Former Binance CEO CZ once mentioned THENA in a tweet and wrote, "Not sure what this post actually means, but DeFi on BNB Chain is rising." As of today, with numerous DeFi protocols continuously emerging on BNB Chain, this sentiment and expectation still apply. Two notable protocols among them are THENA and Lista DAO.

Source of the tweet: https://x.com/cz_binance/status/1626140606983507968

Lista DAO: A secure, simple, and permissionless liquidity staking and stablecoin hedging solution

Lista DAO, originally known as Helio Protocol, was founded in 2022 and issued the over-collateralized stablecoin HAY. In July 2023, Helio merged with liquidity staking provider Synclub to form the new LSDFi Foundation and rebranded as Lista DAO. LISTA stands for the combination of "Liquid" and "Staking."

Users can participate in Lista DAO primarily in two ways. One way is to stake BNB to earn Proof of Stake (PoS) income on the BNB Chain. In return, users receive liquidity staking certificates slisBNB, which can be used for lending, providing liquidity, and other DeFi activities to earn additional income. The other way to participate is by pledging ETH, BNB, or assets like slisBNB as over-collateralization to borrow the stablecoin lisUSD.

As of July 3, 2024, Lista DAO's total value locked (TVL) has exceeded $330 million. Binance Labs invested $10 million in Lista DAO, and Lista DAO became the second Binance Megadrop project.

THENA: A community-driven decentralized exchange, making DeFi accessible

THENA was launched in January 2023 as a spot decentralized exchange aimed at incentivizing liquidity on the BNB Chain in a capital-efficient manner. Since its inception, THENA has decided to return 100% of its revenue to token holders. As of now, THENA has distributed over $20 million in profits to veTHE and theNFT holders. THENA is committed to becoming a comprehensive DeFi platform, and in addition to its spot DEX product, it has also launched "ALPHA," a leading perpetual contract derivative trading platform, to meet the diverse needs of on-chain traders.

Recently, THENA is set to launch a new product, the social trading platform "ARENA," aimed at bringing cryptocurrencies into the mainstream view. In addition, THENA will also introduce "THE Card" physical debit card, "THE Wallet" smart wallet, and fiat withdrawal payment solutions. The THENA team has consistently refined its products and is committed to becoming the preferred platform for new Web2 users to enter the cryptocurrency space. Making DeFi truly accessible has always been THENA's enduring vision.

THENA, as "A protocol for protocols," is a protocol born to operate protocols, built on top of many top DeFi protocols and able to achieve win-win cooperation with partners. The upcoming "WARP" Launchpad Accelerator will further strengthen THENA's strong network of partnerships. "WARP" aims to accelerate the development of early-stage innovative projects in the BNB Chain ecosystem and serve mature projects.

Establishing a democratic and fair competitive environment - the rightful essence of DeFi

One of the original intentions of DeFi is to democratize the financial system, creating a more inclusive and fair competitive environment for everyone. The Binance Research report "Low Float & High FDV: How Did We Get Here?" once again emphasized this vision. The report pointed out that the influx of capital from the private market, aggressive valuations, and optimistic market sentiment have led to tokens being launched with high fully diluted valuations, leaving very limited upside for retail investors after TGE.

The birth and active status of THENA and Lista DAO demonstrate a collaborative vision for building DeFi, recognizing that fair and equitable distribution is crucial for the spirit of DeFi and the long-term sustainable development of its protocols. Both THENA and Lista DAO protocols reserve a significant portion of their token supply for the community and ecosystem, with almost no allocation to private equity or KOL.

THENA and Lista DAO also actively incentivize users to organically contribute to the protocol. Users can participate in Lista DAO's CAC challenge tasks to qualify for airdrops, with Lista DAO distributing 6.1% of the token supply in the first two seasons of the challenge. THENA, through its continuous Zealy task activities, has been rewarding active community members with $THE tokens since its inception. THENA returns over $20 million in revenue 100% to the community and currently has no VC support, further validating its commitment to building a fair, community-centered ecosystem.

BUILD and Build, Innovate Continuously, Surpass Continuously

Lista DAO and THENA are both crucial and continuous builders in the BNB Chain ecosystem.

