $10.6 billion set in 2021. This indicates that the cryptocurrency market may be starting to recover. In terms of regions, the United States led this week with $1.3 billion, but other countries also showed positive sentiment, with the most notable being Switzerland (setting a record high for this year's inflow), Hong Kong, and Canada, with $58 million, $55 million, and $24 million respectively.

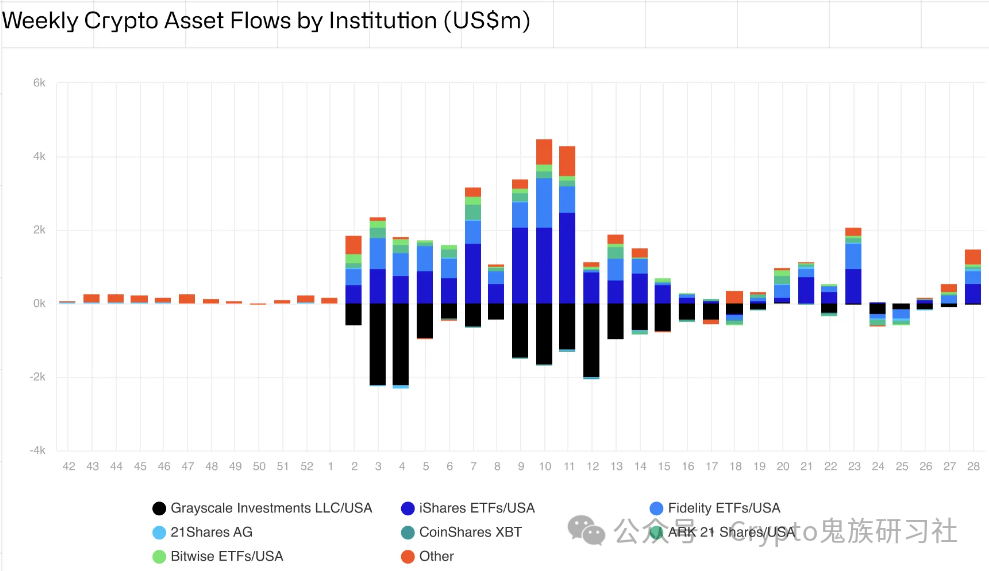

Institutional flow of encrypted assets

At the same time, Bitcoin's weekly inflow reached the fifth highest in history, reaching $1.35 billion. This huge inflow helped the world's first cryptocurrency rebound above the $60,000 mark. However, Bitcoin-related bearish investment products saw the largest weekly outflow since April 2024, totaling over $8.6 million.

