Yesterday, the master placed a pre-buried short order in the 59500-59900 range. After the CPI was announced at 8 pm, the market surged to near 59780. Subsequently, the early morning market dropped to around 57000, and the pre-buried short order in the article once again gained a profit of 1500 points. The pre-buried long order from yesterday did not have the opportunity to enter the market, resulting in a missed entry.

Master's Hot Topic:

First, let's briefly explain the master's analysis of the medium to long-term trends from yesterday. Bitcoin did not linger around 60000-62500 and directly fell below 56550, and Ethereum also retraced to 2810.

Because this trend came faster than expected, it is still necessary to pay attention to the time this week or in the future. It is expected that the market will continue to see new lows due to the demand for oscillating structures. The master's view remains unchanged, personally believing that a new low on the weekly chart will definitely occur!

The CPI data announced last night met expectations, causing a short-term market frenzy. Currently, the market generally believes that there is a high probability of interest rate cuts in September. From the recent statements of Nick and the reaction from Wall Street, the probability of an interest rate cut in September is also increasing.

Currently, the German government only holds 9,094 $BTC (worth $520 million), about 18% of the initial holdings. At this rate, it is expected that they will liquidate all BTC in the next 1-2 days.

Master's Trend Analysis:

BTC 1-hour:

Yesterday, the CPI index was lower than expected, causing Bitcoin to fall back into the box.

The market is still affected by the selling pressure from the return of assets from Mount Gox and the German government's sale of confiscated bitcoins.

Despite the positive news of the CPI being lower than expected, it is difficult to sustain an uptrend due to the lack of market support for the overall market.

Resistance Level Reference:

First Resistance Level: 57350

Second Resistance Level: 58000

In the short term, the formation of a downtrend line has lowered the low point, so operations can be approached from a bearish perspective within the resistance range.

If the first resistance level is broken, the coin price will rise above the 120MA moving average, which can continue the short-term uptrend, but attention should be paid to the psychological resistance level of 58000.

Support Level Reference:

First Support Level: 56700

Second Support Level: 56150

In the short term, a small rebound can be expected at the first support level, and short positions can be taken after the formation of a lower shadow on the candlestick.

Also, pay attention to the trend of the uptrend line (purple line) indicated in the master's chart analysis. If this trend line is broken, a further downtrend may occur, leading to further decline.

Today's Trading Suggestions:

In today's trading, maintain the view of an uptrend while maintaining short-term rebound trends and operations.

Note that the uptrend trend indicated by the master is a good risk-reward ratio range. If a large long black line is formed and breaks the trend line, expect the formation of a lower shadow on the candlestick and engage in ultra-short-term long trades.

With both high and low points decreasing, patience is required to wait and observe for a rebound in small-scale trends before attempting rebound trades.

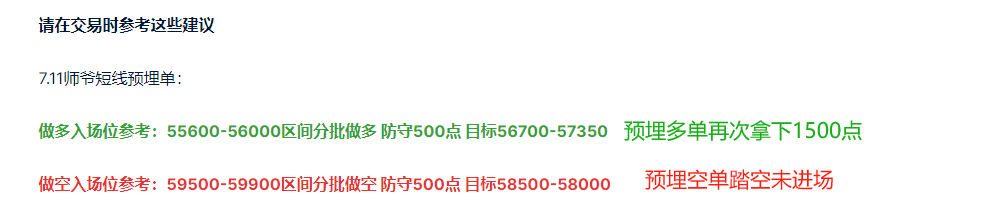

Please refer to these suggestions when trading.

7.12 Master's Short-term Pre-buried Orders:

Long Entry Reference: 55750-56150 range, staggered long positions, defend 500 points, target 57350-58000

Short Entry Reference: 58400-58800 range, staggered short positions, defend 500 points, target 57350-56700

This article is exclusively planned and published by Master Chen (WeChat public account: 币神师爷陈). If you need to learn more about real-time investment strategies, untangling, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication, hoping to help you find what you want in the currency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily updates on macro analysis articles across the web, mainstream coin and altcoin technical indicator analysis, and spot long-term replay price forecasts.

Friendly reminder: Only the column public account (as shown in the picture above) is written by Master Chen. The end of the article and other advertisements in the comment section are not related to the author. Please be cautious in distinguishing between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。