THENA was founded to address the inefficiency of liquidity incentives on the BNB Chain, committed to developing a capital-efficient decentralized exchange to optimize liquidity distribution. After achieving initial success, THENA is now setting its sights on becoming a SuperApp in the DeFi space, providing a powerful decentralized platform comparable to major platforms like Binance. This long-term vision encompasses all the key steps needed to achieve mass adoption, from simplifying wallet usage to bridging traditional finance and DeFi. After nearly 2 years of focused development and refinement, THENA is strategically prepared to welcome a new wave of retail investors into the crypto world and effectively address the common challenges and difficulties in the process from 0 to 1.

Similarly, Lista DAO identified key inefficiencies in decentralized crypto lending models over the past decade, particularly the "stablecoin trilemma," balancing decentralization, price stability, and capital efficiency. Lista DAO's innovative approach is to allow users to leverage their debt positions (CDPs) to mitigate these issues. Combining the principles of Liquid Staking and the MakerDAO model, along with enhanced liquidity from DEX liquidity providers, Lista DAO aims to avoid common pitfalls such as asset freezing and losses due to price fluctuations.

Undoubtedly, it is the relentless construction and exemplary role of these two teams in the DeFi space that have led THENA and Lista DAO to be invited multiple times to share their stories and visions in the BNB Chain and broader communities.

Two BNB Chain giants, one common purpose

Given the collaborative vision between these two DeFi giants, THENA and ListaDAO have been friendly partners from the beginning. In January 2023, Helio joined forces with THENA to achieve several milestones together.

Let's take a look back at the initial partnership announcement together!

https://x.com/ThenaFi_/status/1609901617838723080

THENA's ListaDAO Zone: How to profit from these liquidity pools?

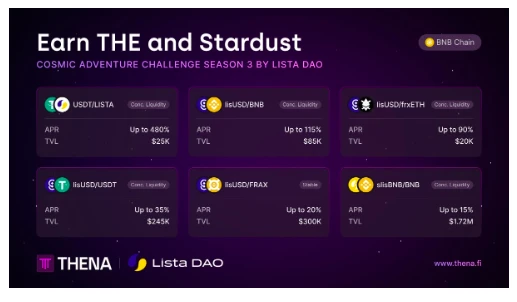

THENA's "ListaDAO Earning Zone": To deepen their partnership, THENA has launched a series of liquidity pools on the platform: USDT/LISTA, lisUSD/BNB, lisUSD/frxETH, lisUSD/USDT, lisUSD/FRAX, and slisBNB/BNB.

Users of THENA can profit from these pools in various ways: providing liquidity, voting, speculating on token price increases, and participating in the CAC Season 3 airdrop.

Providing liquidity to these pools allows users to earn $THE token rewards, with an annualized percentage yield (APR) of up to 200%, for example in the USDT/LISTA pool.

Additionally, users who lock $THE as veTHE can receive weekly voting rewards generated from the USDT/LISTA pool's trading fees and voting incentives. By locking $THE as veTHE, users can also vote weekly in various THENA pools according to their preferences, earning continuous passive income. For more information on locking and voting, please refer to the THENA Gitbook.

All providers of liquidity in the LISTA pools are also eligible to participate in the CAC Season 3 airdrop, with liquidity providers receiving additional $LISTA token rewards.

To learn more about the ListaDAO CAC Season 3 airdrop, please refer to the ListaDAO Medium article.

Except for the lisUSD/FRAX stablecoin pool, all other pools use THENA's centralized liquidity solution FUSION. This innovative approach allows liquidity providers to strategically concentrate funds within active trading ranges, enhancing capital efficiency, deepening token liquidity for ListaDAO, and creating higher fee income for THENA's veTHE holders.

DeFi is rising on the BNB Chain

If liquidity is the lifeblood of blockchain, then protocols are like its flesh and bones. ListaDAO allows users to earn staking rewards and borrow stablecoins, while THENA, as the native liquidity layer on the BNB Chain, offers a range of innovative products to meet various decentralized needs.

The services provided by these protocols make the BNB Chain a more flexible and attractive platform, attracting more DeFi users and increasing user adoption and participation. Therefore, these two protocols have brought a significant amount of liquidity to the BNB Chain, further enhancing its DeFi ecosystem and demonstrating tremendous potential.

DeFi on the BNB Chain is being discovered by more people, becoming a tool to promote financial inclusivity based on practical protocols and maintain DeFi.

We look forward to continuing our long and fruitful cooperation in the future and expect both protocols to grow together through continuous innovation and construction. Never Stop BUILDING Together!

Follow THENA

Website | X | Discord | Telegram | Links

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。