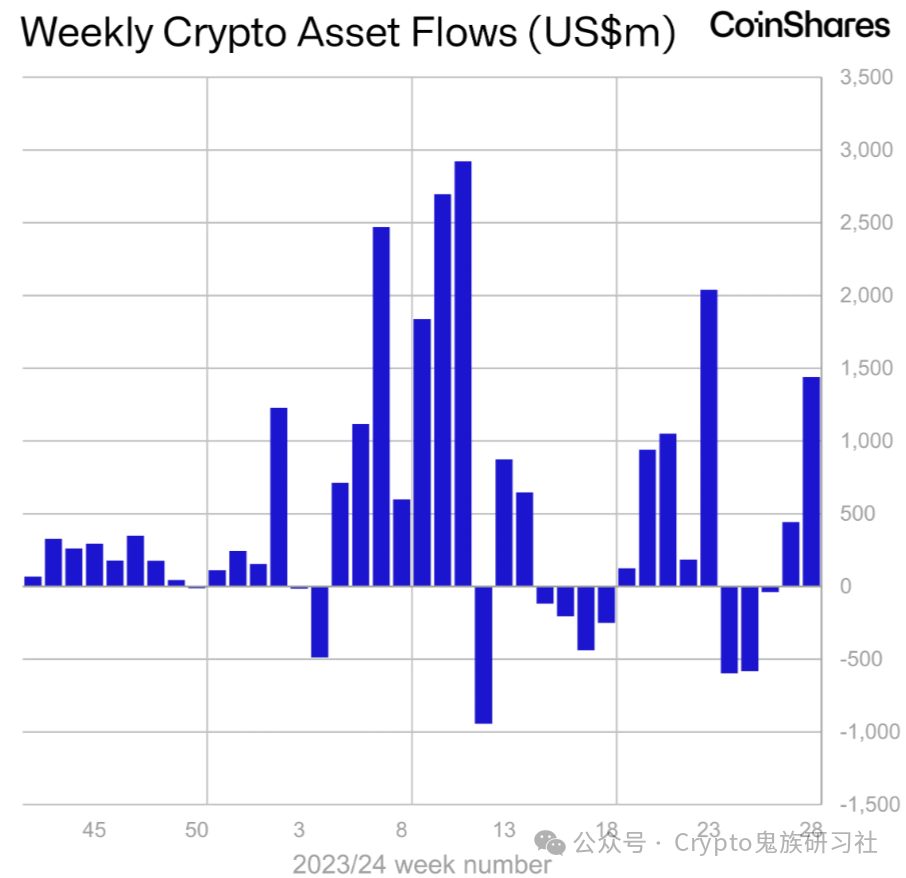

Weekly flow of encrypted assets

Last week, the sale of Bitcoin by the German government led to a softening of prices, and lower-than-expected U.S. consumer price index data led to improved market sentiment, prompting investors to increase their holdings of Bitcoin.

In addition, Ethereum's inflow was second only to Bitcoin, making it the second largest currency, with a total inflow of over $72.1 million in the past week. The continuous increase in fund inflows may be due to expectations for the first Ethereum spot exchange-traded fund (ETF) in the United States, which may start trading in the coming weeks.

According to an insider, the issuer of the U.S. spot Ethereum ETF is expected to receive the final opinion of the U.S. Securities and Exchange Commission (SEC) early this week.

This week, several issuers, including VanEck and 21Shares, submitted revised registration applications in the hope of obtaining final approval from the U.S. Securities and Exchange Commission to list spot Ethereum ETFs. Eight spot issuers are waiting for approval from U.S. regulatory agencies.

Finally, in a week where inflation data was mixed, the market will closely watch Powell's remarks to understand how U.S. monetary policy may change in the future. The Federal Open Market Committee (FOMC) will hold its next meeting at the end of this month, and the interest rate decision has not yet been determined.

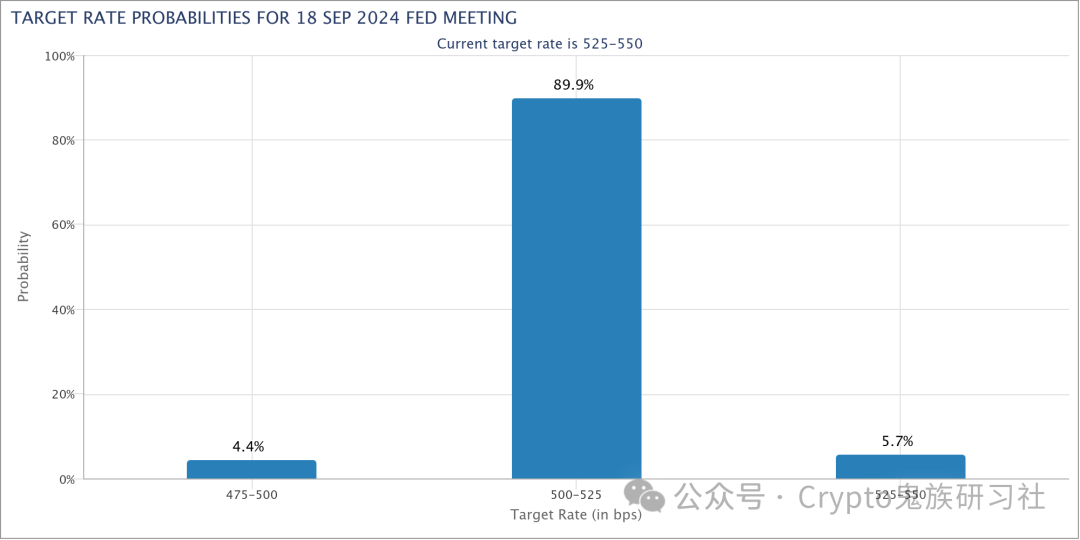

The September meeting of the Federal Open Market Committee (FOMC) remains a key moment for a firm "loose" policy shift.

Probability of target interest rate for September FOMC meeting (CME Group)

The latest data from the Chicago Mercantile Exchange Group's Federal Reserve observation tool shows that as of July 15, the probability of a rate cut in some form in September is 94.3%. In contrast, the probability for this month is only 4.7%.

Charlie Bilello, Chief Market Strategist at wealth management firm Creative Planning, observed that the market currently expects the Federal Reserve to cut rates 2-3 times before the end of this year, and 4 times in 2025.

What do you think?

Official Account ↓↓↓

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。